Hope you had a great bank holiday!

Back to it now with a four-day week.

Interesting to see Renold (RNO) announced not one but two offers last week.

This was a member of my top five shares for 2024 at 34p and whilst I’m no longer holding, it’s nice to see the market finally see the potential.

The offers have come in at 77p and 81p.

Whenever a share I’m holding gets an unsolicited offer, I always take some off the table.

This is because if something goes wrong, or the bidder finds something in its due diligence and walks away, then the price can take a beating.

Given that there are two offers at the same time for Renold, this is less likely, and it could even sniff out more bidders, but holders should always do what they think is best.

Renold was 54p before the offer, and the price of something is only ever what someone else is willing to pay.

If both bidders walk away, then a big chunk of the premium is also likely to crumble.

It’s been a great few weeks for small caps, and the sun is shining, so let’s enjoy it whilst it lasts!

And before we continue, a quick thank you to our sponsor XTB.

XTB offers a Stocks & Shares ISA that is free to deal ETFs and pays out 4.25% interest on uninvested cash. Open a free account here.

Jersey Oil & Gas

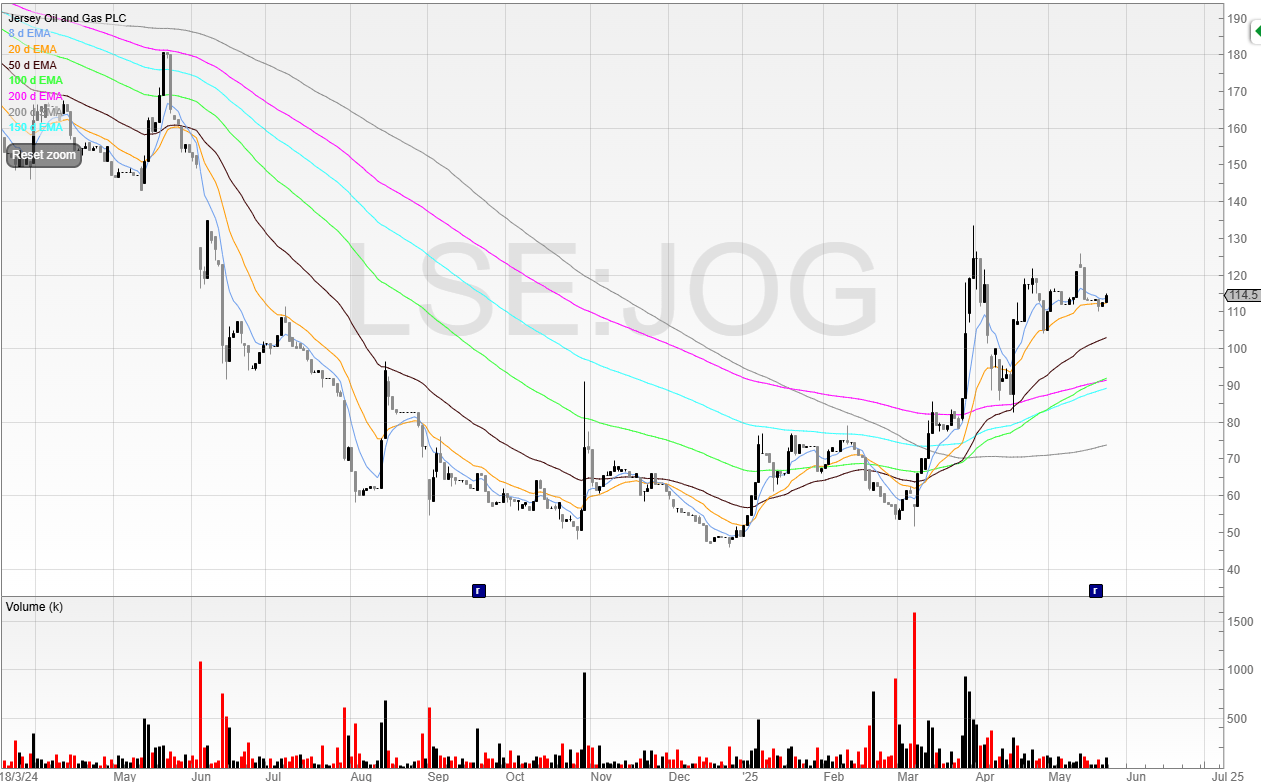

One stock that has come across my filters is Jersey Oil & Gas (JOG).

It’s looking like it has emerged from a stage 4 downtrend.

This isn’t the typical company I’d look at, as I tend to avoid oil & gas unless there is a very good reason.

So it would only be a short-term trade for me.

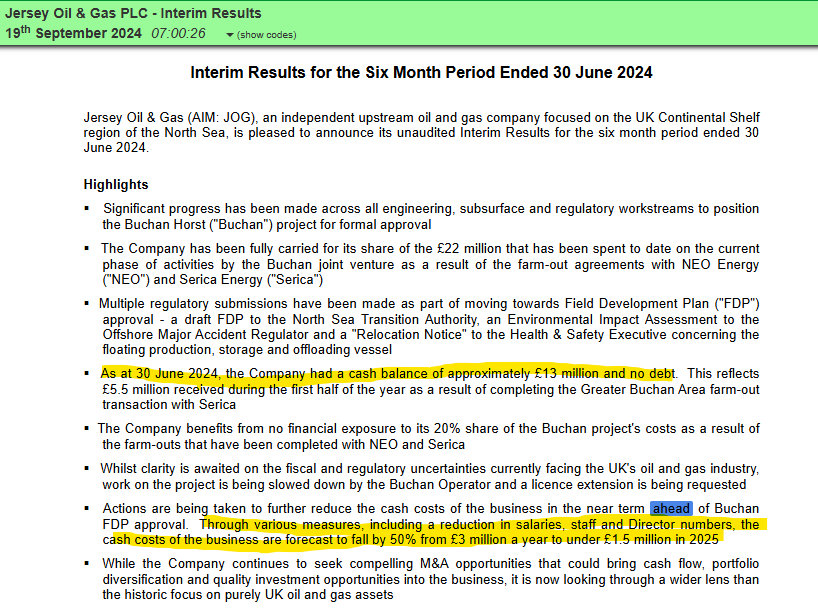

As of the interims, we can see there is absolutely zero income.

However, it also has funds available.

Around £13 million in cash with no debt, with running costs set to fall to £1.5 million.

At a market cap of £37.4 million, I’d argue a lot is priced in for very little.

Yet the price has risen on volume for some reason - anticipation of a deal?

Either way, if the price tightens up there could be a nice risk/reward trade there.

This is unlikely to ever be a serious position for me given the nature of the business and poor quality fundamentals.

These types of shares are typically held long term by the hopes and dreamers, who believe that one day the company can become the next Shell.

Most of them won’t and can’t, but that doesn’t mean there aren’t any quick trades in these dogs.

This next stock is one we’ve looked at before and has enjoyed spectacular gains.

After a period of consolidation, it’s now looking interesting again.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. Priority for all offers and live events. A risk-free trade itself as you get value or you cancel.

Upgrade