It’s been a big week!

Serica Energy had bad news out because of Storm Éowyn.

Basically, sea spray triggered the fire and gas detection system which trigged an automatic production shutdown.

Then Dana Petroleum found minor damage, then an integrity issue..

This meant that Serica Energy pulled its guidance.

The Company's 2025 production guidance is under review, and will be restated or revised pending further clarity on the timeline and implications for the necessary Triton activities.

Obviously, this is not good news.

The company is telling the market it no longer believes it can achieve its current guidance, and therefore this is a profit warning due to the disruption caused.

And no idea was given of how bad the disruption would be.

Now, as we’ve looked at before, Serica is cheap in terms of FCF metrics.

But a surprise profit warning is a surprise profit warning.

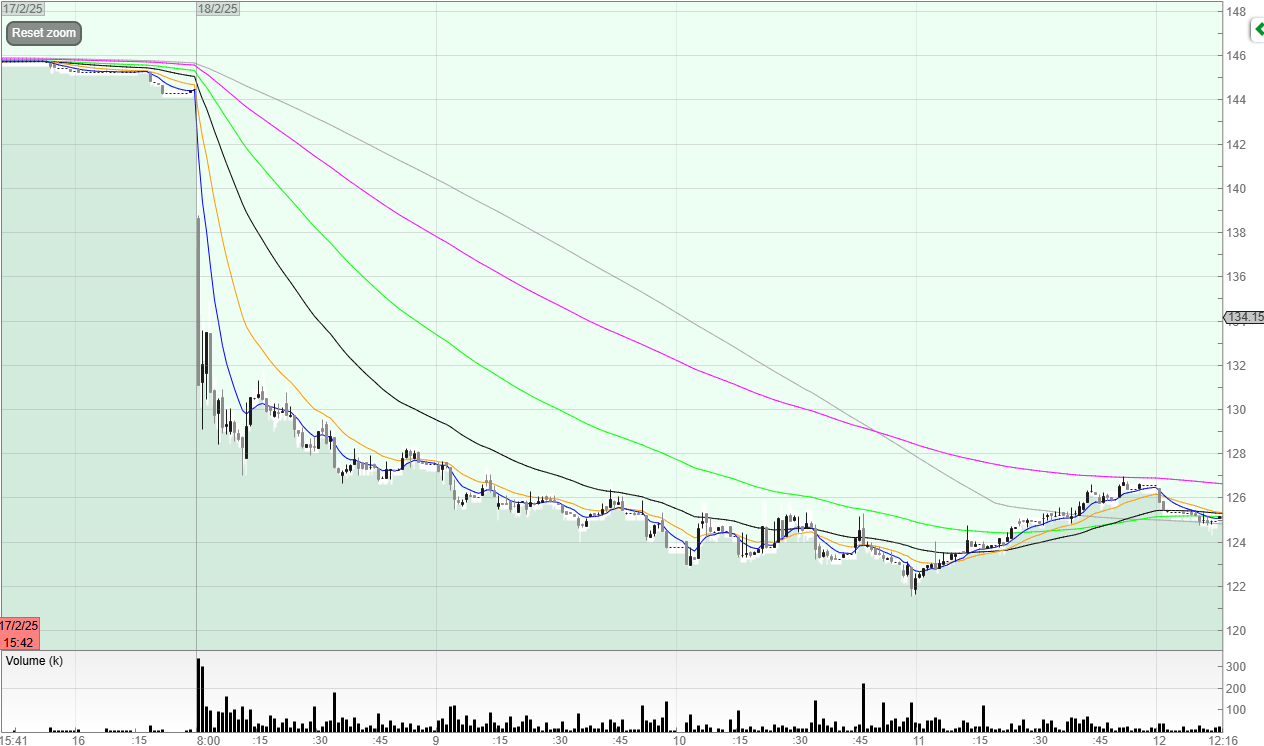

Stocks usually move lower after surprises, and given that the stock was only opening a few pence down this was a nice trade.

Castings (CGS)

Castings put out a bad profit warning this week.

However, the chart says this was not unexpected.

And on a PE of just 7, the downside is relatively protected.

It doesn’t mean it can’t fall further, of course.

But my job as a trader is to assess risk to reward.

And the r/r was not great to short this stock, in my view.

It was a bad warning, but looking at the previous earnings statement it sounds as if it should have been expected.

Outlook

The demand schedules for the remainder of this financial year continue to reflect the lower build rates that the heavy truck OEMs have reported.

We expect production efficiencies to improve in the second half of the year with the businesses having adjusted to the lower demand patterns. Assuming no material further reduction in demand schedules, management believes that the company will trade in line with market expectations for the full year.

In the medium-term, there continues to be opportunities for growth including new parts being quoted for our existing heavy-truck customers, greater reach in the US aided by a new warehousing arrangement, the expansion of the customer base at our larger casting facility and the offshore energy, agriculture and rail markets.

Whenever companies talk about the “medium-term” - it’s usually because they’re not confident in the short term.

Your Spidey senses should be tingling whenever you see the medium term phrasing being bandied about.

And before we continue, a quick thank you to our sponsor who helps towards the upkeep of this newsletter.

There’s a reason 400,000 professionals read this daily.

Join The AI Report, trusted by 400,000+ professionals at Google, Microsoft, and OpenAI. Get daily insights, tools, and strategies to master practical AI skills that drive results.

Pinewood Technologies (PINE)

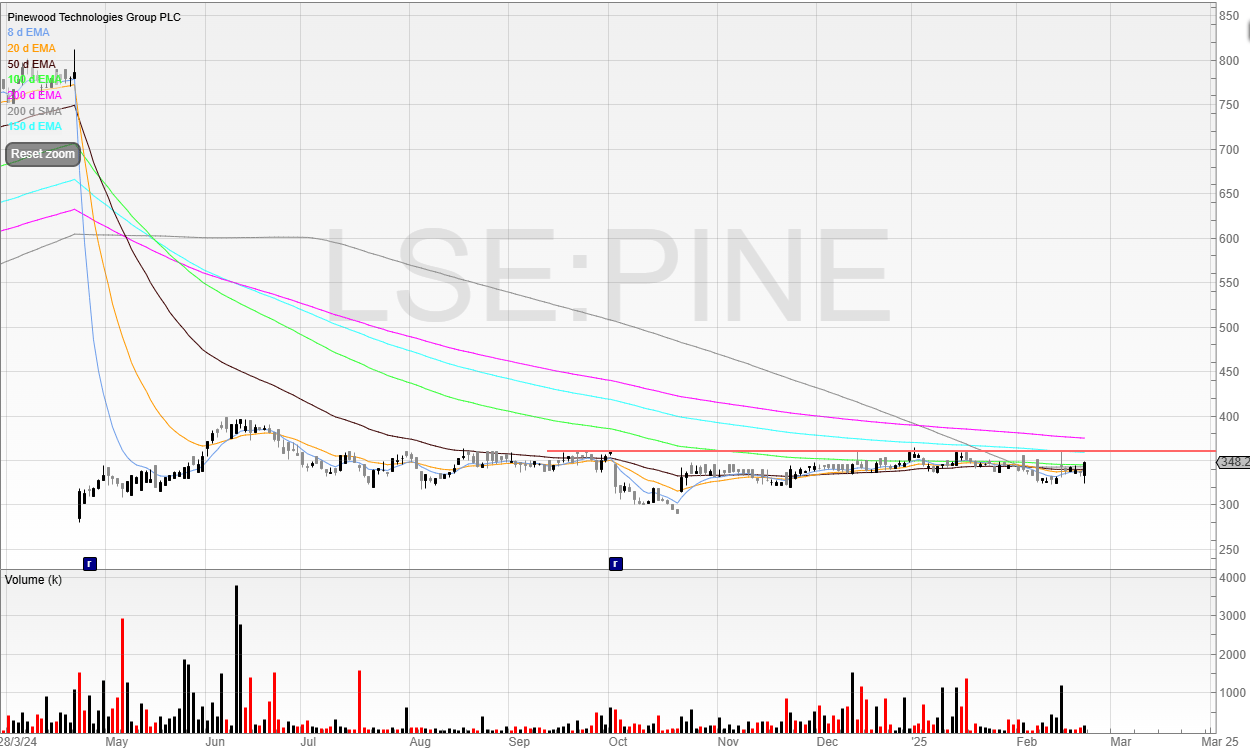

We looked Pinewood the other week.

As I predicted, the company has managed to win a US contract, and this is now accelerating earnings.

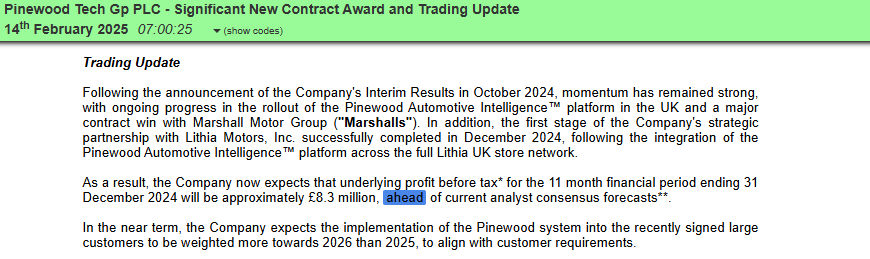

Pinewood Tech Gp PLC - Significant New Contract Award and Trading Update 14th February 2025

Unfortunately though, I didn’t trade the stock as I was busy elsewhere.

And it opened less than 10p higher!

The stock then announced a placing last night which was significantly oversubscribed.

I didn’t put in for this, but if I had I’d be happy as the current price is now 348p against the placing price of 315p.

I think 360p is an ideal breakout point and it’s likely the stock is now on an earnings upgrade cycle.

Remember, the longer the consolidation period, the greater the volatility (in general, of course).

This is because sellers have had ample time to dry up and the average price paid per share has come right down, meaning less people are nursing losses and therefore less likely to be a drag on the price.

This next company was a strong performer in 2023, however I think there could be more to come.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. Priority for all offers and live events. A risk-free trade itself as you get value or you cancel.

Upgrade