Unless you’ve been living in a cave, you’ve probably heard of AI along with one of two sentences:

It’s going to change the world

It’s going to kill us all

It’s entirely possible both of those true, though naturally I’d prefer to die of old age having lived a happy live rather than AI becoming self-aware and deciding we’re not good enough to live.

But in any case, it’s here. And it’s likely here to stay.

Will it continue is the big question?

We’ve seen many “lifechanging technologies” appear since the internet..

3D TV (now just an annoying gimmick)

VR & AR (Google Glass, anyone?)

Self-driving cars (has anyone you know ever been in one?)

Cryptocurrency (still going but most are dead)

Blockchain (didn’t actually revolutionise anything)

Metaverse (a flop so far)

3D TV seemed a good idea but it hurts your head.

VR is also cool but would I watch a concert in VR? No thanks.

Cryptocurrency had a lot of hype but so far limited in its impact.

The blockchain didn’t disrupt every single industry on the planet.

And nobody is talking about the Metaverse anymore.

My point is, these fads come and go.

Ah!

How could I forget 3D printing?

I remember a friend in New York working for a 3D printing company in an incubator, and all of these companies were getting mad funding when even he knew it wasn’t possible to do what the investors wanted to do.

Investors were so in love with the idea that the housing crisis all over the world would be solved with 3D printed houses that they handed over bucket loads of cash.

Anyway, here’s my view on AI.

It’s going to increase productivity by an insane amount and that productivity is gradually going to seep into sectors of the economy and boost corporate profits.

AI is now so good that instead of paying thousands for photographers and product shoots, you can just give AI the product and prompt it to create the desired effects you want.

It’ll write copy for you.

It’ll design a business strategy for you.

It’ll build websites for you.

And for the Luddites that say it will kill jobs?

Yes, it will.

But new jobs will shoot up in their place.

Here’s a quick list of jobs that didn’t exist 20 years ago.

Social media manager

Podcast producer

Mobile app developer

Virtual assistant

SEO analyst

Cloud architect..

Here’s one that AI has created already: prompt engineer.

With AI, anything natural intelligence can do, AI can do it better.

Or at least it can replace something to a high standard.

AI has been around for a while but it’s only now that it’s come to the mainstream.

Maybe you’ve used it yourself, or heard about a mate who got ChatGPT to write covering letters for jobs.

But the power of ChatGPT relies on the prompts. Basically, if you have rubbish prompts, you’ll get rubbish results.

However, AI’s advances will only get faster and faster and it’ll permeate society much faster than the internet did.

And VCs love it too. In fairness, they loved everything in 2020 and 2021, but since last year private markets have been drying up.

Even Masayoshi Sun says the giant is ready to shift to “offense mode”.

Aa lot of AI businesses will end up being value destroyers for shareholders and end up getting acquired by the big players.

But AI in general will fuel the next bull market as it unleashes a spurt of productivity.

When will that happen?

Well, that’s the big question. Nobody knows.

But bear markets don’t last forever.

And the longer this goes on, the bigger the prize at the end.

Placings and sentiment

I’ve seen several placings getting pulled due to a lack of investor demand recently. The companies never say that, but when one company says they’re taking orders below the placing price, it clearly means they can’t get it away.

Sentiment now is as low as I’ve ever seen it (barring the brief Covid drop). Here’s the FTSE AIM All-Share.

Aside from the Covid low, the FTSE AIM All-Share is trading not far from my career lows of early 2016. Another 10% and we’ll be around it.

And it’s easy to say “well yes, Michael, but the FTSE AIM All-Share is full of garbage”.

And I wouldn’t disagree with you. Because it is.

But remember, it’s also weighted to the stocks that are the best of AIM. So even though it’s full of shi, er, rubbish, if the biggest stocks were performing well then so would the index. Much in the same way that if Shell or AstraZeneca has a bad day then the FTSE 100 will likely follow.

Here’s the top AIM 30:

The last column shows the price return since the last trading day of 2022. Only 6 of these are positive.

The FTSE 250 is doing a little better.

Off the October lows but not exactly looking too clever.

It’s hard to make any real predictions about the economy because there are so many moving parts.

It’s taken a lot longer for my prediction for house prices to start falling but rates are finally biting.

With people moving every month from rates as low as 1-2% onto rates as high as 6% and above now, pressure on house prices are likely to continue.

And with everyone worrying about spending and the Cost Of Living Crisis, punters are giving up daily. As I said earlier: hang in there.

Make sure your companies don’t need capital anytime soon

Keep looking for companies that have a catalyst or are running out of capital to short

Stay in defence mode and if your strategies aren’t working, dial your risk down

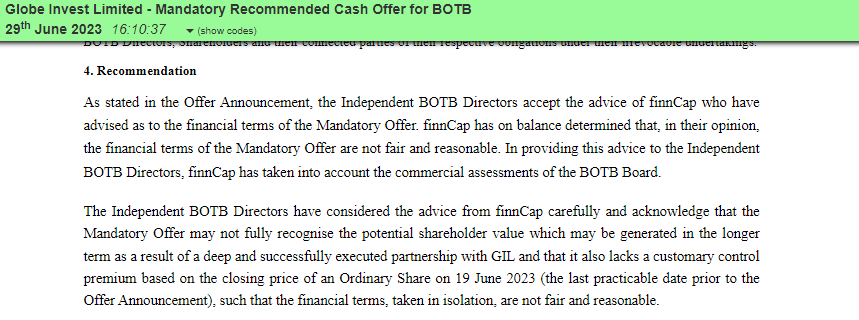

Best of the Best

I last wrote about Best of the Best in March and believed there was a good chance this was a multibagger with limited downside risk due to Teddy Sagi’s interest.

He’s decided to buy out the entire company, and unfortunately management have been yellow bellies and sold it far too cheap.

finnCap agrees with me.

So do the independent directors, but they accept that minority shareholders may not see a dividend or an opportunity to benefit from their shareholding, and have unanimously recommend to sell.

I’ve closed my position for a small loss (I averaged up as I bought).

I did think that management would push back on any potential offer. The price traded as high as 700p - so to be offered the paltry sum of 535p leaves a sour taste - but I accepted this risk and unfortunately it didn’t work out.

Looking back, I think this was an excellent risk/reward trade. It’s obviously a great asset otherwise Sagi wouldn’t be buying it.

So do I regret taking the trade? No. It was a good decision with a bad outcome.

I don’t get them all right (sadly). Not every trade works out. That’s just trading.

Nightcap (NGHT)

We last looked at Nightcap in January (albeit briefly). A lot has happened since then.

The company acquired the Dirty Martini brand for up to £4.65 million. Considering the acquired company did £23.7 million of revenue and £3.9 million of EBITDA in 2022 this is a cheap acquisition.

And given that Nightcap did almost £36 million in sales last year (and that was ending July) it adds a step change to the business.

Or at least, it should.

These were the forecasts for Nightcap back in March.

FY2023 revenue of £49,300,000

And these are the current forecasts for Nightcap now.

Post-acquisition, FY2023 revenue of £47,068,000

Despite 2023 being projected to have 10 more sites and the extra potential of £20 million plus revenue being added, the forecasts have fallen by more than £2 million.

It’s a huge profit warning hidden in the acquisition.

My belief was that this was due to a potential fall in economic spendin,g and the ongoing train strikes that have harmed the business and cost it revenue so far (mentioned in the results). The broker confirmed this.

However, the raise itself is excellent. I wasn’t asked to take part in this placing and it was done with three individuals who are already shareholders (likely to be sticky holders). It’s also a rare placing that was done at a premium 26.3% to the prevailing share price. There’s minimal dilution too for a business that increases the scale of the business.

The stock is well held by directors and managers. So it’s good to see that the pain of dilution is shared.

It’s not uncommon for CEOs with no shareholding (and a fat salary of course) be trigger happy with acquisitions and use shareholders as a capital tap to enlarge the business at whatever the cost.

Why wouldn’t they empire build? It’s not as if there’s any downside to them! This was the case at Totally plc with two hugely dilutive acquisitions that ruined shareholders both times.

With Nightcap generating cash, and having both supportive shareholders and debt options, I think this business will come out of the recession all guns blazing.

I don’t hold any shares, but it remains firmly on the watchlist. Obviously, the hidden profit warning isn’t great news.

But Dirty Martini could turn out to be an absolute steal of an acquisition in years to come, which would do wonders for the current share price.

And other stocks I’m looking at?