Following on from my belief that Burberry (BRBY) is in the process of rerating, I believe we could be at the start of a turnaround story for Watches of Switzerland (WOSG) too.

Now, I can always be wrong. Everything I write is always my own opinion, and I’ll be the first to tell you I don’t get them all right.

But unlike other market commentators, I don’t accept payments from listed companies to talk about them. This means I can say whatever I like, and it’s why many a CEO dislikes me… which is probably unsurprising if you say their stock is an avoid or actively short it.

I don’t have a problem with people who’re paid by companies, so long as they disclose it.

PR is an important part of the stock market and helping to get the story out as well as manage the share price can create value for all shareholders.

Naturally, I don’t like it when a message is overly PR’d and a profit warning is hidden from the RNS only to be revealed in the broker notes (and I’ve made that clear to several PR friends), but I’ve had some good stories and potential turnarounds come my way thanks to a few friends in the industry.

In any case, back to WOSG… it’s a major player in the luxury watch retail market, boasting significant influence in both the UK and US.

Watches of Switzerland is the largest global dealer of Rolex and the company is uniquely positioned in the luxury goods sector, as it benefits from strategic partnerships with some of the most prestigious watch brands.

However, this dependence on Rolex is a double-edged sword.

The partnership has been beneficial so far, but it’s clear any disruption to this relationship could have a significant impact on the company’s revenue and profitability.

The market was certainly spooked by Rolex’s acquisition of Bucherer due to potential conflicts of interest and preferential treatment for Bucherer.

We can also see the profit warning a few months later that cratered the stock.

But the newly launched Rolex Certified Pre-Owned program positions WOSG as a key player in Rolex’s distribution. Early results from the program have been promising, with potential to drive long-term growth and profitability.

Here’s what the company said in its interim results:

Following the launch of Rolex Certified Pre-Owned in the prior year, the pre-owned category continues to grow. Certified Pre-Owned and vintage is performing strongly, with Rolex Certified Pre-Owned becoming the Group's second biggest luxury watch brand.

Whilst it appears the Rolex relationship is growing, it becomes a bigger risk for WOSG.

But also for Rolex too.

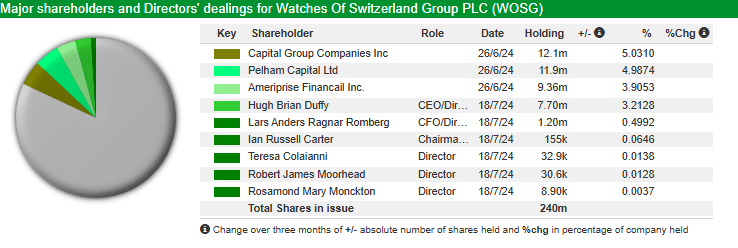

The shareholder register for WOSG is wide open.

This means that with no one shareholder holding a large majority, anyone could come in and make an offer, and Rolex could see its biggest distribution network fall into the hands of a competitor, such as LVMH.

Plus, if a competitor were to acquire a significant amount of stock without making an offer, it could still potentially alter WOSG’s relationship with Rolex and other key brands.

The main risks I see

Nothing is without risk, and this stock is the same.

The luxury watch market is volatile. And I would argue there are two speeds to it.

First of all, you’ve got your entries. The £5k-£15k luxury watches. The Rolex Datejusts, the IWC Pilots, the Tags… these watches are accessible to anyone with a reasonable income and access to personal loans.

It doesn’t mean they can afford it. But relatively low earners can sport a Rolex if they sacrifice elsewhere.

The entry level watches are highly volatile. When everyone is flush with money, it burns a hole in their pockets.

This is why everyone was piling into stocks during the pandemic, and why watches on the grey market were higher than listing price. Demand outstripped supply.

That’s no longer the case for the entry level market. Many models trade below list and you can no longer get the watch from an Authorised Dealer and flip it for a quick buck.

Then you’ve got the premium watches. The Rolex Day Date, IWC Portugieser Perpetual Calendar, Patek Philippe.. These are watches where buyers have more capital and are more resilient to recessions and market downturns.

Because watches are restricted, supply always remains low keeping prices high.

But it’s clear that the market is volatile and this is a big risk. If the economy tanks and people are feeling hard up, the last thing they are going to be buying (if they’re sensible) is an expensive watch.

Now, I don’t see smartphones as a risk. People don’t buy fancy watches to tell the time. They buy them because it symbolises success for many, and for the social status. Luxury watches are worn as jewellery and not because someone wants a more effective way of telling the time or emailing from their wrist.

But growth is a risk itself.

Over the last two years, WOSG has made several acquisitions..

Roberto Coin

This was acquired at 6x earnings and diversifies away from the Rolex concentration. Given that WOSG currently trades at ~15x earnings this seems like an astute buy.

Directors say that Roberto Coin is integrating well and “encouraging”.

This is repeated often throughout H1 results.

Hodinkee

Hodinkee is a global digital editorial content provider for the luxury watch market.

Here’s what management say:

Hodinkee will continue to have editorial independence as a leading editorial media organisation. This will protect Hodinkee's impartial journalism, ensuring the continued creation of unmatched editorial content presented through Hodinkee's unique voice and lens.

I find it hard to believe management can say the editorial which will be owned by WOSG will be independent. It’s hardly going to slag off WOSG, is it?

But at £10 million this isn’t a huge acquisition and it could be beneficial to own a decent sized audience.

Management also bought some stores from Ernest Jones to turn into showrooms. This seems sensible.

So capital allocation is also a risk.. but a risk that is inherent within every business.

Potential upside for WOSG

WOSG is an opportunity to get exposure (not directly) in Rolex. It’s a big driver of revenue for the group with both new and pre-owned watches being sold.

And whilst Rolex isn’t the most expensive watch brand, it’s well-known and the most popular.

Plus, because watches are not a commodity and are highly sought after as a sign of success, the luxury watch companies can continue to up their prices.

The US market is growing and now makes up almost half of WOSG’s revenue. Growth in the US is in early stages and it will soon (if growth continues) be a major player in the US.

This derisks the business as a UK-only business.

Another positive is that the company doesn’t pay a dividend. I like this because it means management clearly believe it can put the capital to work and deliver more value for shareholders rather than paying a dividend.

I’m always suspicious of growth companies when they start paying a dividend. If I wanted a dividend, I’d buy FTSE 100 stocks and blue chips.

What I’d rather is for the money to be put to work growing the business.

And if management can’t find a way to do that and instead decide to give that money back then perhaps it’s not the right stock for me.

So this is a positive.

Regarding the financials - the stock currently trades around 15x earnings given EPS growth is around the same level.

Debt is manageable and the business recently refinanced with longer term funding with a £150 million facility offering more liquidity for the group.

The chart is looking interesting too.

This is the company’s share price since listing. The Covid boom saw the business accelerate in value because watches were all the rage.

The stock bottomed out around 320p after a profit warning, but the business appears to have been rightsized as we’ve seen results released in line with expectations.

I’m looking for consolidation around the breakout level of 592p.

Obviously, the Big Round Number of 600p looms just ahead, but I doubt people will be buying proven resistance at 592p and selling before 600p.

It’s possible, but I don’t see 600p as being significant resistance.

What I dislike is the 20% pullback recently, although historically the stock is volatile.

That’s great if it goes our way, but ideally we want to be minimising our risk.

This is why I like tight consolidations. If the stock is tight, it means I can have a tighter stop and potentially drive a greater risk/reward expansion on the trade.

You’ll also notice I didn’t go too deep into the financials.

The simple reason I don’t much care as long as there are no red flags.

I’m a trader. My job is to capitalise on where I believe I can generate high capital efficiency using stocks to drive returns.

To do that, I repeatedly play similar looking charts with sensible position size management over and over.

I might only be right 50-55% of the time. But I’m risking 1 to make 1.5-3 then that’s a profitable strategy.

Not to mention any Trade 2 Holds which generate higher multiples of risk.

And just to be clear. I’m not advocating anyone buy the stock.

I don’t hold it myself… yet. Plus, if it doesn’t act right, I won’t be buying.

But it’s worth watching, as I believe this is now a stage 2 stock poised for growth.

Especially if the stock enters an earnings upgrade cycle.

Speak soon!

Michael