You might’ve read Aldous Huxley’s dystopian novel Brave New World.

Or is it?

Everyone is happy on the outside (and inside due to their conditioning and hypnopaedic learning), and soma is regularly consumed to remove negative feelings and escape (the parallels with alcohol here are clear).

That said, the government has total control, there is no individuality, and no room for free thought.

So a dystopian novel it is.

But we as a society are entering into our own brave new world.

Think back to 2019.

No Covid.

No lockdowns.

No war in Europe.

Money was cheap, the bull market went on.

Fuelled by cheap money in an age where interest rates were rock bottom, asset prices shot up, including property prices and stocks.

The world as we once knew it has now changed.

I’ve often said before that many market participants were not even born in the last period of high interest rates.

For a period of 40 years from 1980 to 2020 interest rates gradually fell.

And since 2009 they went to rock bottom and stayed there; a permagrease on the stock market due to unprecedented borrowing.

That is now gone. Borrowing is expensive. And credit is now a real consideration.

This isn’t helping to attract capital back into stocks - especially UK ones - and we have to accept that this is our new normal.

Sneaking out the back door

There is an annoying trend now for companies to publish trading updates or results that turn out to be profit warnings. But instead, only those who have access to the research or are signed up to Research Tree will ever find out.

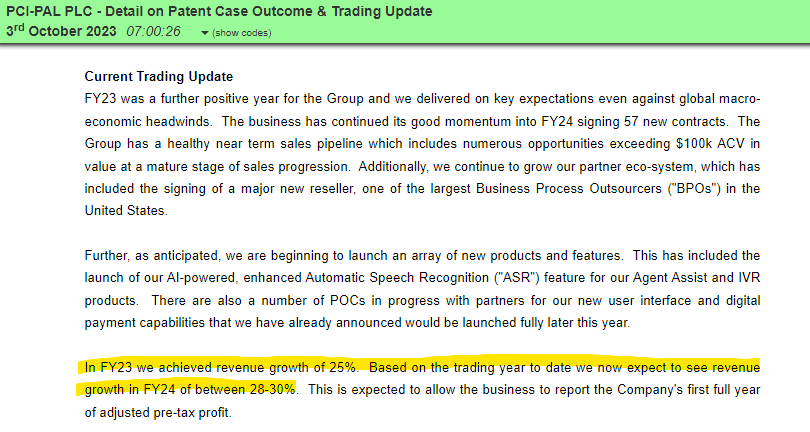

The first one I noticed was PCI Pal (PCIP) a few weeks ago.

Whenever a company doesn’t give a number, my Spidey senses start to tingle.

If the number was good - surely the company would provide it?

So that was the first clue.

But it seemed the company wanted us to work it out. We need to look at FY23 revenue and then multiply it by 1.3 in order to get the max expected number.

We don’t have the FY23 results yet. So we have to look at what was forecast.

If £14.5 million was forecast, and we multiply that by 1.3, then revenue comes in at £18.85 million for 2024.

A profit warning!

Then, the morning note on 3 October 2023 appears:

Changes to forecasts – Following today’s outlook and FY23 revenue growth of +25%, we revise our FY24E revenue growth to +28% from +34%, or £19.1m vs £20.0m. Combined with c.90% gross margin and opex falling to £15.6m from £15.7m, FY24 adjusted EBITDA changes to £1.7m from £2.3m. Including further legal fees, and without including any benefit from costs recovered from the UK High Court case, FY24 net cash moves to £0.3m from £1.5m, with £3.0m of RCF available.

Where was this in the RNS? Exactly.

Unfortunately, the market hasn’t reacted well to this. Did whoever is responsible for this think the market wouldn’t notice? Or that hiding the bad news was the best idea?

The best idea for bad news is to tackle it head on and offer an explanation, and what is being done to fix it (if there is anything to be fixed).

Companies that do this will lose interest in investors as they realise management can’t be trusted.

Here’s the most outrageous one yet from Marks Electrical (MRK).

Costs are higher than expected. Sounds bad. But according to management they still are “laser-focused” on achieving full year targets.

Investors could quite rightly assume that this is a reassuring update.

But Cavendish slips it out the back door again in its 12 October 2023 note:

Forecast changes: We have increased our FY24 revenue forecasts from £114.9m to £115.9m to reflect continued sales growth momentum, but have reduced our gross margin expectation for the year, resulting in our gross profit forecast decreasing from £21.9m to £20.9m and our adj. EBITDA forecast decreasing from £9.3m to £8.1m.

I had a swing trade open on the stock due to the chart breaking out.

It’s a nice chart. Higher lows, then tightens, and breaks out.

I dumped my stock straight away because of the mention of higher costs.

What I should’ve done is done a complete 180 degree flip and gone short.

SharePad has an EPS forecast of 4.68p, which, if we round it to 5p, makes the current price of 92p a PE of more than 18.

Overvalued to me given the company will be reporting lower profits in 2024 than 2023, and a warning has now taken the shine off.

So for anyone wondering why the stock sold off on what seemed like good news.. now you know. The bad news was slipped through the back door.