ShareScope is running a Black Friday promotion with a 30% discount for both new and returning subscribers (not subbed in last 12 months).

This is the software I’ve used daily since 2017, because it’s the best.

You will need to go here: https://www.sharescope.co.uk/sharescope

And use my special code to get the discount: mtbf25

You can also get a free 1-on-1 training session as well as a 30-day moneyback guarantee (new subscribers only) so you have nothing to lose.

ShareScope saves me time and money. If you’re dealing in individual stocks I highly recommend giving it a try.

I’ve just about recovered from the absolute amateur hour shambles that was the Budget.

My guess is that some intern at the OBR pressed ‘publish’ instead of ‘schedule’, and the entire document got leaked an hour early.

Great for hedge funds. Not so great for me.

I was out for a walk getting ready for 12.30, only to get back after all morning preparing to see that it had been leaked. Muppets.

The OBR apologised. Well, thank you. But I’m still cheesed off.

In any case, the event has now passed, which gives some clarity in the market, and hopefully allows people to breath a sigh of relief.

It could’ve been much worse. It could also have been a lot better, but let’s hope the market has calmed somewhat.

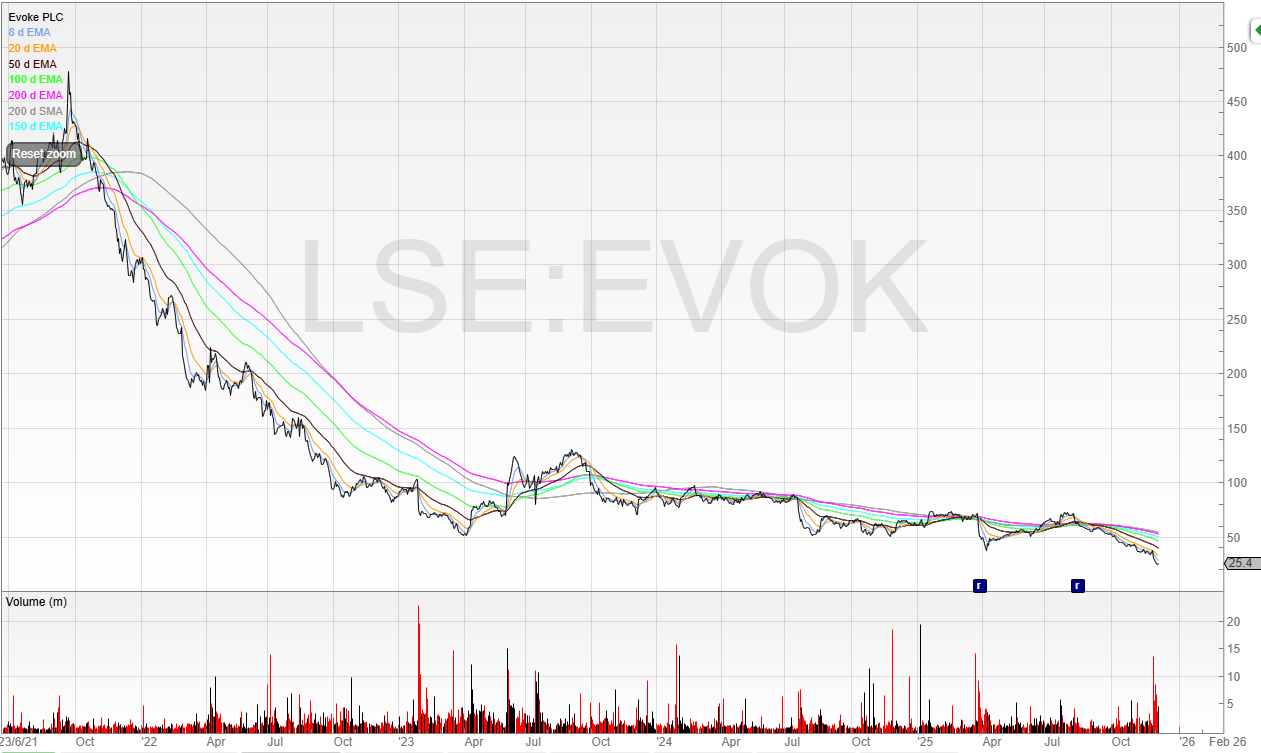

Evoke (EVOK)

Evoke is the old 888 which bought William Hill right at the top of the market.

There are genuine questions now if it can survive.

As I said pre-budget, gambling companies would lengthen the odds and drive punters offshore into unregulated providers and where HMRC won’t collect a penny in tax.

This is exactly what Evoke’s board is saying.

However, the tax is so bad that the board has withdrawn its guidance for the medium term.

I got asked if I would short this company, and the answer is no.

It is deep into a stage 4 downtrend, and anyone shorting now is not early to the trade.

It doesn’t mean it can’t go down further. But the time to be short was when the risk/reward was better.

I think there could be a rights issue/placing on the cards here.

The company now has a debt to equity ratio of almost 20 at £100 million market cap.

A lot of the cash generated is sucked up by interest payments, and whilst the new laws don’t come into effect until April 2027, Evoke will need to be rightsized by then to handle it.

If I was a bondholder, I’d be urging the board to raise fresh equity whilst it still can.

It can survive, but there will likely need to be a steep discount.

Generally, people don’t want to give money for equity when that money is repaying bondholders.

But price it low enough, and people will subscribe.

The next stock is one I was pitched back in July by a broker looking to do a transformational raise.

After six months, perhaps this has now been digested.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. Priority for all offers and live events. A risk-free trade itself as you get value or you cancel.

Upgrade