2025 is almost a wrap.

And as it stands, I’ve generated so much P&L I can afford to take the rest of the year off!

Back to the grindstone next week, of course.

January is full of trading updates and historically has been a great month for me.

It’s always good to trade cautiously in January, because whilst it’s highly unlikely you will make your year, it is definitely possible to blow it.

Most people will start 1 January with a fresh slate as the numbers are set to 0.

If you’re down heavily in January, you’re now in a trough. Even if you had a smashing year last year.

This can be damaging psychologically seeing red, as you’re now climbing out of a hole.

I’m not saying don’t trade and don’t take risks, but be mindful of closing out January significantly in the red.

I’m still finalising my picks for 2026, which will be out today and over the coming weeks.

The Death List

The Death List is a list of stocks that are looking like they’re in significant trouble.

It’s a warning list for stocks that might go bust.

They are either move off the list as confirmed deaths or they turn around and manage to graduate from it.

For example, Naked Wines (WINE) was in danger of going under in my opinion, due to its inventory overbuild and lack of real liquidity.

However, that’s no longer the case and Naked Wines is no longer on the list.

Management successfully converted wine into cash (although at a cost) and seem to have rightsized the business.

When the facts change, I change my mind.

I hold a small position in Naked Wines now and am looking for reasons to increase this.

Two entries from 2024 both went under in the same week last month.

Petrofac (PFC) and Argo Blockchain (ARB) have now gone under, and The Revel Collective (TRC) which is the old Revolution Bars Group will almost certainly soon join them.

Evoke (EVOK) is now on my Death List too, as I don’t believe it can survive in its current form.

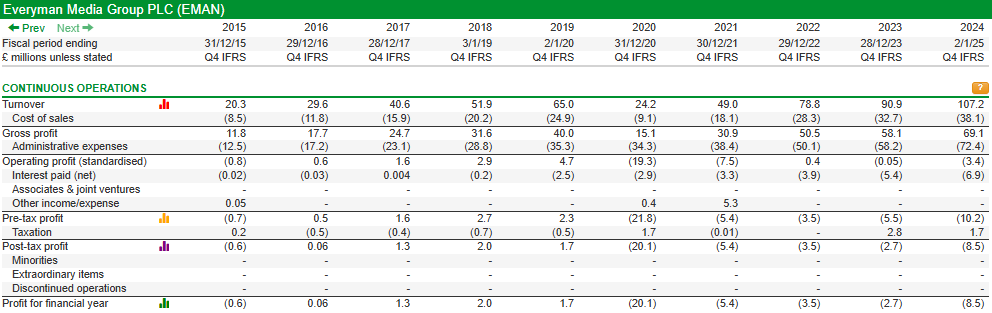

A potential future candidate for the Death List is Everyman (EMAN) however it is far from going bust at the moment.

The issue is, it just cannot make money despite the growing revenues.

It generates a lot of adjusted EBITDA..

But that doesn’t translate to shareholder profits.

Everyman has a lot of options for now. But it’s clear that revenue isn’t bringing operational scale.

I was also surprised to see the Guardian call it “hugely successful”.

For who? Stakeholders?

I would argue that I could generate a lot of revenue selling tenners for a fiver, but it wouldn’t make me any money.

WeCap (WCAP)

This is an AQUIS listed company that may be worth a look in a year.

These is an extreme valuation disconnect, which has lured punters in.

The problem with extreme valuation disconnects is that unless there is a cataylst…

Then the price doesn’t move and the extreme valuation disconnect stays where it is.

For example..

WeCap owns 806,022 WeShop Class A shares directly.

It also holds another 489,583 Class A shares held indirectly via WeCap’s 23.5% stake in Community Social Investments Limited, whose sole asset is 2,083,333 WeShop shares.

Now, at $100 share price for WeShop, that takes the value to £98.7 million compared to WeCap’s current market valuation of £8.3 million.

Here’s WeShop’s share price.

It’s currently worth over a billion dollars.

However, it could be anything within a year.

And that means it could be worth a lot less for WeCap, as there is a lockup..

As set out in the WeShop prospectus¹, no WeShop shareholder (holding ordinary shares prior to the WeShop listing date of 14 November 2025 ("Listing Date") may charge, pledge, encumber or otherwise dispose of any of their ordinary shares during a period of 365 days from the Listing Date. Accordingly, WeCap is not permitted to dispose of its WeShop shares until after lock up period, being 15 November 2026.

It would be a very risky trade to short WeShop and hold WeCap shares long, in order to hedge the trade and lock in profit.

Firstly, borrow costs. Secondly, the borrow might get recalled (and potentially at a loss!).

I’ll set my alarm September as I expect there will be action two months out from the lockup, depending if the disconnect still exists, of course.

My 2026 picks

Every year since 2021 my picks have gone into MoneyWeek.

This means that my picks are there in print and online for all to see, and it’s very easy to see how well they’ve done.

My picks each year since 2021 have delivered an 89.65% return, or an average of 17.93% per year.

When we compare this to fund managers around the world, it would make me one of the best, as most fund managers fail to beat their respective benchmarks (despite their high fees for trying to do so).

I also comfortably beat the market as the FTSE All-World achieved 55.9% in the same period. This means I am outperforming the market by a margin of 60%.

This is without stop losses, as picks need to be held for the full year. So whereas in the real world, I would get rid of a stock that put out bad news, it has to be held for the year and sometimes the news worsens.

However, as I always say.. These are ideas only (not tips).

You should always do your own research.

The first one is an an industry that has been universally hated for several years.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. Priority for all offers and live events. A risk-free trade itself as you get value or you cancel.

Upgrade