A lot can happen in a week.

Trump has decided that, after not being given the Nobel Peace Prize by Norway’s Prime Minister, who says he has repeatedly explained it is an independent decision, he is now no longer inclined to “to think purely of Peace”.

Yes, you read that right.

He didn’t win the Nobel Peace Prize and is now threatening the very opposite of peace.

Which, actually, if you think about it, shows why he shouldn’t have been awarded it anyway.

But I’m sure this irony is lost on him.

I wrote last week that Denmark should explore a deal with Trump and maybe even consider selling it.

However, in a new update last night, Trump ruled out using force.

“People thought I would use force. I don’t have to use force. I don’t want to use force. I won’t use force… We want a piece of ice for world protection, and they won’t give it . . . They have a choice. You can say yes and we will be very appreciative, or you can say no and we will remember.”

This is a good thing.

Is it the typical Trump thing to do, throw lots of things around to obfuscate and confuse?

Probably.

But we wait and see what card he plays next.

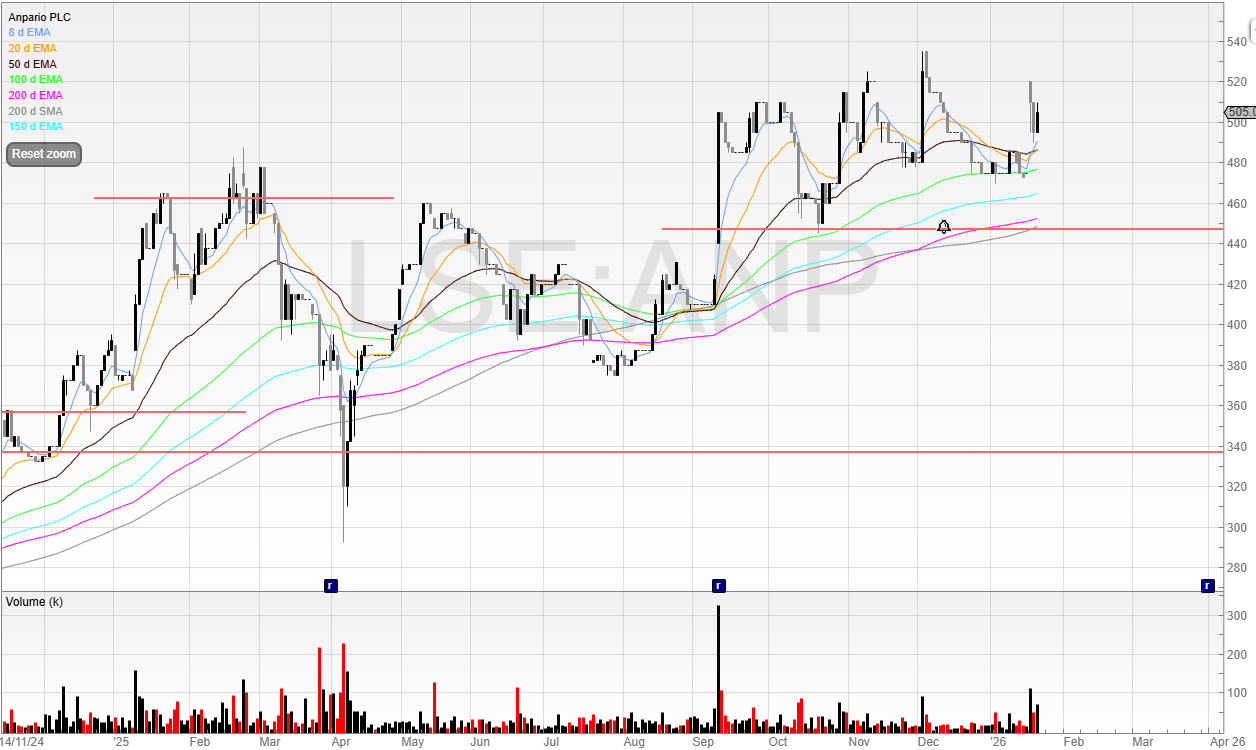

Anpario (ANP)

As always, everything I write and say is my own personal opinion only. It is NOT financial advice.

I don’t accept money from listed companies to talk about them unlike other market commentators, so whilst this is independent nothing is a stock recommendation to buy or sell.

These are ideas only, and whilst I try to be balanced, sometimes I will be wrong.

Anpario is a UK-based company specialising in the manufacture of natural, sustainable feed additives designed to enhance animal health, nutrition, and biosecurity.

It’s primary focus is on understanding and improving animals’ intestinal health and nutrition, which makes it somewhat a unique company.

In any case, Anpario put out good news this week.

It’s beaten its expectations again.

Yet the price sold off.

This tells me that the ‘ahead’ was expected, and so the price has come off a little.

However, the stock appears to be building a base with 520p being the breakout point.

The analyst consensus for FY 2025 before this RNS was revenue of £45.5 million and adjusted EBITDA of £8.2 million.

This is a reasonable beat in both revenue and adjusted EBITDA, yet the price hasn’t moved.

I’ve set an alarm towards the breakout level and will keep watching.

The next stock is a cheap commodities producer that is poised to do well if commodity prices keep printing higher and the final pick for 2026.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. Priority for all offers and live events. A risk-free trade itself as you get value or you cancel.

Upgrade