It feels like we are being guided towards tax rises. There appear to be less outright denials, and the messaging is starting to change.

“Everyone can see in the last year the world has changed and we’re not immune to that change”, Rachel Reeves has said.

The problem is, not everyone can see it.

Russia invaded Ukraine in 2022. The war rages on. The Gaza conflict isn’t new.

For the average person, life is still a grind.

The tax rises were supposed to come with growth, only the growth isn’t appearing as desired.

In fact, the OBR productivity forecast has been downgraded, with the FT reporting a gap of up to £30 billion. And £5 billion has come from the government’s retreat on welfare.

I don’t envy the Chancellor one bit.

Whatever she does, someone is going to be upset.

If she cuts public spending? It hurts those who rely on it.

Raises taxes? People are already hurting.

And if she does both, then everyone is unhappy.

But doing nothing also doesn’t seem to be an option.

Still, she decided to be there.

So whilst it’s a tough job… Nobody is forcing her to do it.

And before we continue, a big thank you to our sponsor XTB who is giving away a free share worth £70 to everyone who opens an account.

There is limited availability, and the value of the share may fluctuate. T&Cs apply.

Reacting to news

As always, everything I write and say is my own personal opinion only. It is NOT financial advice.

I don’t accept money from listed companies to talk about them unlike other market commentators, so whilst this is independent nothing is a stock recommendation to buy or sell.

These are ideas only, and whilst I try to be balanced, sometimes I will be wrong.

Most of my P&L doesn’t come from day trading.

However, reacting to news can be great when attractive risk/reward trades set up.

Tesco was one of those trades yesterday.

It was basically revised upwards guidance within a tighter range.

I’ve always said that whenever management gives a number, it’s always the lowest number.

So I read it as going from £2.7 billion to £2.9 billion.

I also see the top number was nudged up from £3 billion to £3.1 billion.

Management would surely not do this if they wouldn’t beat £3 billion as it would look a bit silly on their part.

So overall, it’s good news.

It’s a surprise ahead too!

The last news said that the guidance was unchanged, so this was a surprise ahead.

Unlike an ‘ahead’ which is the sixth ‘ahead’ in a row, and not really a surprise.

You always need to consider where the market is at, and not what solely is being reported.

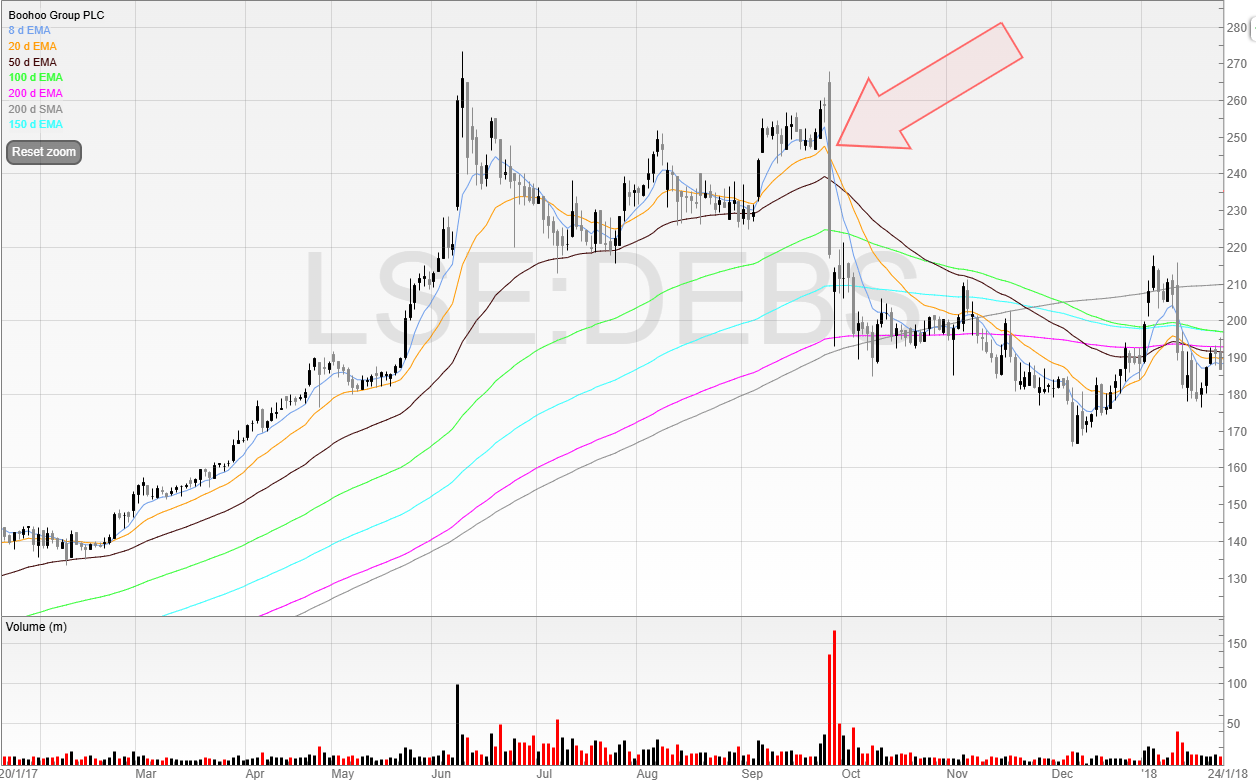

Believe it or not, this huge fall in Boohoo back in 2017 was on an ‘ahead’ statement.

Earlier that week, my broker had called me asking if I wanted to trade Boohoo as it was likely to beat its earnings and would gap up.

Well, it gapped up briefly.

And collapsed and closed at the days lows due to everyone selling.

The simple reason was, everyone expected the stock to beat its expectations.

So it was no longer a beat.

And so the real expectations were even higher.

And when the stock failed to live up to them…

This is why you always want to be early in the upgrade cycle.

In any case, back to Tesco.

I was initially surprised at the low uncrossing price, and wondered if I’d missed something.

But it appeared that I would be getting the news for free with no news premium!

The stock uncrossed, I got filled, and I had a 6 point stop.

My guess was that if I was right, the stock would rally sharpish.

And if I was wrong, I’d get stopped out.

Luckily, the stock rallied, and I was lifted within the hour at 439.8p, capturing 10.5 points.

My strike rate for intraday trading is close to 50%, so I won’t pretend I am nailing these every day.

But the key is to take capture more reward than your risk.

This next stock was an IPO flop but might be turning around.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. Priority for all offers and live events. A risk-free trade itself as you get value or you cancel.

Upgrade