I’ve had a few questions about the launch of The Private Investor this Thursday..

Are the sessions recorded?

The sessions are live and hosted onto the community group to be watched whenever you want. So if you miss one, you won’t actually miss out. You can also submit questions to be answered in the next live Q&A.

You’ll have lifetime access to this and to future upgrades of the program.

When are the sessions?

Every Thursday at 6.30pm online.

I don’t know anything about investing - can I still join?

This is a program for anyone who has never invested before or has started but either hasn’t had the success they’d like or wants to learn more.

If you’re an advanced investor already - this program isn’t for you.

What if it’s not for me?

There’s a 30-day moneyback guarantee. So if it’s not for you, I’ll happily refund you.

Burberry (BRBY)

Burberry was a 2025 pick at 962p.

It now trades at 1,335p.

But the volatility in this stock has been crazy.

Trump’s tariffs caused the stock to crater, before the rebound started in earnest.

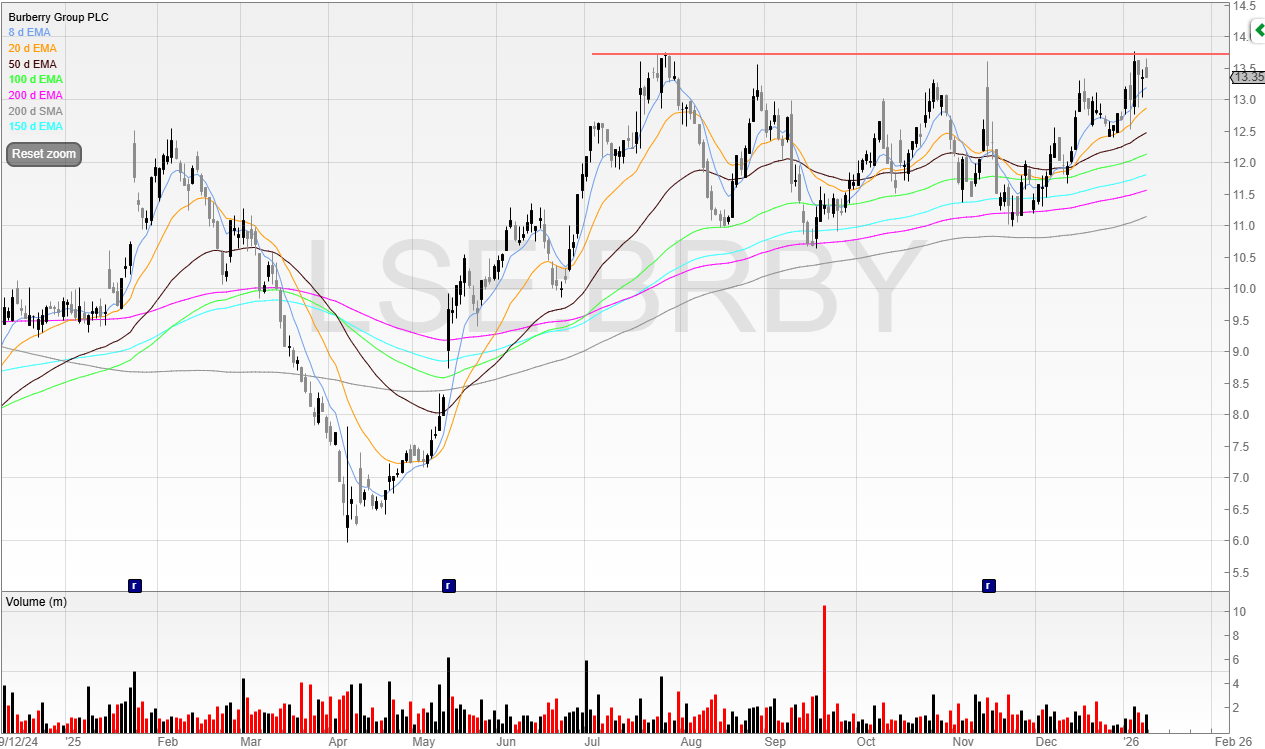

Here’s the stock’s performance for last year.

We can see it’s been building a choppy base since August.

If you don’t know, Burberry has been around for more than 160 years and is best known for its outerwear and signature plaid scarves.

It’s a global business, with 35% of revenue generated in Europe, 43% in Asia, and 22% in North America.

Back in December 2024, I spotted that Burberry searches on Google Trends were the highest they’d been in 10 years.

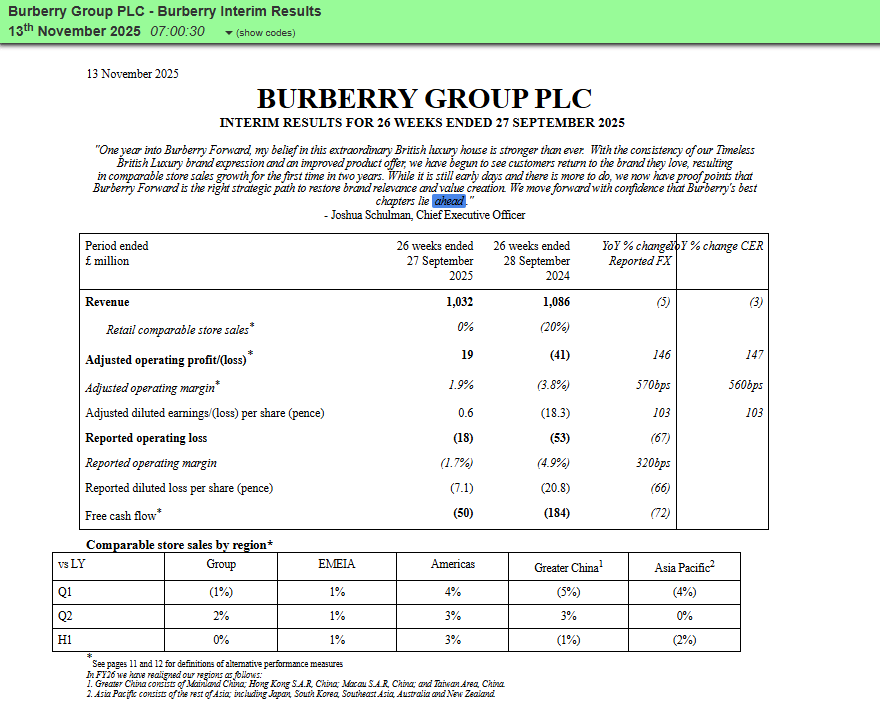

A few weeks later, the company put out better than expected numbers.

We can see the trend searches have been in the second highest this December, so evidence of a continued turnaround?

Obviously, interest does not mean conversions.

As of the last results, Burberry appears to have put a stop to the horrific negative LFLs for now and stabilised the business.

I’m not going to pretend I have any real edge in analysing a business like this. I don’t.

The chart tells me everything I need to know.

The moving averages are starting to get closer to the price and in general we’re seeing a trend of higher lows as the stock consolidates.

I’m watching for a break of the red line and would prefer a bit more consolidation, so I can place a tight stop.

The third stock in my 2026 picks is another Covid float which has collapsed in price.

I believe the business is now entering a new phase of growth and the market has yet to pick up on this.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. Priority for all offers and live events. A risk-free trade itself as you get value or you cancel.

Upgrade