And just like that, the market has discounted the tariffs!

If you were unconscious for a month and woke up and checked the markets, then you’d probably think not much had happened.

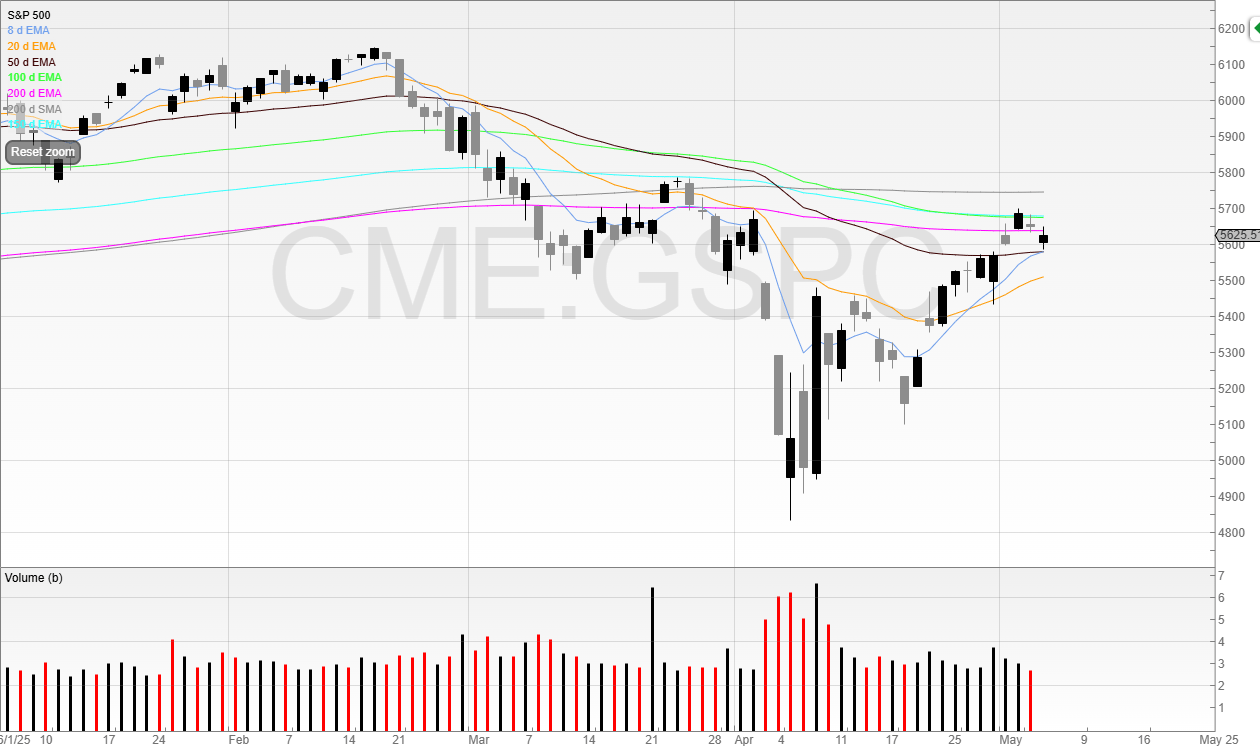

The S&P has rallied to 5,600 as if the worst of the tariffs is over.

It could be right.

Maybe the initial shock was the worst, and now everyone can get on with it.

But we know tariffs are coming, and the worst of it isn’t showing in the data.

In fact, nothing is showing in the data so far.

Here’s the S&P 500.

So there are two options here, both of which can’t be true.

1) The market is right and the tariffs won’t be as bad as everyone thinks

This is possible. The great thing about capitalism is that everyone is motivated by profit.

Of course, there are some bad sides too. But free trade has allowed societies to flourish through Ricardo’s proven theory of comparative advantage.

I learned about this during my overpriced Masters degrees, but it makes sense.

Country A focuses on what it is best at which is Task 1, and Country B does the same and goes for Task 2.

The two countries then trade the results of Tasks 1 and 2 with each other, rather than being worse off both trying to do Task 1 and Task 2.

It’s why bananas grown in Brazil can be packed, transported, and shipped, cooled, trucked, and delivered onto Tesco’s shelves where you can buy them for a quid (or a tenner if you forgot your Clubcard).

So, this can be true, but at the moment, the US market has discounted the tariffs completely.

Then we have the second option…

2) The market is wrong and has failed to factor in tariff disruption on corporate earnings

This is also possible. Of course, Efficient Market Hypothesis lovers won’t like it, but the reality is markets aren’t always correct.

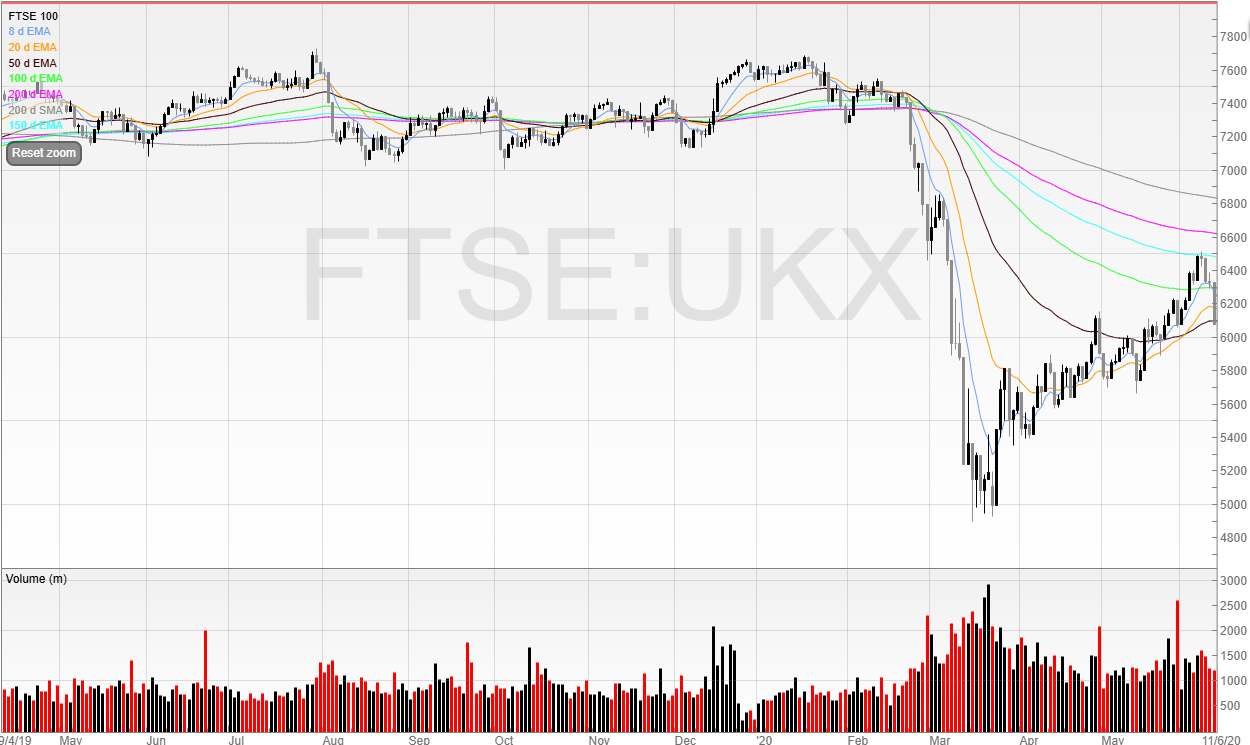

I remember back in February 2020, and Coronavirus was sweeping through Italy.

We saw the videos of the hospitals not only in China but Italy now - with Italians warning people on Twitter that this would come to us too.

And yet the markets were not bothered.

FTSE 100 traded well into February without caring about Covid

So, the big question…

What happens next?

The truth is, I don’t know.

And in all honesty, it’s not my job to know.

I am here to ride trends and find stocks that are outperforming.

If I had to guess, I’d bet on more downside, as Trump is out of his depth.

Watkin Jones (WJG)

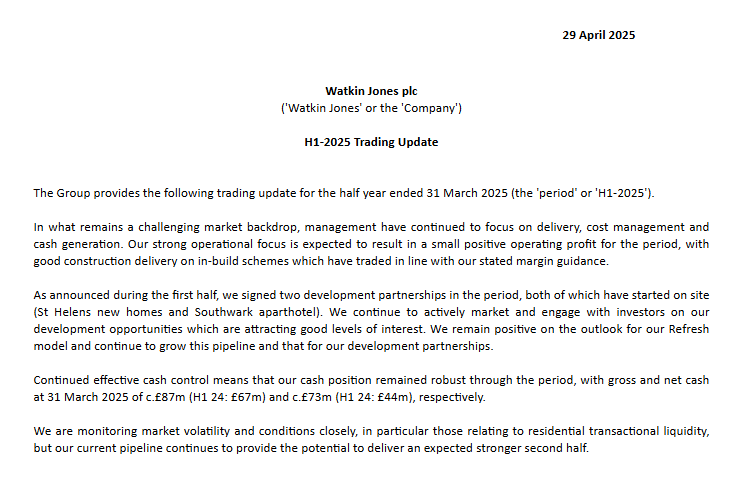

We looked at Watkin Jones a few months back.

It has rebounded since Liberation Day, and now looking at tightening up.

The company also announced its recent trading update.

As the stock has barely moved since, I can only assume that this means the market is unbothered.

What is interesting is that the market cap is only £86.6 million and yet has c£73 million in net cash.

This is nicely up from last year and the business has had effective cash control.

The directors are also talking about an expected stronger half.

This seems to marry with the view that the stock has passed its trough and is now entering a stage 2.

I like how the stock is tightening up here, and how it’s consolidating nicely after a big initial rise a few months back.

30p has historically been support, however it may be possible to use a tighter stop if the stock continues to consolidate.

With earnings risk out the way, I see this as a potential attractive trade.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. Priority for all offers and live events. A risk-free trade itself as you get value or you cancel.

Upgrade