Putin has said he’s open to the US’s plan for peace.

Well, not really.

He “supports the idea” but argues that it would give Ukraine time to regroup just as Russia is gaining the upper hand in Kursk.

His conditions?

Ukraine must recognise Russia’s annexation of Crimea and four other partially occupied regions, promise never to join NATO, accept military restrictions, guarantee protections for Russian speakers, and hold elections to replace Zelenskyy.

So yeah.. not exactly appealing.

If Putin gets his way, Ukraine as a functioning independent state is done.

It would be locked firmly in Russia’s orbit, and NATO’s presence in Eastern Europe would shrink significantly.

Now, Putin doesn’t want to be the one seen torpedoing a Trump peace deal, but he’s also in no hurry to back down.

Tariffs aren’t helping anyone either.

Higher tariffs mean US companies paying more for Chinese imports, which squeezes profit margins and pressures stock prices. It’s effectively a tax on global business.

And if China retaliates (which they usually do), we’re looking at the risk of a full-blown trade war. That’s bad news for everyone

But it’s not just about tariffs.

It’s about the ripple effects too.

Take Canada, for example. After Trump slapped tariffs on Canadian imports, Canadians responded by pulling American-made spirits off their shelves.

As the CEO of Brown-Forman (makers of Jack Daniel’s) put it: “That’s worse than a tariff because it’s literally taking your sales away.”

In other words, play stupid games, win stupid prizes.

Meanwhile, the tech sector has been taking a hammering.

As I write, Tesla is down 54% from its highs, Nvidia nearly 30%. When the market leaders stumble, sentiment across the board takes a hit.

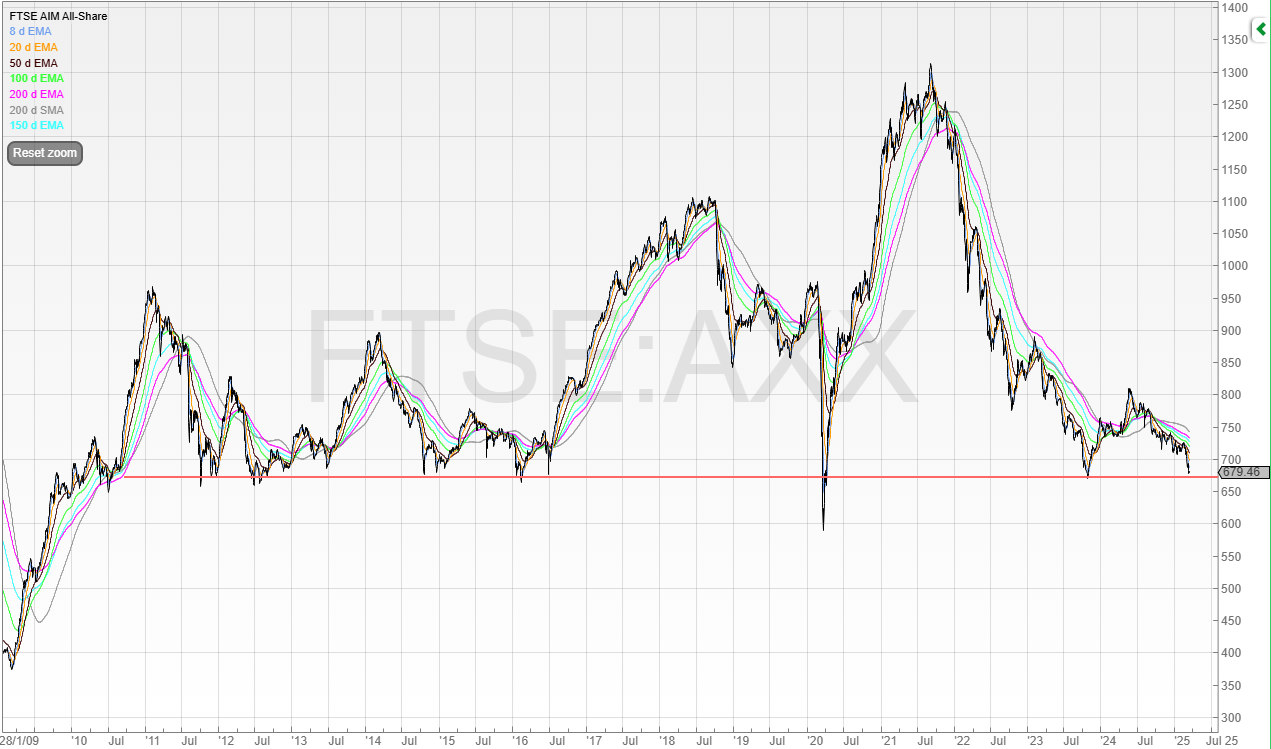

Right now, the FTSE AIM All-Share is closing in on history support and its 2023 lows.

But luckily, there are still trades around, and I trade individual stocks rather than buying the market.

I’ve taken a loss on Beeks this week.

The stock price started moving after this article was posted on FT.

It talks about how Nasdaq has been selectively offering clients faster connections for $10,000 a month.

This seems odd to me that Nasdaq would 1) do such a thing, and 2) sell it for only $10,000 a month.

But when the FT reached out, Nasdaq said: “Nasdaq has begun discontinuing the service”. Beeks has been contacted and provided the following response:

"Thanks for your email to Beeks Financial Cloud. The Company does not comment on share price movements or unsubstantiated rumours. As previously announced, Interim Results will be released on Monday 17th March, with an Investor Meet Company presentation on 19th. You can register to join here:”

My guess is that if it was substantiated, then it would comment. Therefore, this appears nothing to do with Beeks.

But it did a lot of damage to the share price and cleaned out a lot of stops.

This could’ve been a great opportunity for a puke trade too.

The market makers will always go stop hunting and as people chase the bid, the price falls further.

Once the market makers have plenty of stock it’s then in their interest to try to stimulate demand by rising the price and selling back those shares to the market for a profit.

Remember, they also make a turn on the spread too.

The stock has rallied but not to where it previously was.

And with results on the 17th March perhaps we may get some more detail.

But for now, having been stopped out, I’ll be watching for a breakout of the recent high.

Just because a trade stops me out doesn’t make it a bad trade.

Sometimes stops will take me out of a trade only for that stock to eventually print higher.

But stop losses are insurance and protection. What if the stock keeps falling? What if the trade doesn’t recover and instead spends six months underwater? That’s not a great return on capital efficiency and also not great for a trader’s psychology.

Sometimes a shake out allows the stock to set up an even better pattern as it’s removed some weak hands, and sets up even tighter.

I may be out of Beeks at a loss, but it’s one trade of many, and I believe the story is far from over here.

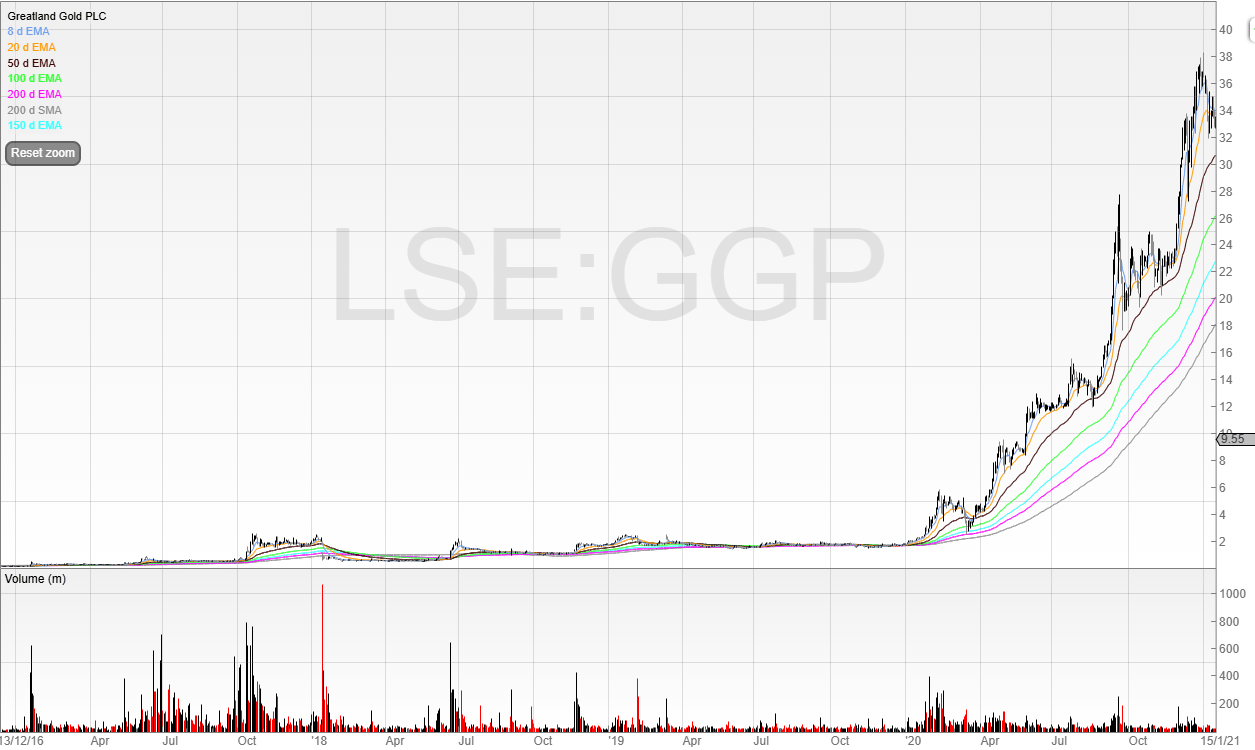

Greatland Gold (GGP)

Greatland Gold is a UK-based mining company focusing on gold and copper exploration and development, primarily in Western Australia.

It was established in 2005 and the company has transitioned from exploration to production, notably through its acquisition of the Telfer gold-copper mine and the development of the Havieron project.

The company went into the stratosphere in 2017 when it put out a hugely rampy (and in fairness, justified) RNS.

But that rally pales into nothing when you look at the 2021 run.

Gold is running rampant with the price being up around 50% in the last 12 months.

Greatland Gold has formed a cup and handle and as of this morning I am long.

This is a M2M trade for me.

The catalyst is the gold price and the fact that the company employs a hedging strategy to manage its exposure to fluctuations in gold prices.

Specifically, the company utilises gold put options, which grant the right (but not the obligation) to sell gold at predetermined prices, thereby providing downside protection while allowing for potential upside if market prices rise.

As of December 2024, Greatland Gold has put options covering 150,000 ounces of gold production at an average strike price of A$3,905.17 per ounce. These options are scheduled across quarterly expirations throughout 2025, as detailed below:

Quarter Ending | Gold Volume (ounces) | Strike Price (A$ per ounce) |

|---|---|---|

31-Mar-2025 | 33,996 | 3,905.17 |

30-Jun-2025 | 46,302 | 3,905.17 |

30-Sep-2025 | 38,910 | 3,905.17 |

31-Dec-2025 | 30,792 | 3,905.17 |

This hedging approach ensures that Greatland Gold has a safety net against potential declines in gold prices while retaining the ability to benefit from any price increases.

Therefore, the company is not entirely unhedged.

But it employs a selective hedging strategy to balance risk and opportunity.

Have a great weekend and speak soon!

Michael