Whenever the Magnificent Seven or AI stocks pull back, the papers are filled with stories about stock market crashes.

And yet both the S&P 500 and NASDAQ 100 are printing within 10% of their 52-week highs.

In fact, the S&P 500 is almost at all-time highs.

Now, whilst I think going all in on the S&P 500 carries not only US risk but significant sector concentration risk, trying to time the market is a muppet’s errand.

I love The Big Short.

It’s probably one of my favourite films along with Margin Call.

But The Big Short has cost traders more money than any other film.

People love the idea of being a contrarian and making a killing.

But they forget whilst Burry was eventually right, he was very wrong for a very long time.

So much so that he gated his fund because his investors literally wanted their money back.

And sure, he was right in the end.. but if not he would’ve been sued into oblivion.

Shorting is hard. Most people shouldn’t do it.

Although if you are going to do it, then at least do it properly.

But this film has contributed to many a trader’s fetish of wanting to time the market.

In fact, this isn’t even the film that made the big money.

The Big Long is what they should’ve made.

But that’s not exciting and it doesn’t get bums on seats.

Because long-term investing is boring. It takes years to grow and build wealth.

However, I did find the Easter Egg in The Big Short amusing.

Although to this day I’m sure if it was intended or just sheer irony.

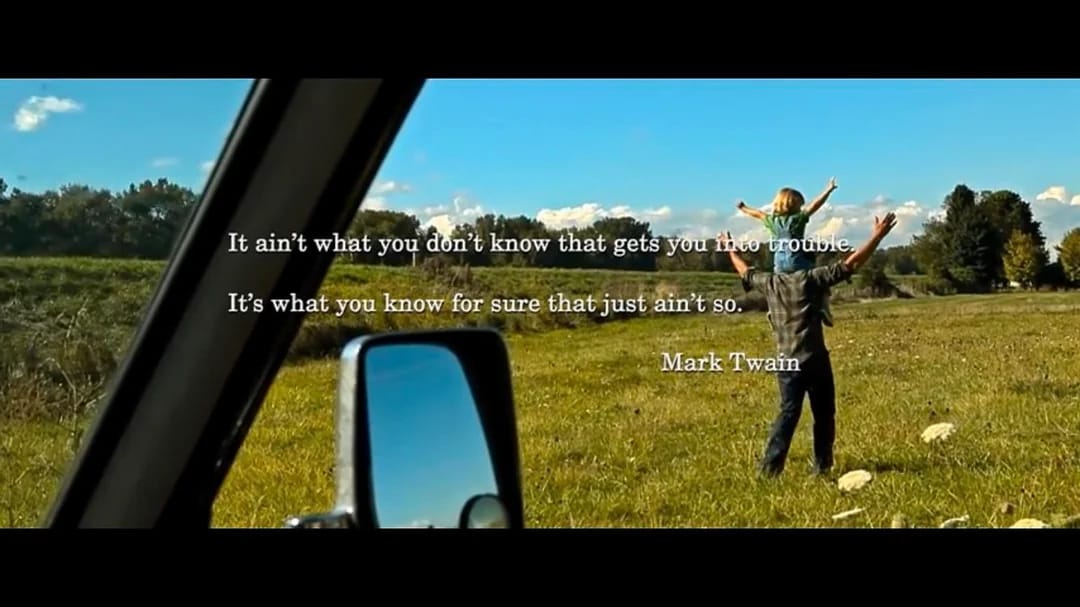

In the opening credits of the film, this quote appears..

It ain’t what you don’t know that gets you into trouble.

It’s what you know for sure that just ain’t so.

The Big Short opening scenes - watch it if you haven’t!

This is included to show that people will believe things that just aren’t true and it’ll get them into trouble.

Like what happened with the big banks and ratings agencies in the GFC.

But here’s the thing…

There’s no actual evidence that Mark Twain ever said such a thing!

It doesn’t appear in any of his writings.

But it has spread like wildfire across the internet and is widely attributed to Mark Twain despite him never having said it.

So was this intentional by the film’s producers?

Or did they fall for the very thing they were trying to highlight?

I guess we’ll never know! But it’s still a great film.

And before we continue, a quick thank you to our sponsor XTB that offers a Stocks & Shares ISA with 0% commission on ETFs and stocks, and pays out 4.25% interest on uninvested cash, which is better than the Bank of England.

Peel Hunt (PEEL)

As always, everything I write and say is my own personal opinion only. It is NOT financial advice.

I don’t accept money from listed companies to talk about them unlike other market commentators, so whilst this is independent nothing is a stock recommendation to buy or sell.

These are ideas only, and whilst I try to be balanced, sometimes I will be wrong.

Therefore, it’s important that you do your own research!

I read an article in the FT over the weekend suggesting that banks were now building up dealmaking teams in expectation of a market rebound.

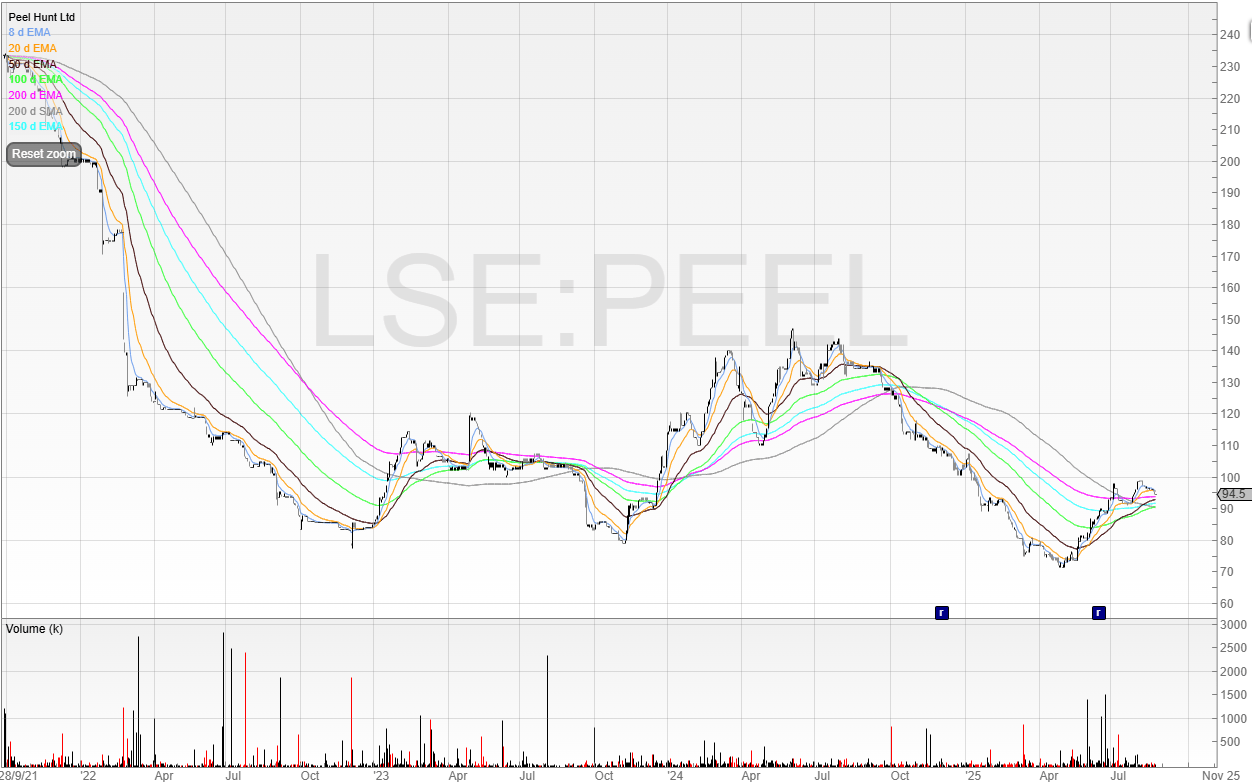

As we can see in the chart below, dealmaking has fallen to a 30-year low.

Since 2022, both the number of deals and deal value has fallen off a cliff.

IPOs can keep teams busy for a year, and not to mention the additional add-ons of secondary raises, research..

In fact, some prefer secondary issues (equity placings) because they’re a lot less work for not so less money.

Despite all the negativity around capital markets, Peel Hunt seems to be doing fine.

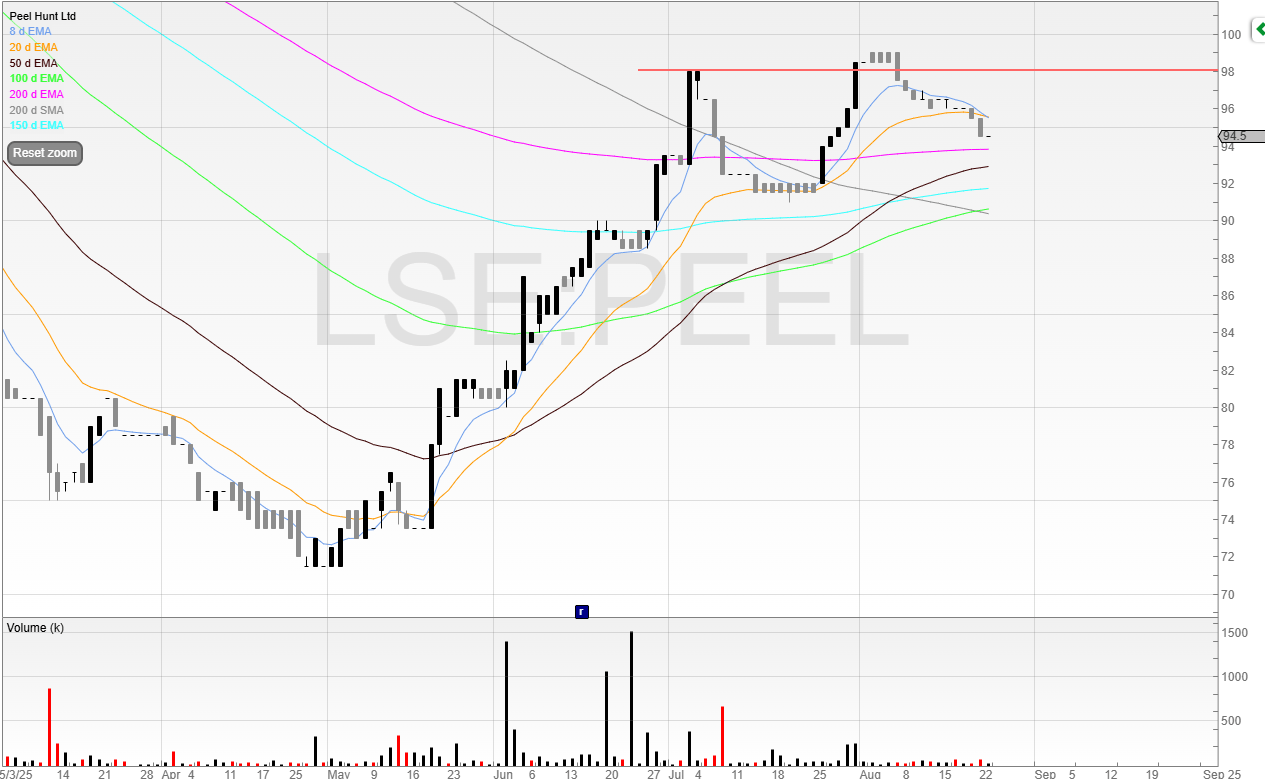

This is backed up by the chart too, to an extent.

It was another 2021 classic, and appears to have bottomed around April this year.

That said, it absolutely could test those lows again. Nothing is guaranteed.

But looking closer, we can see a rise in volume and the price is holding.

Both Peel Hunt and Cavendish (CAV) are proxies for a UK stock market rebound.

Cavendish is the merger of finnCap and Cenkos, and Peel acts for 55 FTSE 350 companies, as well as 50 in the FTSE 250, 5 in the FTSE 100, with a pipeline of IPOs ready to go if market conditions are stable.

I’d be tempted to test a long if the price breaks out of this tight base, but I’d expect to see both stocks rising if UK equity capital markets improve.

This next stock isn’t one I’d typically look at, but the strength in the price warranted a further look.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. Priority for all offers and live events. A risk-free trade itself as you get value or you cancel.

Upgrade