Well, it finally happened.

I’ve been waiting for this news for months and this week it finally dropped.

Plexus Holdings (POS) announced a placing and bookbuild.

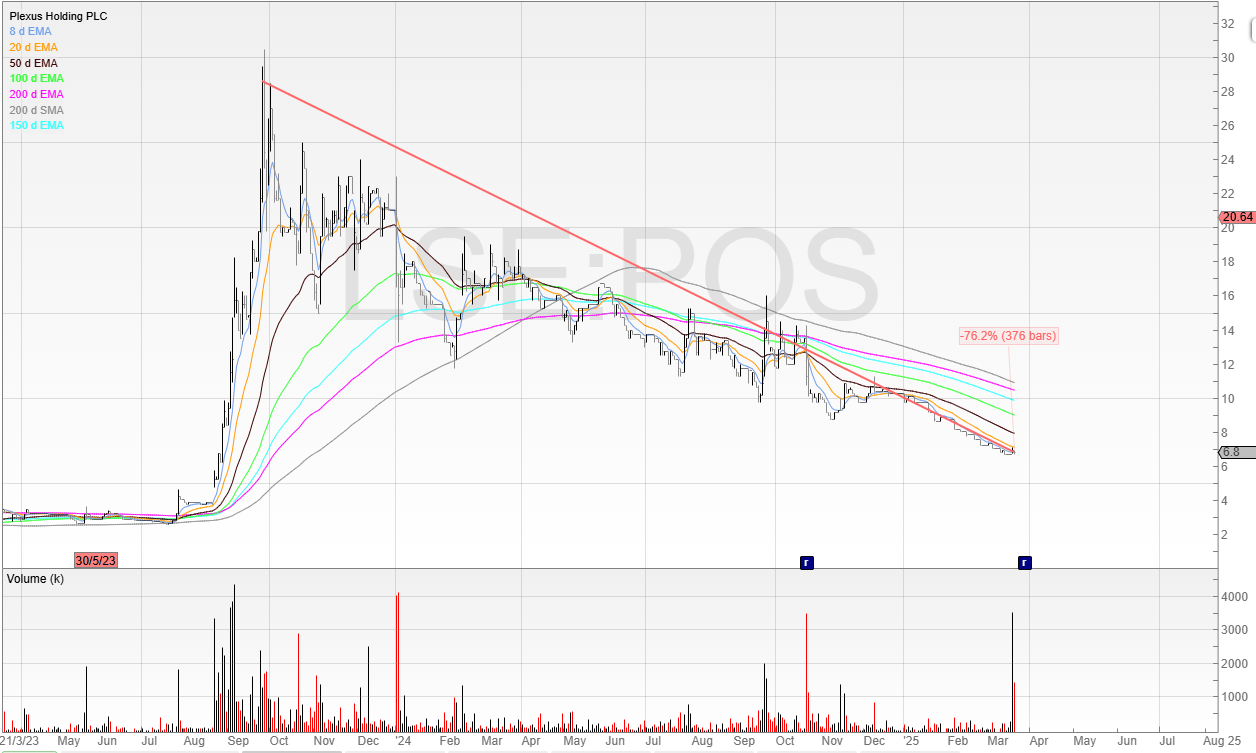

This company had a big run in 2023 and has since entered a stage four downtrend.

Why?

Because everyone knew it would likely need money.

So what we had here was:

People avoiding buying the stock because they assumed a raise was coming

Shorters potentially taking advantage and looking to close in the placing

Now, this would’ve been a dangerous short, as the stock is illiquid, but people do all sorts of crazy things.

Here’s the chart.

Plexus Holdings PLC is a UK-based oil and gas engineering company best known for its proprietary POS-GRIP® technology, which is used in wellhead and metal sealing equipment.

Basically, it makes gear that helps oil companies safely drill into the earth - particularly offshore.

That means it is high-end tech that is able to handle the ridiculous pressure, temperature, and safety demands under the sea.

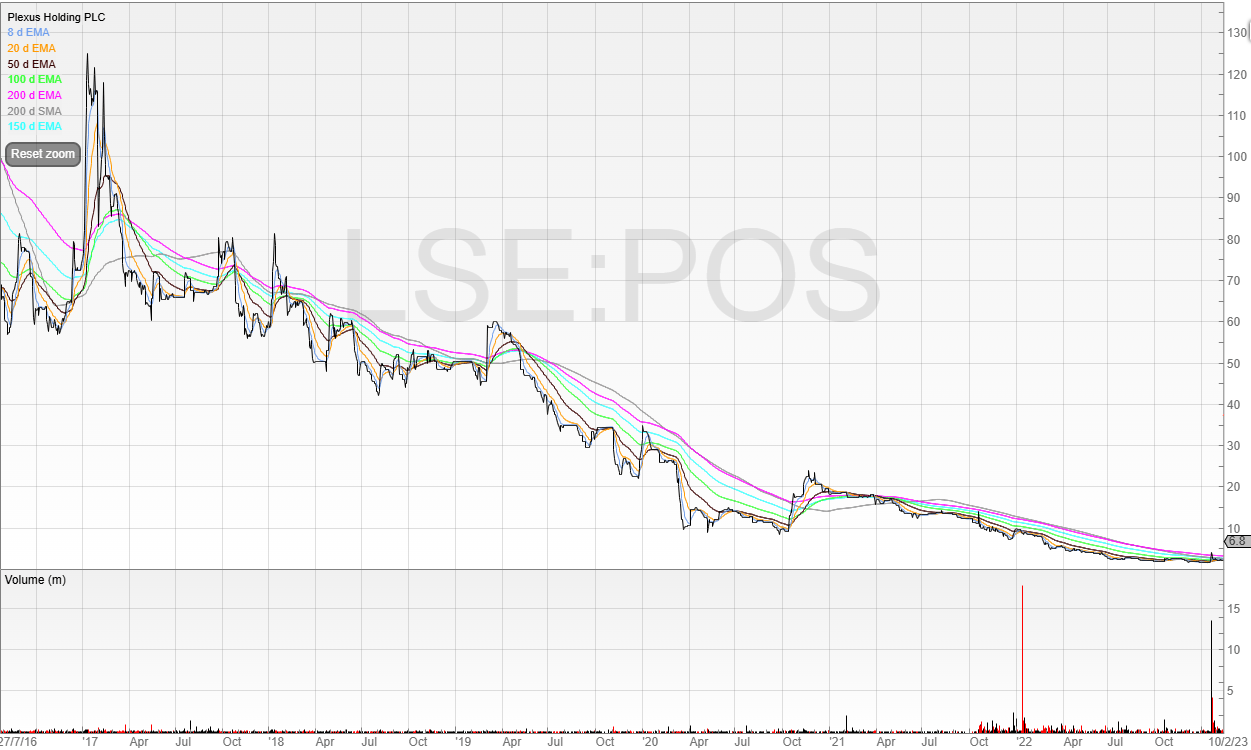

Plexus had a big break in 2017 when it sold a chunk of its jack-up exploration wellhead rental business to TechnipFMC for £42.5 million.

This was a big deal because it gave Plexus a pile of cash and more focus on tech licensing.

But again, looking at the chart, it hasn’t achieved much.

Or at least, if it has, the market hasn’t cared.

So, what’s changed?

Back in August 2023, the company announced this piece of news.

A big increase in revenue, and the price went from 5p to 30p on additional news that followed.

Then the company went silent, it became clear the business would need more money, and so the price fell all the way back down.

Some will ask “Why didn’t the company just raise money?”

And the answer is simple. I don’t know. There is rarely any benefit in delaying an inevitable capital raise.

Of course, management are always optimistic that news will show value accretion but this optimism is often misplaced.

And so, with a lot of dilution, but a good chunk of capital raised, I have taken part in this placing at 6.5p.

My average is slightly higher as I also bought in the open market believing I might get scaled back.

I was expecting some but not the 50% I got!

So there is good appetite for this deal.

And if you want to take part, you can do so here as detailed in the RNS.

Retail Offer

The Company values its retail shareholder base, which has supported the Company alongside institutional investors since IPO. Given the support of retail shareholders, the Company believes that it is appropriate to provide its retail shareholders in the United Kingdom the opportunity to participate in the Retail Offer. The Company is therefore making the Retail Offer available in the United Kingdom through the financial intermediaries which will be listed, subject to certain access restrictions, on the following website: https://www.bookbuild.live/deals/Z7Z9E7/authorised-intermediaries

Why have I taken this deal? Especially when I turn down 95% of them down?

The company says its wellheads are 100% utilised and is having to turn down work.

Plus, the nature of the work is short contract cycles, significant returns on investment, high margins, and fast payback.

It has four sets of Exact-EX wellheads, and it has recently taken delivery of another four which will be allocated for live work.

Here’s what the company says, with the emphasis being mine.

In response to customer demand, Plexus intends to initiate the manufacture of a further eight sets of Exact-EX wellhead sets in order to convert the Company's growing sales pipeline. The additional eight sets will cost approximately £3 million and have the potential to generate revenues of £4.5 million per annum.

Basically, this is a raise to invest in equipment that will allow Plexus to say yes to new business rather than turning it away because it has no capacity.

And please bear in mind - this is a trade for me.

Here’s my thinking.

I am long around 6.5p.

If I place my stop just below 5p - that’s a max 2p of risk. It’s illiquid, and a small company, hence the wider stop to account for both illiquidity and volatility.

Can this business get to 10p by winning new business and growing its earnings? Especially now the uncertainty has been removed?

I think so. That would be around 3.5p of reward - not assuming further upside.

Therefore, entering at 6.5p is attractive risk/reward for me.

I could be wrong, and these are just my thoughts.

Happy to hear yours too in case there’s something I’ve missed!

Have a good weekend and speak soon,

Michael