Well, the dummies have been spat out and the diapers pooped.

Trump and Elon announced their breakup last week in spectacular fashion.

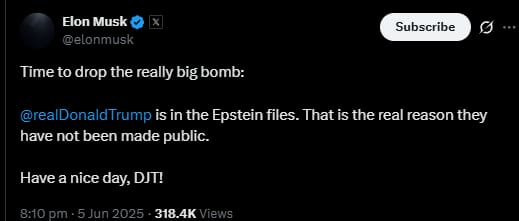

Apparently, Elon was “wearing thin” with Musk claiming that Trump was in the Epstein files.

But wait… didn’t Musk say that he loved Trump as much as a straight man could love another man?

Yes, he did.

So the person that he adored the most in the world…

Was someone he knew to be a wrong’un.

But it only seemed to matter when his contracts were under threat.

Funny how that happens, eh?

And as it turns out, Musk decided to delete those tweets.

In case you missed it…

And Trump’s threat…

In any case, I can’t claim to be the Oracle at Delphi here as it was abundantly clear these two big egos would fall out.

Tesla took a dump.

It’ll be interesting to see how this plays out, as I imagine both sides have wargamed the deterioration of their relationship.

Plus, there’s still all the tariff effects yet to show in economic data.

But despite all that - UK stocks are having a great time.

And whilst the music is playing, you’ve got to keep dancing.

Just make sure when the tide turns - as there will inevitably be some pullbacks at some point - that you’re not holding a book of lazy longs.

Lazy longs don’t stay lazy for long.

And before we continue, a quick thank you to our sponsor Tide as its business account offers members access to its free instant saver (I use this account myself) which gives members up to 4.22% AER variable for the first six months at no cost which is one of the best rates on the market.

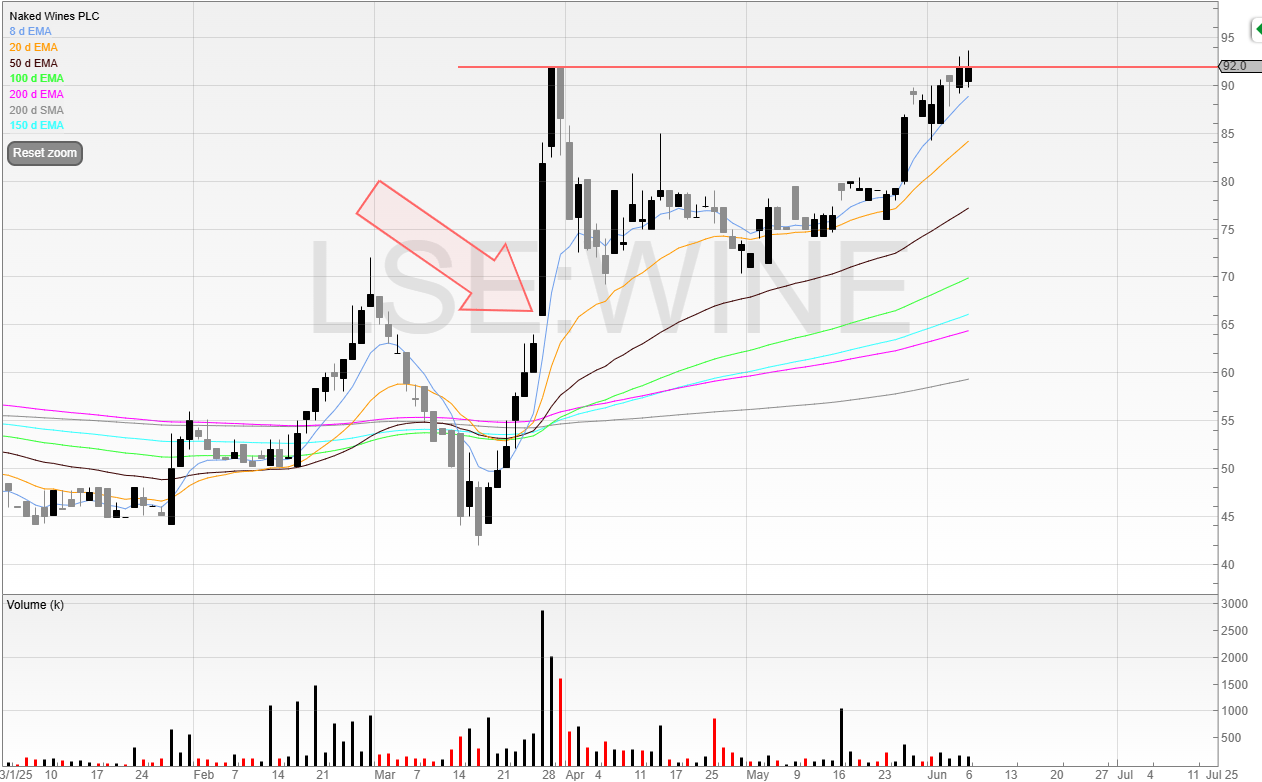

Naked Wines (WINE)

After last week’s look at Virgin Wines (VINO) the stock has continued to rally without a pullback.

As I mentioned, the stock is very illiquid and it’ll be hard to buy a stake, especially when there is a buyer.

Illiquidity works both ways, and so I’d be more inclined to wait for some consolidation before potentially being liquidity for someone else.

But Naked Wines has had a huge fall from grace.

If you’ve not heard of it, Naked Wines is an online wine retailer with a business model connecting its “Angels” directly with independent winemakers by funding their production.

Angels pat upfront into their accounts and in return receive exclusive wins at “wholesale prices”.

Whether this is true or not I don’t know, but it claims to not be the middleman, which is pretty bizarre because if it wasn’t then Angels would pay winemakers directly rather than through Naked Wines.

However, having split from Majestic Wines it sells wine directly online with no physical shops.

It ships to around 40 US states, Australia, and the UK.

A talking head in the US tipped it as the ‘Netflix of wine’ back in 2021, and the stock motored off the back of it.

Yet at one point it looked as if the business was going to go under..

Looking closer, we can see the market responded well to the company’s “New Strategic Plan”.

It describes how additional liquidity will be generated by liquidating excess stock and that careful customer acquisition will be ongoing.

Management have said they have learned from their experience in Australia and can bring those learnings to the overall group:

Australia has returned to growth in FY25 after two years of double digit membership declines, proving that disciplined management and culture of testing our acquisition and retention strategies can restore Naked Wines to sustainable growth.

We can see the market reacting to the New Strategic Plan announcement with the arrow I’ve drawn here:

I’m watching this level here as the stock would be trading above the recent highs.

There was an initial cheat entry at 80p which I didn’t take, and so I’m wary lots of people are now in a nice profit since the start of March.

Therefore, any trade is likely to be a small one.

The next stock is one I’ve been tracking for months and it’s even featured here back in 2023 and it even made a brief appearance here last year.

However, it could be about to make a move given the recent results and the fact it’s trading almost at 52-week highs.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. Priority for all offers and live events. A risk-free trade itself as you get value or you cancel.

Upgrade