The Bank of England cuts rates in what was an expected cut back down to 4%.

Yet a split decision and an unprecedented second vote means that it was not quite the easy cut many expected it to be.

Andrew Bailey said that the trajectory remains downwards, but there is now “genuine uncertainty” because the Monetary Policy Committee sees risks of inflation overshooting forecasts and growth undershooting.

This means that we may see the possibility of higher rates longer than we expected.

The market is now factoring a 75% chance of a further quarter-point cut this year as opposed to the 90% before the decision according to levels implied by the swaps market, says the FT.

What does this mean for you?

If you’re looking to remortgage soon then you may get a cheaper rate on your debt.

If you hold savings in Cash ISAs these rates may fall too.

Generally, lower rates can provide a lubricant for the economy as the cost of borrowing decreases and the hurdle rate to achieve a positive NPV on projects becomes lower.

For me personally, I don’t much care.

Lower interest rates can push people to invest into stocks because cash no longer pays equity-like returns.

But opportunities will always be there regardless, as small cap stocks often march to the beat of their own drum.

And before we continue, a quick thank you to our sponsor XTB that offers a Stocks & Shares ISA with 0% commission on ETFs and stocks, and pays out 4.5% interest on uninvested cash, which is better than the Bank of England. You can open a free account here.

Likewise (LIKE)

As always, everything I write and say is my own personal opinion only. It is NOT financial advice.

I don’t accept money from listed companies to talk about them unlike other market commentators, so whilst this is independent nothing is a stock recommendation to buy or sell.

These are ideas only, and whilst I try to be balanced, sometimes I will be wrong.

Therefore, it’s important that you do your own research!

I have taken a small position in Likewise (LIKE) as I think the risk/reward is attractive here.

Here’s the chart:

Likewise appears to be moving in the right direction.

It’s made significant progress from its IPO in 2021.

It’s saying that monthly revenues annualise to £170 million in May, and so if there is no extra growth from here it’ll still be faster growth than 2022 and 2023.

The spike in 2021 to 2022 was from the acquisition of Valley Wholesale Carpets.

The company has been buying back shares from 19p to 23.5p with Zeus managing the buyback with up to £250,000 allocation.

This is small but buying back shares when the stock is cheap (assuming the stock is cheap, of course) can be highly accretive to shareholders as less shares in issue means less shares available to buy.

I noticed my friend Laurence Hulse at Onward Opportunities has taken a slug too with a direct subscription of £1.4 million at 25p (nil discount).

Therefore, I doubt the company will be buying shares back above 25p as this would mean they would’ve sold a chunk of shares at 25p only to buy them back higher.

But it does make sense to use some of that excess cash to continue mopping up stock around 20p - although there may not be much, if any, of the buyback left.

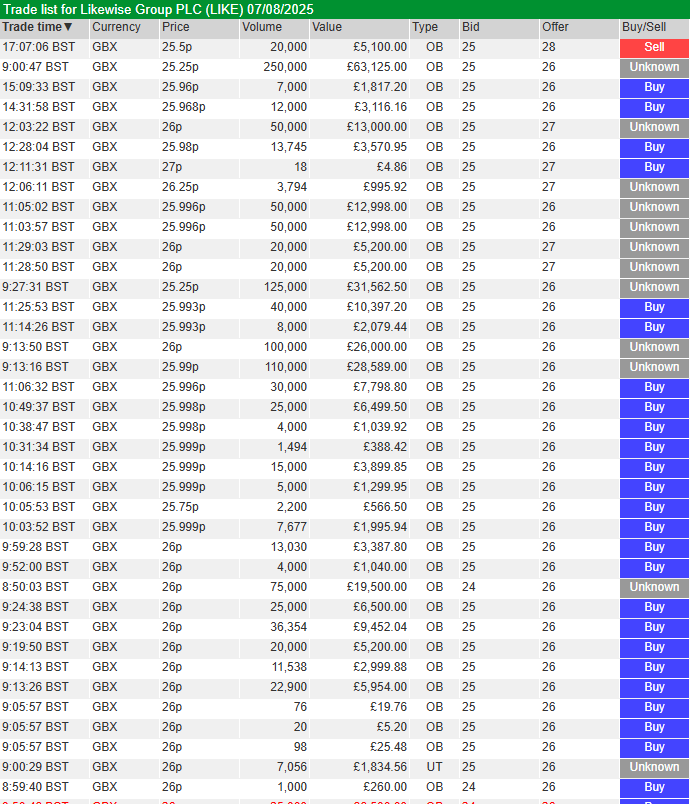

At the moment, it appears there is a sell order being worked.

Despite the steady buying yesterday the price didn’t budge.

I expect to see a delayed sell order at some point, as there is clearly something going on in the background we are not seeing.

A steady and relentless stream of buying throughout the day yet the price didn’t tick up.

Usually, this is because market makers are marketing stock for an attractive price to try and get rid of it. Obviously, if they were to increase the price, the stock may see fewer buyers and they would then have to mark it down again to lower the price.

Sometimes they do this, of course. But the price not moving despite a one-way street in buying or selling usually means a background order is being worked.

It’s entirely possible that tomorrow (if the market makers reading this don’t mark the stock up) you’ll be able to buy at 26p too.

Make no mistake, this is not a long term investment for me. Stocks never are.

But I can see how the stock prints higher over the coming weeks and months.

The stock is looking like it’s breaking into an early stage 2 uptrend and soon is attacking multi-year highs.

There are a few spots left for my Finance & Wellness Retreat.

What you can expect:

Three days at a luxury hotel and spa estate

Breakfasts, lunches, dinners, drinks included

Live trading sessions and stock picking

High performance coaching sessions

Plus, everyone who attends gets lifetime access to UK Stock Trader Pro (worth £689) in order to continue their education.

And with the rooms being double, you can also bring a partner or friend.

The next stock is high risk. Everyone hates it, and if it pulls its strategy off there could be a healthy rerating.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. Priority for all offers and live events. A risk-free trade itself as you get value or you cancel.

Upgrade