Big news! China has unleashed a huge stimulus package designed to drive growth.

If you remember the old Fast & Furious games, this is basically pressing the Nos button to put your car into turbo mode.

Basically, the People’s Bank of China announced that there is going to be government funding to boost the stock market as well as buy back shares, and more support for the property sector which has taken a pounding.

These measures are being taken to promote a “moderate rebound in prices”.

This news was pretty much a green light to get long.

Resources gapped up and luxury goods stocks such as LVMH, Kering, and Hermes all rose because these companies are sensitive to Chinese consumer spending.

That was the one of the big reasons for the profit warning in Burberry which we looked at a few months ago.

However, Burberry traders didn’t seem too convinced.

The stock opened up a few percent and fell back down.

In any case, here’s one stock I’m looking at.

Anpario (ANP)

Anpario produces and distributes internationally what it calls “high performance natural feed additives” for animal health, hygiene, and nutrition.

If you’re like me, you’d be tempted to think dog and cat food.

This is stuff that improves yields, and looks after the health of the animals in order to maximise their revenue.

The company did a tender offer to shareholders for 4m shares at 225p using £9 million of its own cash. That appears to have been a good move given that the share price is now 325p.

Reduced shares in issue means a boosted EPS on the same profits, and the numbers are looking better.

Notice how profit before tax is up 53% but diluted adjusted earnings per share rockets 84%.

That’s because of the share reduction, and so next year’s figures should be much more aligned.

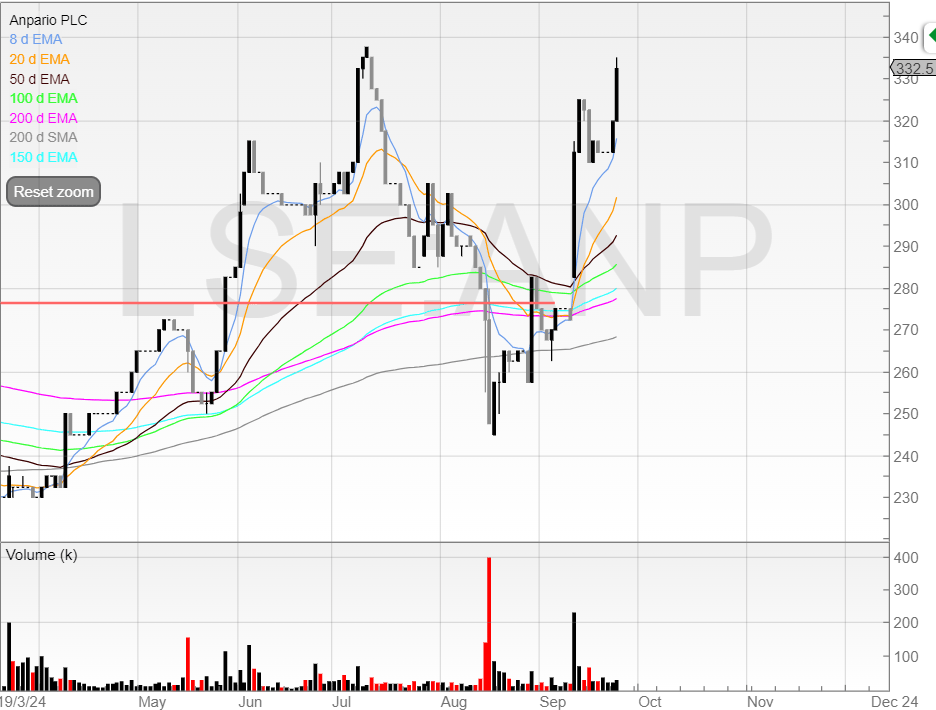

But more importantly the chart is looking better.

We had a big capitulation even in March 2023 and the stock tested these lows in May. It looks like since then the stock has bottomed.

I think the stock is now looking like a stage 2 stock.

The trend seemed like it was breaking down recently.

But since the selloff due to the yen carry trade unwinding the stock has snapped right back up.

I have a small holding here, and would like the opportunity to average up.

The valuation seems reasonable based on forecast figures.

With a market cap of £56.2 million, the company is on a forward PE of 14. That seems reasonable to me.

That said, historic PE numbers for this business have typically been around 20.

And it would be easy to anchor ourselves to the historic average PE and say there’s 50% upside when the market rerates the stock back towards its historic rating.

But we have to remember that the PEs of today are not the same as the PEs in the low interest rate cycle.

Higher interest rates mean higher hurdle rates. And therefore the attraction of stocks is lower.

A PE of 14 seems fair to me. Obviously, I’m not averse to any PE uplift, but I think the stock will grow due to earnings growth and institutional money getting involved.

I see 338p as the last resistance, but I’m aware the stock has been rallying hard in recent weeks and so there may be money in the stock looking to take profit.

And whenever you’re ready..

There are three ways I can help you.

If you’re wanting to profitably trade UK stocks then I’d recommend my entry level course:

Spread Bet Accelerator: The exact system I use to trade and get you to your first £10k in profits. Use the code GIVEME99 for a subscriber discount.

Want more trading ideas and a clearer view of the markets?

Buy The Bull Market Premium: Free 30-day trial covering potential trades and insights as a professional trader.

Want to work with me personally?

Alpha Trader is where I work closely with traders who want to get to a professional level.

We have our own channel, meet up, and have fun trading and learning [opening soon].

Speak soon!

Michael