It’s Black Friday! Which means retailers the nation over are wheeling out stock that didn’t sell and marking it down.

Or taking one highly-prized product, knocking 50% off it, but limiting sales because the job is to create a buzz and get people in the door to buy the other stuff.

OK - maybe I’m too cynical. But in any case, a bargain is only a bargain if you actually wanted what you’ve bought. If you’re impulse buying, chances are you’re buying it because it’s on discount and not because you wanted it.

Top of my list this year: a new fridge-freezer. In fact, it’s the only thing on my list aside from a few gift vouchers.

I’m not running a Black Friday offer myself.

But I am offering a £300 beta discount to those who become lifetime members of UK Stock Trader Pro before the first live session on 10 December. You’ll get the final polished version in Q1 2025 and get eight live sessions with me as we go through the course as well as Q&A, plus all future updates are free.

Spots are filling up, and I’m excited to build what will be the best program out there for trading UK stocks.

If you’ve got any questions - hit reply and I’ll get back to you. After I’ve bought my fridge-freezer.

It’s been a busy week on the market!

Lots of news, with several takeover offers.

A few profit warnings too.

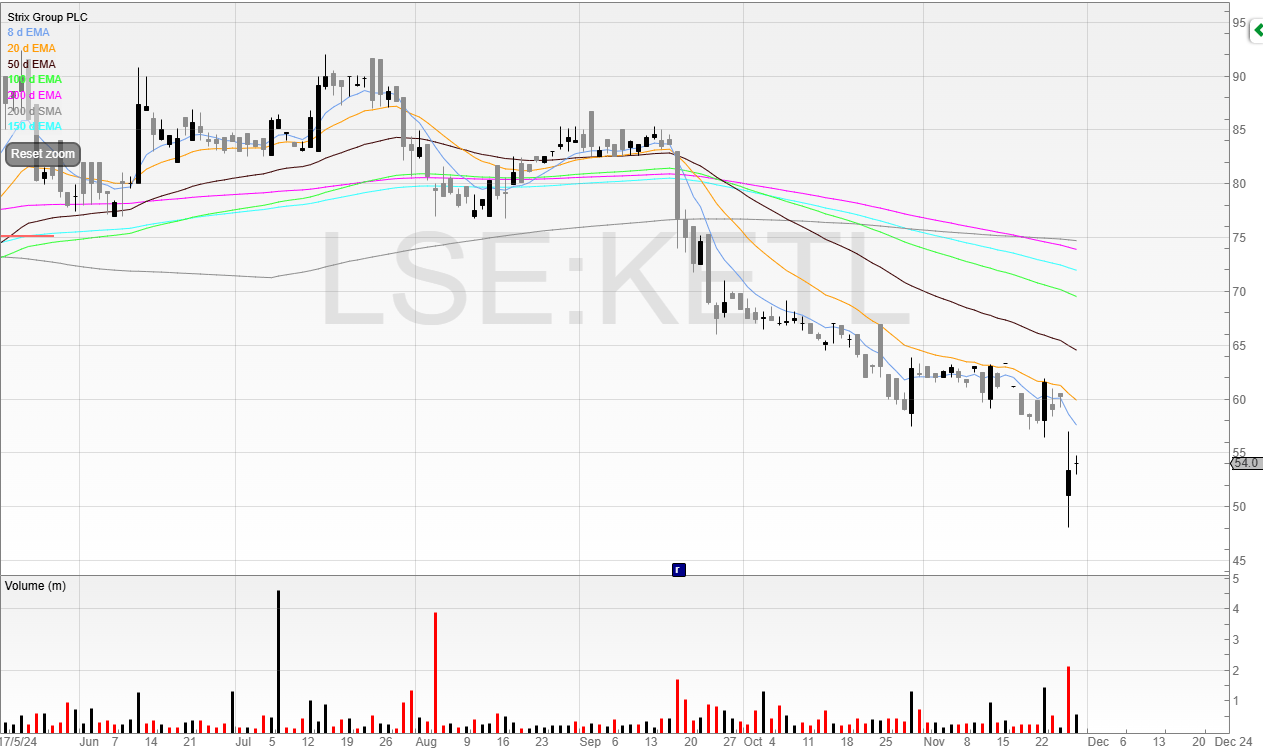

Strix Group (KETL) also warned again.

Pre-tax profit was chopped by several million and Zeus has revised its forecasts down by 26%.

I was reluctant to short here on the bell as it’s not unexpected news, and the stock initially traded lower before rallying.

This doesn’t fill me with confidence.

Net debt leverage has also expanded to more than 2x from 1.76x, and I think this is a potential short or at the very least an avoid.

I’ve opened up a small short at ~56p, because I felt against the closing price of 60p the session before this didn’t reflect the news.

But I can always be wrong (and often am), and if the price prints higher than 57p I’ll take the loss and move on.

Just because I think a stock is garbage doesn’t mean everyone else does.

For all I know, the stock could be rallying because shorts are covering as they’ve made their money already!

And before we continue, a quick thank you to our sponsor who helps towards the upkeep of this newsletter.

Invest in AI & Tech Innovators Before They Potentially Hit the Public Market

UpMarket provides accredited investors with exclusive access to companies at the forefront of AI and tech innovation. From SpaceX and OpenAI to Neuralink and ByteDance, these private companies are pushing technological boundaries and driving innovation. With over $175M invested by our community, UpMarket is a U.S.-based platform offering vetted, private investment options.

Aston Martin Lagonda (AML)

Aston Martin is a stock the punters love. Probably because of the cars, which, in fairness, are quite nice.

But the stock is a different story.

A few months ago I said this was an avoid and I could see another placing coming.

Well, here it is.

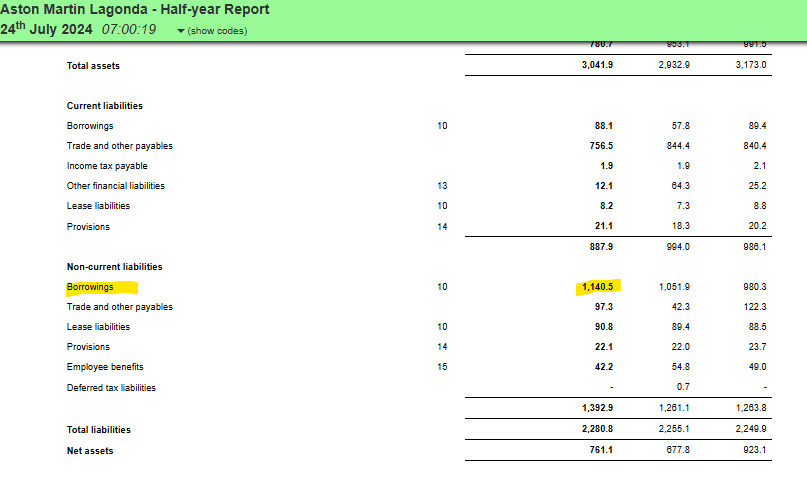

It’s raised £112.5 million selling shares plus another £100 million in senior secured notes. This gives the company additional liquidity of around £200 million but the balance sheet is overloaded with debt.

Borrowings are now well over £1 billion with these new notes.

And cash generation at the moment is nowhere near enough to pay down the debt.

It’s entirely possible the business starts selling more cars with its “reinvograted portfolio” and more Specials interest.

If that happens and the share price rises, then the business could use the strength of the equity to raise more money and pay down the debt.

But even though there’s just been a placing - I suspect there will be another one down the line.

The liquidity means there is little financing risk in the short-term and so anyone jumping in for a quick trade should be fine - but I’ll be avoiding now.

Why bother with high risk stocks when the reward isn’t attractive enough to justify risk taken?

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. A risk-free trade itself as you get value or you cancel.

Upgrade