Well, what a surprise…

The Budget was not as bad as expected!

All the scare mongering and LinkedIn outrage was for nothing.

Now, it’s not the world’s best budget. There are some things I would’ve done differently.

But then I’m not an economist. But then neither is Rachel Reeves!

However, despite the bond market and the FTSE 100 and FTSE 250 falling, I think there is stability. Which is what matters in the long run.

Plus, both ISAs and spread bets were left alone - so a great day indeed.

Several stocks moved from the cheat sheet I sent you.

As I said, any positive changes to the EPL would see Serica Energy (SQZ) rally, and the same for any additions to green energy for Ceres Power Holdings (CWR).

Both of these had strong moves on the day.

The popular stocks I mentioned such as Warpaint (W7L) also moved positively on the day.

And as there was no gambling duty mentioned, both Rank (RNK) and Evoke (EVOK) rallied.

So a successful cheat sheet!

Another one I looked at was Supreme (SUP) (I hold a long position in this stock).

The new Vaping Duty came in as expected, and wasn’t as bad as I thought.

True, vaping will now become several times more expensive.

However, vapers have three options:

Start smoking again

This is unlikely, given that tobacco will also increase in line too to dissuade vapers back to cigarettes.

Vape less

This is entirely possible. However, vaping is still going to be cheap.

There is a flat-rate tax of £2.20 per 10ml bottle of vape liquid that will be introduced from October 2026. So we can expect huge vape sales in the months before as vapers become aware that the price will shoot up and stock up.

88vape currently sells 10ml for £1.20. So the tax of £2.20 plus VAT will mean a £2.64 increase. So given the current price, we’re looking at £3.84 per 10ml.

Not exactly insignificant!

But 100ml is around 20,000-30,000 puffs of a vape.

Given that you only average 20,000 breaths per day (including the time you’re asleep) - you’d need to be smashing the vapes before you even paid £26.40 extra.

So in reality, I still see vaping as cheap.

Quit

The third option is vapers quit. It’s entirely possible. But unless you’ve got a vape permanently stuck to your lips it’s going to be a while before that extra £26.40 starts to feed through.

And I’ll say again - I hold this stock personally so it’s impossible for me to speak about this without bias.

But the stock moved as the market decided this wasn’t as bad as expected.

Hope you caught a few movers!

Here are a few more stocks I’m watching for now.

Capita (CPI)

Capita is a UK-based company specialising in consulting, transformation, and professional delivery services.

It assists businesses and governments in improving efficiency and service delivery through digital solutions and operational expertise.

Given how useless our governments are and have been, my guess is that it doesn’t assist them very well.

But essentially, Capita offers several services:

Consulting: Providing expert advice

Digital Solutions: This is by implementing technology to enhance customer experiences and streamline operations.

Operational Delivery: This is managing essential functions such as customer service centres, HR processes, and IT services.

Capita serves a diverse client base across both public and private sectors, including both government agencies and private companies.

It generates revenues through contracts with organisations that pay for its services, either long-term agreements or short-term projects.

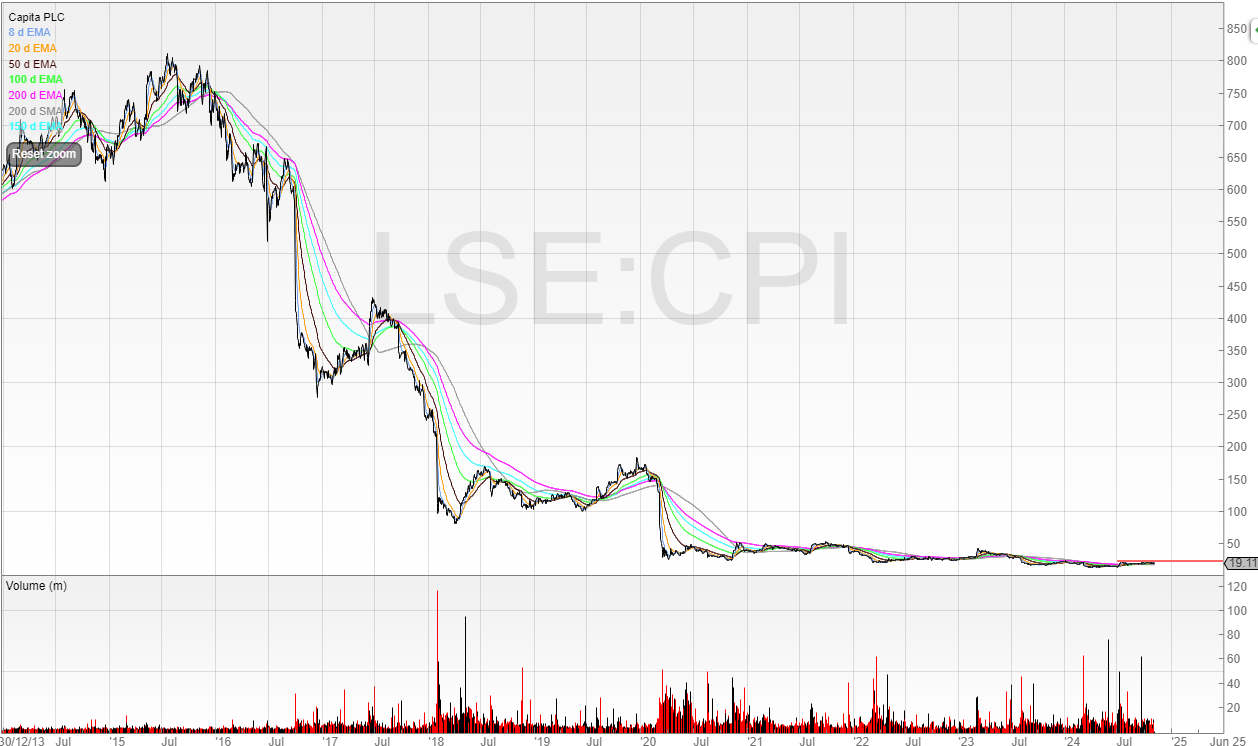

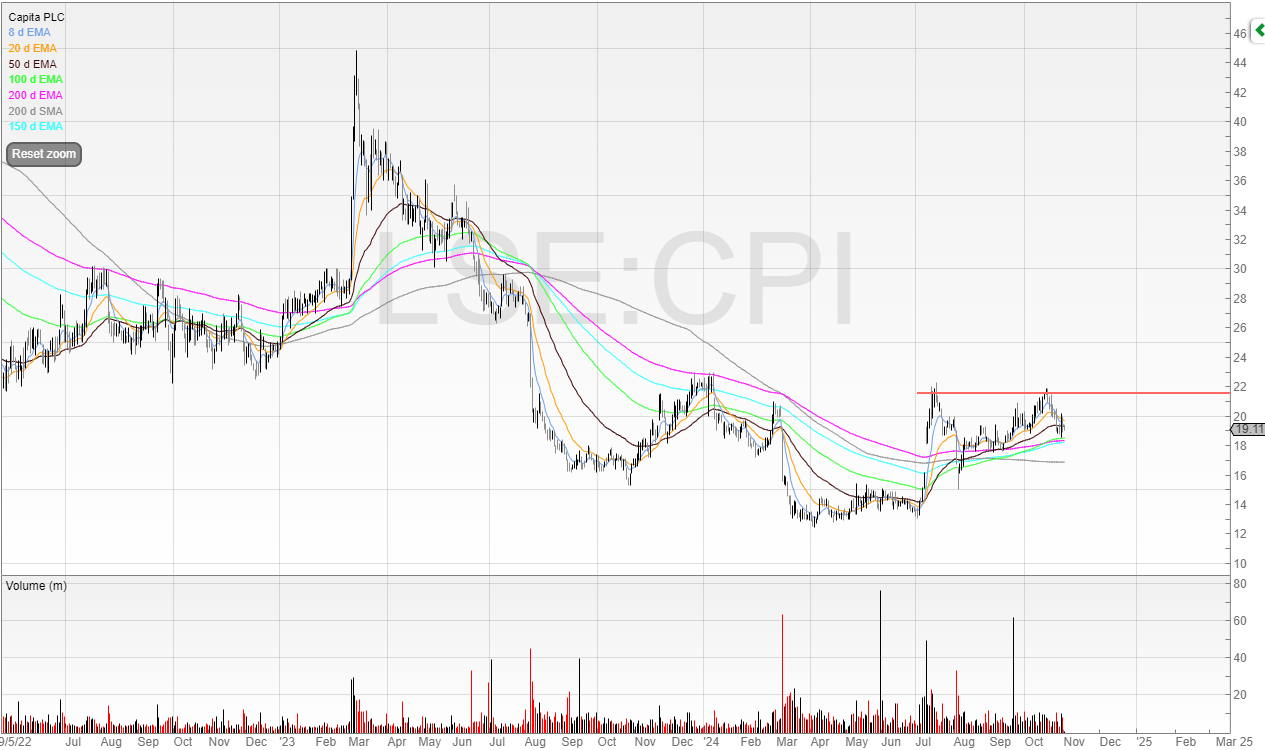

Throughout literally my entire trading career, Capita looks like its been in a stage 4 downtrend.

It’s currently 98% down from its highs.

There was another 88% collapse in 2020, which just goes to show that no matter how much a stock falls, it can always fall a lot more.

But are we seeing the building of a stage 1 base here?

I’d like to see a cup and handle form and it’s on my watchlist.

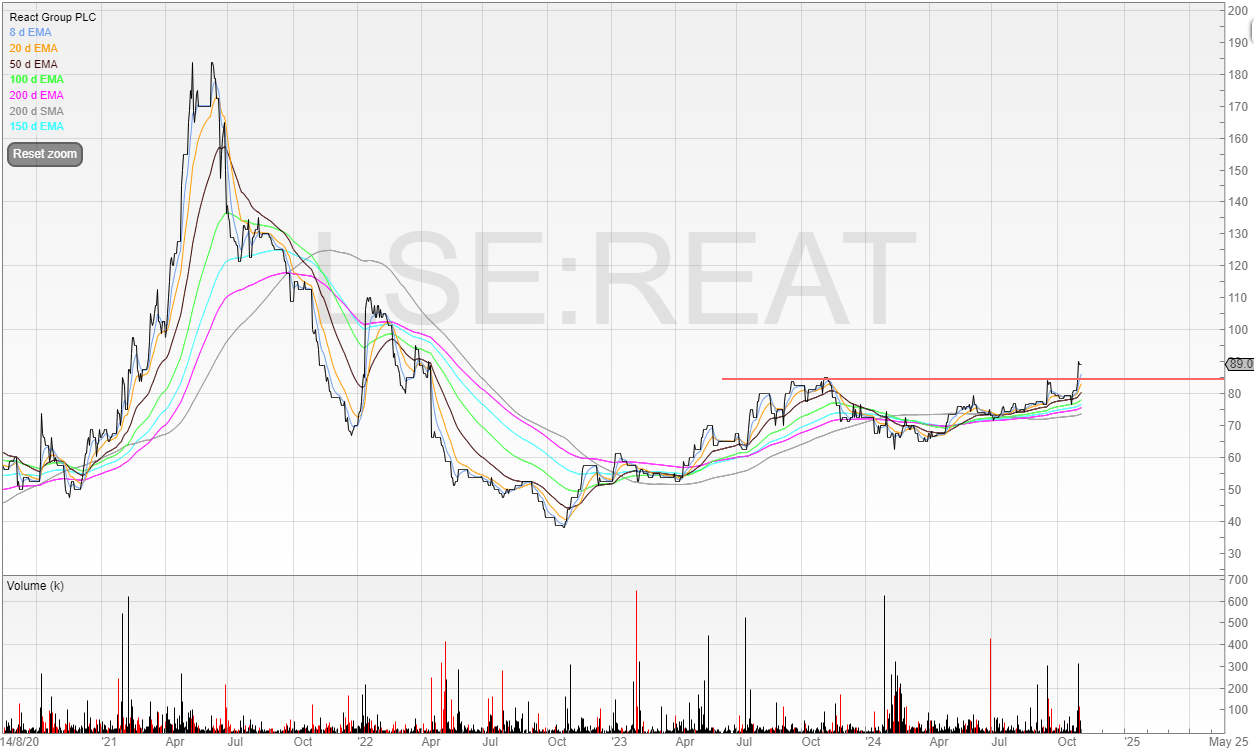

React Group (REAT)

React Group is focused on specialist cleaning, decontamination, and hygiene services.

It’s a turnaround company that is pursuing a buy-and-build strategy by growing organically and acquiring complimentary businesses.

So far, the company has bought Fidelis and LaddersFree in 2022.

This placing killed sentiment in the stock as it was done at a steep discount and also doubled the shares in issue.

But given its performance, this acquisition looks to have been a success and that management were right to pursue it.

I mentioned to the Chair that I didn’t want dilution like that again, and that if React keeps acquiring and significantly diluting, it will kill any sentiment and thereby fail to give paper any power when acquiring.

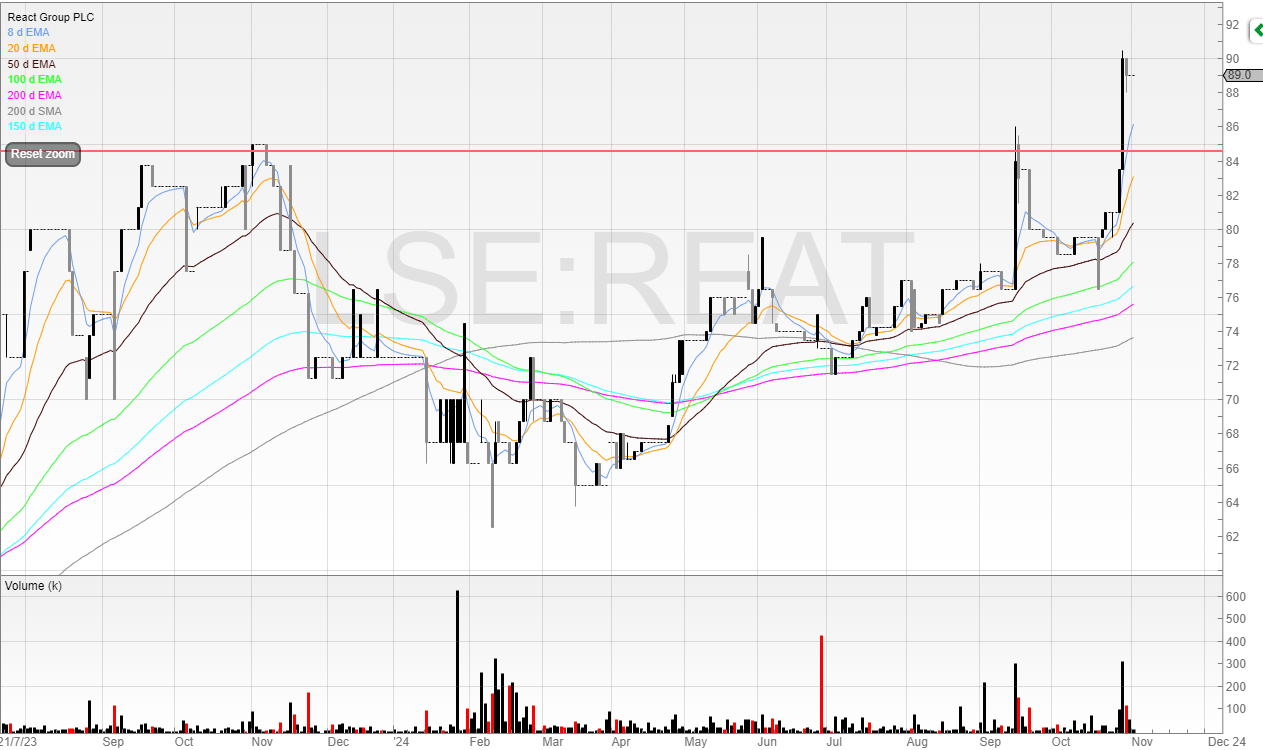

I’m happy to see that the latest acquisition comes with minimal dilution but immediately enhances earnings significantly.

It’s a £7.4 million acquisition, £2.4 million of which is in cash.

Another £4.48 million comes from a new debt facility provided by HSBC, and a £1.1 gross proceeds fundraise.

Dilution is minimal here, and I hold a long position in this stock in family accounts.

The placing was done at 81p so around the existing share price, and we’re told it was “heavily oversubscribed”.

Given the share holder register I can imagine this is true, and I was not even offered a chance to participate.

The share price is now poking out into two-year highs (and now above the LaddersFree placing price!).

I hold this stock in family accounts.

If React can continue to grow businesses and then use cash flow and earnings to access debt to grow, then the stock could have much further to go.

Cavendish Financial (CAV)

Cavendish Financial is the merger of finnCap and Cenkos.

The idea here is that instead of competing, the business can strip out a load of costs and operate as a single entity.

So far - it’s working.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. A risk-free trade itself as you get value or you cancel.

Upgrade