There was a time when you told people you traded stocks and they’d say “Oh, like Wolf of Wall Street?”

And you’d politely explain that they were the people who were estate agents for houses, rather than the people doing the actual buying and selling.

Then they’d ask you for some stock tips. And I’d explain that I can’t give tips because I have no idea of their strategy and goals, and if I tell them when to get in I’d also have to tell them when to sell etc..

Now I’d always offer to give them a list of resources to learn for themselves, and at that point their eyes would glaze over and I knew it was time to change the subject.

But then there was a time when you’d say you traded stocks and they’d say “I’m a trader too!”

And they’d happily be giving me stock tips. As well as proselytising about their favourite, and why stock X was a sure thing.

I remember meeting a gentleman at an engagement party who thought buying Cathie Wood’s stocks was a good idea. He thought he was clever because he’d take the target price, knock a chunk off it, then keep that lower number as his own target.

Cathie Wood, if you don’t know, is a degenerate gambler and dangerous. I’m reluctant to speak ill of people (especially when they’re not here to defend themselves), but in my view Cathie is responsible for many an individual investor’s loss because of her overly promotional hypes and pumps in financial media.

Those people trusted their hard-earned cash with her and she invested it into blue-sky story stocks at ridiculous valuations. Of course, it’s always easy to say in hindsight.

The rise and fall of Cathie Wood. Just over 100% returns in nearly 10 years. Not exactly amazing, right?

But at the time, I told the gentleman that:

It’s an insanely risky strategy

Markets change and we are in a phase of euphoria

Nobody likes to be told they’re going to lose money. And so I did my best to politely suggest caution, and that he should think about realising profits because they aren’t real until crystalised.

And a few months later at the wedding? He’d done his dough.

Now we’re back to the first stage: where nobody is interested in trading and you can’t even give stocks away to charity.

We’re seeing this when stocks with good news sell off. You’ve probably noticed it in your own stocks.

I’m seeing breakouts often reversing and getting stopped out. There used to be jokes about traders buying and selling for 10%. Now it appears the 5% crew are undercutting them!

However, this is entirely down to private investor sentiment and investor appetite.

Most people are losing money and aren’t especially bullish. That means they’re unwilling to part with their capital and so we see cash outflows of private investors.

And given that it’s private investors that fund the more speculative part of the market, it may not be that surprising to see discounted placings like at Fusion Antibodies.

No one wanted to fund this crock.

So, the special situations short trade that I cover in my course is still alive and well.

Here’s how to do it:

Check the cash under assets on the balance sheet

Go to the operating cash flow statement

Look at ‘cash generated/used in operations’

Take this number and divide it by the period covered by the statement

Use this result to work back the cash amount from the balance sheet cash to the current month

This will give you a company needs to raise or not.

For example, if Piece of Garbage plc had £2 million on the balance sheet and burned through £3 million in six months.. then you know the company is burning roughly £500k per month and in the third month post-statement you know it’s likely going to be raising money.. because by the fourth month there’s no money left.

These trades are still around, although many trash stocks have been hammered so much already it skews the risk/reward.

My belief is that if your data is showing you your losing money on certain setups, you should ask yourself:

Am I following the plan that I know so far has worked?

And if the answer is yes:

Has the market changed and is this strategy the right play?

For example: We know breakouts work. But breakouts in bear markets are going to result in a high amount of whipsaw and chop, along with regular stop outs.

The solution? Dial down size. Focus on higher quality setups. Or start shorting breakdowns depending on which stage of the bear market you’re in.

Focusing on higher quality setups is a great way to master your swing.

The issue in bull markets is that there are too many breakouts and it’s tempting to try and catch them all. Doing so is going to leave you widely exposed to the overall market with reduced sizings in your conviction positions. It also means that when something excellent comes along, you’re already heavily invested.

To outperform in stocks, you have to be willing to accept that:

You will watch others make money on trades that you’ve passed on

You have a specific criteria and you need to wait for your pitch

Not all stocks are created equal. Don’t treat them so.

Some thoughts on intraday trading

The other week I tweeted about intraday trading. Specifically, about big placings where quick money is made. Here’s the video.

Whenever a company does a large placing, the next day is always important. There could be a potential trading opportunity.

In this instance, ASOS had done an accelerated bookbuild placing the night before at 418.1p for £75 million. That’s a decent-sized amount, and when the stock was gapping up it meant there was a lot of profit.

Here’s what happened.

The stock uncrossed at 438p meaning anyone who took the placing was up 4.76%. And the stock rallied higher in the first few minutes.

My thesis is that whenever a large amount of money is made quickly, there will be a rush to the bank and crystallise those profits.

In this instance, my belief was that this quick money selling and banking profit would provide a drag on the stock price, at least whilst the stock was meaningfully above the placing price of 418.1p.

I shorted the stock into the rally. I’ve learned from experience that being too aggressive and going short in the uncrossing can sometimes be immediately on the wrong side as the stock rallies and gets sold into. Therefore, a better risk/reward entry (although not guaranteed to be executed unlike getting involved in the uncrossing trade) is to put an ambitious order in and hope to be filled.

My thesis played out, and the stock gradually came back towards the placing price, and I closed for a profit.

You could say I closed early looking at the below chart.

Now that’s a mega plop.

Now this is one way of playing the big placing. Shorting the quick money.

But there’s another way: Longing the flat open.

Midwich ran an accelerated bookbuild to acquire a company.

Accelerated Book Build (ABB) price to be determined.

I was told by my broker at 7pm that orders under 425p risk missing out.

That was the case, as the next day the placing price was announced as 425p - approximately a 5.6% discount to the closing price of 450p the night before.

Now, if the opening price had been 450p, we could’ve taken the view of quick money will bank and take a view of shorting the stock.

The opposite side of that is if the stock opens flat or slightly above the placing price. We can view the placing price as putting an artificial short term floor in the stock and that anyone who didn’t get in might want to buy.

And if we’re wrong - we can exit the stock quickly. Here’s what happened with Midwich.

Stock opened flat and rallied. And if it had fallen straight away we’d be able to quickly exit.

Intraday trading has become harder during this low volatility environment. But there are still opportunities out there… just less frequent.

Here’s 888 that moved quickly last week.

A big move, a gap up and rally on big volume.. straight into resistance

I want stocks to break out but I want them to have rallies after the break out.

I’m not looking for volatility before the stock breaks out.

Why? Because it comes back to quick money again. Money that’s made quickly.. is often banked.

Think about it. If you buy a stock, and you’re unexpectedly up quickly.. what are you likely to do? Take the better than expected result? Or try and push your luck and go for more?

If you answered the former.. then well done. That’s exactly what I’d expect you to do, and it’s why I don’t want to be the liquidity for others selling.

We can use this to our advantage.

Look what happened when it tagged resistance.

The pulled back more than 5% after hitting resistance.

When you get a big rally on news that isn’t obviously material, shorting resistance is sometimes not a terrible idea. You can always get out quickly if you’re wrong (and if you can’t then don’t take the trade).

But coming back to placings. Not every placing is subject to the two rules I’ve written about above.

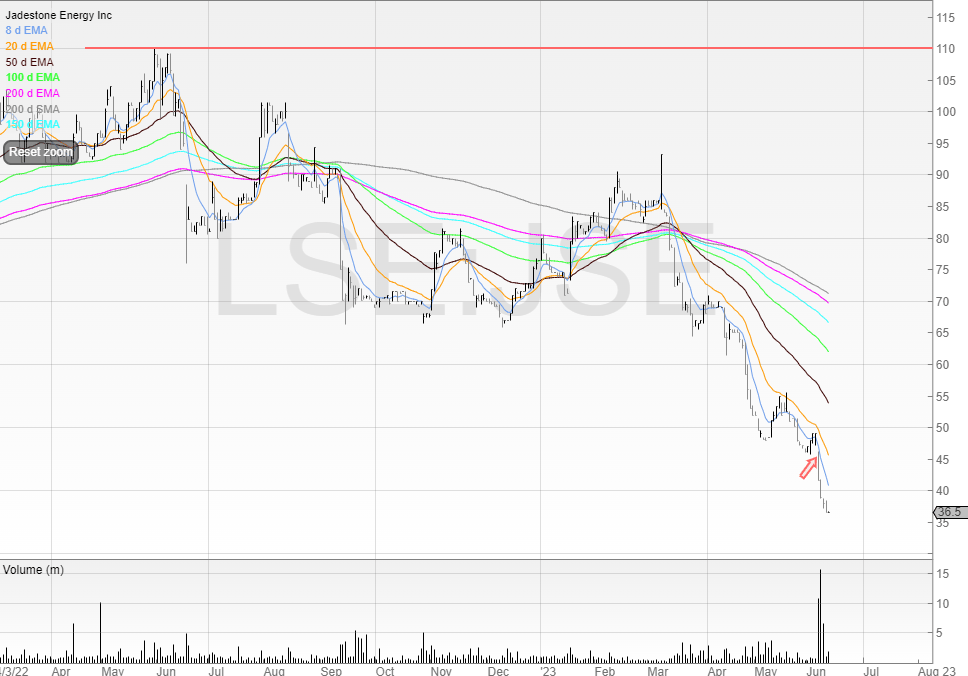

Jadestone Energy (JSE)

Jadestone Energy ran a bookbuild on 6 June 2023.

Negative surprises are often not nice.

The company mentioned that an eight-month shut-in had eroded the balance sheet and that the additional funding was a surprise.

They weren’t wrong. Here’s the share price.

The stock is now well underwater from its all-time high.

Charts like this are an instant avoid. Jumping into emergency placings sometimes can be a great trade, but only if the discount is so distressed you get others buying into the stock purely because of the discount.

This placing was a negative surprise and so the price has responded accordingly.

Smartspace Software (SMRT)

Last month I wrote about Smartspace Software and the upcoming results. Well, they were flat and uninspiring.

Growth is pedestrian, and whilst no raise is forecast, the stock just isn’t likely to deliver the growth to trigger a rerate. At least in my opinion.

I could be wrong. And I may yet be surprised. But the market seems to agree.

Could be a stage 1 base in the fullness of time but nothing to do here.

Dekel Agrivision (DKL)

Another stock I wrote about last month is Dekel Agrivision. I started writing about the stock at 2.5p and since then we’ve had continued good news and an uplift in the share price.

Impressive LFLs but remember last year was poor.

Interestingly, the company is delivering premiums to the international CPO price of around €800-€850 by achieving €953 per tonne.

And whilst there is some further softening to be expected, it’s worth noting that historic prices in the five years leading up to 2021 were on average €578 per tonne.

WH Ireland has €42.8 million of revenue forecast along with €7 million of EBITDA and an adjusted profit before tax of €3.2 million.

However, if does come with a forecast €23.9 million of net debt too which, against the market cap of £18.7 million, is understandably off-putting.

That said, this is a simple business to understand, and a nicely cash generative one at that. The cashew project and increasing production diversifying the business should provide a catalyst for the price to continue on its trajectory higher barring any unfortunately setbacks.

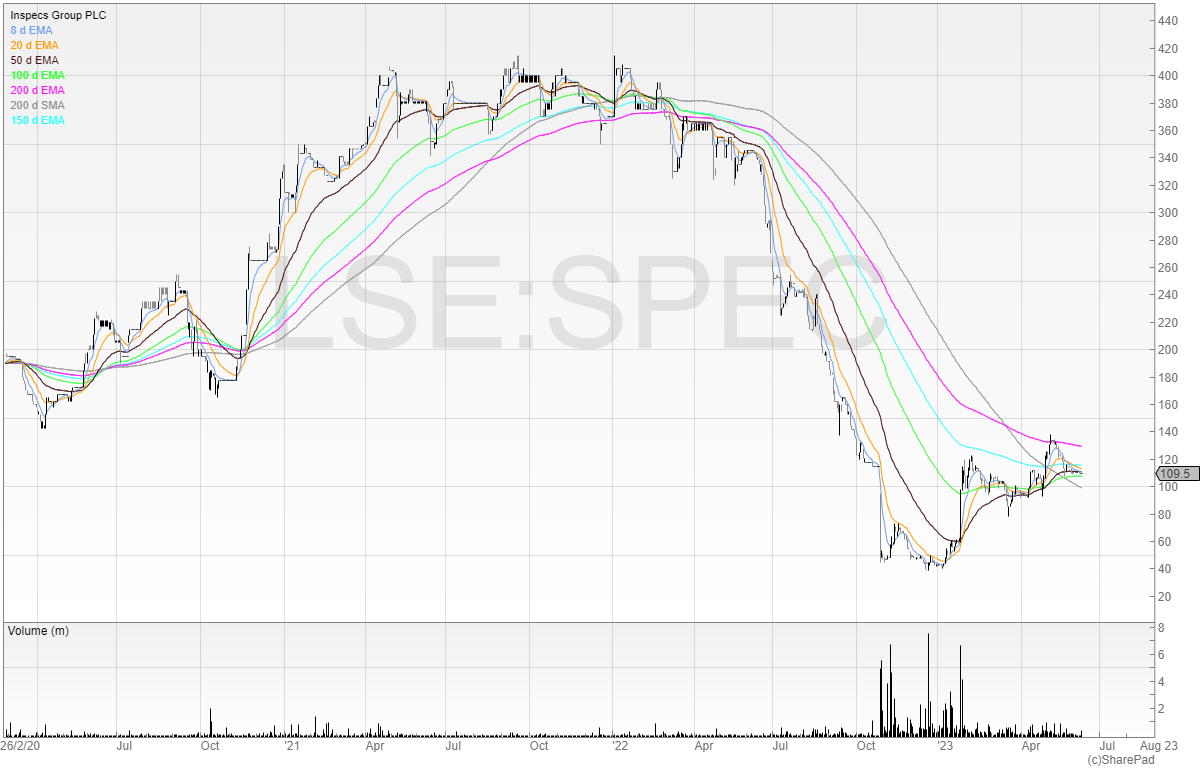

Inspecs Group

Inspecs floated on what was possibly one of the worst days to list: 26 February 2020 - days before the market started to sell off because of the global pandemic.

Despite that though it’s had an exciting and/or gut-wrenching journey depending on where you bought and/or held.

Looking at the chart there seems to be clear capitulation volume.

You may’ve heard me use the phrase “monster volume” before. It’s a highly technical term which refers to volume that is way in excess of the average.

There are no stringent conditions for volume to be defined as monster volume, but you often know when you see it. From October last year, volumes ramped up excessively, and continued. This is a clear sign of shares swapping hands, and clear interest in the stock at that level.

The stock then went on a rally, and from its low of 38p is not doing too shabbily sitting at 109.5p.

Here’s a closer look at the chart.

This looks to me like a potential stage 2 base forming. Although we can see the 200 EMA acted as resistance.

What does the company do? As you might’ve guessed from the EPIC code, it’s involved in eyewear. Specifically, the company is a designer, manufacturer, and distributor of eyewear in the form of sunglasses, optical frames, and lenses and produces products for several designers such as Botaniq, Superdry, and Savile Row Titanium.

The company announced in the end of January that the business was trading in line with (reduced) expectations following the profit warning in October.

Quite why this triggered a re-rate of the shares, I don’t know. But stocks move for two reasons:

Anticipation

Expectation

It could’ve been that the market was anticipating far worse results (hence why the price didn’t move before the news), and then when those expectations were mismatched on reality, the price suddenly rallied. Who knows? But this could be one explanation.

Having had a quick scan of the financials I can’t see anything I dislike. But nothing that makes me want to pile in either.

Reverse stress test on the covenants from the directors.

Obviously, if trading gets worse then this isn’t a stock you want to hold. But that’s true of all stocks. And the trend is up.

A break of 135p might be interesting.

A break of 135p here would mean the price has cleared the 200 EMA (a bullish indicator) and broken out of the recent high too.

We can see that the 50 EMA has acted as a loose form of support, trading below it for a few sessions, then tagging it twice, and now trading around it.

Obviously, the tighter the stop, the better risk/reward we have.

This is because our position size can be larger and therefore we get greater upside. Having 30% stops can work, but you need to be aiming for at least 30% on the trade just to have a 1:1 risk/reward ratio.

This is why I feel tighter stops, so long as they are sensible and effective, are better.

Obviously, setting a 10% stop in a stock that is trading in a range of 12% from peak to trough is just asking to be stopped out.

Here are some other stocks I’m looking at.

Likewise Group (LIKE)

Likewise is in the business of flooring. Both residential and commercial carpeting and laminates.

It listed during 2021 and got caught up in the wave of the home furnishings boom, before taking a bath throughout 2022.

Big volume and rally in 2023

Since then, it’s seen a resurgence. The stock looked like it was going to break out having posted impressive LFL numbers.

But despite the growth, the stock appears to have priced it in. Even after a more than 25% haircut, Likewise still trades on an adjusted PBT PE of almost 20.

For a carpet business? Um, no thanks.

It may set up in future when the earnings have improved and decreased the valuation, but for now I think it’s too rich and an easy avoid.

You have to ask yourself: Can I not find a better trade? I’m sure I can.

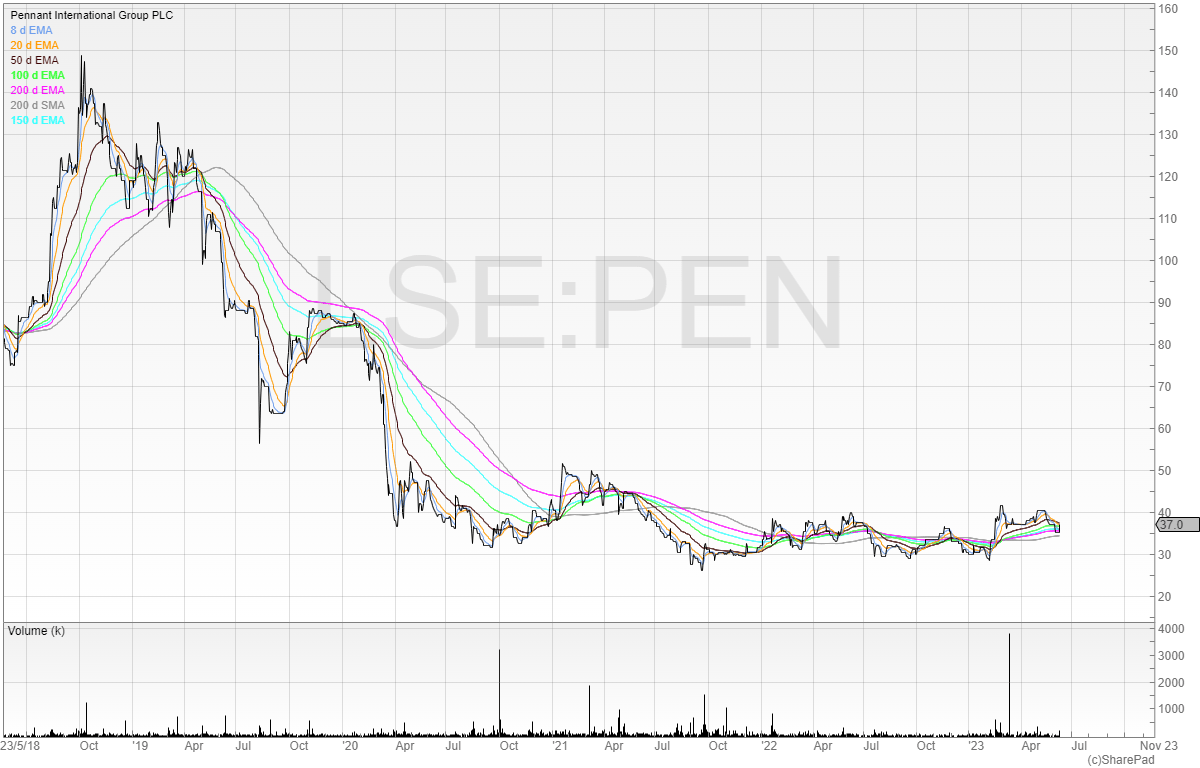

Pennant International (PEN)

I was invited to Pennant’s Capital Markets Day last July and went along as I thought the stock was a potential turnaround.

Almost a year later and the share price hasn’t changed.

However, this is looking more and more like an extended stage 1 base.

40p appears to be resistance.

But even the gentle smile of Simon Thompson from Investors' Chronicle couldn’t move the share price as he talked about the stock in April.

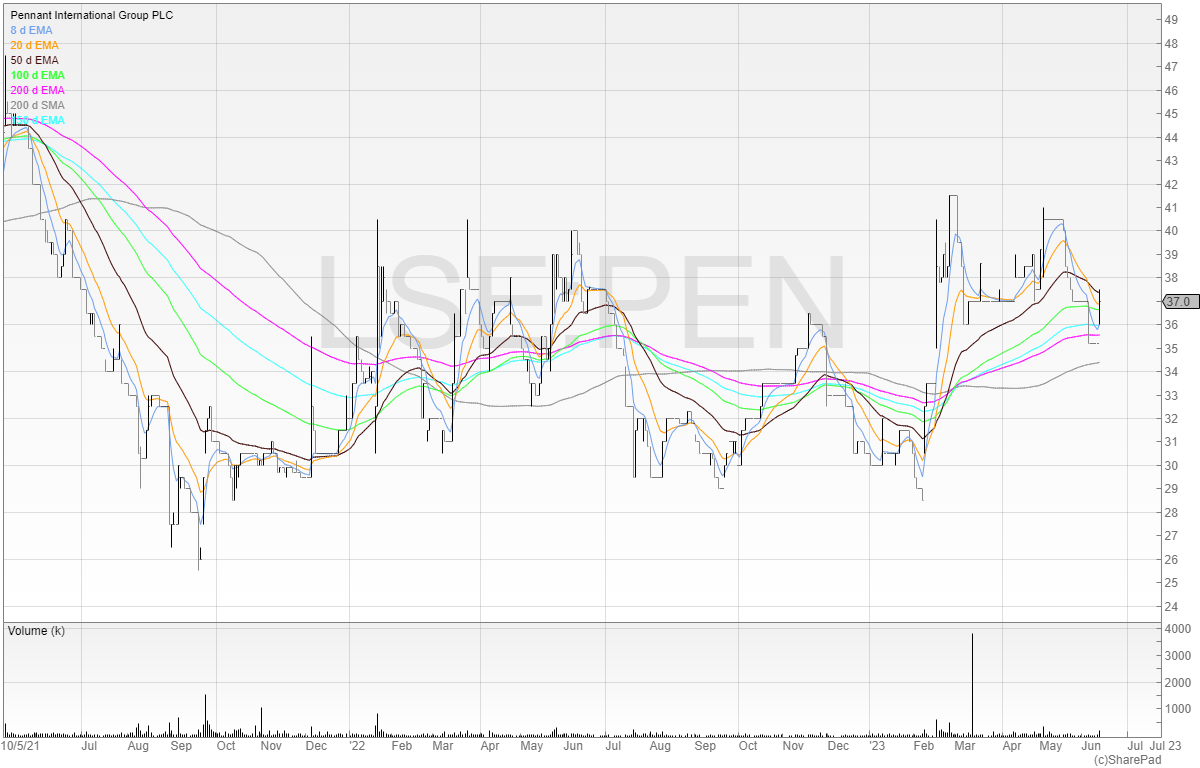

Here’s a closer look at the chart.

Closing in on 2-year consolidation.

Pennant does both technical training and integrated product support. It’s active in defense, rail, power, and aerospace along with government departments.

These services include training equipment in the form of hardware and additional support, as well as simulation, virtual reality, and computer based training. I also got a technical demo which made absolutely zero sense to me but I was impressed with the VR kit.

From what I gather, the story here is simple. The business got itself into trouble with a legacy engineered solution contract. It’s focus now is moving away from deliverables to software, which although will mean revenue takes a hit, margins go up and allow the business to increase.

The business has some heavy-hitting partners and customers, including the Ministry of Defence, BAE, and Boeing.

Previously the balance sheet was debt-laden - this has now changed with the sale of surplus to requirements Pennant Court. And on 13 April 2023 Pennant acquired Track Access Productions.

The acquisition brings two benefits:

It consolidates Pennant’s presence in the rail market

It also further strengthens the company’s strategy of recurring revenues

It’s worth noting that this has been a long turnaround that started in 2018.

And we have had a pandemic during that period. But it’s a turnaround that, finally, starts to be bearing fruit.

The issue is, I have no real idea on how quickly revenues and profits can grow.

House broker WH Ireland has adjusted PBT of £1.3 million, and 2024 doesn’t exactly shoot the lights out either.

It could be that these are deliberately conservative. I’d need to look into the business further.

Either way, I think given the:

Long period of consolidation

Fundamentals strengthening

Relative obscurity

the business is worth keeping an eye on.

Strix Group (STRIX)

Strix Group manufactures and markets kettle controls for kettles worldwide.

It’s a boring business (at least in my opinion - I can’t say kettle excite me too much) and has been a pedestrian business until the Covid ramp.

Since then, the stock price has gone off the boil (pun absolutely intended) and a series off profit warnings has seen the stock fall from grace.

Can you spot the monster volume?

However, eyeballing the chart tells me that the stock may have stopped falling.

Let’s look closer.

Stock bottomed?

Ever since that profit warning and capitulation volume, the stock has been gently rising.

And in the Final Results the chief executive was talking about a return to growth.

Given the impact of profit warnings on the stock, it wouldn’t make sense to hint at a turnaround in the stock’s fortunes only to warn again. That would devastate investor trust and ruin sentiment for some time.

A break above the pre-profit warning high in December of 130p would be nicely above the closing 52-week low and the 200 EMA is likely to be pointing upwards too.

With a forecast of £26.4 million for 2024 the business is trading on a single digit PE of 9. But then again it’s not exactly a high growth business.

It might be worth a technical trade, but not a stock I can get awfully excited about.

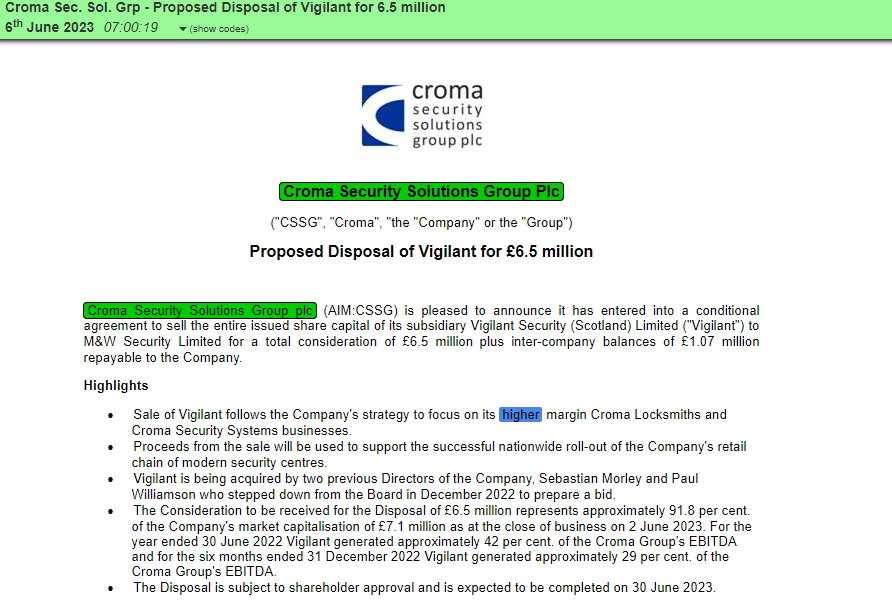

Croma Security Solutions Group (CSSG)

This company has been around a while - I remember holding it in 2017 and being excited about the FastVein technology.

Judging by the share price, it either sucked or the business failed to sell it/monetise if effectively.

The company announced big news (for the company) last week.

Disposal represents 91.8% of the company’s market capitalisation.

It has sold Vigilant for £6.5 million. This business generated 42% of the company’s EBITDA for the year ending June 2022, and 29% of the company’s EBITDA in the six months ending December 2022.

According to the CEO of CSSG, the sale of Vigilant will:

“.. accelerate our ability to drive the Locks and Systems business through the roll out of our modern Security Centres.”

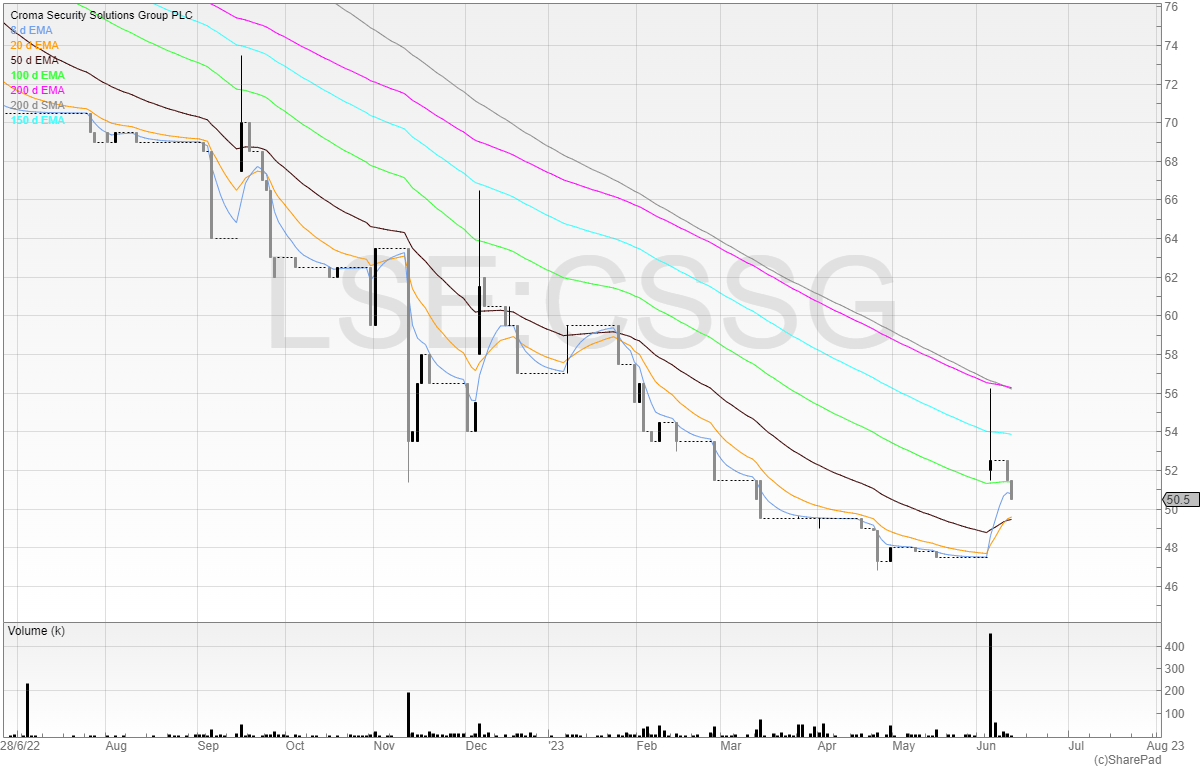

Here’s what happened to the stock price.

Gap up and initial rally then selloff.

This is undoubtedly due to the liquidity of the stock. People are getting good news and taking advantage by dumping.

You can’t blame them. Investors have taken a pounding over the last year.

But the business at 50.5p is now worth £7.5 million, and will receive £6.5 million (assuming the sale is approved).

As of the last results, it also had cash balances of £601k. So the business is trading with an EV of £400k.

That said, a business with an EV of £400k can still be expensive if the existing business is garbage.

I don’t know. I haven’t looked. But it’s worth flagging because everyone will ignore this. It’s too small, and requires work.

But this is where alpha can be found: by doing work that nobody does and finding something nobody knows about.

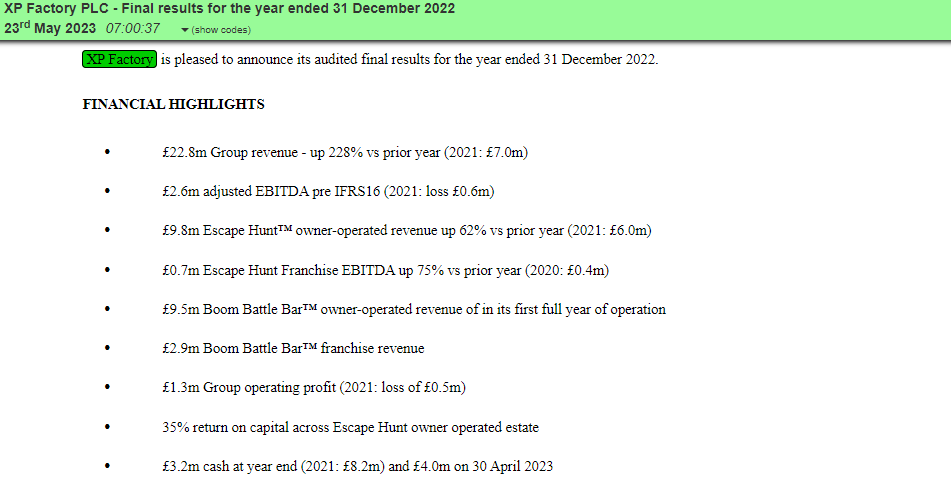

XP Factory (XPF)

XP Factory is is the old Escape Hunt. It had a great 2021 but since then has been stuck in a slump.

Stage 4 turning into stage 1?

The company had results out this month which were ahead of management expectations.

Boom Battle Bars has been a transformative acquisition and this can be seen in the numbers.

Plus “overall trading ahead of the Board's expectations in Q1 2023”.

The board expects the rollout to be funded from future cash flows and so this means there is no need for another raise.

We remain confident that the high expectations for return on capital are achievable, as the build costs per square foot are being well managed, and this, combined both with the strong cash generation from the units and the capital contributions we are typically receiving from landlords (often circa £500k), result in forecast paybacks of between 1 and 2 years. Given this performance, it seems prudent to continue our site-opening strategy at a pace, and whilst we will not repeat the 18 Boom units achieved in 2022, we have cash and debt options to continue the rollout at pace.

The stock reacted typically to a stock with good news in this market: it sold off.

22p seems to be clear resistance.

I like this stock. It’s an easy business to understand, and site level margins are performing better than expected. So it makes sense that the business will continue to scale.

One worry was that the decline in consumer discretionary spending would harm the business, but that hasn’t happened at all. Maybe consumers are focusing on enjoying themselves rather than buying stuff? I prefer to do this, at least.

I note that Singer Capital Markets has £1.1 million in adjusted PBT for 2023, and house broker Shore Capital has £2.2 million. But these are adjusted metrics, and so it’s hard to have an idea of any real forecast.

But business is going well, and I believe the share price will follow. For disclosure, I hold this stock in family accounts.

Thoughts on the market

We’re seeing lots of stocks gap up on good news and sell off. Breakouts are fakeouts, and in general there is a lot of chop.

This low volatility and low volume environment can be frustrating.

But my view is that if you can persevere and keep going, eventually it gets easier.

This is the hardest market I’ve traded in my career so far and the first proper bear market. But opportunities pop up where you least expect them and the pool of private investors and traders out there gets smaller by the week.

Keep going because the market is cyclical. Nothing lasts forever. Even if the media tries to make it seem so.

It’s my belief that AI is going to fuel the next bull market. Productivity is going to increase and that is going to be a big driver of corporate earnings. It’ll take time but markets look ahead, and nobody ever holds a sign up saying “this is the new bull market”.

The start is often easy to spot in hindsight, but when you’re deep in the trenches you never know. It could be tomorrow. It could be 2025.

Make sure you’re tracking your trades with a journal. If you’re not - try tradesmash.com. This is a trading journal I’m building that will eventually have analytics - but at the very least you’ll be able to see what’s working and what isn’t.

As always, I’m not a financial adviser. These are just my opinions from a guy trading from his spare bedroom.

Hope you enjoyed it and find it useful!

Thanks for your understanding re the lateness of this post.

The next post will be live on Wednesday 5th July. As always you’ll be emailed once the post is live!

I’m waiting on results from two stocks. Depending on how they are I may have found two potential multibaggers. More in July.