Humans are inherently optimistic.

That’s good.

Because pessimists rarely seize opportunities and often fail.

And you can’t achieve success without risking failure.

In the markets, pessimism sounds clever. But over the long term (assuming you’ve not put all your money into a complete dog) optimism wins.

Challenges appear, and humans are motivated by profit to overcome these challenges.

Now, there are some things wrong with capitalism. It’s not perfect. But it has lifted living standards across the globe.

The markets are also optimistic that the worst of the trade wars is over and has now fully discounted them.

Fear & Greed Index

The Fear & Greed Index is now approaching extreme greed. It’s possible for it to stay there for some time, but taking on higher risks now should be viewed with caution, as this index is a nice barometer of sentiment.

Again, it doesn’t mean stocks can’t keep going up. But it means lots of people are positioned expecting them to.

Trump is speaking to Putin this week to try and push forward peace talks. Personally, I’m not expecting anything much.

There are some big names reporting this week too including Greggs, Marks & Spencer, Currys, and JD Sports. It’ll give some idea of how the high street is doing.

Here are two stocks I’m watching at the moment.

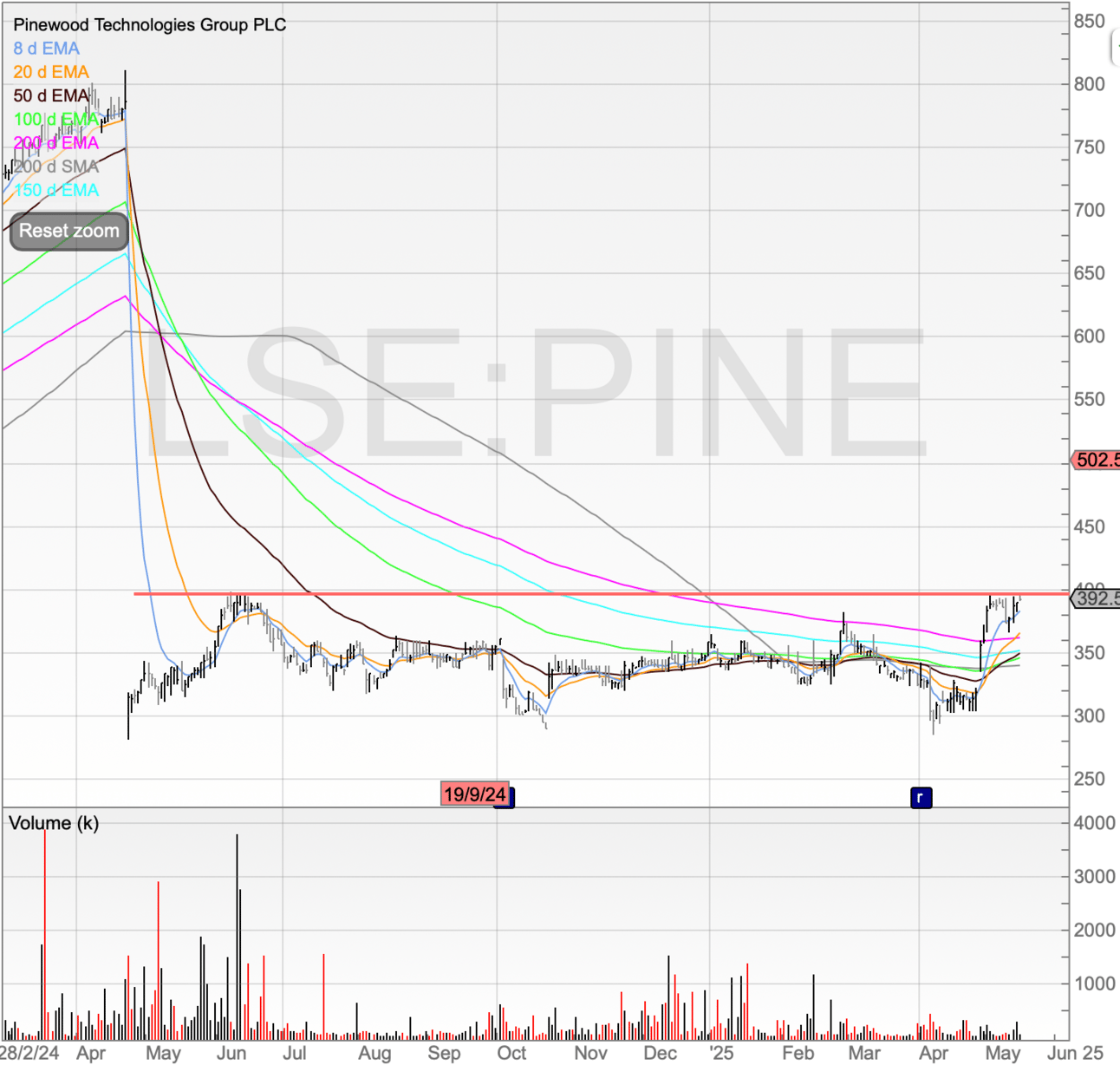

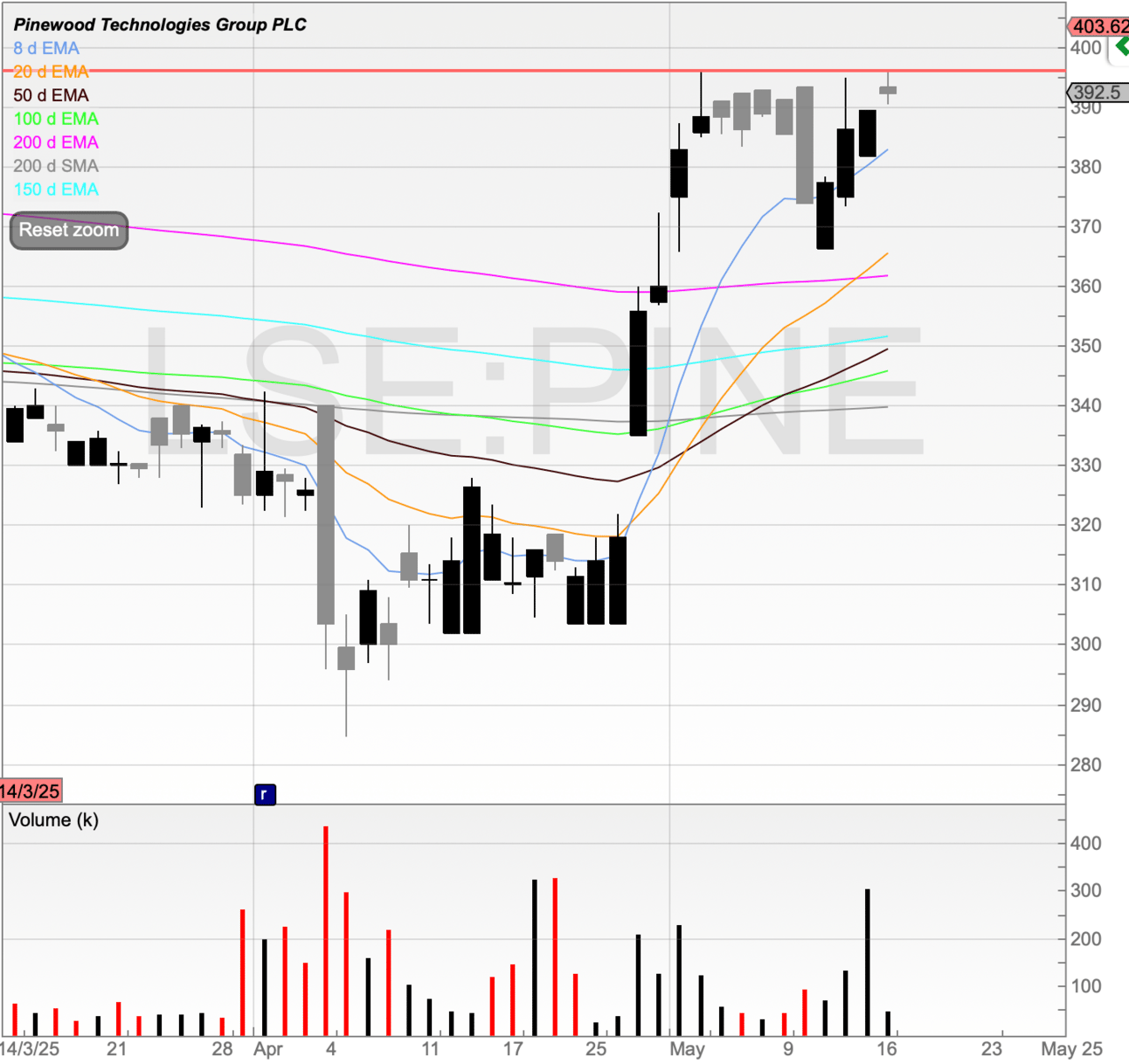

Pinewood Technologies Group (PINE)

We’ve looked at Pinewood Technologies before and it’s now closing in on the highs since it consolidated and paid out a special dividend for selling off the old business.

It’s a UK-based company specialising in automotive software solutions, focusing on cloud-based dealer management systems (DMS) to vehicle retailers globally with its product.

This offers dealers various functions, such as:

Customer Relationship Management (CRM): Tools to manage customer interactions and enhance sales processes.

Vehicle sales management: Modules to oversee the entire sales lifecycle from inventory to final sale.

Parts and service management: Systems to handle parts inventory and service scheduling efficiently.

By having all of these in one single platform, Pinewood enables dealerships to operate more efficiently and improve customer satisfaction.

Pinewood has a strong client list comprising of independent dealerships, franchise dealers, and Original Equipment Manufacturers (OEMs).

It has operations in EMEA and APAC and is now looking to expand into the US, which could be a big driver of growth.

Back in February, the company undertook a fundraise, and in April announced it was trading ahead of expectations.

It’s pushed the stock close to highs.

I’m looking for a breakout here and a stop to be placed just below the 200 EMA and recent lows.

Some will naturally be concerned about 400p being so close with it being a Big Round Number.

However, this would be just over 1% above the breakout level, and so I don’t see many traders buying at 395p to sell at 398-399p.

It’s possible. But unlikely in my opinion.

This would be a significant new high breakout out of the level set when the stock consolidated back in April 2024.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. Priority for all offers and live events. A risk-free trade itself as you get value or you cancel.

Upgrade