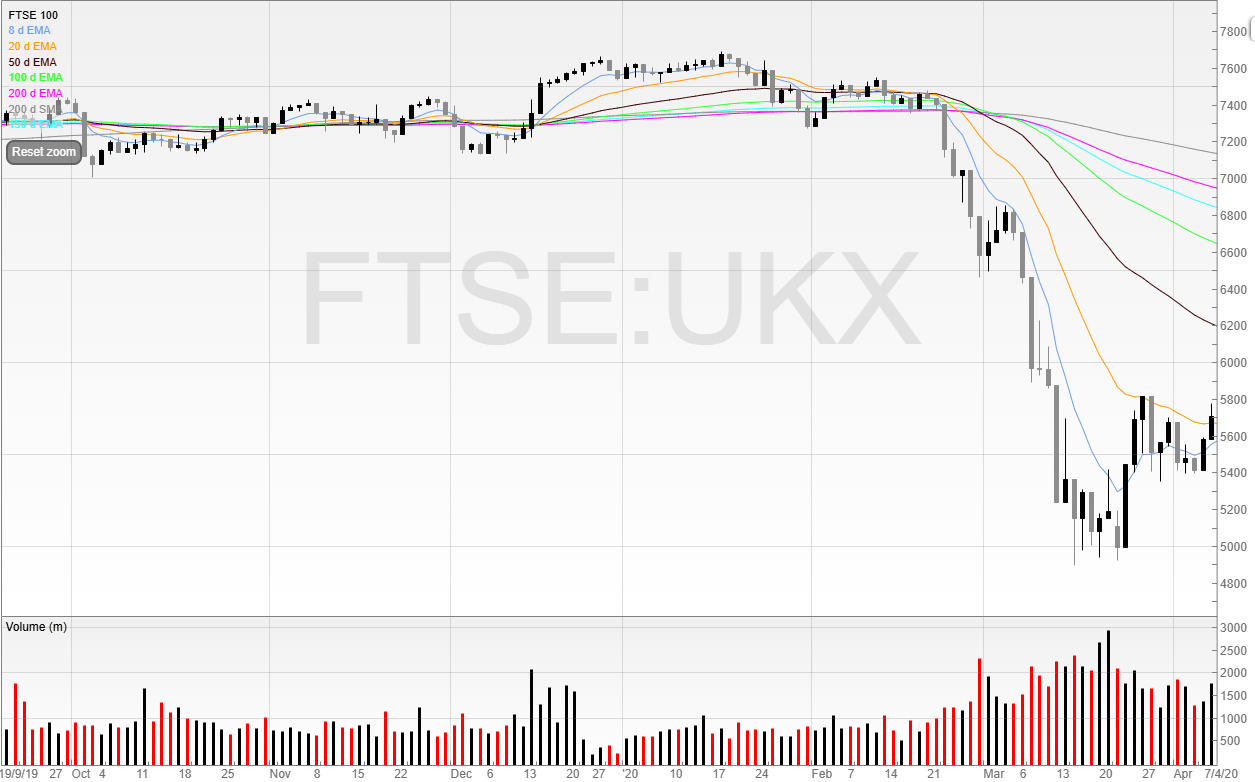

The FTSE 100 had its worst day since April on Friday.

And yet it looks like a blip on the two-year chart.

One of the questions I regularly get is “Is this the start of a market crash?”

My answer is always the same: “No idea”.

Markets can be irrational for long periods of time.

I remember hearing of a hedge fund manager in talking in Ye Olde Watling and saying he was very, very short in December 2019 (he used different words which I probably shouldn’t repeat here) because of Covid.

And it turns out he was right.

It did spread across the world. It did cause widespread economic turmoil. And it did trigger mass lockdowns.

But the market didn’t care until over two months later, trading not far off from all-time highs.

So if you’re a long-term ETF investor… do nothing and stay the course.

And if you’re an active trader… then keep doing what you’re doing.

Your stops will take you out of the market and risk management will do its job, meaning you don’t actually have to worry about a market crash.

And before we continue, a big thank you to our sponsor XTB who offers 4.25% interest on uninvested cash, and 0% commissions on ETFs and stocks in its ISA, plus a free share.

There is limited availability on the free share, and your capital is at risk. The value of the share may also fluctuate. T&Cs apply.

Audioboom (BOOM) (I hold a long position)

As always, everything I write and say is my own personal opinion only. It is NOT financial advice.

I don’t accept money from listed companies to talk about them unlike other market commentators, so whilst this is independent nothing is a stock recommendation to buy or sell.

These are ideas only, and whilst I try to be balanced, sometimes I will be wrong.

Audioboom has long been a punter stock.

The other week, a Sky News article spurred the price more than 20% in a day, only for the stock to push on towards 750p.

Here’s the article.

The company actually provided a response on Friday the same day after the close.

It basically said that nothing had happened.

I was expecting the price to fall on the Monday given that this news was completely meaningless, yet the price kept rising, so I kept selling.

A trader better than myself once said: “When the fish are biting, keep feeding”.

It’s stuck with me forever, and backed up by Mark Minervini who often says that traders should practice “nailing down their profits into strength”.

Well, the shine has worn off the article, and the price is now trading below the undisturbed (the price before the Sky News article came out).

There’s also been a trading update since.

However, the company appears to not be able to add up.

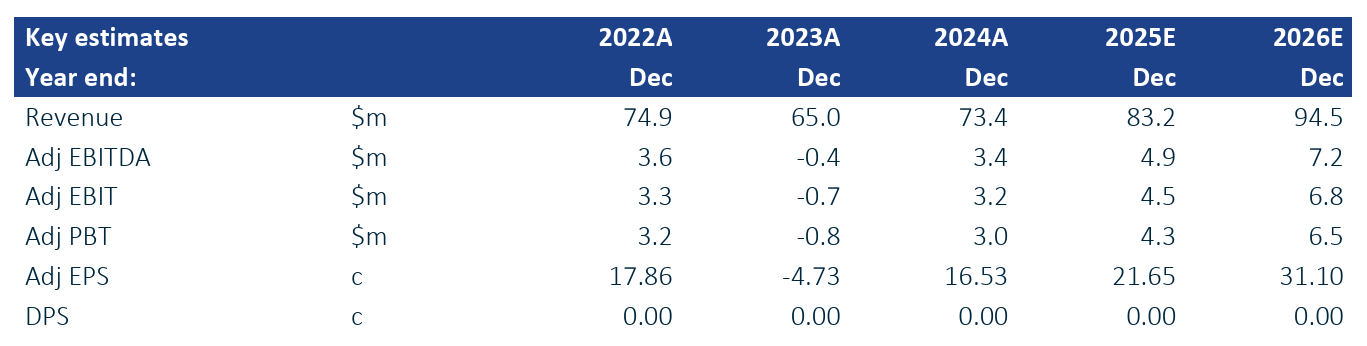

Q1 adjusted EBITDA was $0.7 million.

Q2 adjusted EBITDA was $1.2 million.

We are now told that Q3 adjusted EBITDA was $1.2 million, which gives $3.1 million for the year… yet the company says adjusted EBITDA for the nine months up to 30 September, the same three quarters to the day, is only $3.0 million.

However, in the last quarter of 202 Audioboom did $2.1 million in adjusted EBITDA.

If we assume no growth on the quarter, then Audioboom would be looking at $5.2 million in adjusted EBITDA for the year - $0.2 million ahead of forecast.

I am not quite sure why the company has decided to put itself up for sale.

This rarely ends well as if someone wanted to come and buy the company… they would.

And even if someone came in tomorrow for, let’s say, 1,000p - nearly 100% higher than the current share price - that would still be more than 50% off the highs in 2021.

OK, they were irrational days, but given the size of this potential market and ability to scale, as a shareholder I personally am not in a rush to sell (though I certainly wouldn’t complain if someone did come in for 1,000p as it would be a quick gain and free up plenty of capital).

I have been a buyer around 510-540p to rebuy my holding sold into the rally, with more ready to go should the price go below sub 500p.

Given that this is a Trade 2 Hold for me, my stop is wider to account for wider volatility.

For anyone looking to swing trade this, I would be looking to buy sub 500p with a tight stop with a quick snapback rally.

This next stock is one I’ve been publicly negative about since its IPO in 2021.

But facts change, and I reserve the right to change my mind when they do.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. Priority for all offers and live events. A risk-free trade itself as you get value or you cancel.

Upgrade