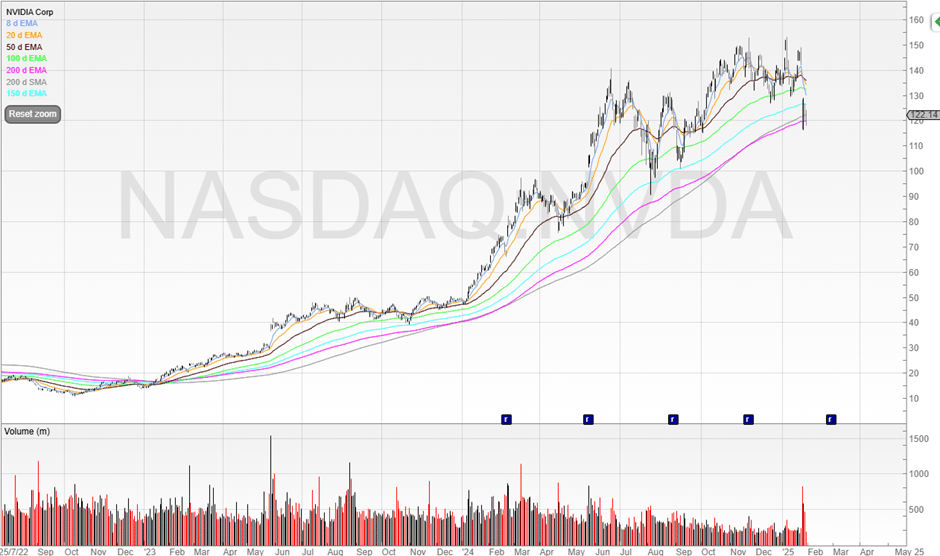

A big week! Nvidia got smashed on Monday.

The biggest fall of any company on a single day ever.

This was because of the news on DeepSeek.

And whilst it might not look like that - that drop was around $600 billion.

To put that into perspective, the biggest company in the UK, AstraZeneca, is valued at £175 billion.

And when you zoom out – we can see the 200 moving averages are under threat.

Here’s an actual pic of Nvidia investors who’re all in right now…

If Nvidia doesn’t hold, then it could be the start of a stage four downtrend.

Stage four downtrends are for schmucks, and lots of trend followers will be watching this closely.

The 200 moving averages will be a fierce battle. There are, quite literally, hundreds of billions of dollars at stake.

If it holds and rallies, then there’ll be a big sigh of relief and the stock can continue its uptrend, at least for now.

And if it falls, then it’ll invite a lot more selling pressure and create overhead supply to churn through.

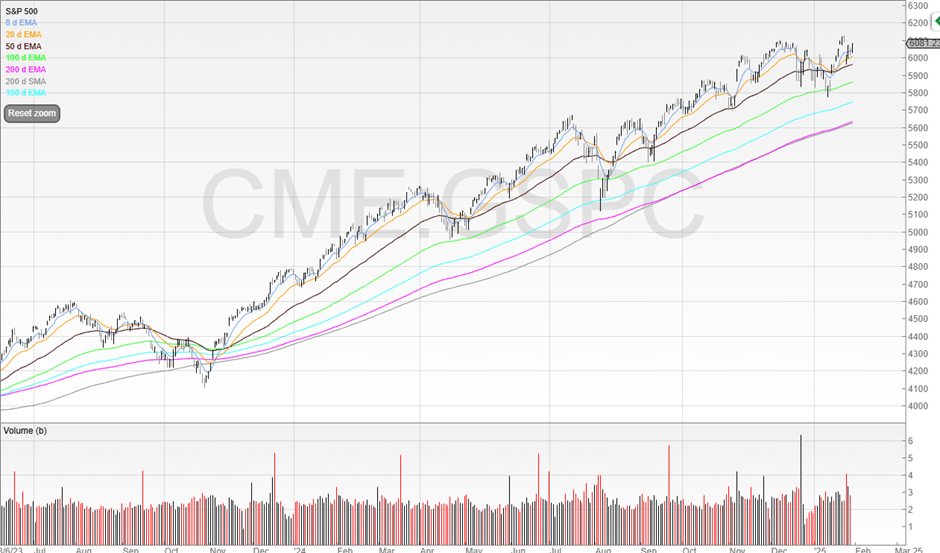

Interestingly, the S&P looks relatively unbothered.

But the potential ramifications for DeekSeek are huge.

This could be history in the making (again, if it’s true).

We’ve always thought that to compete in AI we needed huge amounts of computing power.

According to DeepSeek - that’s no longer the case.

AI is a must-win battle for both superpowers.

It’s going to be interesting to see how it unfolds.

And before we continue, a quick thank you to our sponsor Huel who contributes to the upkeep of this newsletter.

I use Huel Black personally for a post workout shake because it’s nutritionally superior to the other sugar-laden protein shakes on the market.

Make Mealtime Easy with Huel

Packed with 40g of protein & 27 essential nutrients

Fast & convenient for the busiest days

8 delicious flavors including Chocolate, Cookies & Cream, and Coffee Caramel

Get 15% off your first order, plus a free t-shirt and shaker with code BEHUEL15

Metro Bank (MTRO)

Metro Bank was a missed opportunity for me last year.

It had been on the watchlist for some time, only for the stock to put out good news, with nobody seeming to care, and so because nobody cared I left it, only to then watch it rocket.

Since then, the stock has been rallying sharply.

It’s clearly in a stage 2 uptrend.

Metro Bank was founded in 2010 and it was the first new high street bank to launch in the UK in over 150 years. It offers a variety of banking products and services including personal, business, and commercial banking.

It generates revenue through various streams too.

One of these is net interest income. This is the earnings from the difference between interest received on loans and interest paid on deposits.

It also charges fees and commissions for services such as account maintenance, transaction processing, and advisory services.

There are also other operating streams such as revenue from ancillary services, including safe deposit box rentals and foreign exchange transactions.

However, there have been challenges.

There was a big financial restructuring in October 2023 which took a big bite out of the equity value.

Then in November 2024, Metro Bank was fined nearly £17 million by the Financial Conduct Authority for anti-money laundering control failings.

However, this is in the past, and what we care about is what happens in future.

This is looking potentially interesting if it can break from the recent high at 107p.

Ferrexpo (FXPO)

Ferrexpo is no stranger to anyone. It’s the Ukrainian iron ore pellet producer, that has understandably tanked since the outbreak of war.

It’s been in a long and drawn out downtrend before looking like an early stage 2.

I pointed this out as a stock that would move if Trump had a chance of winning.

I was right, but unfortunately didn’t actually buy any.

And even though I missed the trade, I think looking at the technicals there could be more to come.

The price has more than doubled from the lows, and is holding up strongly.

We can see the 50 EMA providing support, and the stock looks to be consolidating.

The business appears to be doing better than the prior year too - though obviously this is highly dependent on the ongoing war.

Any sign of an end to hostilities is positive for Ferrexpo. So be on the lookout for peace talks.

I believe I’ve found another early stage 2 stock that is relatively liquid, and I’ll be sending that out next week.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. Priority for all offers and live events. A risk-free trade itself as you get value or you cancel.

Upgrade