Change happens slowly.

Then all at once.

“At around noon on April 14 2025, America ceased to have a law-abiding government.”

This was published in the FT in an article titled ‘Trump is halfway to making America a police state’ as Trump reportedly ignored a 9-0 Supreme Court ruling to repatriate an illegally deported man.

Which basically means, if you’re American, you can be deported illegally and Trump holds the final say.

The article is worth reading, and whilst all writers have their bias, filling up the government with yes people and people who’re scared to lose their jobs from speaking out encourages groupthink.

Groupthink lacks diverse thinking, which is necessary for high performance.

It’s a slippery slope, and not one that is good for America when debate and healthy disagreements are stifled.

Bases being reloaded?

Over the last week many UK stocks are moving higher.

This is good to see, because it allows new setups and new leaders to emerge.

It’s also worth noting that many aren’t.

But downtrending stocks and broken bases are of zero interest to me.

It’s likely that some of your stop losses were triggered and stocks have gone higher.

Some of mine have.

That’s what stop losses are for.

They are insurance in case things get worse.

Back in Covid, I was quick to sell and went short a big basket of stocks.

My mistake was not shorting any index as this was a cleaner way to play the trade, without spreads, commissions, and of course liquidity issues.

Then, when stocks bottomed and were breaking out, going long when stocks were tightening up and breaking out seemed a good idea, despite the UK in lockdown and the end of the world in sight.

I didn’t sell at the top. I didn’t catch the bottom with my shorts.

But you don’t need to.

Active trading is about going with trends, and going with risk/reward.

There is a romanticism around holding onto stocks for years and being loyal.

But stocks are not life partners. You owe them nothing.

Plus, you don’t know if the stock will even come back.

Microsoft is one of the best companies in the world today, and one of the big winners of the Dotcom boom.

But if you held onto it after Dotcom, you would’ve been waiting 16 years for it to break even.

Risk is the only thing you can control. The end result of the trade is chance.

And talking about risk…

Argentex goes pop?

Argentex Group is a UK-based financial services firm specialising in foreign exchange (FX) services and currency risk management for corporate, institutional, and high-net-worth clients.

The company facilitates payments and trades in over 140 currencies and is licensed to operate in 30 countries.

Essentially, it provides spot, forward, and structured FX products to help clients manage currency exposure and facilitate international payments:

Clients can access its online portal for executing trades, managing accounts, and making payments.

These clients are corporate, financial institutions, or private clients who’re often HNWIs.

It’s had a rough time since its IPO.

But the big news yesterday may see that slump continue.

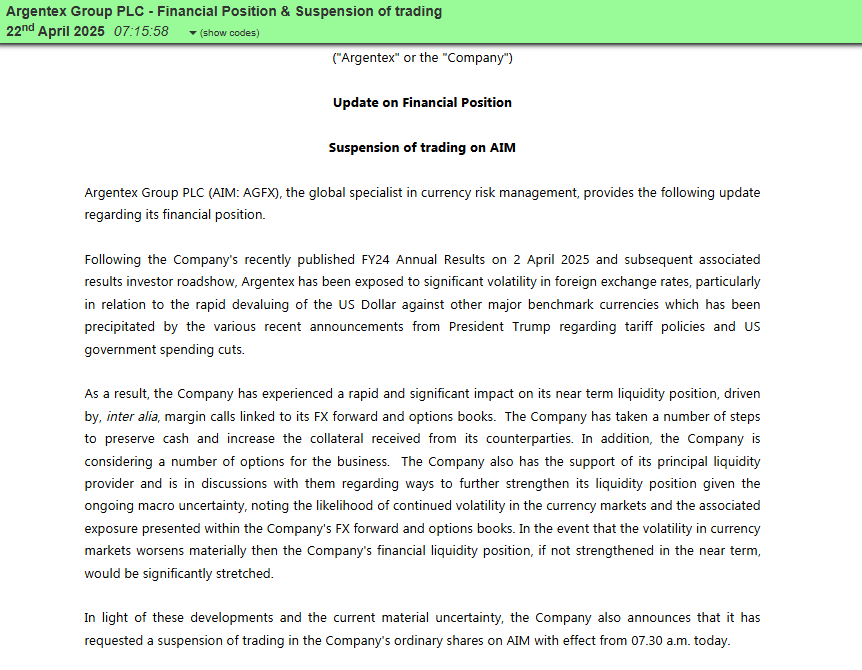

The company is saying that the rapid devaluing of the US dollar has exposed the business to significant volatility.

You’d imagine that, this being their job to manage risk and volatility, that it wouldn’t affect them, but something has clearly gone wrong.

And whilst it doesn’t mention losses, it does talk about margin calls linked to FX forward and options books.

This can happen that when volatility spikes, prime brokers want more margin up front.

And if you don’t have it, you can then be forced to close the position regardless of P&L.

For example, let’s say to put on a trade of £20,000 in Vodafone, you only need £4,000 up front to place the trade.

But if your broker then suddenly said they needed another £4,000 to put up against that £20,000 position in Vodafone, which is what is known as a margin call, then if you don’t have it you’d be forced to close the position.

This is what looks to have happened with Argentex.

So whilst the underlying business may be fine (there is nothing said that it isn’t), it’s a solvency issue and Argentex suddenly needs more money.

What are the options then?

Raise more capital through equity (I imagine this is almost certainly being discussed)

Find more money from someone else or convince the lenders to let them off

Appoint the administrators and delist (as a last resort)

The problem is, this would be an emergency fundraise and new investors have no allegiance to current shareholders.

So it could be deeply discounted, unless existing shareholders are willing to prop the price up. But even if it’s a lot yet not enough, the price may need to go lower to get more interest.

I am big on risk management precisely because things like this can happen.

Nobody can blame themselves here if they’re holding.

It’s literally Argentex’s job to manage risk, so not something you’d expect.

But it goes to show that bad things can and do happen, and it’s sad news for existing holders.

I consider it a lucky escape for myself, as the business recently announced that profits were ahead of expectations.

But the big eye-catcher for me had been the director buying.

Directors sell for all sorts of reasons. Tax purposes, divorces, new kitchens, because they think the company is terrible…

Directors only buy for two reasons:

1) A bit of PR

2) They think the stock will rise

Argentex directors have all bought reasonable sums.

Of course, this tends to depend on their overall wealth, but the sums don’t look as if they’re done for a bit of PR.

Source: ShareScope

This is all within the last few weeks after the results were announced.

Which tells me that the directors were obviously expecting the company’s fortunes to keep improving.

Nobody puts a gun to a director’s head and forces them to buy.

The chart was looking better too.

It’s nicely more than 50% off the lows, and has tagged 48p twice marking it as resistance.

We can see a 25.8% pullback, and the next pullback could’ve been tighter.

And whilst I was looking for the stock to tighten up before taking a position, I expect to be notified of an emergency fundraise.

Which changes things a little.

But the next stock is closing in on significant highs, and I think it’s looking excellent.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. Priority for all offers and live events. A risk-free trade itself as you get value or you cancel.

Upgrade