At least one of these picks won’t come as a surprise - if not all of them.

And one of them Filtronic (FTC) was derisked a little already as it upgraded its recently upgraded expectations on Monday.

Whilst it remains to be seen for next year, having forecasts nudged upwards is no bad thing in my book.

But coming in at number four it’s Audioboom (BOOM).

This is another stock I’ve covered extensively and one I’m excited for with the growth and scaling of Showcase.

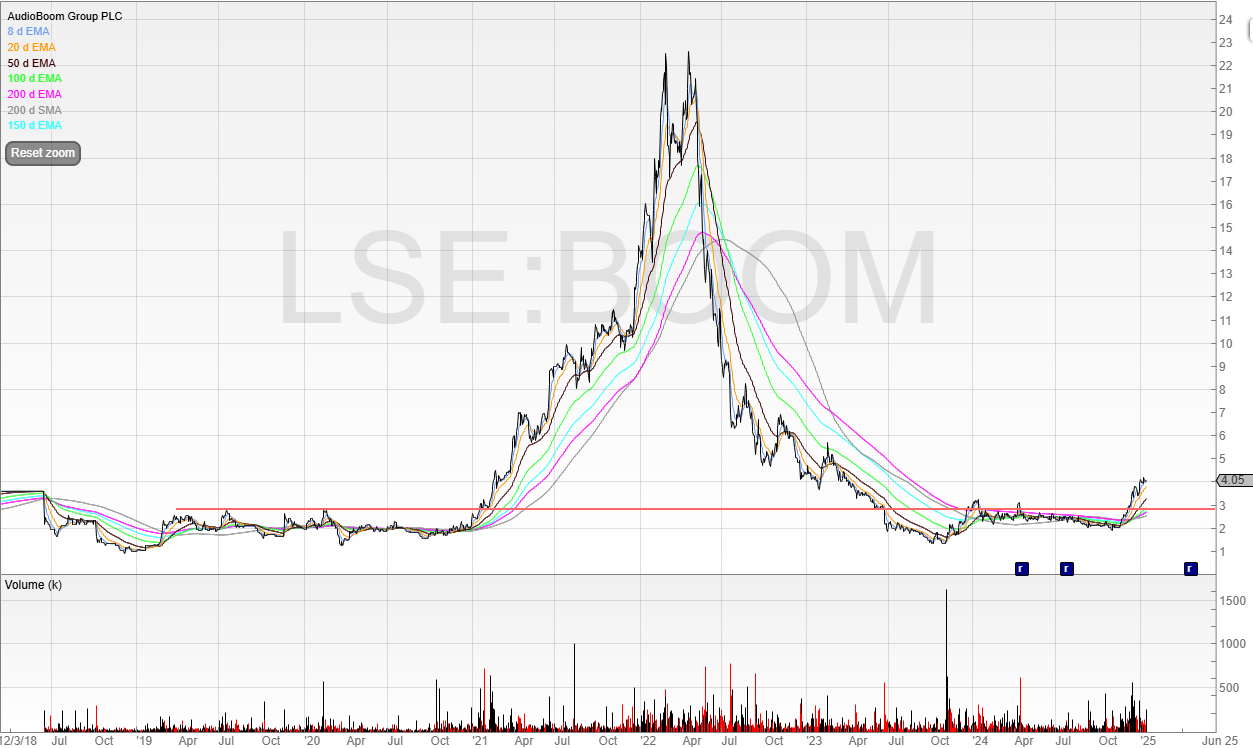

It’s had a turbulent history, to say the least.

Investors got terribly excited during 2021, and the shares collapsed as the podcasting revenue market went through a trough as well as Audioboom making the mistake of paying top dollar for some podcasts which turned out to be unprofitable under its minimum revenue guarantee to creators.

However, forecasts were upgraded three times for FY 2024.

Audioboom has gone from its adjusted EBITDA expectations from $1.3 million, to $2.5 million in October, $2.8 million in November, and $3.1 million in December.

Audioboom isn’t cheap based on next year’s numbers as forecast PBT is $3.5 million.

But if we get more upgrades? The shares could go on an even bigger rally - especially since the bad contracts will be coming to an end completely meaning no more cash payouts on loss-making agreements with podcasters.

The chart is clearly in a stage 2 uptrend now.

I’m looking to increase my position if the stock can break out if this tight range.

Showcase is the fastest growing part of the business. It’s also the highest margin part too.

And not only that but advertising CPMs are increasing too. So that’s a double boost to margins.

Audioboom has a lot of content inventory and I think it’s not unlikely some of the main podcasting platforms have looked at the business.

I would never suggest holding the shares expecting a takeover - people have been thinking Fevertree would get taken out by Coca-Cola for a decade now. And ITV, which some believed was a sitting duck, is still a listed business.

But with the business now firing on all cylinders, it’s a possibility.

Naturally, I’d prefer for the price to rally plenty before any bid happens but I also won’t complain if one comes in.

This was the case when Crestchic (LOAD) was taken out by Aggreko in 2022.

It was annoying because I felt the upside was being swiped at a lowball price, but it gave me a flush of cash and a nice profit quickly… which ultimately is never terrible.

We’re expecting earnings in January from BOOM - so let’s see what happens.

Intercede (IGP)

Intercede won’t be a surprise given that I’ve been banging the drum here since 114p.

The price is now 191p.

But I think it goes higher.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. Priority for all offers and live events. A risk-free trade itself as you get value or you cancel.

Upgrade