Even though UK stocks have risen since what appears to have been the 2023 bottom, they’re still firmly out of favour.

That said, the election and the budget were two big uncertainties. And there will always be something new to spook people, but at the moment the path is looking clear.

Plus, even if UK stocks on the whole don’t perform as well as the US markets, there are still great opportunities in the UK.

One of these is an ex-FTSE 100 member and not a stock I’d usually look at.

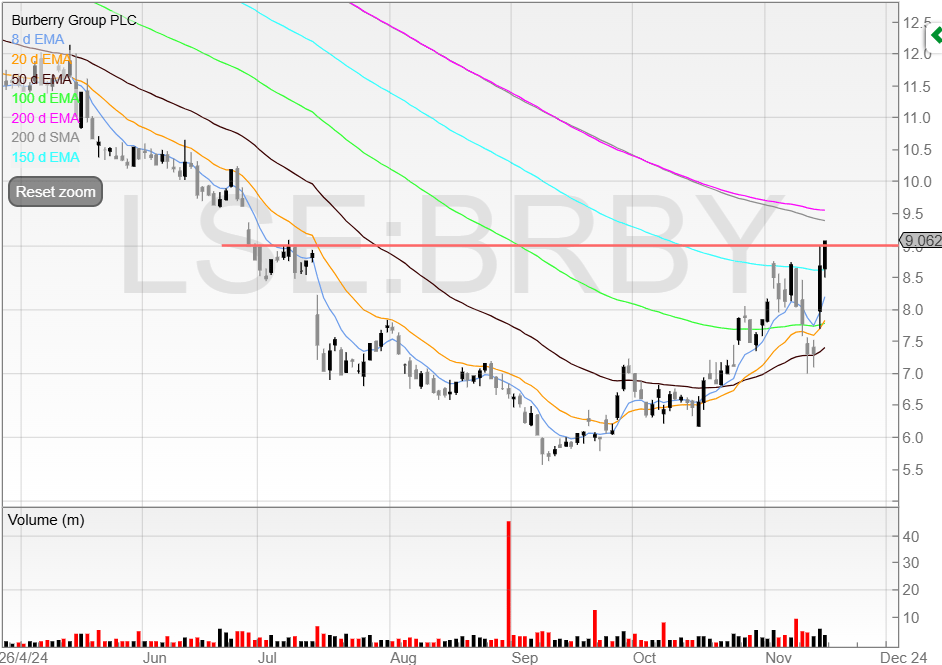

I wrote about it a few weeks ago: Burberry (BRBY).

Since then, Moncler has repeated its claim that it won’t comment on “unsubstantiated rumours”. But again, this is not a denial.

Reuters says that “four sources close to the matter” have said there is no deal coming.

So who knows?

Results were out and the chief executive said a lot of things without saying much at all.

To summarise:

Burberry wants to be consistent with brand execution and improve focus on its core outerwear category as well as core customer segments.

In lay peoples’ terms, it’s been making terrible clothes that its usual customers don’t want.

The outlook does little to inspire confidence either:

An uncertain macroeconomic environment is the reason the company is giving to offset the first-half adjusted loss.

That means that the stock could actually report a loss for the year.

The last time Burberry made less than £100 million profit after tax in a year was 2009, where it made a £5.1 million loss.

So that’s not good.

Yet the price rallied!

This stock is getting more attractive to me, and I want to see some consolidation before a breakout of the Big Round Number at 1,000p.

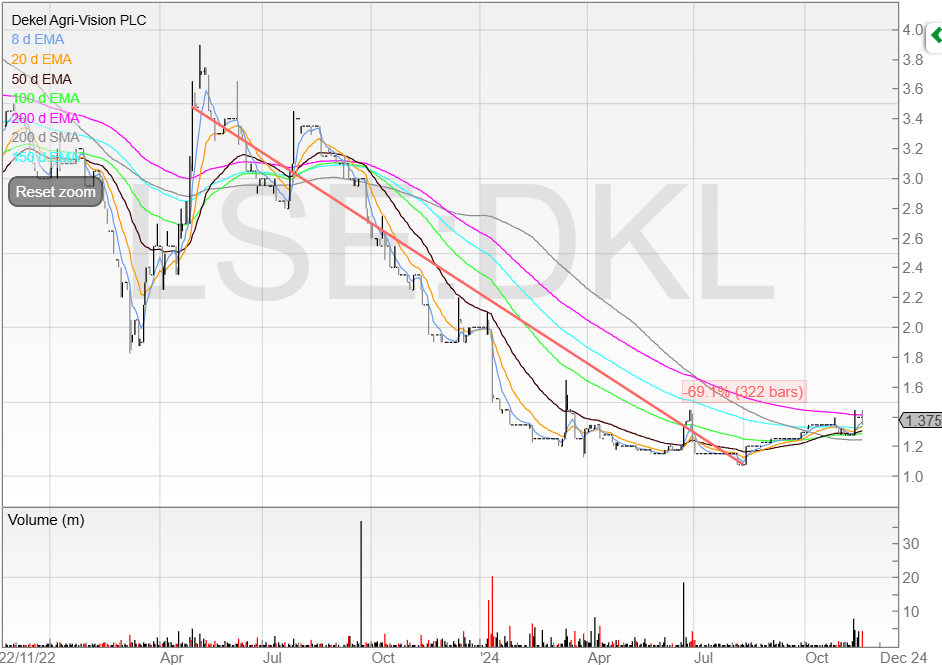

Dekel Agri-Vision (DKL)

You couldn’t even give this stock away to charity if you tried, it’s reviled that much.

And not without good reason.

I remember turning down the placing in 2021 that saw the company raise money for machinery that would allow the business to diversify and get another revenue stream up and running - cashews.

Well, coming up four years later and the cashew revenue stream has been one big burden on the company’s EBITDA generated from palm oil.

Firstly, the machinery took forever to ship. It then took more time to arrive and assemble. Then, the machinery the company bought has been riddled with problems.

Finally, management bit the bullet and ordered new machinery.

This has been a big drain on cash, and whilst it remains to be seen if the cashew operation can get to cash flow breakeven for a start, management are optimistic.

As a result, we expect to report an improvement in cashew results in the Q4 2024 report compared to Q4 2023. In addition, based on the current positive progress, the Cashew Operation is tracking well to become operationally cashflow positive from December 2024.

The problem is, management have been positive the last few years leading to broken promises. And whilst dodgy machinery isn’t completely their fault, the facts are these broken promises have completely shot any sentiment, and nobody is willing to believe them.

If the cashew operation does become operationally cashflow positive from December 2024, then this is a material progression for the business.

The cashew operation cost the business €0.9m in EBITDA the first six months of the year, and €2.2 million for the full year of 2023. Palm oil produced €4.8 million of EBITDA the same year, leaving the business with €2.6 overall. If the cashew operations were breakeven, EBITDA almost doubles.

And if it starts to become cash flow positive then starts to nudge up the group’s overall EBITDA.

We need to remember that EBITDA isn’t profit. But cash generation matters, and with the group priced at a £7.7 million market cap, little is priced in.

This could be a stage one base being built.

We can see some higher volume at the start of November but for now, I’d wait to see if the cashew operation does become cashflow positive.

Watchlist for now.

Speak soon,

Michael