Paddington Bear owner Canal+ comes to the stock market next week, as Vivendi aims to split up its business because its owners argue that the group’s market capitalisation is lower than the sum of its parts.

The split makes sense - investors are very good at diversifying and therefore being able to buy exactly what part of the business they want rather than the whole group could lead to varying valuations on each part.

Canal+ is expected to have a valuation of between €6 billion-€8 billion. It’s the biggest primary listing since Haleon in 2022 which was spun out of GSK for around £30 billion.

When spinoffs are introduced, it’s always worth taking a peek. I remember when Anglo American (AAL) gave back Thungela Resources (TGA) to shareholders back in 2021.

Anglo’s view here was that it wanted to get rid of dirty coal and improve its name.

I remember meeting an energy trader who had worked for BP and Shell who told me that this was hugely undervalued because it threw off so much cash.

It was always on my list of stocks to look at but given this was the period where everything was going up and deals were daily I never ended up properly taking a look.

Well, he was right. Thungela went up 10x in the next 15 months and I only ever traded it for scraps!

Another one was 4basebio (4BB) which was spun out from its German parent.

Bizarrely, this was listing only at £14.5 million despite having £14 million of cash, which valued the existing business at £500k.

Granted, it was a non-profitable cash burning business, but it also had a £22 million loan facility, plus it was peak furlough time where everyone was ploughing money into stocks.

But the big attraction here was that it raised no new money.

Which basically meant there were no sellers, unless the German investors decided to sell some.

It also meant that UK market makers were unlikely to have any stock.

I called my broker and placed an outrageous order only for him to call me back and say we’d got everything I asked for.

This made me think that either I’d missed something, or if I was right then then the market maker would realise his mistake and try to cancel the trade.

Thankfully, I was right, and the stock started to move. I knew the market makers likely had no stock and this one now had to buy what he had sold to me back and the only way to do that would be to bid up the price.

All this did though was encourage more buying!

Given my buys around 130p, this was a nice trade.

Now, I’m not suggesting this is what will happen to Canal+.

But when smaller companies are spun off, check the story. There could be a trade.

And before we continue, a quick thank you to our sponsor who helps towards the upkeep of this newsletter.

Billionaires wanted it, but 66,737 everyday investors got it first… and profited

When incredibly rare and valuable assets come up for sale, it's typically the wealthiest people that end up taking home an amazing investment. But not always…

One platform is taking on the billionaires at their own game, buying up and offering shares of some of history’s most prized blue-chip artworks for its investors. In just the last few years, those investors realized representative annualized net returns like +17.6%, +17.8% and +21.5% (among assets held 1+ year).

It's called Masterworks. Their nearly $1 billion collection includes works by greats like Banksy, Picasso, and Warhol, all of which are collectively invested in by everyday investors. When Masterworks sells a painting – like the 23 it's already sold – investors reap their portion of any profits.

It's easy to get started, but offerings can sell out in minutes.

Past performance not indicative of future returns. Investing Involves Risk. See Important Disclosures at masterworks.com/cd.

Yu Group (YU.)

Yu has been a standout performer in the last few years.

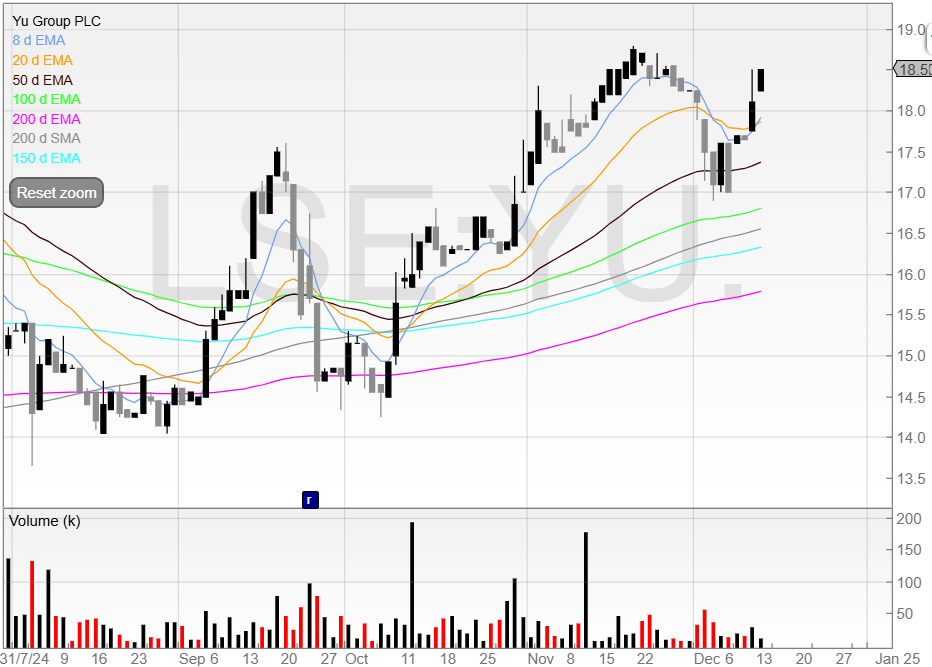

Here’s the share price.

The share price has been consolidating since April and this could be another stage 2 base.

The 200 EMA has held up well and this stock has come onto my 10% within 26 week high filter.

I use this filter to look at stocks that are close to breaking out but have yet to do so.

You can find all of my filters on SharePad by searching “Michael” in the filter library.

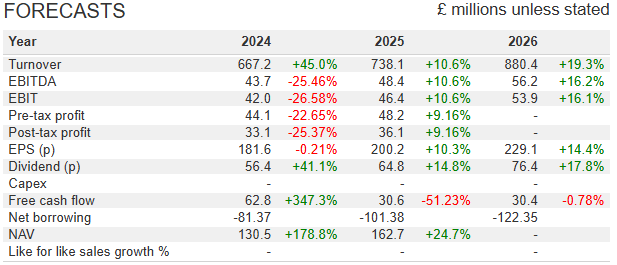

Back to Yu - forecasts are undemanding.

This puts the company on a sub 10 PE for FY24, and even lower for FY25.

And that’s assuming that these forecasts aren’t beaten (although a company can also fail to meet its forecasts!).

Yu is generating plenty of cash, and the chart is looking better.

It looked like there was some distribution back in July as the stock sold off on a trading update.

Big volume and a price fall looks like someone exiting or unwinding a position.

Yet the 200 moving averages held firm, and five months later the stock is closing towards new highs.

I think it’s worth watching for a tightening up at the recent highs.

However, we’re told that there will be a trading update on 21 January.

Given the move in the last update to the downside - I feel it prudent to not take any earnings risk here and be out of any potential trade by this time.

Why take unnecessary risk when you don’t need to?

This job is hard enough without adding extra risks.

Dr. Martens (DOCS)

Hold your nose. Whilst this isn’t the biggest bag of odorous excrement ever assembled in the history of capitalism, as Jeremy Irons’ character says in Margin Call, it’s definitely odorous.

Private equity firm Permira brought this flea-ridden mutt to market at peak market fervour, and it was a superb trade.

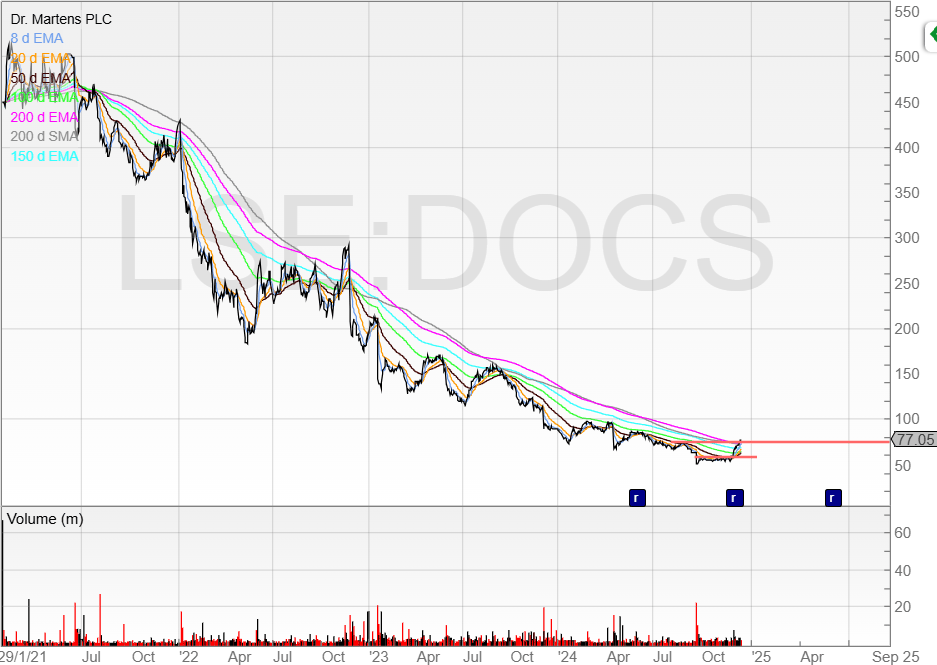

The stock was down almost 90% at one point.

But fundamentally, the business appears to have stabilised.

Indeed, the share price even went up last week on the interim results.

Not that I can see anything attractive in these figures at first glance.

Nor do I want to start getting into the details of this business. I don’t have any edge here, especially given that it’s a £750 million market cap.

But if the share price is going to start going up, then I am not averse to buying odorous excrement.

Notice the volume in September. Was that capitulation volume? It looks like it, as the stock hit 50p and is now 50% higher printing above 75p.

We had what was potentially a short stage 1 base, and now the stock is looking like it could be starting a new trend.

It’s above all moving averages and average volume is elevated.

I’m not a buyer here because of the extended rally (I bottled buying the results) but it’s now firmly on the watchlist.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. A risk-free trade itself as you get value or you cancel.

Upgrade