I’ve been following a company since I started trading.

It has this technology, which, if it can be proven and launched commercially, could actually change the world.

And over the years, lots of investors have bought into this dream.

Unfortunately, that’s all it ever was.

A dream.

Neil Woodford funded it years too early.

There have been two recapitalisations which wiped existing shareholders out completely.

Countless equity raises.

The company would even tell the market that it would need to raise equity, which was a green light to short the stock because nobody in their right mind would buy the stock if they knew they were going to diluted at a lower price.

But despite this, the green shoots may actually be appearing.

It’s only taken 11 years - and I believe it may need at least one more placing.

It’s now on my watch list and I’ll be writing more about the company should I take a position.

And before we continue, a big thank you to our sponsor XTB who offers 4% interest on uninvested cash, and 0% commissions on ETFs and stocks in its ISA.

Shield Therapeutics (STX)

As always, everything I write and say is my own personal opinion only. It is NOT financial advice.

I don’t accept money from listed companies to talk about them unlike other market commentators, so whilst this is independent nothing is a stock recommendation to buy or sell.

These are ideas only, and whilst I try to be balanced, sometimes I will be wrong.

Shield Therapeutics is a commercial-stage specialty pharmaceutical company focused on treating iron deficiency in adults.

Its main product is ACCRUFeR/Feraccru (the branding changes depending on territory), which is an oral iron therapy, and is supposed to be better tolerated than many alternatives.

Shield Therapeutics commercialises ACCRUFeR in the US (partnered with Viatris), and out-licences it in other markets via agreements with companies like Norgine in Europe, and various partners in Canada, Korea, and Asia.

These licence partners in other countries handle the regulatory, marketing, and distribution under out-licensing deals.

Shield makes money from product sales of ACCRUFeR, which is the biggest source, in particular US prescription sales.

It also generates royalties and milestones from licence partners in Europe, Canada, and Japan.

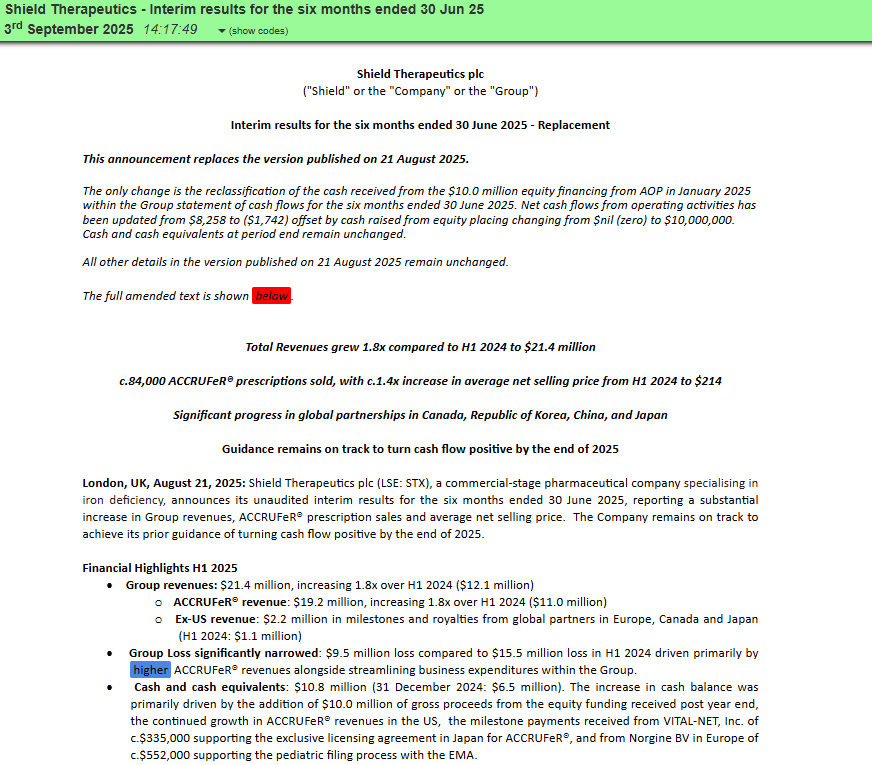

Here’s the latest results.

Revenue is accelerating, but losses remain high.

However, the company believes it is on track to turn cash flow positive by the end of 2025.

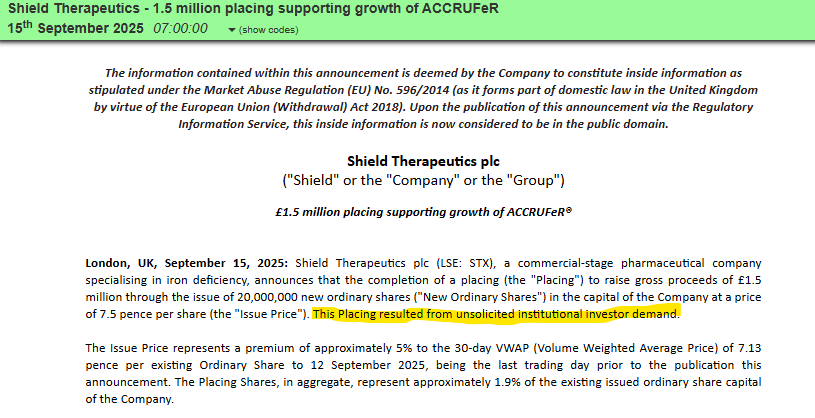

Shield has also raised a further £1.5 million at 7.5p due to “unsolicited institutional investor demand”.

I’ve been in several placings before where this was the case, in my own name and not my corporate vehicle. I don’t trust this one bit.

But this price was not too far off the screen price at the time, so a good raise, and an extra £1.5 million (gross, not net) can’t harm.

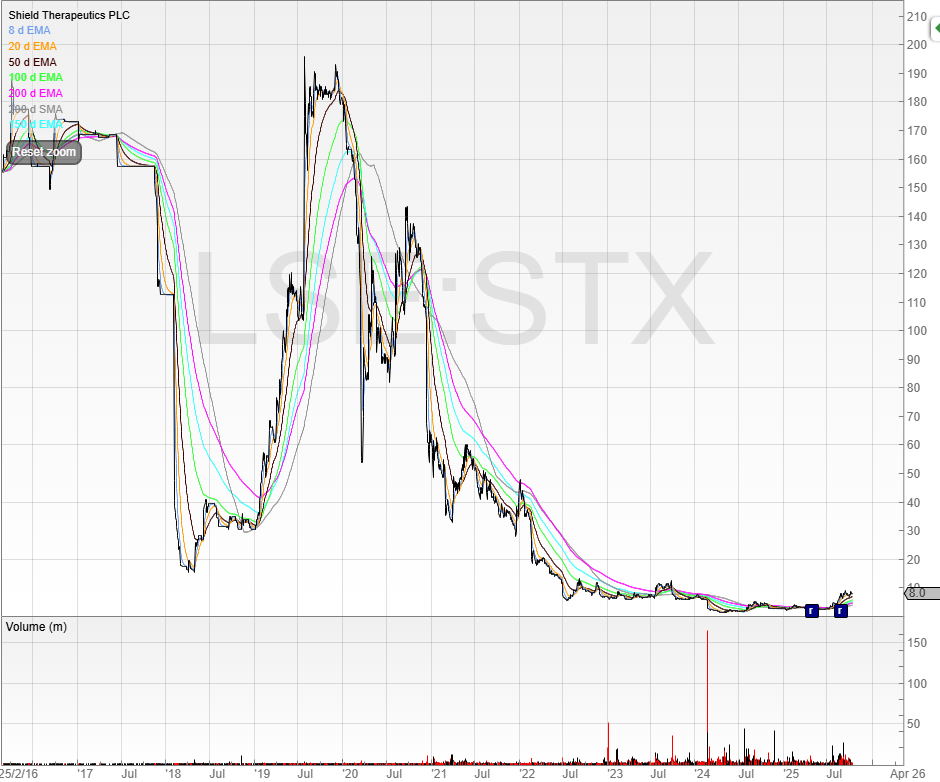

This is Shield since listing. It’s had a crazy ride.

However, I’m only interested in recent years.

We can see the stock has moved significantly off the lows and there is a rise in average volume since July.

So this puts Shield firmly in the parameters of what could be a stage 2 stock.

Revenues appear to be sharply growing, and if cash flow breakeven is achieved, which given that net cash flows from operating activities was an outflow of $1.7 million for the interims, it seems that this is actually achievable given the balance sheet of $10.8 million and the small top up raise.

Net cash flows from operating activities* | (1,742) |

The closing price before this raise was 9p, so if the stock breaks out then it would be pushing into highs not seen since October 2023.

Some potential catalysts include:

Accelerating growth in revenue

More partnership and licensing agreements signed

Price per prescription rising

Achieving cash flow breakeven

But as this is a loss-making pharmaceutical company, there are of course some risks to consider:

Currently loss-making and burning through cash

High dependence on the US market for now

Regulatory risks

Further fundraisings if cash flow breakeven slips too much

It’s an interesting stock and one for the watchlist.

This next stock is an early stage 2 stock (and a current holding).

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. Priority for all offers and live events. A risk-free trade itself as you get value or you cancel.

Upgrade