Next week we’ve got the all-important budget. This is going to be like a firehose of RNSs attached to your face in a single day.

AIM shares are under threat. People with assets are a target. Entrepreneurs aren’t happy.

And neither is the stock market. Ever since the rose garden “this budget will be painful” speech, risking money in stocks has the same appeal of a stone cold Greggs sausage roll.

But here’s what we do know.

A huge amount of downside is now priced in, which, if it doesn’t come to pass, is lining up one spectacular rally. A wall of cash is on the sidelines ready to be deployed.

And even if it as bad as feared, there will still be great companies around. Remember, the government can change the tax status of those companies but not the companies themselves.

Yes, it’s also true making UK stocks less attractive will hurt the market in the long run.

But I’m told that the new treasury understands the importance of the market. Whether that’s true, I guess we’ll see.

In any case, use the time this weekend to make a plan and be prepared.

Here are some stocks I’m watching.

Audioboom (BOOM)

Audioboom is a podcasting company that’s helping to power the booming world of audio content. It provides a platform for podcasters to create, distribute, and monetise their shows, connecting creators with advertisers and audiences around the world.

Here’s how it works: creators upload their podcasts to Audioboom, which then distributes them to all the major listening platforms, like Spotify, Apple Podcasts, and Amazon Music.

This saves creators the hassle of managing multiple accounts and ensures their shows reach as many listeners as possible.

But Audioboom doesn’t just help with distribution. They also connect podcasters with advertisers, making it easy for creators to earn money from their content.

They offer tools for inserting ads into episodes, handling sponsorship deals, and providing analytics so creators can see how their shows are performing.

Audioboom’s customers include a mix of podcast creators, from independent podcasters to large media companies. They work with content creators across different genres, from true crime and sports to business and lifestyle.

Some of their popular shows include “Casefile True Crime” and “No Such Thing as a Fish.” In fact, I’ve never heard of some of their mentioned shows, but some have over 100m regular listeners so it’s fair to say that they’re popular.

On the other side, Audioboom works with advertisers who want to reach engaged audiences through podcast ads.

Brands and companies partner with Audioboom to place ads on shows that match their target audience, leveraging the intimate and trusted nature of podcasting to connect with listeners.

Essentially, Audioboom makes money in three ways:

Advertising: Audioboom earns money by placing ads on the podcasts they host. They work with advertisers to run different types of ads, including pre-recorded spots and sponsorships. Since podcast advertising can be more personal and targeted, it’s a popular choice for brands looking to reach specific audiences.

Subscription Services: Podcasters can also choose to pay for premium features on Audioboom’s platform. These features might include enhanced analytics, better ad tools, and more options for customizing their shows.

Content Production: Audioboom partners with creators to produce original podcasts. They invest in these shows and share in the revenue they generate, giving the company another way to earn income.

As more people listen to podcasts, more brands are recognizing the power of podcast advertising.

However, the share price leaves a lot to be desired, aside from a Grand Old Duke of York 10x rise in 2020 and 2021.

For most of its listed life, Audioboom has been in the doldrums.

There’s clearly a seller there, as every time the company puts out news, the stock sells off.

I’ve marked that here with arrows.

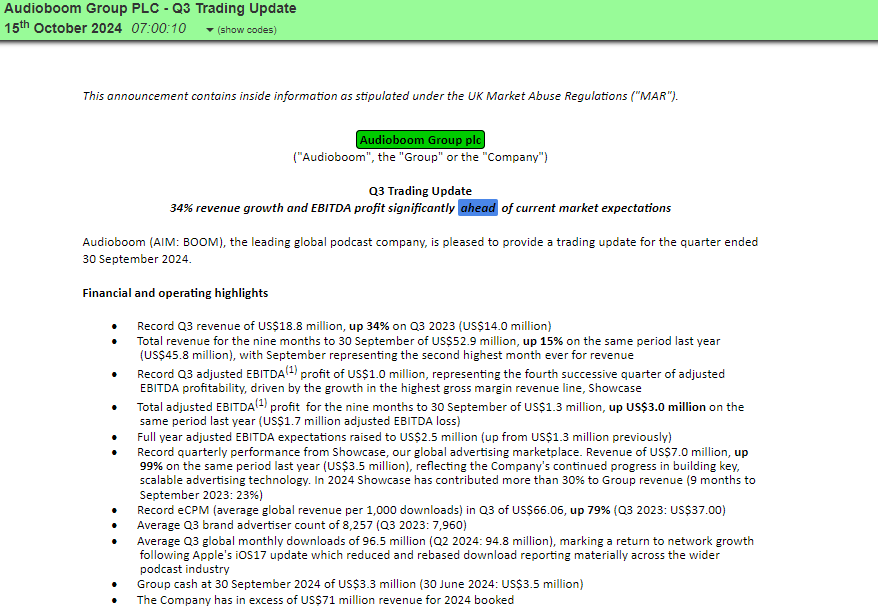

It happened again recently when the stock beat expectations.

EBITDA isn’t profit. But the company is clearly cash flow sustaining and Showcase is rapidly scaling up.

Plus, any uplift in advertising CPMs will give a big boost to earnings as it’s extra profit on top.

I think BOOM has a lot of potential - especially if Showcase continues to scale up.

But until there is a lack of pressure on the shares and the stock resumes an uptrend, it’s the watchlist only for me.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. A risk-free trade itself as you get value or you cancel.

Upgrade