The Alternative Investment Market is a terrible place to invest.

Or it would be, if you were buying the market as a whole.

Here’s what it looks like.

In nearly 30 years, not a single shred of value generated on the whole.

So AIM then really is a stockpicker’s market. Buying a basket of stocks is more than likely going to lose you money.

Many people argue that trading is a zero-sum game. They argue that for someone to make money someone else must lose. In forex, yes. In stocks, no.

Given that the S&P 500 is currently printing near new all-time highs, the value generated for the shareholders of those companies is overwhelming positive.

But for AIM, it’s a negative-sum game for sure.

However, you’ve probably seen the staggering rises of companies like JD Sports, ASOS, Boohoo (although those two darlings have had their day), Fevertree, Burford Capital, Accesso, Mears..

If you back the right horse, then the rewards can far exceed the risks.

I’ve had my fair share of multibaggers over the years. My fair share of losses, too.

That said, I’m a firm believer that technical analysis plus further research yields the best results.

And I think these two companies have a big chance of generating excess returns.

But please don’t take my word for it. I have no qualms admitting I’m often wrong. Do your own research, and kick the tyres yourself. If I’m wrong - let me know! I’d far rather be aware and potentially change my mind, rather than not know.

Intercede (IGP)

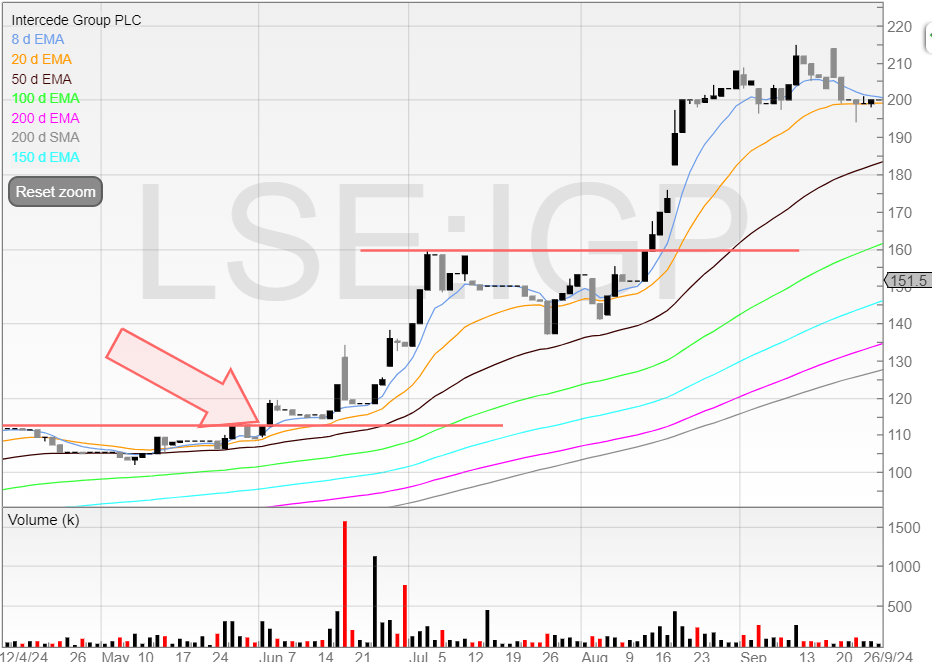

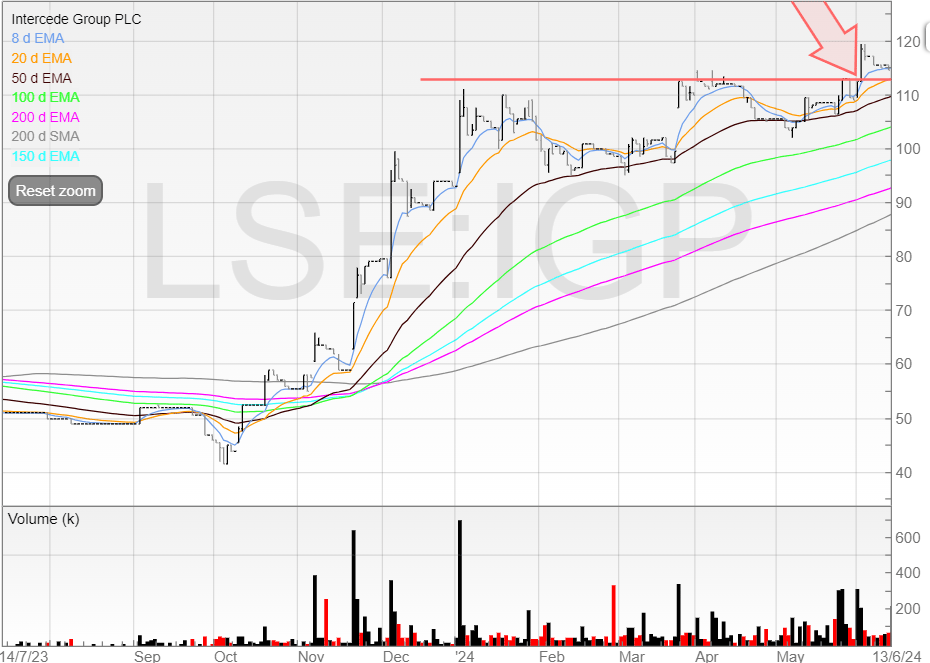

I highlighted Intercede a few months ago as an early stage 2 stock.

It had all the hallmarks of a classic. Increasing average volume, big volume on up days, a strong trend. And a tight consolidation over several months.

The result was a big gain over several months with the stock almost doubling.

Technically, this was a great setup.

However, investor sentiment for risk has evaporated. So much so that Sky News reported last week that more than 140 companies had written to the chancellor saying that the “uncertainty over the future of a crucial tax relief is damaging investor confidence”.

My only surprise is that it isn’t more!

This sentiment and a trading update that didn’t beat expectations has contributed to plenty of profit taking in an illiquid name.

And at a 38 PE for 2025, there’s still the argument that you could call this stock overvalued.

However, it’s only in hindsight whether you know if you were right or not.

My experience has been that overvalued companies can stay overvalued for long periods of time. And Mark Minervini says something similar.

Contrary to what many believe, the stock market doesn't trade on the basis of mathematical measures of “intrinsic value” such as P/E ratios or price-to-book.

But what does Intercede actually do? And does it deserve the premium rating?

Intercede Group tackles one of the biggest challenges in today’s world: cybersecurity. As businesses and governments move more of their operations online, keeping data safe has never been more important. This is where Intercede Intercede comes in.

Intercede is all about making sure that the right people have access to the right information. Its core product, MyID, helps organisations manage the credentials.

These are security badges, smart cards, or even secure mobile devices that employees use to log in and access critical systems.

Imagine a massive corporation with thousands of employees, each needing access to different levels of sensitive information. A complex system is required.

Intercede’s software ensures that only the right people get in.

It’s basically a digital bouncer, keeping hackers out and sensitive information safe.

And who trusts this digital bouncer?

Intercede has some of the most security-conscious clients out there. Governments, defence contractors, aerospace firms, and financial institutions all use Intercede’s technology.

In fact, the chief executive said Intercede has a “client list to die for”. I personally wouldn’t die for any client, but each to their own.

Nevertheless, he does have a point.

Here’s Intercede’s client list.

The US, the UK, the Saudi governments. Some of the biggest names in aviation. Financial and industry powerhouses. These organisations can’t afford any slip-ups, which says a lot about the trust they place in Intercede.

Now, here’s where it gets interesting for us.

Intercede’s customers mostly don’t just buy their software once. It’s a recurring revenue deal through licensing agreements, and given the importance and high switching cost of the job these revenues are sticky, so long as Intercede does what it says it can do.

That said, the company did recently sell a perpetual licence, which caused a big spike in profit.

Intercede Group PLC - Final Results, 18th June 2024

That means that forecast profits are lower in FY25, but then there’s always the potential for another big perpetual license order.

Back when the new chief executive joined in 2018, the goal was to return to revenue growth.

Strip out the $6.6 million order and the growth is still there.

And with a 97% gross margin, incremental profits trickle down heavily to the bottom line of the income statement.

So the question here is really what price is too much?

I remember getting scared out of Boohoo and Fevertree back in 2016 because the PEs were eye-watering. Those stocks went onto deliver multibagger returns.

I think Intercede certainly has the potential to do the same. Nothing is guaranteed of course. Let’s be honest - one slip up in security is going to significantly damage trust in MyID and Intercede’s products. And see an almighty whack to the share price.

As Warren Buffett says - reputation takes a lifetime to build and a few seconds to ruin.

So that’s a big risk. But a risk I’m comfortable with. It’s a trade to hold for me unless I get stopped out, and I’d like to add to my position should the stock break out.

The recent high is 210p. I’d like to see the stock tighten up before breaking out and offer me a nice risk/reward entry.

The second company I think is similar in the fact that it also has a heavy-hitting client list and its clients are hugely dependant on it.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. A risk-free trade itself as you get value or you cancel.

Upgrade