Welcome to the August edition of Buy The Bull Market!

Let me know what you think. My goal is to create a trading journal that makes you more effective and ultimately increases your P&L.

And on that note, I was asked what I think makes a good trader.

Boiling down to it, there are only three real attributes that all successful traders have.

Rationality

Grit

Expansive market knowledge combined with effective sizing and risk management

All three of these are obtainable. They aren’t traits that you need to be born with. As Peter Lynch said, he wasn’t teething on ticker tape.

The first two are personality attributes, and the latter point is skill-based.

You also need to have all three.

Rationality and grit without knowledge leads to a blown account

Grit and knowledge without rationality leads to impulsive decisions

Rationality and knowledge without grit will see you quiet when times get tough

The markets are intensely emotional sport, and emotions lead to heightened arousal and poor decision making.

Fear is the path to the dark side… fear leads to anger… anger leads to hate… hate leads to suffering.

And whilst it’s certainly an extreme, trading can lead to suffering through the complete loss of capital and deterioration of a personal life.

Some people are better off doing dollar cost averaging in an ETF fund.

But that’s not us.

If you don’t have the above three points - do your best to get them.

Watch your emotions and learn to control them.

Most people get led astray by emotions in investing. They get led astray by being excessively careless and optimistic when they have big profits, and by getting excessively pessimistic and too cautious when they have big losses.

Don’t give up when everything looks bleak.

Successful investing requires patience

And do your best to increase your market awareness and improve your skills.

Beware of your own ignorance. So many people buy something with the tiniest amount of information. They don’t really understand what it is that they’re buying.

It’s easy to read the above quote and think that Mr Templeton was referring to buying stocks.

And in fairness, he probably was.

But as a trader, I don’t need to know what the company does.

In some cases, to me the business is just a life support machine for a stock market listing.

But if I do trade a company, I’ll know why I’m trading because I’ll have a reason for the trade.

This is crucial. If you don’t know why you’re buying then you’re a punter. And punters don’t make money.

4imprint (FOUR)

Last week 4imprint released a trading update… at 08:47:12

And I’m glad it did, because it offered a trading opportunity that doesn’t come around everyday.

Now, if we assume that the market is efficient, then this £1.3 billion (at the time) market cap company would’ve instantly rerated to its new price.

That wasn’t the case.

And it’s worth remembering that the only people who say the market is efficient are the people who want an excuse because they can’t make money in it.

If the market was efficient, then it wouldn’t be possible for people without the biggest bankroll, the biggest teams, and the biggest computers to achieve any scraps of alpha. It would be gobbled up instantly.

But check this out..

4imprint Trading Statement

The company announced it was trading “materially above the current consensus of analysts’ forecasts”.

The stock did move quick as algos and I managed to buy within the first minute candle.

But it then took another 17 minutes for the stock to break out of that high.

So what we had here was a stock saying it was “materially above” yet trading around 2% higher than before the news.

Even if you didn’t have fast fingers, you had ample time to take a position.

And yet the price had barely moved.

This meant that even if you were late to the trade, you could buy knowing that your stop could be either:

At the LOD conservatively, or

Below the price before news dropped

The upside if you were correct was multiples of your risk.

Which is exactly exactly what happened.

Slowly the news started to filter through the market.

And the stock started printing higher throughout the day.

The market proving how efficient it is in a £1.3 billion company.

Looking back, I ought to have been aggressive here and loaded up.

Thinking in terms of Expected Value

There was a more than 50% chance in my view that the price would rally, and not trade below the pre-news price. Let’s say 60%. I think in reality probably closer to 80%, as intraday news rarely closes below the pre-news price unless it was expected, and this appears not to have been given its weakness in the chart.

I also thought it likely I could see a 6-10% gain on this trade for a max 3% risk.

Therefore, if we calculate the EV:

Losing trade: 40% multiplied by 3%

Winning trade: 60% multiplied by 6%

That is -0.4 × -3 = -1.2 for the losing trade.

And 0.6 × 0.06 = 3.6 for the winning trade.

Now we need to add both the outcomes and we get an EV of 2.4 (positive) for the positive trade.

So this clearly was a great trade, and I’d priced it 60%. The optics of a 20% chance of loss and an 80% chance only increased the EV.

I went on the bid when I realised this was a potential great trade, but I should’ve just paid up. I had the time to.

I was fully out by 5,000p, but this could’ve and should’ve been a bigger winner for me.

Rolls Royce

Rolls Royce is a FTSE 100 company and not a company I’d ever trade unless there’s news.

This is because these stocks are not volatile unless there is something big happening either in the stock or in the world (it moved like a penny stock during Covid).

And this was significant news.

“materially above consensus expectations”

When you see a FTSE 100 with materially above or materially below expectations, you need to trade it. Or at least consider it.

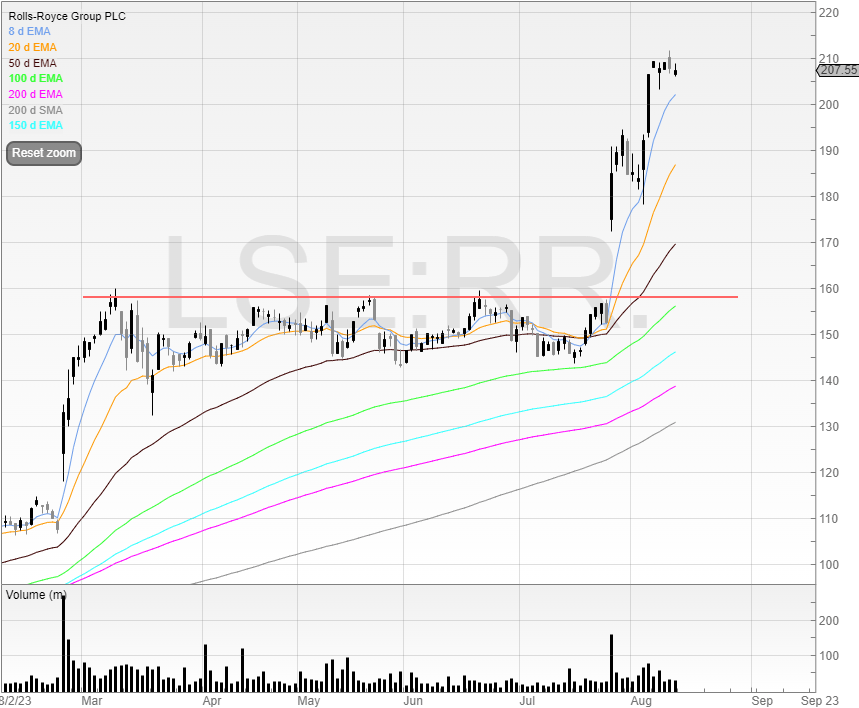

Here’s the chart for this year:

The first arrow is when Rolls Royce put out surprise good news. Notice how the stock gapped up, traded below the opening price with the extended wick, but closed the day near the top of its high. This was a bullish signal for swing traders and the stock continued to print higher for the next 11 sessions consecutively.

This is the classic PEAD (post-earnings announcement drift) - a phenomenon where a stock’s price continues to move and trend after the earnings release. It takes time for the market to digest new information and as efficient as FTSE 100 companies are, we can clearly see that the stock didn’t open at its correct market price in the uncrossing trade on the day of the earnings release.

If the market was purely efficient, then all of the information would’ve been digested within that hour, the stock would open up, and then there’d be no volatility.

This is why as an intraday trader I’m looking for earnings surprises. This is where the reported earnings per share (EPS) or profit after tax differs significantly from the market’s expectations or analysts’ forecasts.

Sometimes the company will explicitly say the business is performing ahead of or below these expectations, but sometimes you have to check for yourself.

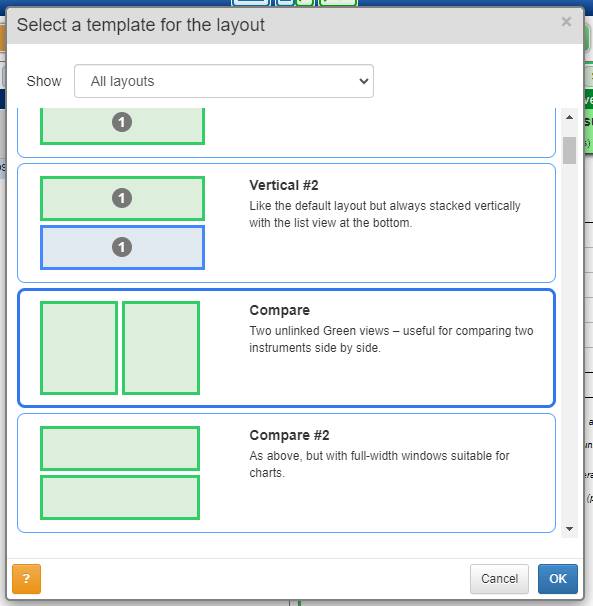

You can do this by creating a new layout on SharePad.

I call this layout “RNS”

Once you’ve done this, change the left green screen to Financials > Forecasts and have the right green screen on news.

This way, you can scroll through the news as you would using the arrow keys and tab to jump in and out, as well as pg up and pg down to move up and down, but once you find a stock worth investigating you can then move to the left green view, click, and enter that stock.

So for example, if I’m reading PFC’s RNS and want to check the forecasts, I move the mouse, click, type PFC, then enter, and the consensus forecasts show up on the screen instantly.

This has the advantage of

Saving time

Moving efficiently

I’d recommend setting this up, as well as my colouring and filtering system on RNSs.

Anyway, I digress.

Back to Rolls Royce.

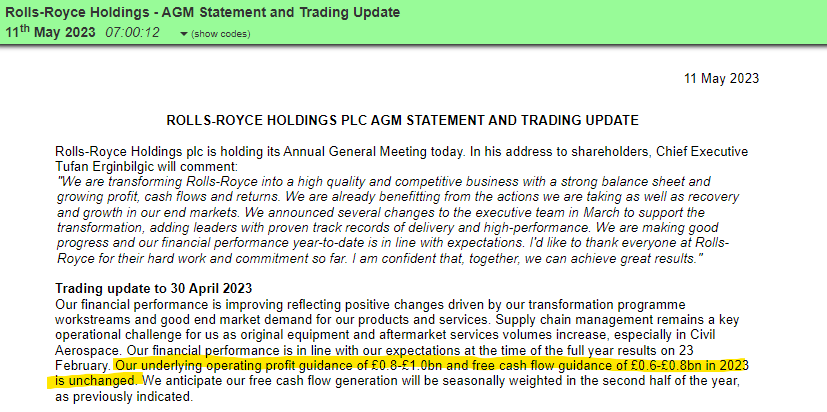

The second arrow is when the stock announced it was trading in line with expectations.

Highlights are mine.

It looks like the market expected more as the stock sold off on the open.

But since then, the stock had traded in a range for several months.

You can draw on lines from around 145p to just below 160p.

This was a sign of consolidation, and then we had the catalyst of the news.

Here’s what happened.

Big volatile reaction.

This is why I say you want volatility after the move and not before it.

We can see that the market was completely surprised by this because there was no rally into the results, and it was still trading within range.

Therefore, the evidence suggested this was a surprise ahead and not an expected ahead. A surprise ahead has genuine upside, whereas an expected ahead often gaps up and gets sold into. News that is expected is often priced into the stock, hence the old adage “buy the rally, sell the news”.

My view was that the stock was highly likely to print higher, and that the uncrossing trade would be one of the most competitive prices of the day.

However, I always thought there is a risk that it moves slightly lower, and if it goes a few pence away from the uncrossing them I’m out instantly.

As Rolls Royce is extremely liquid, it doesn’t matter that I’m not Blackrock and so liquidity isn’t an issue.

I got filled in the uncrossing trade, put what I call a ’snake in the book‘, which is a bid further down the book that you would like to get filled but it doesn’t matter if it doesn’t, and then the stock responded by ralling.

I was all out by 180p, which in hindsight was far too early, but this was a scalp trade and my risk was tight. If I’d wanted to swing trade this, my risk would’ve been wider and as well as my reward.

I talked about this trade in more detail here.

To conclude on this stock:

Material aheads and material belows are great but only if they’re surprise aheads and belows

FTSE 100 stocks with surprise news give plenty of liquidity and tight spreads

Always check the chart before you decide to trade the stock

Any questions? Let me know!

Argo Blockchain

I wrote about Argo Blockchain last month:

“My view: Placing likely. Being long here is a risky bet that might pay off if there’s a crazy Bitcoin rally, but realistically:

The company’s Bitcoin reserves are depleted

The Halving is happening in April 2024

Hash rate needs to double fast and not just increase by 12%

As of 31 December 2022, the company had £46 million in debt

If this is the beginning of the bull run in crypto, then Argo may’ve done enough to survive and attract new investment. But it cost it its entire Bitcoin reserves.

I also don’t see how a placing isn’t going to be required here.

I’m short here because I think after this rally, the risk/reward is in my favour.

There is a risk that Bitcoin price rises and punters get excited and pile in.

The two prices are correlated (see my SharePad chart below).”

Well, that’s exactly that happened.