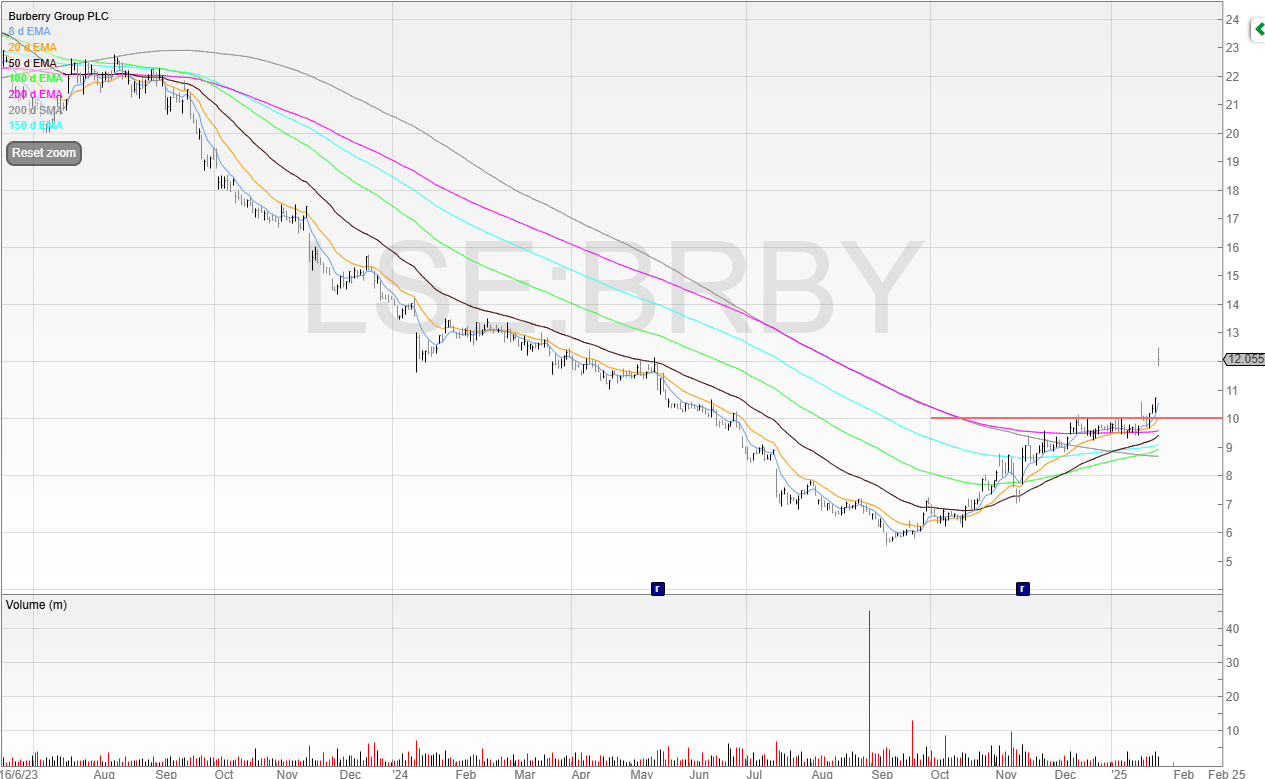

Good news for my top pick Burberry (BRBY) today as the results were better than expected.

This has led to a big gap up in the price and I believe there is more to come.

However, this was a big and significant beat.

Comparative sales growth has improved in Q3 from -20% to -4% which was sharply ahead of the -12% expected.

Burberry experienced much better sales trends over November and December, which I highlighted a few weeks ago could be possible due to the Google Trends data.

This had led to the company becoming more positive.

Whereas in the last earnings the company said (emphasis mine)…

In the short term, with our all-important festive trading period ahead and an uncertain macroeconomic environment, it is too early to determine whether our second-half results will fully offset the first-half adjusted operating loss.

… and the stock rallied, the company now says…

In light of our Q3 performance, it is now more likely our second-half results will broadly offset the first-half adjusted operating loss, notwithstanding the uncertain macroeconomic environment.

That’s a big difference.

Remember, there will be a lot of clever people crunching numbers here and doing the work.

But in the end, the chart told the story.

It will be eyes on for LVMH next Tuesday. Burberry has just reported, so I can’t see too much of a read across, but if LVMH also does better than expected then that’s definitely not bad news.

And before we continue, a quick thank you to our sponsor who helps towards the upkeep of this newsletter.

Unlock the full potential of your workday with cutting-edge AI strategies and actionable insights, empowering you to achieve unparalleled excellence in the future of work. Download the free guide today!

Audioboom (BOOM)

I listened in to the management call for Audioboom and made some notes.

First of all, this was very positive and there were no red flags.

Audioboom has consistently grown its revenue from $6.1 million in 2017 to a projected $80 million in 2024, outpacing industry growth and positioning itself for significant future expansion.

Management say this could potentially reach $215 million by 2030.

Whilst this is certainly a huge number, revenue has already tripled twice (6 > 18 > 54) and so tripling a third time does not seem unfeasible - especially given the scalability of the platform.

I will make it clear again though - I’m a trader and not an investor. So whilst I like fundamentals and certainly am in favour of them strengthening, the reality is I almost certainly won’t be holding in 2030.

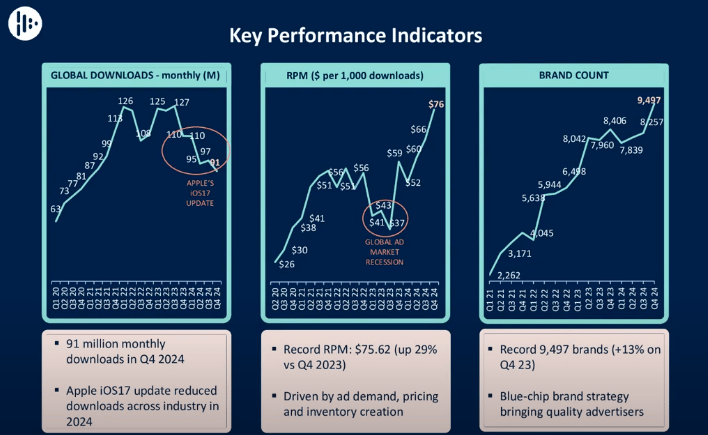

But my belief that the ad market has bottomed out has been validated by Audioboom’s KPIs.

RPM (Revenue Per Mille) went up to $76, up more than 50% from $52 at the start of the year.

This shows that when the ad market is strong then Audioboom can scale. It also works both ways though which is why the stock has been languishing in the doldrums the past few years.

But the big news was Showcase.

This has rapidly grown, generating $23.1 million in revenue with a 56% increase from the previous year, driven by advanced audience targeting capabilities and a 30% price increase for advertisers.

There is scope for expansion here too, as the company has increased its advertising monetisation from 2.7 to 4 minutes per hour of content, with potential to grow to 6 or 7 minutes, enhancing revenue while maintaining a quality listener experience.

It was noted that radio was up to 20 minutes - although I would add that this is why radio sucks and I hate it.

Nor has the NASDAQ move been ignored. Management say it aims to achieve $100 million in revenue and $8-10 million in EBITDA to effectively pursue a move to NASDAQ.

There’s also a second-half weighting which we knew about, but worth restating, as once minimum guarantees are paid to podcasters this means cash improves.

As of now, earnings estimates are $80 million of revenue and $4.1 million of adjusted EBITDA.

Given that the company achieved $2.1 million in Q4 2024, then if we assume zero growth than the company only needs to find another $2 million across the other three quarters.

My belief is that these forecasts are almost certainly going to be upgraded.

But I can always be wrong, so let’s see.

And onto my final pick for 2025..

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. Priority for all offers and live events. A risk-free trade itself as you get value or you cancel.

Upgrade