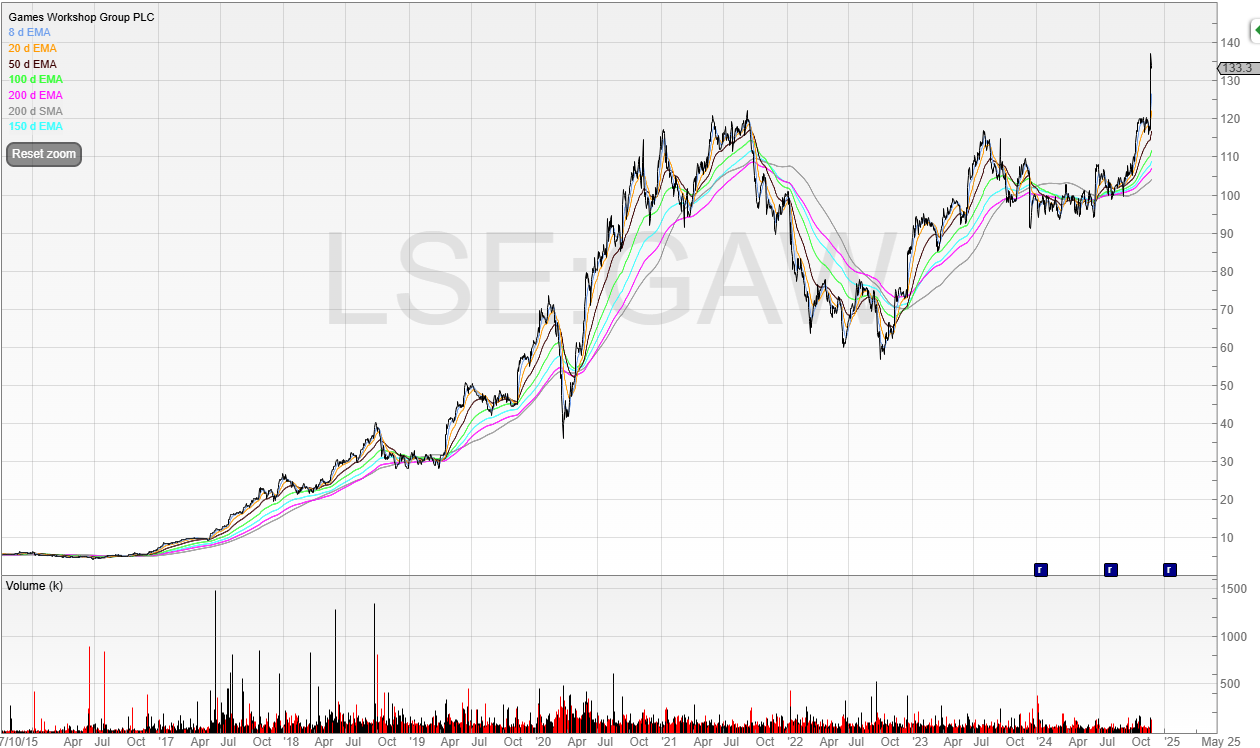

Games Workshop (GAW) is one of the best performing stocks in the UK market.

In fairness, just being positive over a 10-year period is enough to beat most UK stocks.

But over the last eight or so years GAW has gone to the stratosphere.

A bold claim, but Games Workshop backs it up.

Back in 2016 the stock price was around 400p. It’s now 1,335p. That’s more than a 20x return in eight years (although there has been some stomach-churning volatility on the way).

And even though I’m not an investor, Games Workshop has been a stock I’ve actively traded.

In earnings upgrade cycles, the stock would drive higher on news. And when the stock was richly rated yet traded in line, it was a nice stock to short.

Games Workshop is not your typical ‘cool’ brand. It owns the Warhammer game where players use table top figurines to battle with armies.

And because of the cult-like status of the game, this has been fantastically profitable.

It’s built a huge fanbase of customers loyal to its products, who engage with the products by painting soldiers and armies and then using these decorated figures in games.

And before we continue, a quick thank you to our sponsor who helps towards the upkeep of this newsletter.

Billionaires wanted it, but 66,737 everyday investors got it first… and profited

When incredibly rare and valuable assets come up for sale, it's typically the wealthiest people that end up taking home an amazing investment. But not always…

One platform is taking on the billionaires at their own game, buying up and offering shares of some of history’s most prized blue-chip artworks for its investors. In just the last few years, those investors realized representative annualized net returns like +17.6%, +17.8% and +21.5% (among assets held 1+ year).

It's called Masterworks. Their nearly $1 billion collection includes works by greats like Banksy, Picasso, and Warhol, all of which are collectively invested in by everyday investors. When Masterworks sells a painting – like the 23 it's already sold – investors reap their portion of any profits.

It's easy to get started, but offerings can sell out in minutes.

Past performance not indicative of future returns. Investing Involves Risk. See Important Disclosures at masterworks.com/cd.

Last week the stock offered a great entry point for an Opening Drive trade.

This is the trading pattern I call stocks that are gapping up and expected to drive higher in the early session or throughout the day because of good news.

The stock was flat for the last six weeks and even trended down slightly before gapping up.

To me, that means a positive news update wasn’t expected.

If it was, then the stock would’ve rallied.

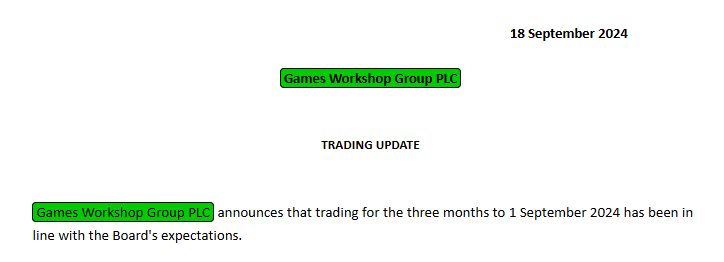

Here’s the update:

Games Workshop is always nice and succinct. No corporate buzzwords. No nonsense. The exact type of wording I like, and new guidance given.

My only gripe is that I struggled to find the old guidance quickly, and so didn’t put an order in for as much as I would’ve wanted.

But it’s also the first in potentially a new cycle.

Here’s the last earnings update.

So the update is not only a surprise but also the first.

Here’s how the stock reacted.

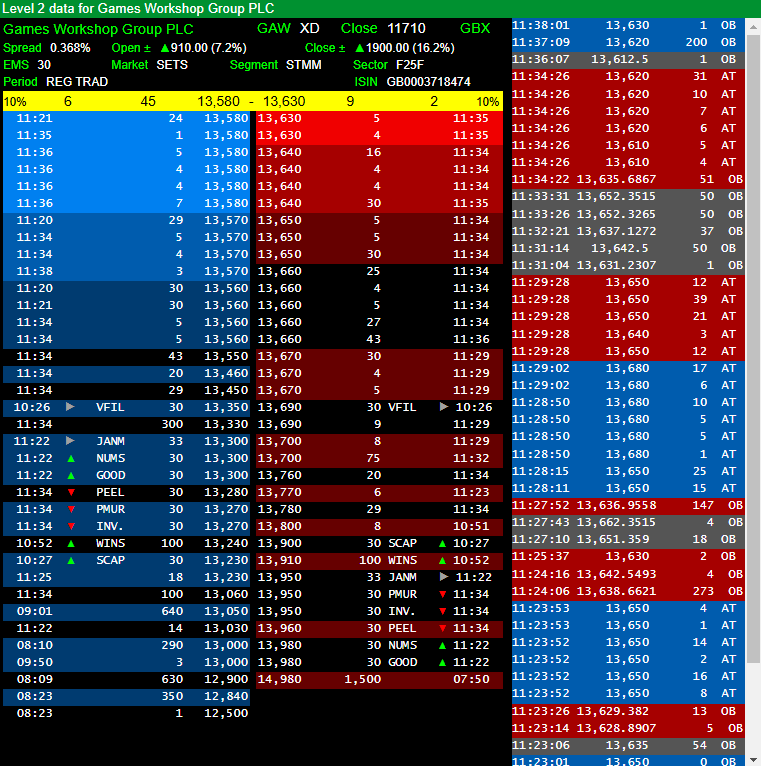

This is why I believe the opening auction is a great opportunity for traders, and why Level 2 comes into play.

Level 2 shows you the market in real-time, with bid orders on the left and ask orders on the right.

During an auction, the yellow strip (showing the most competitive bid and ask prices) will show a single price. This is the indicative uncrossing trade, which means it’s the uncrossing trade price if the auction was to uncross at that moment, hence ‘indicative’.

But this can and does change rapidly, especially as orders pile into the auction in the last few seconds before the uncrossing period begins (08:00:00). Why show your hand when you don’t need to?

The indicative uncrossing will show you the price and also the volume taking place in the auction.

You can use this to gauge the auction’s pulse and enter your order accordingly.

Using auctions to trade what I call the ‘Opening Drive’ is a great strategy to take advantage of unexpected surprise news – both positive and negative.

As we’re not huge >£100m institutions (well, I’m not at least) we can use position agility to get ahead and get in and out of stocks quickly, especially at the size of Games Workshop which is now a £4bn+ company.

Many institutions will not be able to buy as much stock as they want in the opening auction. That means they could be buyers over several days or even weeks. There’ll always be sellers, but when inflows exceed outflows over a period of time, the net effect is a price rise.

We can ride these coattails either as an intraday trade or a swing trade.

Next time you see a stock with:

Unexpected positive news

A flat or falling chart

Make sure you look deeper. There could be a trade there.

It doesn’t work all the time, of course. Nothing ever does. And nothing is guaranteed.

However, it has been a consistently profitable strategy over time for me with careful risk management.

I’ll be covering the Opening Drive and other patterns in my playbook in the live cohort of UK Stock Trader Pro.

Any questions? Hit reply and I’ll get back you.

Speak soon!

Michael