Bitcoin has broken decisively out of the $100,000 level.

I was on a taxi in Berlin in December 2017.

OK - not that exciting. But the taxi driver was trading crypto.

Whilst he was driving.

I kid you not. He had a chart open on his phone and was tapping away as he was driving.

Eventually, I asked him what he was trading, and if he could stop, and he proceeded to excitedly tell me about how amazing these coins were and how well they were doing for him.

My German isn’t the best, but I told him to pick a level of profit that he wanted as a minimum (a stop loss) because this is likely a bubble, and once the herd is spooked it will be a mad rush for the exit.

I can only hope he listened.

Because less than two weeks later, the top was in, and crypto fell into a multi-year bear market.

I’m not telling you this to show off. You’ll see why…

But all the classic tell-tale signs were there:

Taxi drivers trading crypto - for a start

The Tesco checkout girl telling me about it

Friends who had never shown any interest in trading were messaging me telling ME what coins to buy

And as the old tale goes.. when the shoeshine boy is giving out stock picks. Run for the hills.

Whether this story of JFK’s Dad is actually true or not, it does make sense.

When the people who are on the lower paid rungs of society (and I am not in any way looking down upon people here - I was once a McDonald’s Chicken McNugget fryer and bagger as well as a toilet cleaner) are talking about buying stocks… who is left to buy?

Well, that’s how it was in December 2017.

And I’d love to tell you I shorted the top and cleaned up. But I didn’t.

I was too scared.

Front-side shorting is dangerous, and it’s like stepping front of a runaway mine train.

They’re fun when you’re on them. But you don’t want to be in the way.

Better to wait for a blowoff top on big volume, a failure to break highs, and look for classic stage three price action with distribution days.

And on that note, I’m running a free webinar on Monday at 6.30pm.

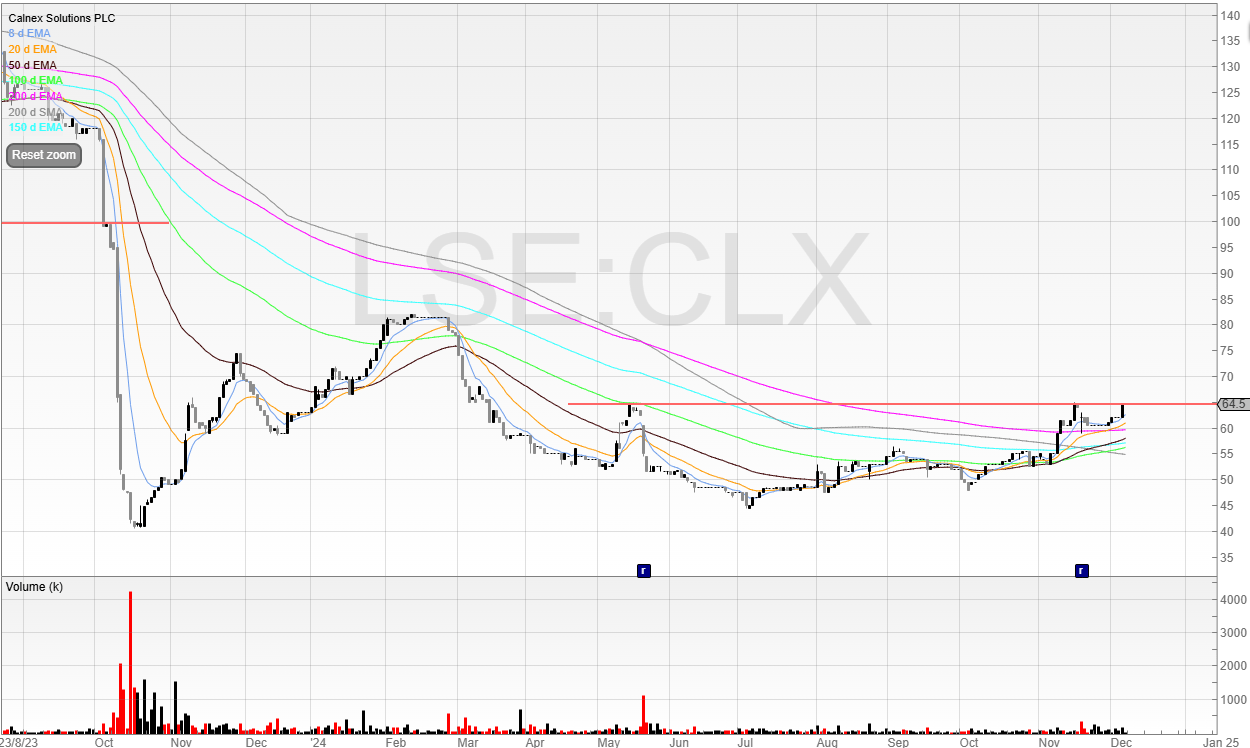

Calnex Solutions (CLX)

Calnex was an IPO back in 2020, which is actually one of the few that did well. It reached highs of 195p in 2023 against its IPO price of 50p.

Yet in October it managed to trade below that hitting 40p as a series of profit warnings smacked the price.

I was short here purely by luck on the second profit warning as the chart started selling off through significant support.

When you go with the trend, you often find yourself getting lucky.

Uptrending stocks put out good news and the stock drives higher.

Downtrending stocks put out bad news and the stock collapses further.

Calnex was displaying classic stage 3 action:

Moving averaged pointing downwards

Stock failing to beat into fresh new highs

Trading below significant support

I managed to almost nail the bottom with a puke trade on capitulation volume.

Again, I’d love to say I rode the short all the way down then did a 180 degree flip straight to long, but I closed, went flat, and then entered as I saw the volume come in.

As we can see, that was within 10% of the lows.

This was also profitable, and since then it’s been out of play for me until now.

However, the chart is looking interesting again!

That looks to me like an extended stage 1 base with a cup and handle forming.

Cavendish forecasts a return to profitability this year with cash burn minimal.

I don’t believe there is a significant financing risk here, but the obvious risk is that it warns on profits again.

But the last warning was October, so we could be past that now.

I’m watching for a breakout, and think a stop below the Big Round Number of 60p and 200 EMA seems sensible.

This could be a potential early stage 2 stock. It’s up plenty from the lows, but unless it breaks and holds I’d consider this still a stage 1.

And before we continue, a quick thank you to our sponsor who helps towards the upkeep of this newsletter.

Learn how to make AI work for you

AI won’t take your job, but a person using AI might. That’s why 1,000,000+ professionals read The Rundown AI – the free newsletter that keeps you updated on the latest AI news and teaches you how to use it in just 5 minutes a day.

Beeks Financial Cloud (BKS)

Beeks Financial Cloud is finally threatening to break out of its trading range.

I think this is one of the most exciting stocks on the market despite the racy valuation.

In a bull market, reliable tech can be bid up to high multiples. And it’s also working with NASDAQ.

Beeks offers cloud-based services specifically tailored for the financial industry. Its main product is providing ultra-low latency, high-performance connections.

Latency is a fancy word for "delay," and in trading, even a millisecond delay can mean the difference between making money or losing it.

Beeks helps traders execute trades as quickly as possible by hosting their servers close to major financial exchanges, meaning the data has less distance to travel.

For example, if you're a hedge fund trading in New York but using a trading platform based in London, Beeks’ infrastructure ensures that your orders are executed with minimal delay.

They offer these services to a range of financial institutions, from retail brokers to big investment banks.

As you can imagine, once Beeks lands a client, it’s going to be difficult to displace them, unless of course it messes up.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. A risk-free trade itself as you get value or you cancel.

Upgrade