Welcome to the March edition of Buy The Bull Market. My wife gave birth to our son this week, and so I was somewhat distracted!

I also didn’t want to put out something unless I was fully happy with it, so thank you for your patience.

I’ve invested in a developer to get email alerts set up, so you should’ve received an email from me telling you that this post is live. It’s set up so that every time I upload a new post – anyone who is subscribed will get an email.

If you’re reading this and you didn’t get that email – please check your spam – and if it’s still not there then let me know.

But before we get onto the main part of the issue, I’m often asked about my intraday trades.

Intraday trading is cool.. or at least it looks like it on the films. Lots of screens, flashing lights, action, fast profits.

But what you don’t see? Unpredictability, chaos, lots of chop, small losses, and the occasional big winner that keeps you going and pays for a lot of losses. Intraday trading is fun but it’s hard yards. It’s also a constant grind because you’re churning the account and each day brings new potential trades.

The reality is intraday trading is not where the money is at. At least, not for me. Don’t get me wrong, you can make good money doing this. But I believe I can make far more with less effort.The reason is because intraday trading is: 1) far harder, and 2) the amount of money chasing alpha is far higher.

That changes when it comes to smaller stocks. Swing trader is far more lucrative for me because the competition changes and it’s easier to take money from those who don’t know what they’re doing.

This is the opportunity.

It throws up stocks that have been beaten down and left in the dirt, avoided by institutions and castaway from the investment community.

This is where multibaggers hide.

And I think I might’ve found one..

Best of the Best (BOTB)

I wrote about Best of the Best last month. But having reviewed everything I averaged up and bought more on the pullback.

I think at the moment this stock is offering the best risk/reward on the market that I can find. Why?

To understand that, we have to go back to the pre-Covid business.

Before Covid, Best of the Best was a small business that was putting cars in shopping malls and airports and encouraging people to bet to win a car.

It was making the transition to move much of its business online, which would naturally offer lower costs, increased margins, and the ability to scale.

Here’s the Half-year Report from BOTB on 30 January 2020. 99% of revenues were then online.

Source: SharePad (1-free month worth £74 through me)

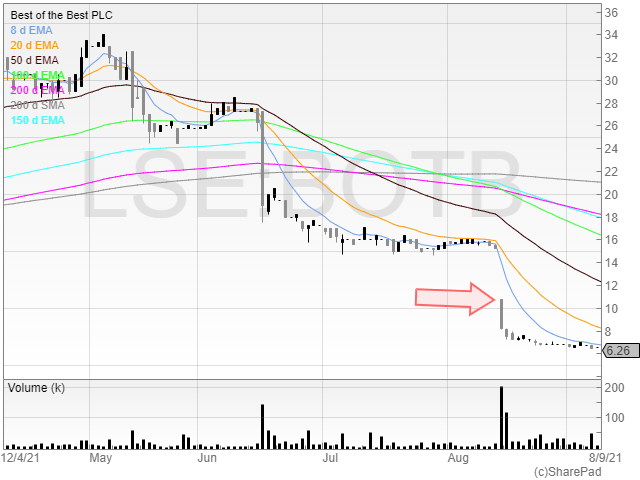

Here’s the chart at the time.

Steep drawdown but the stock was testing and breaking out of multi-year highs.

So the business had fundamentally changed. Yet the market hadn’t factored this into the price. Everyone still thought it was a stuffy airport and shopping mall business that lacked scale.

We can see towards the right of the chart that the stock dipped in Covid then snapped back quickly.

I started building my position here because I was sure that the risk/reward here was hugely in my favour.

The business was already profitable and cash generative, without the online factor in the stock price, and people were now sat at home gambling away their money.

Source: My post in our UK Stock Market AIM & FTSE Shares Facebook GroupPassword: Tr4d1ng (if you’re not already in!)

Then we got the trading update a few weeks later.

Earnings growth better than expected and continuing momentum

This is what happened.

I sold some into the liquidity around 600p and again around 1200p.

As expected, the stock re-rated.

What were the lessons here?

Extended sideways trading

Fundamentals strengthening

Zero interest in the stock

These three principles often form the best asymmetric risk/reward trades for me.

The sideways trading acts like a coiled spring, then when the catalyst is released or the market wakes up, there is suddenly a scramble and also a re-rating.

That said, I clearly sold too early.

The stock went from intensely hated to madly loved over 12 months.

By the time the price was hitting £30, people were talking about £100.

The narrative had gone from the stock being a boring avoid to everyone stumbling all over each other to buy!And naturally, when everyone is singing from the same hymn sheet, the end results is always the same: irrational exuberance.

By June 2021 the euphoria was reaching its peak..

Hike in the Final Dividend, Special Dividend paid out.. what’s not to like?

When everyone starts to love a stock, the trader in me always looks for a potential fade.

Starting a front-side short into strength is dangerous and foolish. But watching for a stage 3 and then going short? That’s a solid strategy.

The clue for me was that Best of the Best was heavily reliant on Facebook ads. I have friends in the ecommerce industry and knew that Facebook ads were becoming ridiculously expensive and that the introduction of iOS 14.5 had skyrocketed CACs (Customer Acquisition Costs).

Why? Because iOS 14.5 meant that apps were required to ask your permission when they want to track you across apps and websites owned by other companies. You could change your preference on any app or even prevent apps from asking for permission entirely in the Settings.

Many people did – and as a result – people were no longer able to target potential customers anywhere near as effectively.

Anyone with their ears to the ground in the ecommerce industry could’ve known this. Best of the Best had made no secret it was relying on Facebook ads to fuel growth and the potent combination of bored punters who had other peoples’ money in their pocket meant when times were good, they were good.

iOS 14.5 was released on 26 April 2021. But the feature changes had long been known about for months.

A month earlier, Mark Slater bought 9.12% of the company from selling directors at 2,400p. At the heights of 3,500p this looked an astute buy.

I was wondering what he saw in it as in my opinion he was late to the party and Best of the Best was at risk of a profit warning. I assumed he was aware of the risks and as a fund manager, he’d probably done his homework far better than I had (after all, I’m just a trader from my spare bedroom) and therefore knew what he was doing.

Unfortunately for him, a few months later Best of the Best put out a devastating warning.

Best of the Best goes to worst of the worst in one big profit warning.

The stock had gone from a high flyer to saying that the current year’s profits and earnings were going to be c.62% below current market forecasts.

I shorted here but closed on the same day as I was aware I was potentially late to the trade.

This brings us nicely onto 2022. And Best of the Best started the year with another warning.

The stock was already hated and now this poured fuel on the fire.

The market didn’t take too kindly to this warning.

This warning knocked the stuffing out of the last few diehard bulls. Capitulation volume.

But this warning also started paving the foundations for the current trade. It sent the stock back to pre-pandemic levels, despite the business being in a stronger place.

The stock price also then started trading sideways. Classic stage 1 base action.

Note the false breakout I fell for in the middle.

I did enter the stock in September on the false breakout. This was when it was announced that Teddy Sagi’s family office had gotten involved and bought a 29.90% slug. But there was clear price rejection and so I got stopped out, and the price went even lower.

I covered last month how I thought this was now a potential stage 2 stock. Having looked at the business more I’ve added on the pullback and believe this is now a potential multibagger.

Who is Teddy Sagi?

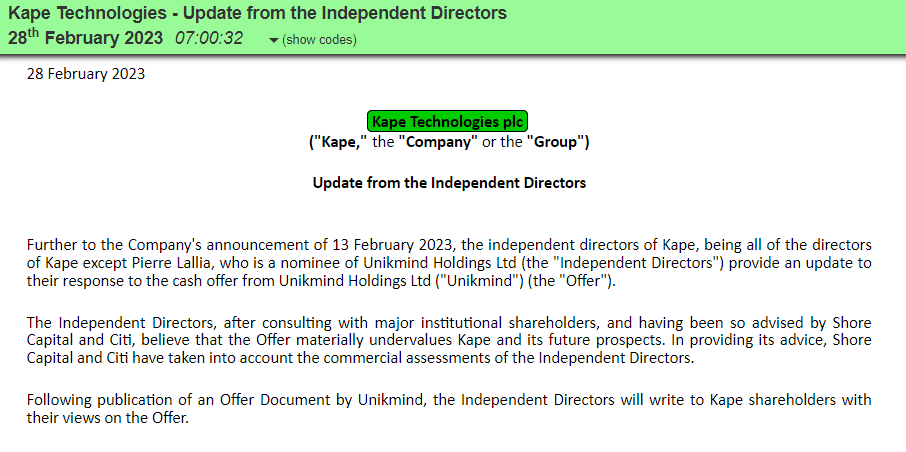

For those who don’t know Teddy Sagi – he founded Playtech in 1999 and it listed on the LSE in 2006 with a valuation of around £550 million. It’s a company that offers gambling software technology and since then he has moved into other companies (recently making a bid for Kape Technologies) and real estate.

Many Kape Technologies shareholders are complaining about the takeover offer saying it’s too low.

And the independent directors agree.

Naturally, unless directors have been offered handsome stay-on packages, they will always disagree. Directors are never going to do anything against their own interests – even if it’s in the best interests of the company.

But guess what? If someone has 52% of the company, they own a majority position, and that puts them in a firm position to do things that are in the best interests of themselves as a shareholder, but not necessarily the other shareholders.

I remember back in the day a company called London Capital Group. The board held over 90% of the outstanding shares, and after using the stock market to raise money and right before the business almost turned profitable, there was a management buyout (MBO) and the price tanked 50%.

Sometimes shareholders can have too much of the business.

But coming back to Best of the Best – I would imagine Sagi has a few tricks up his sleeve when it comes to international expansion – especially as he is the King of gambling software.

If he wanted to buy it out, then it’s not as if he can’t afford it. His net worth is over $5bn. And if the business materially improves and the share price doesn’t reflect that – maybe he will.

It’s worth noting though that at this stage it’s just a Letter Of Intent (LOI) and a strategic investment.

You’d think that Sagi’s family office wouldn’t invest in they didn’t intend to do anything.. but stranger things have happened.

International expansion on the cards?

To be clear: GIL will have exclusive use to a license for the BOTB business model and concept it all territories outside the UK. It’ll also be able to non-exclusively promote BOTB in the UK on an agreed revenue share or Cost Per Acquisition model.

This means that both parties will need to work together to come to a solid partnership and understanding. GIL can take the brand global but it will come at a cost. But given BOTB are not exploiting that market at all – this works well for them.

Why now for Best of the Best?

Best of the Best meets all three of my criterion for a potential multibagger trade:

Sideways consolidation

Strengthening fundamentals

Stock hated or intensely disliked

The stock has been consolidating since the capitulation day profit warning on 19 January 2022. That gives the stock at least a year of consolidation and allows the deadwood to clear.

The stock is now past the pandemic madness phase too.

Highlights are mine.

Note how the revenue is sharply down, but still significantly greater than the £7.60 million delivered pre-pandemic.

Be wary of management teams that compare to prior periods that aren’t directly the last year. This is usually done to make the financial results look better than they are (another trick is lengthen the financial year to 18 months).

However, in this instance, the board give last year but also the pre-pandemic year seems a sensible comparison.

We know that 2021 was a boom year. We know it was truly exceptional. And we know that it wasn’t normal.

But note how – despite the ~30% fall in revenue growth – profit was only down slightly more than 10%.

Why?

The company reported on this in the Final Results on 16 June 2022.

Our principal competitions are now the Weekly Dream Car and Midweek Lifestyle Competitions, the latter being the result of a recent trial combining our Midweek Car and Lifestyle competitions. Both competitions offer the opportunity to win brand new cars, with the former operating via Spot the Ball and the latter via a suitably skill-based question.

So management have maintained the profitability of the business despite the fall in revenue through a successful trial.

And EPS has actually risen because of the approved tender offer that was announced the day of the Final Results.

Because of the 6.8% reduction in share count, the business doesn’t need to add as much value in order to get to the former price highs. The shares are now more valuable because there are less of them.

This is smart capital allocation by management, in my view. The company still maintains a strong balance sheet with no debt, and it’s a cash generator.

finnCap has forecasts of £5.5 million in adjusted PBT for 2023. At the current price of 595p, that gives a market cap of £56 million and an adjusted pre-tax PE of just over 10.

Source: finnCap

I feel this is reasonably low for a company that could now be returning to growth. Therefore, if growth does occur, then this stock is too cheap.

If it doesn’t? Reasonably well protected with a resilient business and proven management.

As an aside, if you’re a gambler, then I imagine betting money to win your dream car is probably fun. You’re far more likely to win than a lottery ticket and you have an emotional connection to the car, rather than just an arbitrary amount of money.

Some of the Dream Supercar prizes

But as I only like to play when the odds are in my favour, I’m long the stock and not the product.

My system provided this trade idea

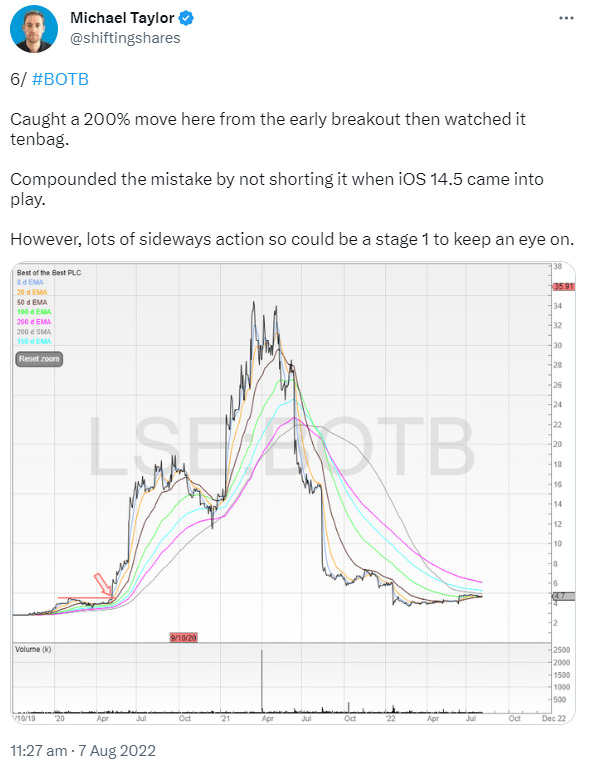

I had a look through my tweets on Best of the Best and found this from August 2022.

Base was noted in August

I’ve been aware of this stock since at least August and set an alert on ShareScope to alert me if the stock reached a certain level.

Doing this is an amazing way to find ideas then store them in a second brain that works 24/7 for you. Automating your systems as much as possible will relieve cognitive load and boost your P&L.

I know I’ve spoken about this before (many times). But it’s a point worth labouring again.

You don’t need tipsters. You don’t need gurus. All you need is a proven system to follow that works for you and not against you.

Remember, everyone knows the system is rigged.

But there are some people who use this to their advantage. And there are others who complain and do nothing.

Don’t be a complainer.

Best of the Best summary

To summarise – I like this stock because there is clear upside from the UK expansion of the business now that the pandemic players have washed through. Plus, there’s potential upside from Sagi’s involvement should anything come of that. It’s also possible he could put in a lowball offer, but at 29.90% it’s unlikely this would be approved. It’s still a risk though.

But whilst all of this has been true for some time, what matters to me is the chart and the fact that the price has now hit 52-week highs recently and is trading out of what looks like a stage 1 base.

I added to my position in the pullback, but wouldn’t rush out to buy more just yet.

Here’s the chart.

Source: SharePad (1-free month worth £74 through me)

The stock has rallied sharply from the lows of 400p and it’s only to be expected there will be some profit taking.

I increased my position on the pullback, but I’d be looking for a break of 680p to add more. That would be a sign that the price is potential moving higher and for now I think it’s not unlikely to see a range build over the coming weeks.

Please don’t buy the stock because I have. I get many wrong, and I could be wrong here. The stock is illiquid, and I’m also in at a lower price (average of around 590p).

Personally, I think this could be a great trade, but you need to do your own research and decide if the company fits your stock market criteria and goals.

Best of the Best is far from a market darling. But it could become one (again).

Journeo (JNEO)

Journeo is a business that has been on my watchlist for several years.

I had a few calls with management in 2021 but decided that whilst the business looked OK it was never going to excite me, or more importantly, the market.

But that could be about to change.

Here’s the chart.

Confirmed stage 2 uptrend from the start of 2021

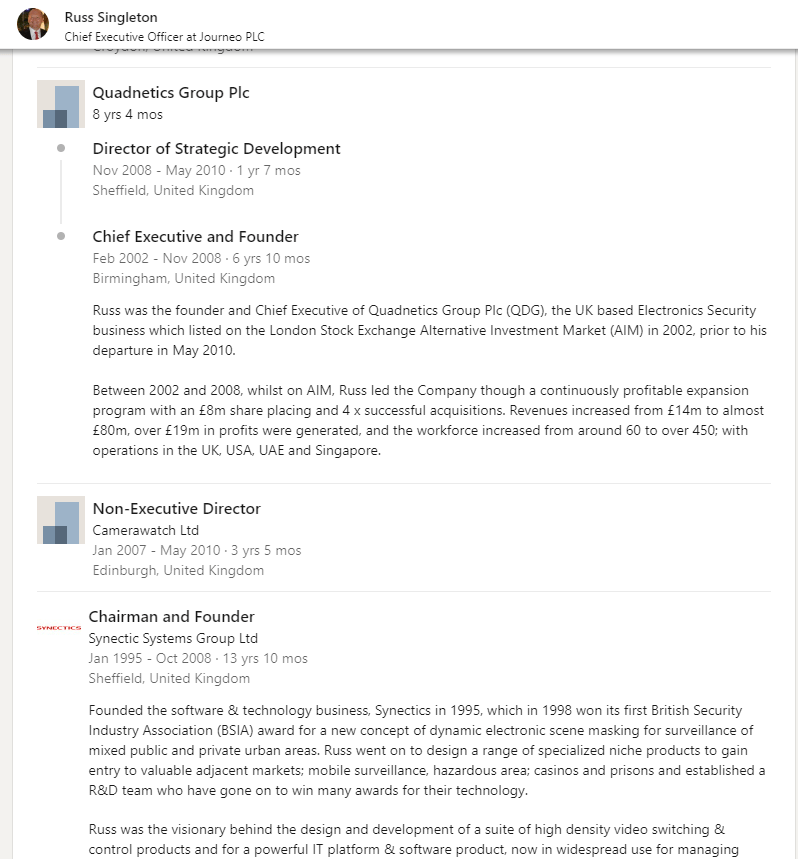

Russ Singleton has been there for some time. Since October 2013, in fact. Nearly 10 years.

Has he been successful? You decide.

Here’s the longer term chart.

The company was known as 21st Century before.

Russ was the founder of Quadnetics in 1995. It then became Synectics, which is still listed on AIM.

As impressive as his achievements are, those successes have taken time to translate into success at 21st Century and now Journeo.

Back in 2021, Russ told me he believed there was now a step change in the business, hence the name change, and that acquisitions were potentially in the pipeline. My belief was that the original business was unlikely to be anything amazing looking at the business unless there was a transformative acquisition.

And on 22 December 2022, Journeo shareholders were gifted an early Christmas present.

Placing price of 107p which was a tiny discount at the time

I can’t remember if I was offered this deal but it’s unlikely I would’ve taken it given the illiquidity of the stock. Whilst the stock was technically uptrending, it was trading sideways for a long period of time. For all I knew, it could have still been trading sideways a year later.

However, at first glance the acquisition appears to be game changing for Journeo.

Here are the Cenkos forecasts.

Acquisition of Infotech sees a step change in revenue and profit after tax.

With a market cap of £22.2 million at the share price of £2.8 million, it means the company is trading on a forward PE of 6.4 (although 20 for the current year is not exactly cheap).

I like the chart here, and there are several new institutions on the shareholder register such as Octopus, Slater Investments, Premier Miton, and Downing, but I have struggled to ever understand what exactly the business does (for example, Best of the Best is an online gambling company that has Dream Car competitions using spot the ball) other than working with transport providers to help them become more efficient and under a SaaS model with connected vehicles.

Here’s what SharePad has to say, which leaves me none the wiser.

Journeo PLC is a UK-based company that acts as a specialist provider of tailored solutions to the transport community, solving complex operational requirements both on and off the vehicle. The company operates through two business segments: Fleet Systems and Passenger Systems. The Fleet Systems segment include video surveillance to improve passenger and driver safety, vehicle and driver performance monitoring and automatic passenger counting whereas the Passenger Systems segment includes the hardware and software for electronic passenger information systems, off-vehicle smart ticketing, and wayfinding. Most of the company’s revenue comes from the United Kingdom.

I think Journeo could be a nice trend trade if it breaks out. And some big name institutions are happy to back it (although some fund managers will write cheques to businesses they don’t actually understand properly because they need somewhere to put the money) but it’s never going to be one of my best ideas unless I did the work to understand the key drivers of the share price.

The market did get excited in April over an RNS but the breakout was rejected.

Here’s the RNS the stock responded to:

Punters love big numbers and big names.. relative to a market cap, of course.

I did suspect the stock might rally on this RNS but left the trade because 1) I was busy elsewhere, and 2) the stock is so illiquid I might not be able to get out easily if I was wrong.

But the price rejection told me the stock still had some stale bulls in it that needed to clear out, and that I should keep the stock on my watchlist.

I feel there could be a trade if the stock breaks out of the 140p area into 10-year highs.

Notice how the stock is slowly grinding higher?

Keep in mind though it’s illiquid, and it may be tough to get in and out.

Aura Energy (AURA)

Aura Energy is a stock I’ve been in and out since 2021. It’s my belief that this is the best leveraged play on the uranium trade on the London Stock Exchange.

AURA is now in a stage 2 uptrend.

It’s taking some time to gyrate but this is a long sideways base with continued higher lows. I’m looking for a potential breakout of the big volume July 2021 high.

There is also Yellow Cake (YCA) to play the uranium trade which is becoming increasingly attractive (I may write about this in detail in future).

Here’s a closer look.

The stock is still trading in a wide range but I’m looking for that range to narrow and tighten.

The moving averages are trending up and the fundamentals here are getting better with every $1 increase in the uranium price.

The company intends to hit production in 2024 and so there is always a pre-producer risk, but I’d be interested in getting long again should the price break out.

Victorian Plumbing (VIC)

Victorian Plumbing was at one point a few pence away from joining The 90% Club – a bag of garbage IPOs that floated in 2021 and fell more than 90%.

It floated at 262p and printed a low at 33p.

The founder and chief executive did spectacularly well, cashing in £212m of his own holding in the IPO. Great trade!

But not so great for the rest of the shareholders..

Now that’s what I call nailing the top. Bravo.

At one point, the chief executive could’ve bought 100% of the entire company and had another £20 million in pocket money to spare.

However, things started to change in October last year.

This RNS was the catalyst for a change in share price.

It also says it’s highly cash generative but doesn’t give us the figure for the same year previously. Why not? If it’s highly cash generative, then why not show off the number?

Usually when companies say something and don’t prove it, I tend to assume that the opposite is true.

But this is essentially an ecommerce business, so if it’s not cash generative.. that’s a big problem.

The half results show that in the six months to 31 March 2021 the company generated £16.6m in net cash from operating activities.

The same period in 2022? £3.2m. Not exactly great.

However, the chief executive seems to be keen.

Here’s a list of his purchases:

9 December 2021: £497,511 @ 94p

10 December 2021: £2,899,500 @ 96.65p

5 April 2022: £354,200 @ 50.6p

10 October 2022: £400,000 @ 40p

This RNS marked the bottom.

Stage 2 uptrend? It has all the main features.

We had an AGM Trading Update from the company last week and everything was in line. So earnings risk at this point is relatively low, and we can see a base forming since the start of January.

This isn’t the most liquid of stocks despite being a near £300 million market cap.

But it’s been beaten down and has now beaten consensus at least once.

Ending note..

Thanks for reading!

I’ve written about fewer stocks this issue but more detail about my best idea.

You can see the updated stock library below.

The April edition will be out on Tuesday April 11th.

Have a great month. Play tight!

Stock library

List of stocks mentioned:888 Holdings – 888February 2023

AO. – AO World.January 2023

ATM – Andrada MiningJanuary 2023

AURA – Aura EnergyMarch 2023

BMN – Bushveld MineralsFebruary 2023

BOTB – Best of the BestFebruary 2023March 2023

BRH – BraveheartFebruary 2023

BSFA – BSF EnterprisesFebruary 2023

DOTD – DotdigitalFebruary 2023

IGR – IG DesignJanuary 2023February 2023

IMMO – ImmotionFebruary 2023

JET – Just Eat TakeawayJanuary 2023February 2023

JNEO – JourneoMarch 2023

MMAG – Music MagpieFebruary 2023

NGHT – Nightcap GroupJanuary 2023February 2023

RBG – Revolution Bars GroupJanuary 2023

RENX – RenalytixFebruary 2023

RNK – Rank GroupJanuary 2023

ROO – DeliverooJanuary 2023

VIC – Victorian PlumbingMarch 2023

The post A gambling multibagger? first appeared on Buy the Bull Market.