I watched Gladiator II on the plane last week.

It sucked.

Demonic baboons, and sharks in the colosseum.

Come on.. If I wanted CGI of things that aren’t real I’d watch Avengers.

It doesn’t compare to the original, which has this great line.

Trump said something similar in his last remark: “This is going to be great television”.

And whether you agree with his politics or not, it was remarkable to say the least.

One day HBS may even use it as a case study.

Trump says lots of things, and backtracks against lots of things.

First we had the de minimus rule that scrapped the duty-free rule for China packages.

And because of the backlog that caused, it was repealed.

Now we have 25% tariffs on Mexico and Canada, and a doubling of duties on Chinese goods to 20%.

China has already imposed up to 15% tariffs on key US farm exports, including soy, beef in retaliatory measure.

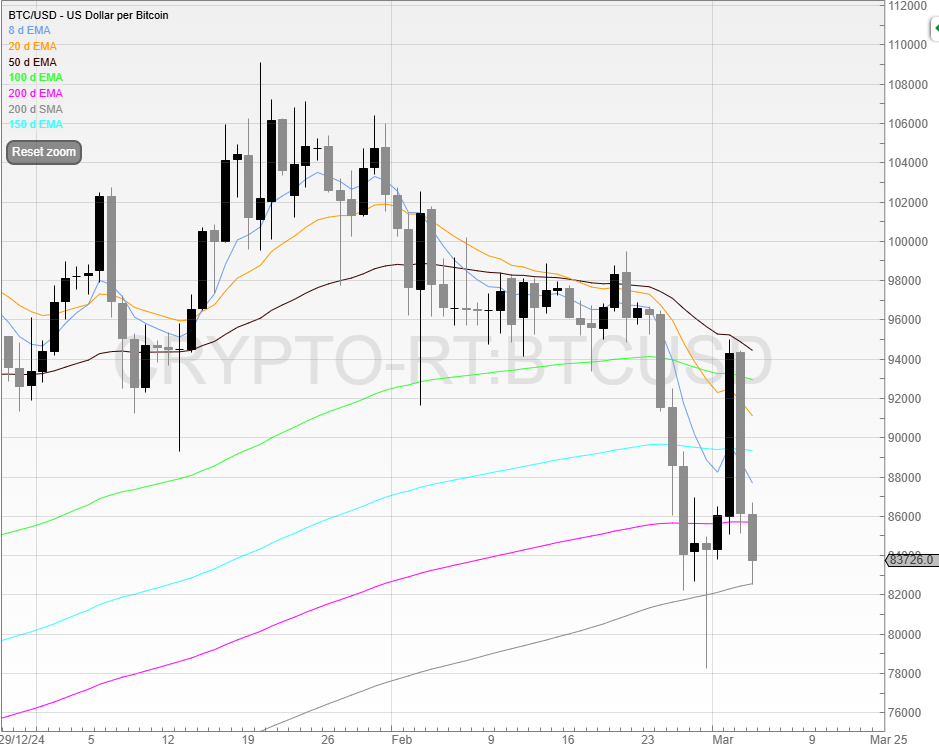

This comes after Trump announced a ‘crypto strategic reserve’ pumping the price of Bitcoin and crypto and adding nearly half a trillion in cryptocurrency value on Sunday.

But within two days, Bitcoin has given its entire gains back.

Again… say what you want. But it’s definitely not boring.

Cordel Group (CRDL)

Cordel Group is UK-based technology company specialising in artificial intelligence (AI) solutions for the transportation sector, with a primary focus on the railway industry.

The company offers a cloud-based platform, Cordel Connect, designed to automate infrastructure inspections and data management, enhancing safety, efficiency, and sustainability in rail operations.

But what does this actually mean?

Cordel’s AI-powered platform integrates data from various sources, including LiDAR sensors and high-resolution cameras, to deliver comprehensive analytics for transport corridors (railways).

Its solutions enable railway operators to automate inspections, predict maintenance needs, and manage infrastructure assets more effectively.

And despite being UK based, it operates in various countries such as the UK, Australia, New Zealand, and the Americas.

Efficient and accurate infrastructure monitoring is crucial for the safety and reliability of railway operations. Cordel's AI-driven solutions enable proactive maintenance and early detection of potential issues, reducing downtime and enhancing the overall performance of rail networks.

So there is a clear need for this product.

However, it’s not yet a viable business.

Despite lots of contracts being won, it’s still EBITDA negative.

And heavily cash-burning from its last set of results.

The chart is positive, at least.

However, I’d be careful as it’s not unlikely that more funds are required for this business.

Management say differently of course in the last placing RNS.

After careful consideration the Directors determined that, while the Company had not anticipated a placing given management's expectation of a positive cashflow profile for the 2025 fiscal year, in light of the progress being made in its AI capabilities, the additional funds would enable the Company to accelerate the development of the Company's 3D object recognition capabilities through its AI platform. The Directors believe that this will enable the Company to broaden the application of its technology portfolio across rail networks and should lead to enhanced revenue opportunities.

It remains to be seen!

Definitely an interesting business though.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. Priority for all offers and live events. A risk-free trade itself as you get value or you cancel.

Upgrade