That’s 25% of the year complete!

Q1 done. It goes quick.

And with the spring budget out the way, there are no major changes coming until at least the autumn budget.

Cash ISAs survive… for now.

But even with the £14 billion cuts to welfare to restore the £9.9 billion of headroom, much of this has gone already due to the rise in bond yields.

And with Trump’s potential tariffs yet to come, this is going to cause more headaches and issues for Rachel Reeves.

Even if the UK escapes more pain - the reality is a global escalating trade war is going to be good for no one.

Regardless of your opinion of the Chancellor, she has an impossible job.

Many are expecting tax hikes, more cuts in public spending, or a change in the fiscal rules.

Or several options!

The money has to come from somewhere.

And whilst I’m staunchly against a change in Cash ISAs, we are likely to see changes.

We’ve got a busy week ahead of us!

Here are two stocks I’m watching..

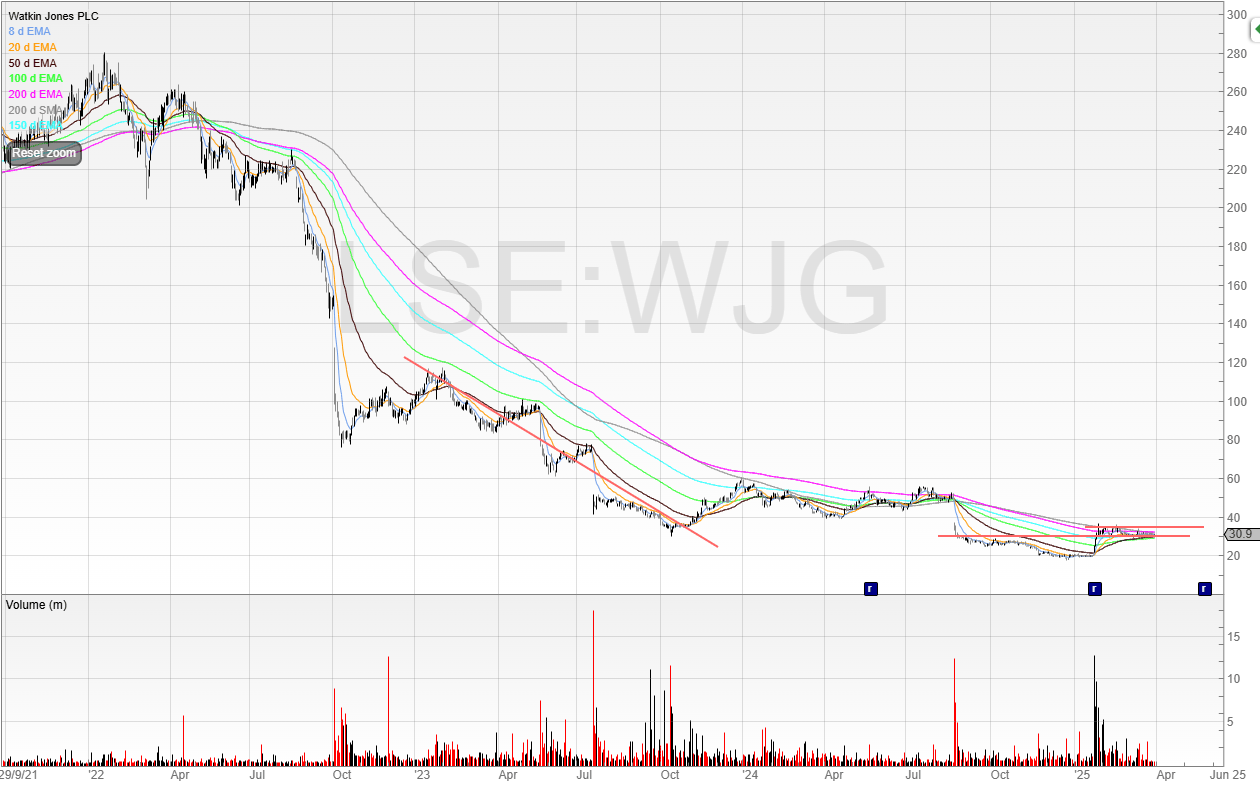

Watkin Jones

As I’m sure you’re aware already - none of my writeups are ever tips.

They’re my thoughts and why I like a stock, and why I don’t like it.

Unlike many stock market commentators, I refuse to take money from companies to promote their shares.

That means what you’re getting is purely my opinion, which of course will sometimes be wrong. Nobody gets them all right - and certainly not me!

Please always do your own research and you should never follow anyone blindly.

Watkin Jones (WJG) is a UK-based holding company specialising in the development and management of residential-for-rent homes.

The company focuses on sectors such as build-to-rent (BTR), purpose-built student accommodation (PBSA), and affordable housing.

Additionally, Watkin Jones offers accommodation management services through its Fresh Property Group (FPG) subsidiary, overseeing properties developed both in-house and by third parties.

From my understanding, the company's approach often involves forward-funding arrangements with institutional investors, allowing for reduced capital exposure and risk.

These institutional investors are its main clients seeking opportunities in the residential rental market. Additionally, through its accommodation management services, the company engages directly with tenants, including students and private renters.

The company's revenue streams include:

Development contracts: Income from developing residential projects, often through forward-funding agreements.

Property management Fees: Earnings from managing accommodation facilities via FPG.

Sales of Residential Units: Proceeds from selling completed housing units, particularly in the affordable homes segment.

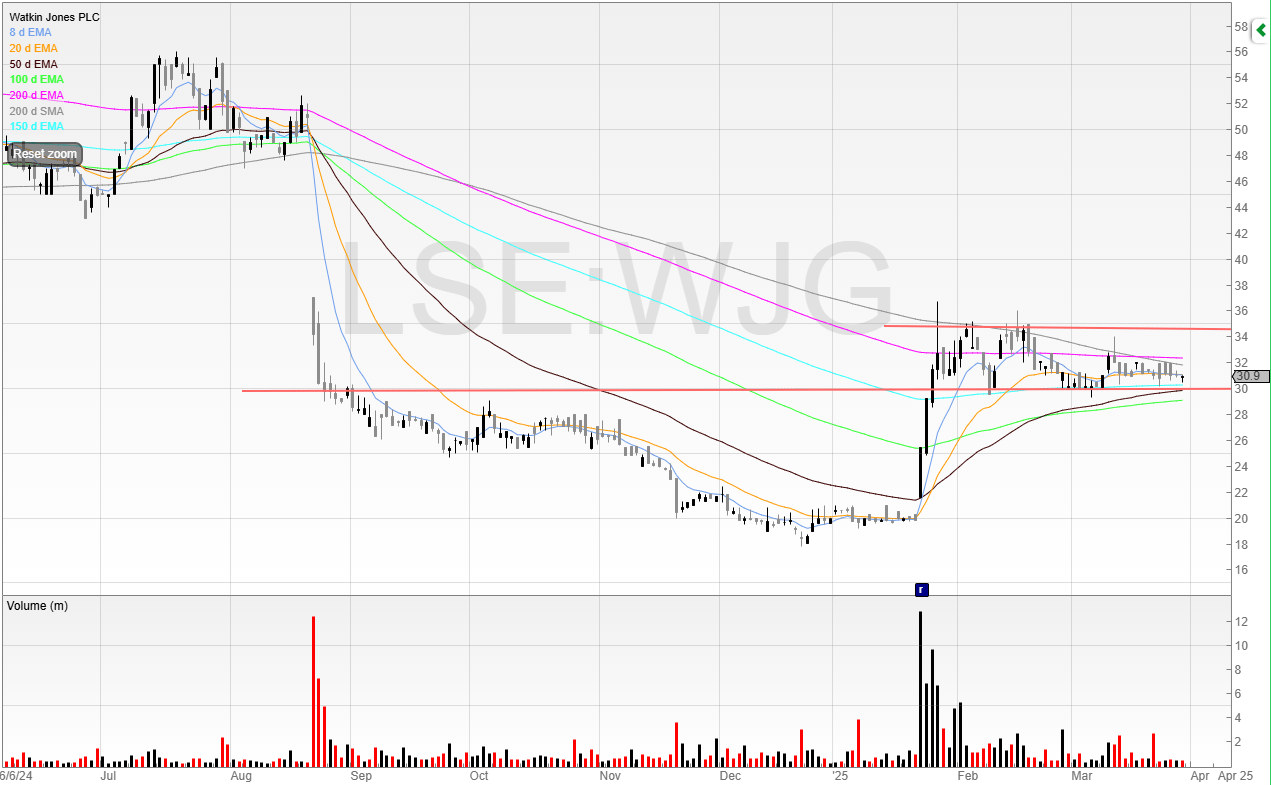

The company has had a rough time.

It was looking like it needed to raise last summer.

Then, a few weeks ago the stock rocketed on the full year results, as gross and net cash balances were higher.

I’m looking for the stock to tighten up and potentially break from 34.5p.

Breaking out here will put the stock above all moving averages, and it’s well off the lows too.

I had a meeting with another company a few weeks ago and whilst I have no position yet, I expect to be long at some point.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. Priority for all offers and live events. A risk-free trade itself as you get value or you cancel.

Upgrade