Burberry(BRBY) is by far the FTSE 100’s worst performer this year, and it’s currently down 73% from its highs.

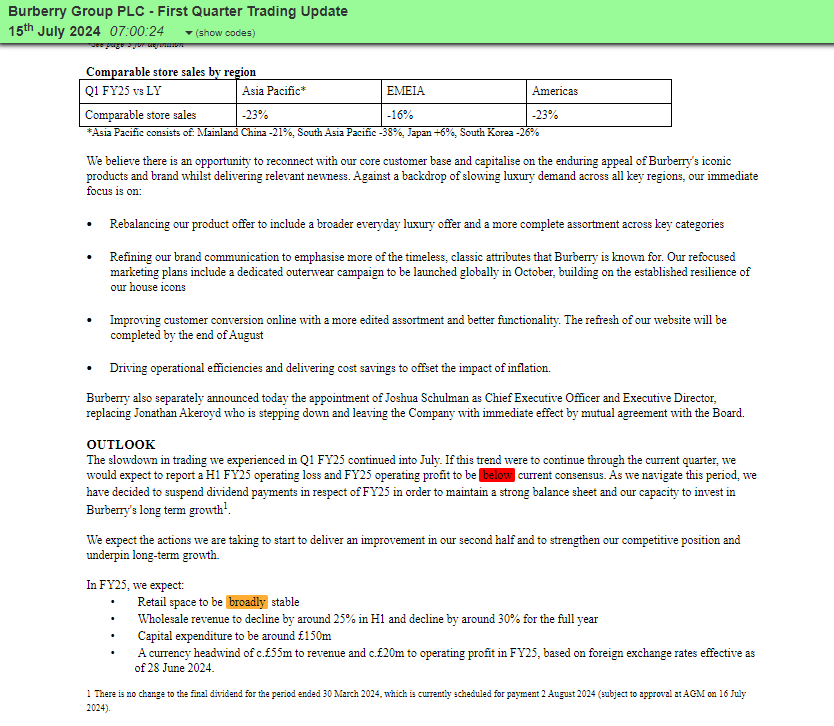

The slowdown in the luxury market is worse than expected, with constant currency sales falling by 20%.

The dividend was slashed, which makes it a thoroughly awful RNS.

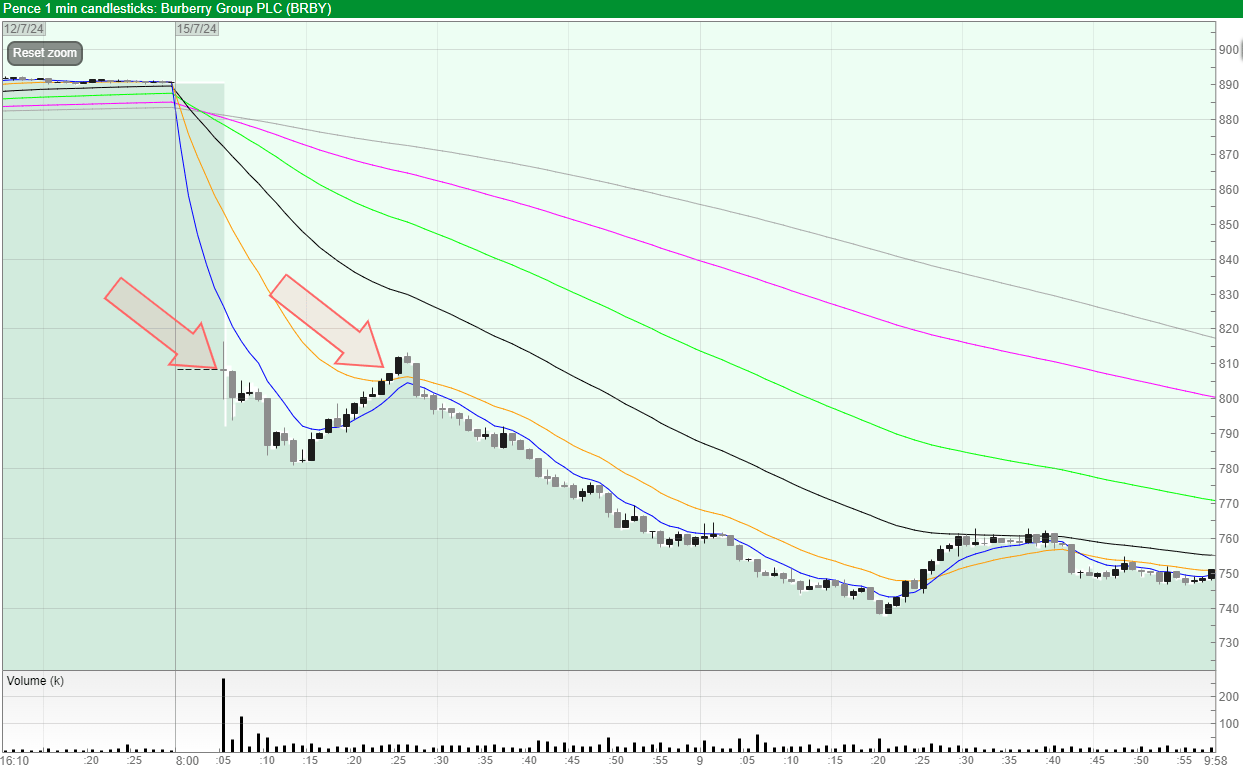

Here’s how the price responded.

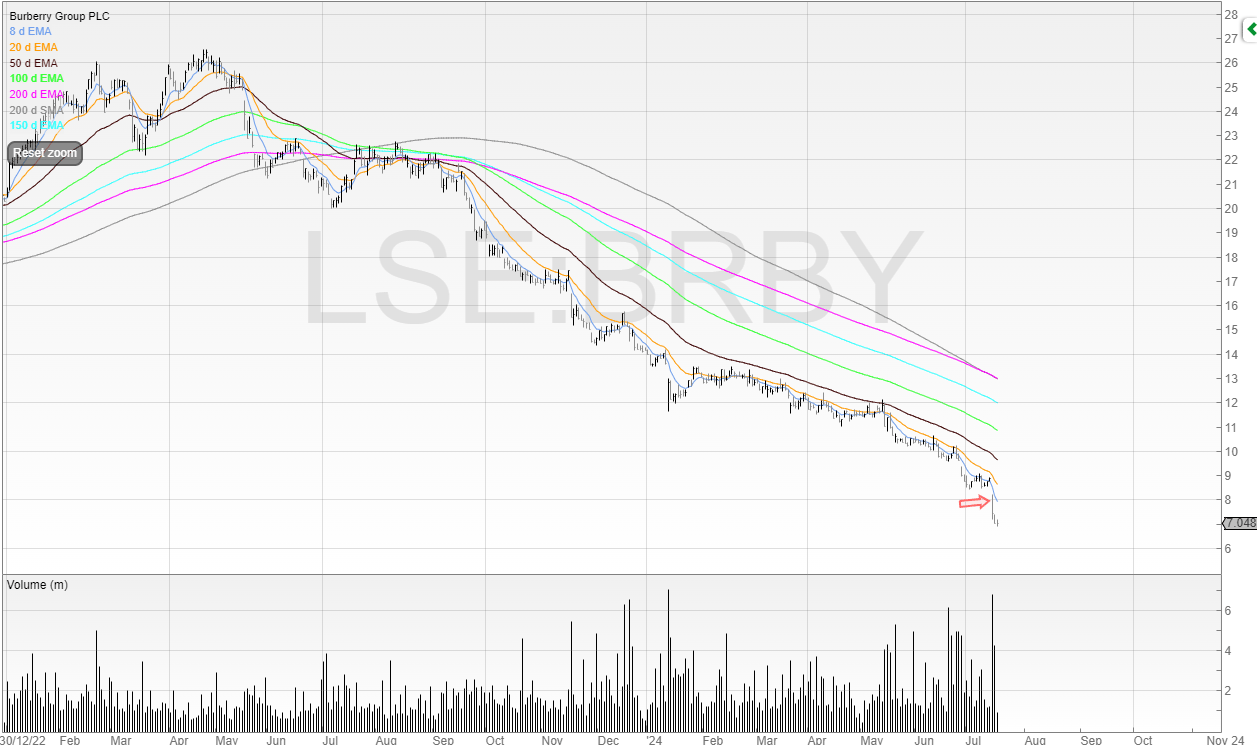

Despite being in a stage four downtrend already, the price still got whacked.

Here’s the overall trend..

Now, obviously you wouldn’t have been holding Burberry because it’s a falling stock. Why would you?

But it did offer an intraday trade.

Although because it was already a stage four stock it made me wary.

A profit warning on a downtrend is not exactly unexpected. Nor had the price risen sharply into the news, so the market wasn’t expecting anything good either.

So the real question was:

How much of this profit warning is priced in?

There’s no exact science to this, but you need to go direct to the source.

Store sales have fallen off a cliff. The slowdown in trading has continued into July. Dividends have been suspended.

Wholesale revenue is expected to decline by 25% and around 30% for the full year (it accelerates!).

And a currency headwind of c. £20m to operating profit in FY25 to stick the boot in.

My view was that there is absolutely no reason for anyone to be buying this apart from shorts closing.. which was a real possibility.

To trade this I decided to stagger my entry into two.

The first half went into the uncrossing trade.

I then waited to see if the stock would rally before putting on the next half.

The advantage of this is that it gives me a lower risk on the trade because I’m entering closer to where my stop would be on the second half.

But the disadvantage is that if I’m right straight away and the price starts falling from the open, I’m not getting as much profit.

Here’s how it played out..

Arrows mark my entries.

The stock uncrossed and started falling. Naturally, I wish I’d lobbed full size on.

However, I’ve noticed that often stocks may come back to test the uncrossing trade.

You then get a good risk/reward opportunity here as if the stock breaks through and continues, you know you may be wrong.

And if it doesn’t, you’re in the money.

This is exactly what happened and I closed the trade at 761.2p.

Not all of them are like this, of course. But it’s worth watching the uncrossing trade retest.

And as for opportunity with Burberry?

Here’s my thoughts in a recent TikTok.

@shiftingshares Burberry stock is down 71.9%

As an aside, if someone messages you on social media that looks like me… it’s not me.

There are 20+ accounts impersonating me on TikTok and despite me reporting them TikTok refuses to remove them.

Speak soon!

Michael