Xeros Technology Group (XSG) is a UK-based company specialising in developing innovative, sustainable technologies aimed at reducing the environmental impact of the laundry and apparel industries.

What does that mean?

Here’s what its website says:

Xeros develop innovative sustainable technologies that greatly reduce the impact of laundry on the eco-system.

Our technology achieves superior performance, is cost effective and highly efficient all whilst minimising the environmental impact of manufacturing and cleaning our clothes.

It has two products.

The first being the Microfibre Pollution Filter.

This technology captures over 99% of microplastics.

Don’t know what these are? Neither did I when I first came across this company.

Basically, 700,000 microfibres are shed from our clothes with every wash.

These are synthetic fibres, and as a result around 500,000 tonnes of microplastics flow into the world’s oceans every year.

In fact, microfibres account for around 85% of man-made debris on shores globally.

This is a real issue, as microfibres end up in our water, our food chain, and is made plenty worse by fast fashion.

Here’s where Xeros comes in.

It’s filtration technology captures over 99% of microplastics.

It also offers a Garment Finishing System. This is a closed system called the XDrum which releases reusable polymer spheres called XOrbs.

These XOrbs use up to half the normal amount of water and provide additional mechanical atrion which helps drive chemistry deeper into fabrics.

At the end of the cycle, the XDrum collects the XOrbs back into the storage system to be reused again and again.

Now, you’re probably reading this and thinking the Total Addressable Market (TAM) for this business is huge.

And you’d be right.

It is.

But this sort of thinking has allowed investors to be completely wiped out several times.

During the course of my career, I’ve seen this stock refinance and wipe out 99.9% of shareholder value twice.

I’ve even made money on it, because previous management teams were incredibly dumb.

The first time was 2018.

It was my ‘free money trade’.

I think I’ve shorted the stock before a placing at least three separate times in all but those are two examples.

Basically, management would tell the market that it would need to raise money before it went and did it.

This did two things.

First of all, nobody bought the stock.

Why would you?

If you know there’s a discounted placing coming, because management literally told you then unless you have a fetish for losing money you’d just wait until the refinancing was done.

Second of all, people sold the short. Why wait for the price to go down? Just buy back either in the placing or after it’s complete.

And then people like me short sold the stock. By selling the shares, I was able to buy these back at a discount.

If you don’t understand how shorting works or want to learn how I do this - this video will help.

However, a new management team has come in who appear to have some sense.

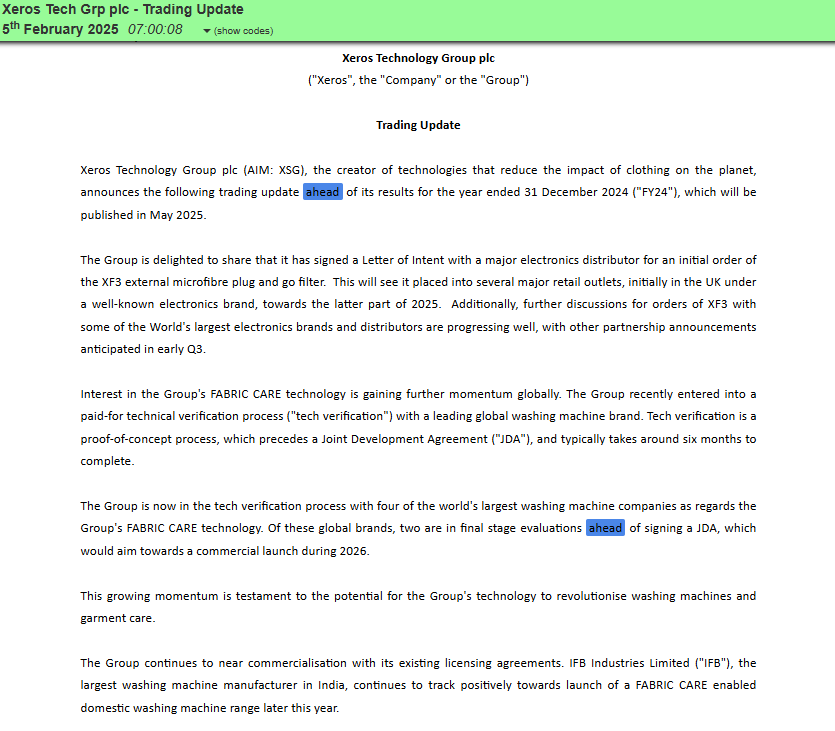

And on the recent trading update, I actually went long.

It was a tiny position, but one I’m now up over 100% in as the stock has rallied sharply.

Now, just to be clear…

I am not suggesting that anyone buys at these levels.

The stock is extended, and you’re paying way higher prices for the same piece of news that came out the other week.

It’s likely profits will be taken at some point, and I also feel it would be prudent for the company to raise cash if it needs to whilst the market is strong.

However, the company claims to be amply funded for now.

Net cash at 31 December 2024 was £2.8m. With our ongoing focus on operating cost discipline the Board continues to anticipate that this will be sufficient to take the Group to month on month cash flow break even during the course of this year. Cognisant of potential timing issues when working with large global organisations, the Board is taking a prudent view of its revenue expectations for FY25. Allowing for some delays and slippages within the existing pipeline, the Board expects to achieve revenue of approximately £2.5m in the current year, though this does not include the significant upside potential of additional revenue opportunities from the numerous discussions we currently have underway.

I’ve heard this one before, and a quick check of the cash flow statement tells me that the company burned through nearly £5 million in cash last financial year.

So whilst net cash on 31 December 2024 was £2.8 million, even with the £2.5 million of revenue projected (remember this is revenue and not cash converted) I would say the balance sheet looks precarious.

Allowing for some delays and slippages within the existing pipeline, the Board expects to achieve revenue of approximately £2.5m in the current year, though this does not include the significant upside potential of additional revenue opportunities from the numerous discussions we currently have underway.

But if the company does convert one of these discussions into an actual contract or raises money, this company could be worth a further look.

At the moment, it’s nothing more than a speculative punt.

However, the next stock is a business that is established, winning business, and yet still lowly rated.

My belief is that this could be a quality compounder on a low earnings multiple.

Synectics (SNX)

Synectics offers a comprehensive range of security and surveillance solutions.

It trades on a pre-tax PE of just under 14.

But growth is forecast to be even higher, which makes this trade on a PEG of below 1.

This is a clear turnaround story that I believe has not been fully appreciated by the market.

Earnings are now improving sharply after a 10-year period of stagnation.

One of the key driver of this has been the contracts it’s been winning.

Synectics offers surveillance software for casinos which itself is a structural growth story.

Obviously during the pandemic, casinos were shut and capex projects delayed.

The industry is now playing catchup with 20-25 casinos opening within the next five years, all of which will require in-depth and reliable surveillance software systems complete with a control room, as well as the necessary cameras and hardware.

Now, I’m not going to say that Synectics will win all of these contracts.

But it can certainly throw its hard in the ring.

For example, Synectics won the Marina Bay Sands casino (F1 fans will know this from the Singapore circuit) six years ago and so it definitely has a chance of winning some of the business up for grabs.

But that doesn’t include the other big structural growth industry: datacentres.

Last year, datacentres were not considered critical infrastructure.

That has now changed, and many of the big players see datacentres as their big infrastructure projects.

Therefore, Synectics is a business that is already growing and has two key industries where it can grow into and win market share.

Last year EBIT was upgraded twice. There is a record order book for this year.

And surveillance has evergreen importance that will only become more so.

I’m told by my friend Laurence (who runs the Onward Opportunities fund) that Synectics’ customers pay it because it’s the best in class (but not the cheapest) and that it had displaced some competitors because the tech wasn’t good enough as deemed by the regulator.

These contracts are typically multi-year cycles, and if your tech is good enough, then it’s less likely you’re going to be replaced.

The chart is in an uptrend and looks like it could be consolidating.

I’m long already and would look to add to my position on a breakout.

Have a good weekend!

Speak soon,

Michael