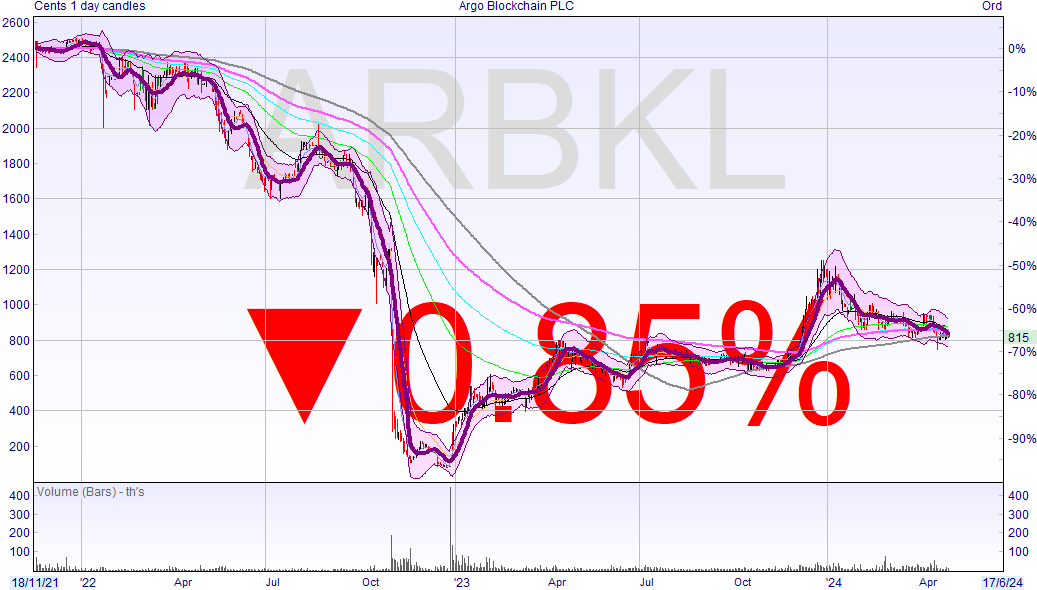

Sometimes you see a company that is such a microwaved pile of turd that you assume you must’ve missed something because the market cap is above £10m.

And as I write this, the company’s market cap is £69.3 million.

Which according to the company’s own financial report, makes the business around £69.2 million overvalued.

$158,000 in shareholder equity!

Equities never trade at what they’re worth.

Even when Cineworld repeatedly warned shareholders that shareholders would have nothing in the reorganisation plan the stock still traded with a market cap over £5 million.

However, at £69.3 million it seems that many believe in the turnaround potential of Argo Blockchain (ARB).

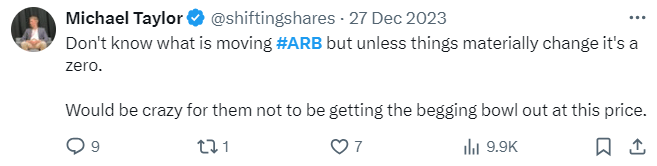

Back in December last year I said the company would need to place.

Three weeks later it raised $9.9 million.

It wasn’t enough though, and again I said it would raise money.

So far that hasn’t happened - but I think it’s about to.

If you don’t know, Argo Blockchain has mining machines that mine Bitcoin. That’s the business.

But unfortunately (for Argo Blockchain, at least), mining Bitcoin is not even profitable for the company.

The ‘halving’ is a quadrennial event that happened a few days ago on 25 April.

It means that the reward for mining Bitcoins has now halved.

So if the price of Bitcoin stays the same as it was pre-halving, the amount anyone gets for mining Bitcoin is now exactly half what they were getting pre-halving.

Argo was struggling pre-halving. It’s sold almost all of its Bitcoins in order to keep the lights on, along with two equity placings that have gone towards paying off debt.

Here’s a list of the company’s Bitcoin holdings issued every month.

June 2022: 1,953 BTC

July: 1,295 BTC

August: 1,098 BTC

September: 512 BTC

October 138 BTC

November: 126 BTC

December: 141 BTC

January 2023: 115 BTC

February: 101 BTC

March: 85 BTC

April: 83 BTC

May: 50 BTC

June: 44 BTC

July: 46 BTC

August: 49 BTC

September: 32 BTC

October: 21 BTC

November: 21 BTC

December: 9 BTC

January 2024: 18 BTC

February: 14 BTC

March: 26 BTC

As we can see, the company’s Bitcoin reserves are almost depleted and at one point was down to 9.

Basically, any uptick in the price of these assets is not going to be captured because the company is selling what it mines and more every month for cash.

As of December that trend seems to be have reversed, but the halving has now happened and it’s now twice as hard to mine.

Now, to stay in the same place, the company’s hash rate (the rate it mines Bitcoins) needs to double. Either that, or Bitcoin needs to double.

The price is currently $59,523.

And Argo Blockchain told us in the annual report that the “average direct cost per Bitcoin mined was approximately $31,000.”

This direct cost includes only hosting and power. The two things needed to mine Bitcoin. Nothing else.

Now divide the current Bitcoin price by two in order to get the new reward rate and we get $29,761.

What this means is that Argo Blockchain is actually losing money mining Bitcoin at a gross profit level.

This is the equivalent of selling a cup of coffee for less than it costs to make it.

Better to just switch the machines off completely as the company would lose less money!

It was losing a truckload of cash ($35.8 million to be precise) last year and it’s definitely not getting any better this year.

The company is also saddled with debt. Debt that it won’t be able to repay unless Bitcoin more than doubles and then some (and fast).

Let’s remember that the company was only able to stay afloat in 2023 because of a share placing, and I think that’s likely the case for the placing in January… but who is going to give a Bitcoin miner money if it can’t make money mining Bitcoin?

I wouldn’t (unless I was closing a short).

Argo Blockchain has failed to materially get its hash rate up (something I said needed to happen months ago or the company is stuffed) and now it’s finally looking like endgame.

And if you wanted any more evidence, the bonds are trading nearly 70% down.

The bondholders don’t participate in the equity upside of the business. All they care about is can the business pay back its loans.

Right now, the bondholders are saying they don’t believe Argo Blockchain is capable of doing that.

It was the same story with Thomas Cook, Petrofac..

Just to be clear: I am short.

To summarise:

Argo Blockchain wasn’t cash positive pre-halving

The halving has halved the reward for Bitcoin mining

The company has failed to up its hash rate significantly

Even if Bitcoin doubles the company will still not make money

Bitcoin’s mining machines will become outdated and there’s no money to replace these

That said, there are of course risks to this trade.

Bitcoin could go up several hundred percent in a few weeks, in which case it means Argo Blockchain could survive with a big placing, the punters start foaming at the mouths, and the price goes through the roof…

But aside from that, I think it’s a great risk/reward if you can stomach any potential short term volatility.

And if you’re long - please let me know in the comments why. I’m always open to hearing the opposite side. After all, I’d rather be wrong and get myself out of a sticky situation than staunchly try to be right.

Wanting to be right is an expensive hobby.

P.S. There’s also a potential class action lawsuit as described in Note 28 of the accounts. But right now the company needs cash. That’s the trade.