The low volume low volatility has continued throughout the summer.

And I hear many traders say that “there’s just no opportunity for traders”.

It got me thinking of a story I heard from Trader Dante.

He once said he’d heard of a trader who had another trader complain to him about being signed up for an fx guru’s trades who consistently lost money.

This trader then got all the details, messaged the “fx guru” and asked if he could get a discount for a year.

Once signed up, he then took the exact opposite trade that the fx guru published. As this is currency, it’s easy to go the other way.

And because the fx guru consistently lost, the new trader consistently won just by mirroring his trades.

All because one trader complained he couldn’t make any money following this guy.

Both the original follower and the new trader had the exact same information from the fx guru but only one of them made money.

Sometimes opportunities are there but you might not see them.

And it’s similar to when people complain about the summer lull.

The summer lull means less eyes on the market, and that means there can be mispricings.

Mispricings can often be a great way to trade.

For example, here’s Gulf Keystone (GKP) the other week.

Some context here:

This company operates in a place you probably wouldn’t want to go on holiday to (the Kurdistan region of Iraq – and apologies if you happen to live there) and has continuously struggled to collect money from the KRG.

The closure of the Iraq-Turkey Pipeline in March has impacted the company and stalled further payments.

Therefore, the company has “shifted rapidly from a focus on driving profitable production growth to preserving liquidity, suspending all expansion activity and aggressively reducing expenditures across the business”.

However, many people believed this RNS to be good news. Apparently, being able to cover the cost of the monthly capital and operating expenditures by local sales was a positive (that’s the only positive that I could pick out).

We can see the stock opened slightly down and rallied.

Yet scroll further in the RNS and we get a “material uncertainty”.

Indeed, the RNS coverage by the brokers also didn’t mention anything bad.

This is never good news, because the directors are saying there is a material uncertainty as to whether the company is financially stable enough to meet its obligations and continue doing business for the next 12 months.

My belief was that the stock would open down, especially as management were talking about external financing (likely equity given the high-risk jurisdiction of the business).

It opened down a few pence, then sharply rallied for the next few minutes to 107p.

Was this because:

Shorters were closing positions?

Bulls were disregarding the material uncertainty?

Nobody had read the material uncertainty?

In options 1 & 2, the material uncertainty had come into play but it was deemed not material to the price.

And in option 3, there was a time lag between the information being released into the market and the market processing the information.

This can sometimes happen when bad news is buried within the RNS and not so prominent at the top.

It also means that if the stock reverses against you, and you think the market has yet to acknowledge and price in the bad news, there can be a high-risk but high-reward trade by adding to the position.

However, this is not a trade for amateurs, and it should already be a part of your trade plan before you enter the trade.

Setting aside some of the position to get a better entry price if it goes against you is completely different to “the market has yet to price this in therefore I’m adding to a losing position”.

One is calculated. The other is emotional.

But why does any of this matter?

For intraday traders, it can take time for the market to digest new information.

If you think you’ve spotted something significantly good or bad and the price doesn’t move – don’t assume that you’re wrong and close the trade.

Sometimes it can pay to hold and place a tight stop, knowing that if you’re wrong you took a small loss, but if you’re right you’re at the start of a potential move.

I’ve often seen prices not move until after 8.30am. Perhaps it takes time for broker notes to circulate and we are told what to think by the ‘smart money’. Or perhaps the market just didn’t read it properly.

This is one of the reasons why intraday trading is hard, because you never know what is truly happening, and there is a lot of variance. Sometimes stocks sell off because a new fund manager has taken the helm and is wiping the slate clean. Or maybe because a private investor needs capital for a new bathroom.

However, log your trades and eventually you’ll notice commonalities between your winners and losers.

Another example of this was the recent offer for Round Hill Music (RHMP).

Nice 67.3% premium for existing shareholders.

Whenever there’s a takeover in the sector, always look for other stocks in the same sector.

It’s likely they may see an uplift in their valuations as a result of a sector compatriot receiving an offer.

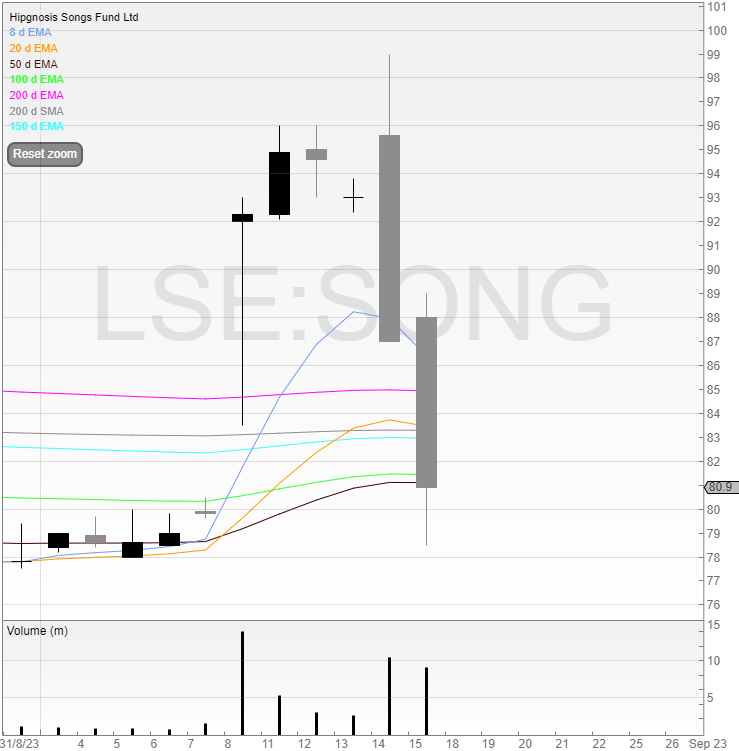

That’s exactly what happened with Hipgnosis Songs Fund (SONG).

As you can see, the stock gapped up, dipped, then closed positive.

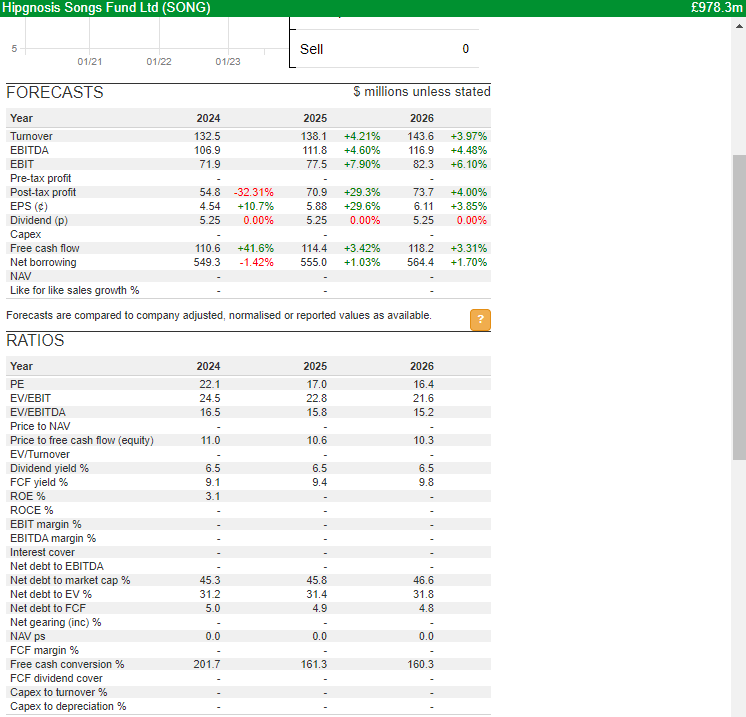

My view was that SONG was already richly valued on a PE of around 20.

And so with the near 15% gap up, I decided to fade the stock (take the opposite position to the move) and short it.

The trade here was that there was surely not a large upside based on a sector bid and the company’s PE ratio, and that any initial excitement may wear off.

That’s exactly what happened and I closed the trade. However, it rallied again and I counted my timely exit to good fortune.

My mistake was that I took the stock off my immediate watchlist.

Here’s what happened.

The stock continued rallying, before coming off heavily.

My mistake was to not watch the stock after I’d closed the trade.

Admittedly, I would’ve missed a short re-entry here. My entry would’ve been above the Big Round Number (BRN) of 100p to get me as close to where the trade would be wrong as possible.

As it never got there, even if I had been watching, I would’ve never have entered.

Perhaps what I could’ve done is staggered my entry and entered 1/3 early, 1/3 at my intended point, and 1/3 above my intended entry.

This would’ve got me in the trade earlier and maybe allowed me to enter a trade I wouldn’t have otherwise done with a smaller position.

To avoid paying three sets of commission, you can use a parent and wave order on IG’s L2 Dealer.

You can do this by clicking the tick box on your deal ticket and entering the size you’d like to buy in total (the sum of all your entries).

You then enter how many you want to buy in the first tranche. Then click “Proceed”.

Once you’re done, you can then add another wave in your trade book where the parent order will show.

Once all waves are completed, you’ll then pay one set of commission rather than if you entered all trades individually!

Use parent and wave orders if you want to stagger your stops or stagger your entries.

Buy British Stocks

In other news, French bank BNP Paribas has told its clients to buy British stocks.

Apparently, the FTSE is a value market.

That’s evidenced by the number of takeovers that are currently ongoing.

Another one last week week was DX - a 48p offer against the prevailing price of 36p.

Put simply - if valuations don’t start rising in UK stocks then we’ll be left with scraps.

Companies are being taken out and there isn’t a quality pipeline of IPOs.

But it’s good to see that institutions are slowly waking up.

Does this mean things are turning? Who knows.

But cash inflows are needed to drive valuations and stock prices higher.

There’s some evidence of that in recent weeks..