Was it inevitable?

Probably.

The US has bombed three nuclear sites in Iran and potentially drawn the US into another war in the Middle East.

It isn’t that long ago that the US lost the ‘war on terror’ as the US humiliatingly left Afghanistan as resistance crumbled.

Trump has said that Iran now needs to hold this ceasefire and previously had hinted at more attacks if it did not.

Iran’s foreign minister has accused the US of committing a “grave violation of the UN Charter”.

It’s a big gamble for Trump.

If it pays off, he will have successfully damaged Iranian nuclear facilities which has been a key policy debate in the US for decades.

And if it doesn’t, well, we can expect more turmoil in the Middle East.

Iran has already hit back in what is a seen as a symbolic attack to save face.

And the US will likely have taken extra precautions here before this.

At least - you’d think so.

So damage may be limited for now.

Secondly, Iran could hit the US’s Gulf allies further.

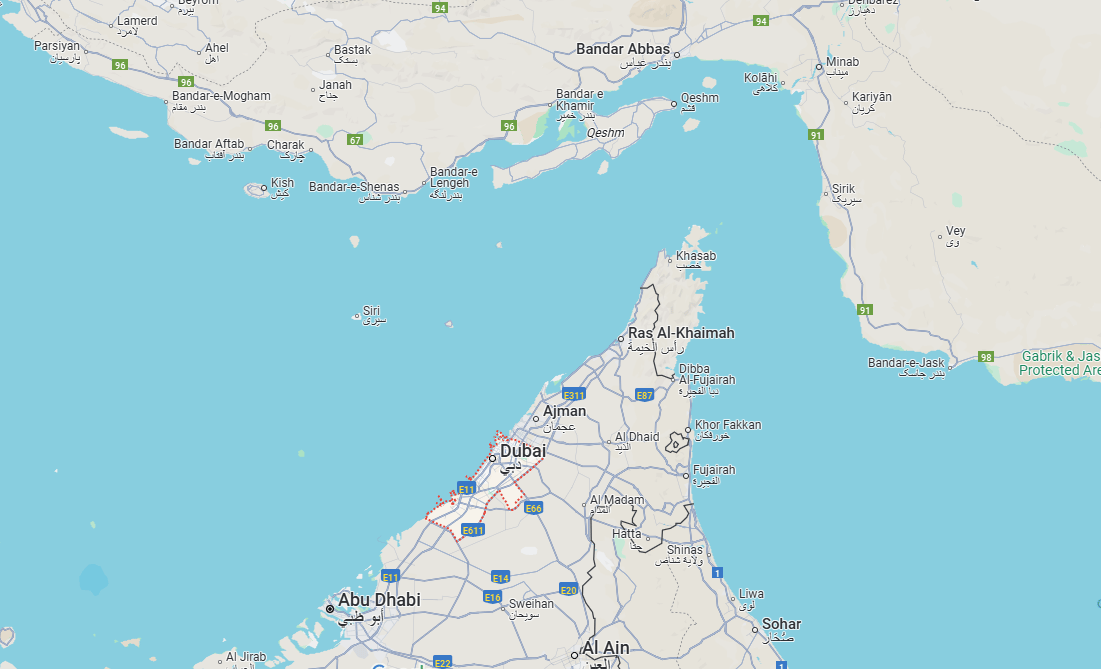

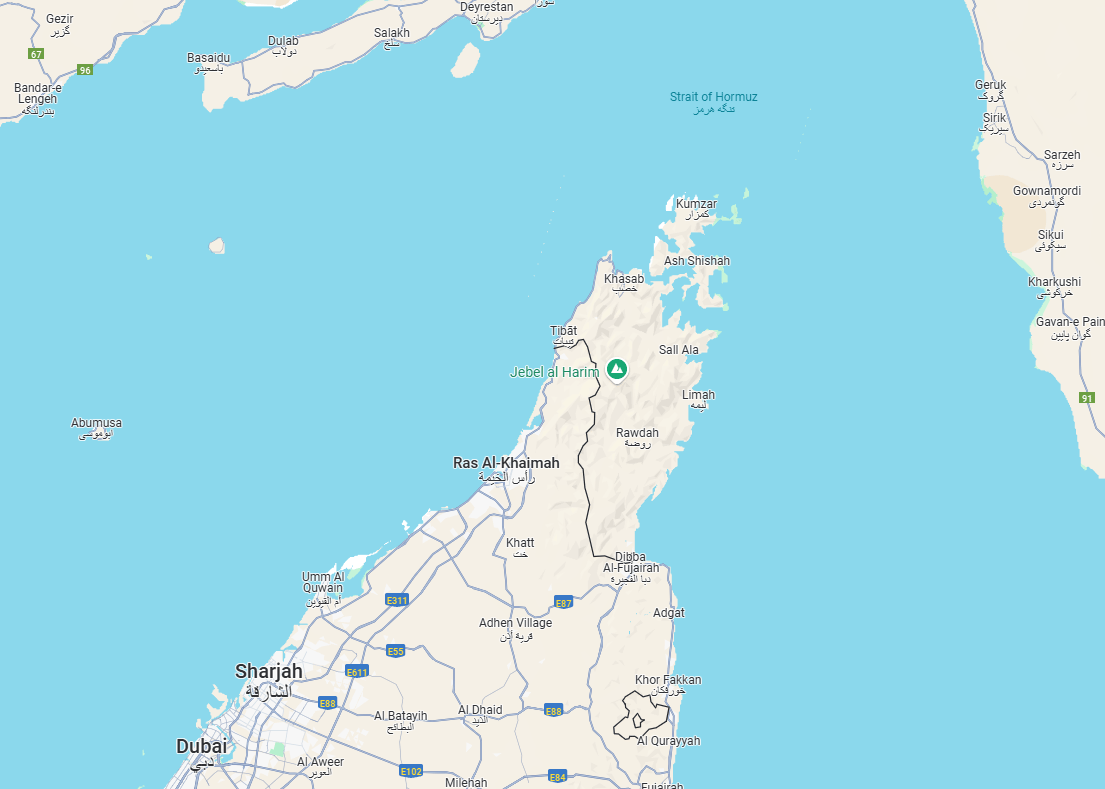

As an aside, I always find it odd when I go to Dubai I’m only around 100KM from the coast of Iran.

Not sure I would want to be there right now!

But there is also an easier and less direct option: the Strait of Hormuz.

A third of the world’s seaborne crude passes through the Strait of Hormuz every day.

Closing that spikes oil prices immediately.

Here’s where the Strait of Hormuz is on the map (I confess to not knowing myself).

Iran has options here with mines, attack boats, drones, and submarines.

However, Iran uses the Strait itself.

It’s also worth pointing out that Iran’s military options are likely to have been weakened and depleted.

Israel has taken almost complete air dominance over Iran.

In terms of risk/reward, Iran is likely best just agreeing to US terms because:

It is losing the war with Israel

The US is battle-ready and can do a lot more damage

But as we know, people aren’t rational.

They tend to act on their feelings, and in this case Iran may understandably feel slighted.

Even if it agrees to peace now, I think Iran is now far more likely to see the benefit of arming itself with nuclear weapons in order to deter unwanted military action and take the appropriate steps to doing so.

And if I was Iran… I would’ve moved my nuclear enrichment facilities out of Fordow to somewhere undisclosed.

In happier news, I’ve secured a country estate hotel & spa for my 2-night Finance & Wellness Retreat in September.

Want early access? Hit reply and type “Retreat”

Luxury rooms, big breakfasts, lunches, three-course dinners, and drinks are all covered.

As well as various sessions including market opens, breathwork, and performance coaching.

Several spots have already been taken, and though we have exclusive use of the venue the rooms are limited.

If you want early access then hit reply to this email with “Retreat” to let me know.

The Smarter Web Company (SWC)

Treasury plays are all the rage at the moment.

It’s quite incredible to watch.

Huge amounts of cash are being piled into anything that says ‘treasury’ in an RNS, and it reminds me of 2017 where companies would put “Bitcoin” in a piece of news and the price would go nuts.

Basically, what this means is a company will buy Bitcoin or some other crypto asset as part of its treasury reserve.

For some reason I have yet to work out, it has punters properly foaming at the mouths and we are seeing insane price moves.

This is London’s best ever IPO return within a few weeks.

It’s gone from £4 million to over £1 billion in less than two months.

Consider this with the fact that the value of the Bitcoin it currently holds is £27 million, and you get a potential that is trading well over 20x mNAV.

You might assume that mNAV has something to do with NAV - or Net Asset Value.

I did. And I was wrong.

Because mNAV is actually EV (Enterprive Value) over Bitcoin NAV.

So EV / Bitcoin NAV.

And as EV is market cap plus debt minus cash, or the real price you’d pay for the company’s shares including both its debt and cash balances, it shows the company’s EV in terms of its Bitcoin NAV.

Smarter Web Company is clearly massively overvalued.

But you’d be crazy to short it.

Because companies can stay overvalued for long periods of time, and often people buying aren’t rational.

I’ve bought frauds before because I was sure I’d make money.

Now Smarter Web Company is definitely not a fraud.

It’s doing exactly what it said it would do.

It’s just the market is choosing to ascribe a very rich valuation to the business.

Personally, I’ll be leaving this stock alone for now but I have some exposure to other Treasury plays (all short term holds that I may sell at any point).

And before we continue, a quick thank you to our sponsor XTB.

XTB offers a Stocks & Shares ISA that is free to deal ETFs and pays out 4.5% interest on uninvested cash. Open a free account here.

The next stock will potentially benefit from another cyclical uplift.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. Priority for all offers and live events. A risk-free trade itself as you get value or you cancel.

Upgrade