The problem with intraday trading is it’s hard.

Yes, it sounds great.. pressing a few buttons and watching the pounds stack up in your account.

But most people fail. Some lose everything they own.

The risks are real here.

And to compound that - even when you’re right you can still lose money.

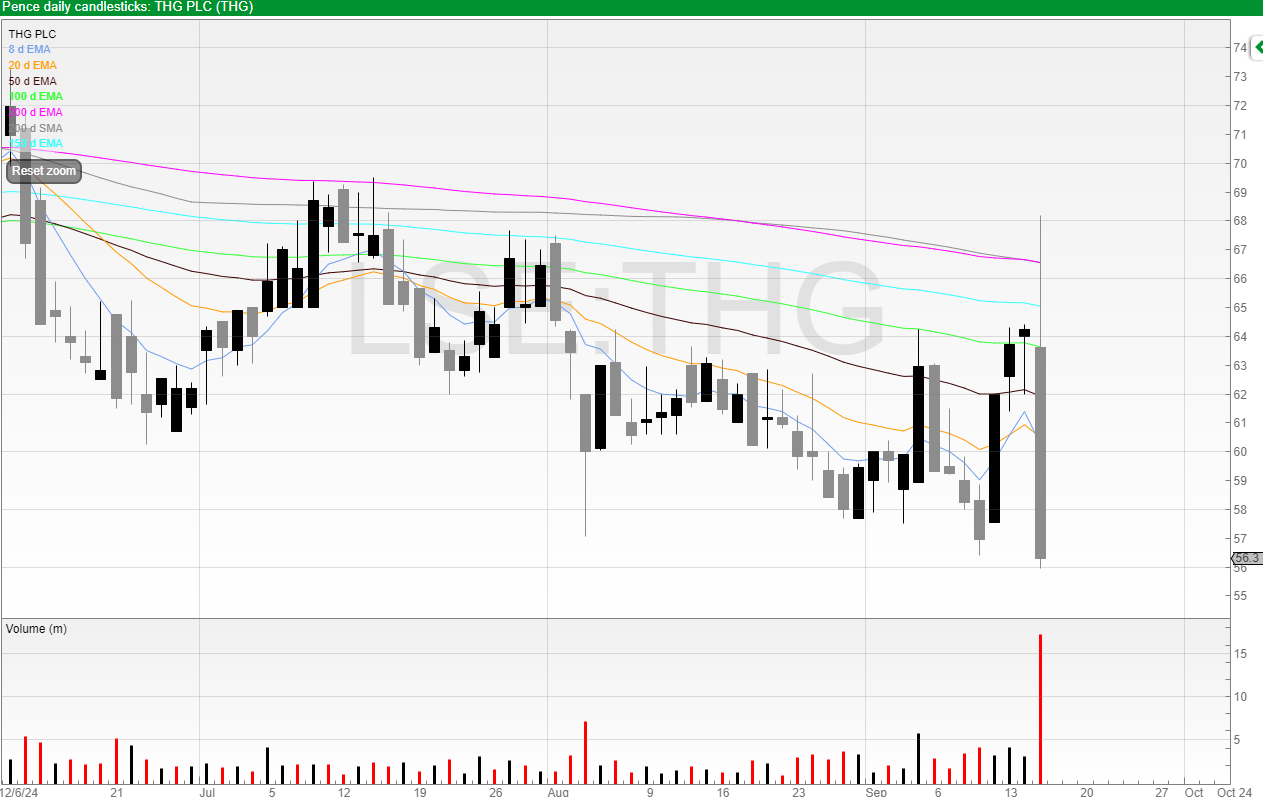

Take THG this week (formerly known as The Hut Group).

You may know this business from its Myprotein brand (I used to be avid consumer before switching to Huel).

It put out interim results which was clearly not great news.

So because the business is going to be at the lower end of the range analysts had forecast the business to make, my view was that the shares would be down on the day.

And they were.

On big volume too.

It doesn’t mean I made a profit though.

I went short too aggressively on the open, only to get stopped out close to the daily highs.

The stock then trended downwards all day, doing exactly what I thought it would do, without me having a position.

Luckily, there is always another trade.

Restore (RST)

Restore is an interesting business - interesting because it’s hard to believe it exists.

It stores files away in boxes for clients and those boxes collect two things:

1) Dust, and

2) Cash

This practice of storing physical archiving sounds ancient yet it’s still around 70% of the business. Government documents as well as NHS and legal records are kept here.

To get a picture of the size of the business, Restore has 22 million boxes lying around.

Well, I’m sure they’re more ‘stored precisely’ rather than ‘lying around’, but you get the idea.

And another fun fact: chief executive Charles Skinner bought 22 nuclear bunkers from the US after the Cold War.

Unsurprisingly, the market rate for these wasn’t high.

And now they’re full of boxes.

Restore is a company that helps companies manage their valuable data such as information, both digital and physical.

Restore and its biggest competitor Iron Mountain make up 70 percent of the market which means that it’s reasonably stable with little capital expenditure required.

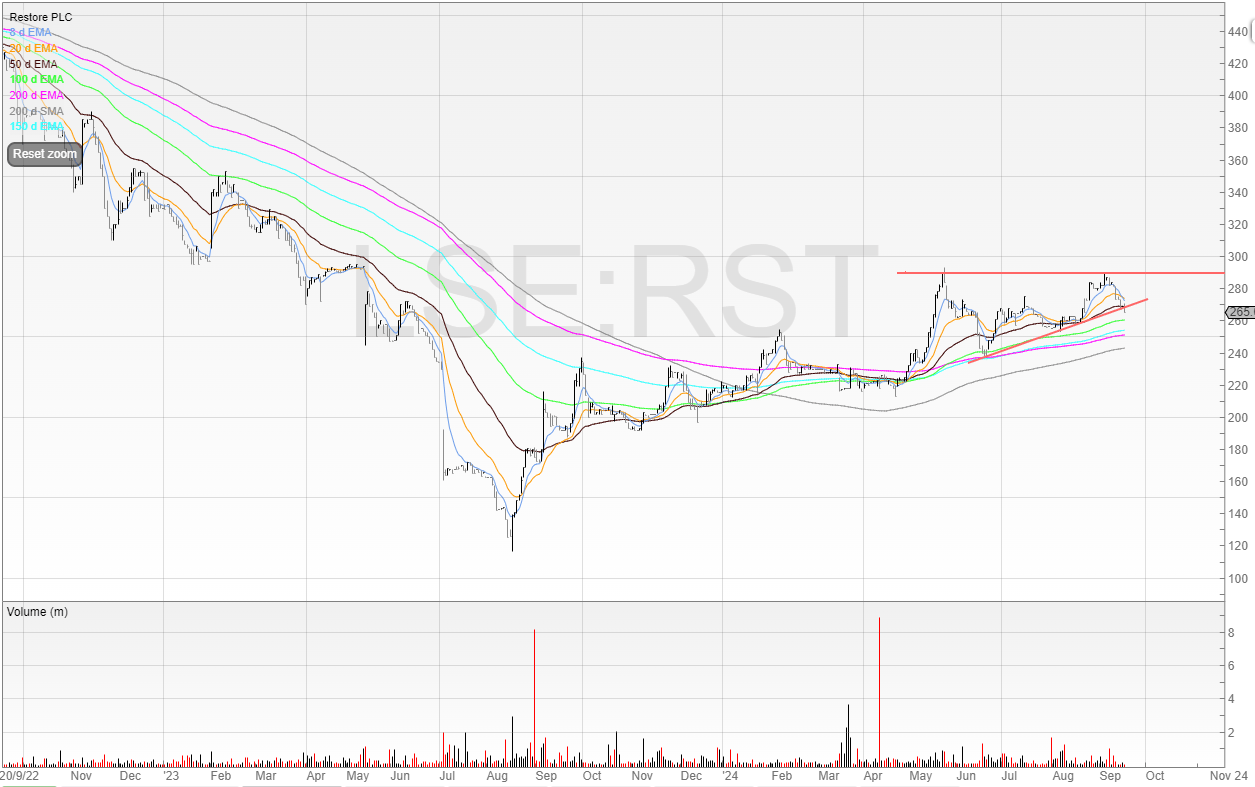

However, the chart is certainly looking better.

I want to see the stock tighten up a bit further before breaking out.

The 290p mark seems to be resistance.

Eurocell (ECEL)

Eurocell sounds like a batteries business.

It’s something completely different.

It manufactures, distributes, and recycles UPVC products, including windows and doors, skylights, roofs etc. A bit like Safestyle, however Eurocell sells to fabricators who then supply the final products to installers, retail outlets, and housebuilders.

This stock therefore is likely to be correlated to the improving fortunes of housebuilders.

And housebuilders are likely to be correlated to the lowering of interest rates.

So my second-order thinking is that the lowering of interest rates will boost Eurocell indirectly as its customers see benefits.

Lower interest rates mean borrowing ability goes up and that projects are more attractive, therefore companies spend and grease the wheels of the economy.

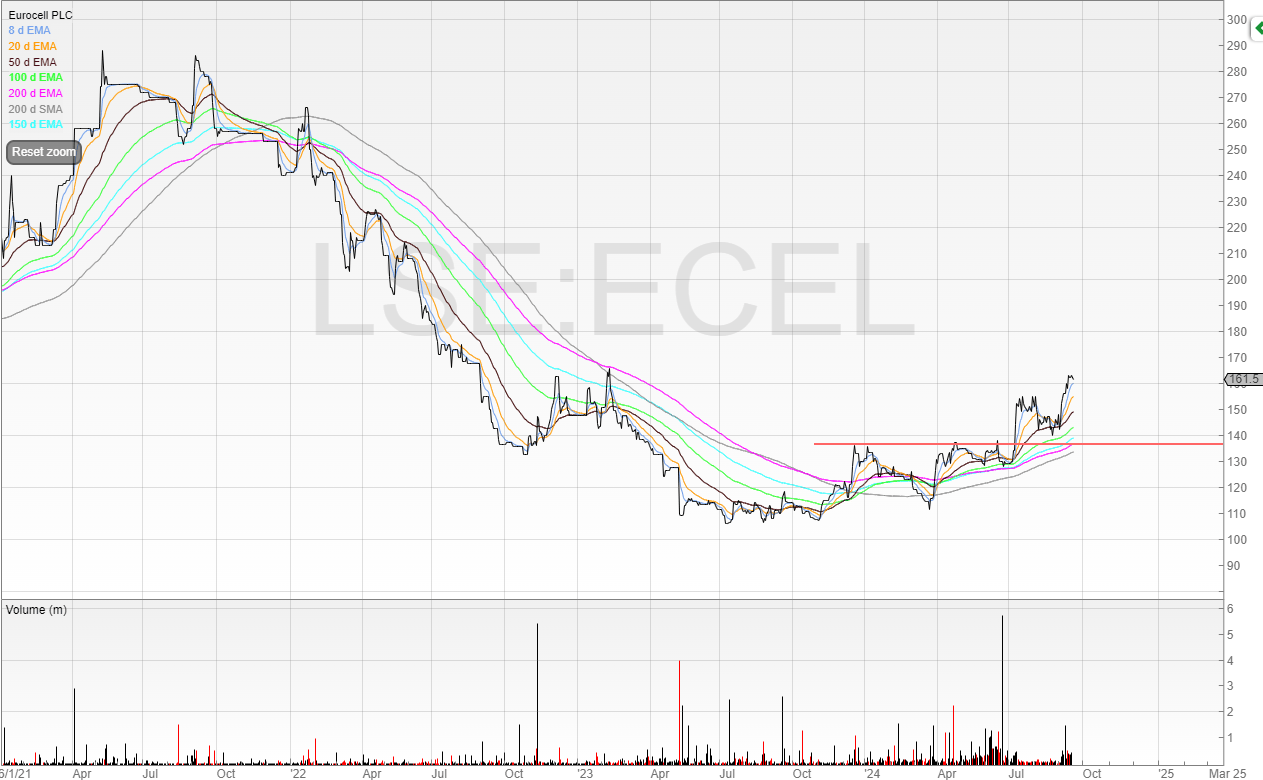

After a painful few years for shareholders the business is now looking better.

I highlighted the iceberg that was holding the shares back a few months ago.

The shares have rallied since and I’m still long as I’ve yet to be stopped out.

I think this is an early stage 2 uptrend.

It has all the hallmarks: moving averages pointing upwards, increased volume on up days, and price trading above the long term moving averages.