Tomorrow will be the last day to sign up for my Finance & Wellness Retreat.

If you’ve got any questions please send them across, as this’ll the last chance if you’re thinking of joining.

Putin wins!

The much-hyped discussion between Putin and Trump has seen Trump seemingly swap sides again and Putin hasn’t had to concede a thing.

Trump gave plenty of ultimatums about a ceasefire and consequences, and now there will be no consequences.

In fact, Putin bought more time and can keep pressing his advantage.

Boris Johnson called it “the most vomit inducing summit in diplomatic history”.

Putin appears to have words of honey; a soothsayer when it comes to Trump.

Apparently, Trump later told Fox News host Sean Hannity that Putin had assured him that he was cheated out of the 2020 election.

Which I bet was music to Trump’s ears.

Putin no longer wants a ceasefire. It doesn’t make sense.

When you have the advantage, it makes more sense to push for a “peace agreement”.

That way you can keep fighting and pressing until the deal is signed.

Meanwhile, Zelensky doesn’t want to capitulate as too much has gone into this war.. and capitulating would mean the end of Ukraine.

And Trump wants a “deal” so he can claim it as his own. The terms of that deal don’t much seem to matter.

But although Putin didn’t get commercial agreements restored, it’s a definite win for the Russian President.

A sad day all around.

And before we continue, a quick thank you to our sponsor XTB that offers a Stocks & Shares ISA with 0% commission on ETFs and stocks, and pays out 4.25% interest on uninvested cash, which is better than the Bank of England. You can open a free account here.

Tortilla (MEX)

As always, everything I write and say is my own personal opinion only. It is NOT financial advice.

I don’t accept money from listed companies to talk about them unlike other market commentators, so whilst this is independent nothing is a stock recommendation to buy or sell.

These are ideas only, and whilst I try to be balanced, sometimes I will be wrong.

Therefore, it’s important that you do your own research!

Tortilla is another 2021 IPO classic.

I used to be a regular eater of a burrito after a big gym session.

But it sits like a brick in the stomach.

The narrative here has been that it could be like Chipotle in the US.

But there is a key difference between the US and the UK.

First of all, there is a much bigger Hispanic population in the US.

And the US is far more pre-disposed to Mexican food than in the UK.

So the idea that Tortilla could rival Chipotle is quite silly, but that doesn’t mean it’s a terrible business.

The business is growing, and acquired its largest European competitor Fresh Burritos last year.

It did this without raising fresh equity and whilst net debt is relatively high compared to the market cap, it’s manageable.

Adjusted EBITDA has grown yet the French business contributed a loss of £1.2 million, halving the group’s overall EBITDA to £1.2 million.

However, the French business is seeing ongoing investment and is expected to be completed by year end.

Earlier this year a new Central Production Kitchen was launched in Lille improving the food quality and ensuring consistency with Tortilla UK.

It’s worth nothing though that this kitchen is 14,000 square feet, which is three times the size of Tortilla’s UK facility.

That means the capacity for growth is more than there, and a potential springboard into Belgium, the Netherlands, and Northern Germany.

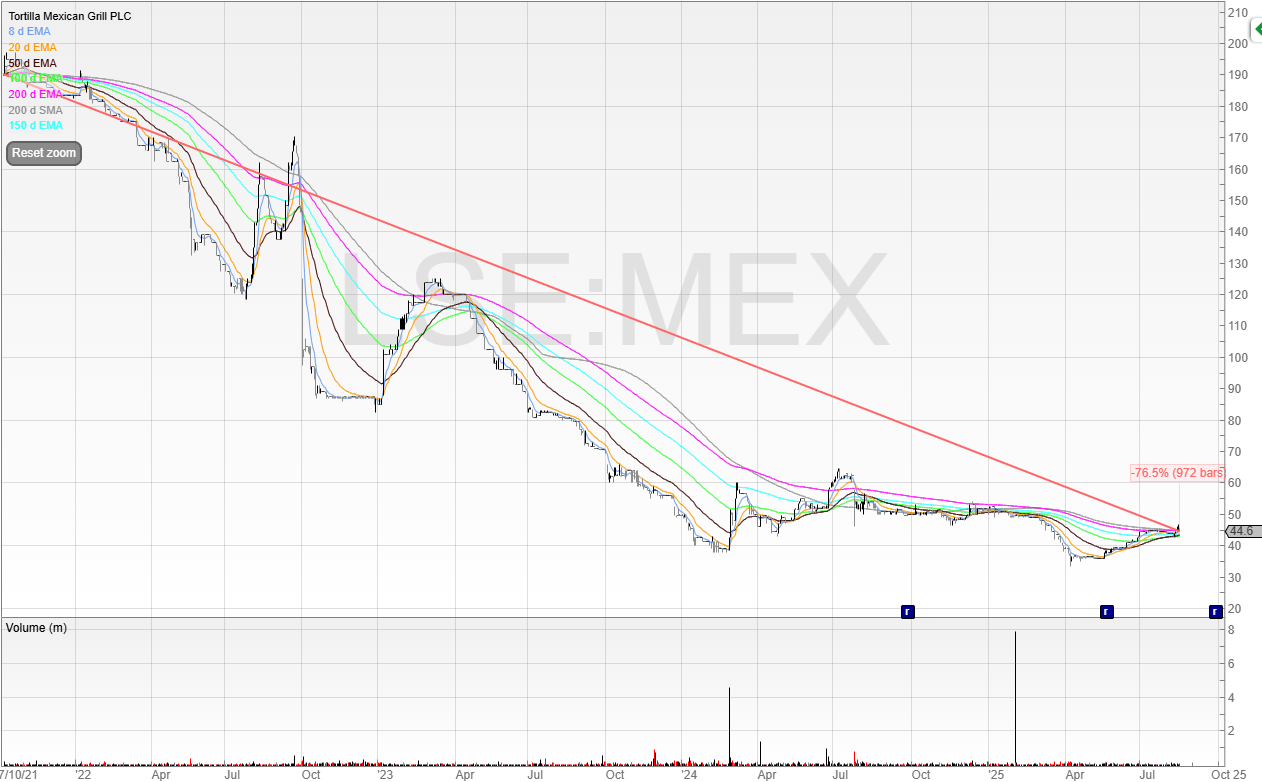

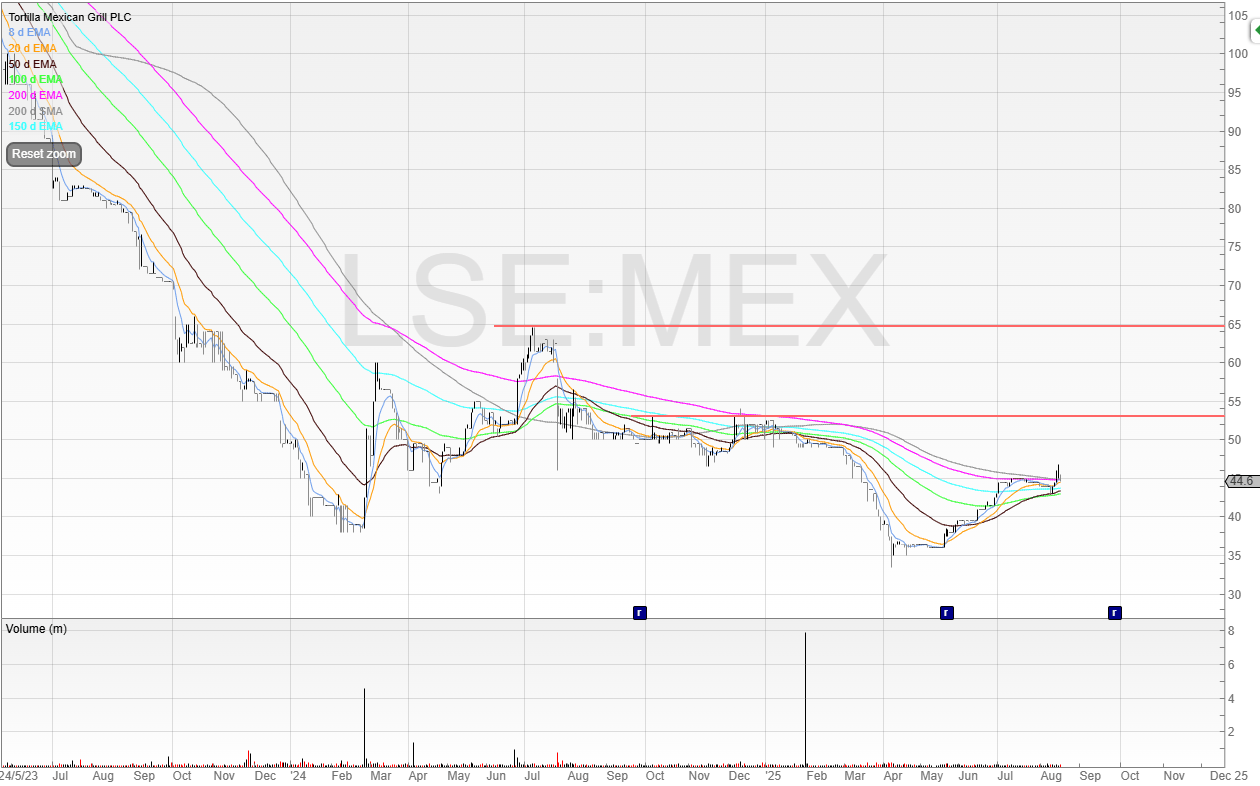

Here’s the chart.

This looks like a stage 4 downtrend to me.

So it’s not one I have any intention of buying right now.

Why bet on the bottom?

Rather, I’d wait for the stock to actually form an uptrend.

I don’t need to try and buy the bottom to generate P&L.

If I can catch a trend early it can run for several months.

Breaking 53p would get my interest.

It’s a level of resistance from last year and 65p is the high from last year.

53p is also 51% above the lows of 35p and the stock would be above all moving averages with the longer term ones potentially pointing up.

I’ll be watching for more good news but I’ve no intention of buying until there is a decent confirmation the trend has now changed.

This next stock has no liquidity issues, and not the usual type of share I look at.

But a trade is a trade!

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. Priority for all offers and live events. A risk-free trade itself as you get value or you cancel.

Upgrade