To much of the nation’s surprise, Mr Sunak has called an election.

This was off the back of the latest inflation figures that were published last week, which show price rises slowed to 2.3% in April compared to the Bank of England’s target of 2%.

That Sunak has called an election now means one of three things.

1) He thinks this is his best chance, which could also mean

2) He thinks this is the best it will get economically before he has to call an election, or

3) He isn’t sure if he’ll last his term (like his predecessors)

Either way, no government has ever won an election doing so badly in the polls.

And yet the polls show that Labour’s lead is not as rock solid as it seems.

But Reform, for all their noise and bluster, failed to win a single seat. And unlike in 2010 where the Liberal Democrats peeled votes from Labour, it looks like Reform will there to seduce wavering Tories.

But more importantly… what does this mean for us?

Well, on the back of the election news I thought Harbour Energy’s (HBR) and Serica Energy’s (SQZ) price action was interesting.

It’s no secret that Labour will do untold damage to the North Sea. Regardless of your political affiliation, the uncertainty and Labour’s commitment to taxation here is already having an affect.

Kistos (KIST) has turned down two deals because of it. Chevron is exiting the North Sea after 55 years.

It’s had an effect on the small caps who are focused on the North Sea rather than the large caps who are well diversified.

But back to HBR and SQZ.

These were on my watchlist on the election news.

My view was that with Labour looking so strong these oilers would sell off.

They did, but they recovered their initial losses.

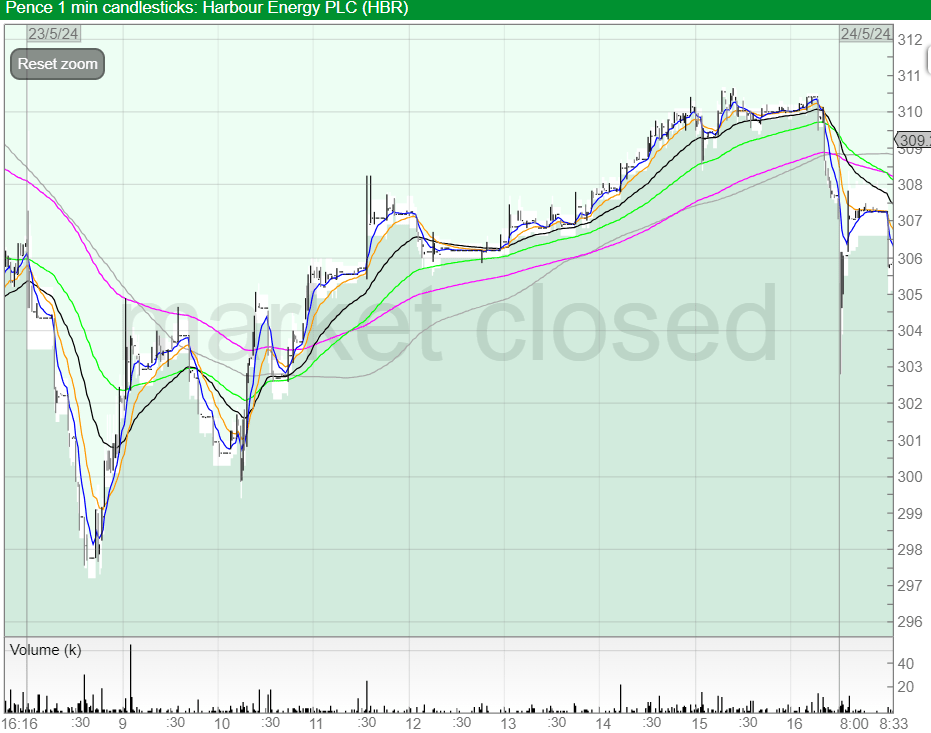

Here’s HBR.

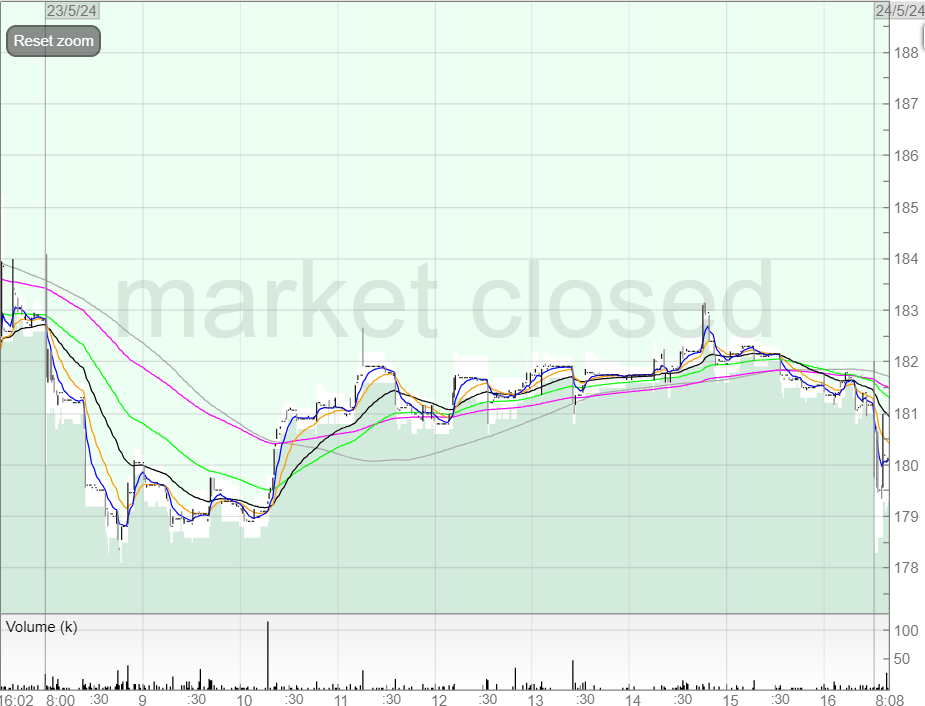

And here’s SQZ.

This tells me that there are no surprises and the downside is potentially baked in here for now.

Another potential stock to be affected is Supreme (SUP).

Previously, Labour mentioned that it may look to make vaping prescription only.

This is idiotic given that it is less harmful and helps people stop smoking.

And given the popularity of vaping, and the ambivalence of those who don’t vape, restricting this is likely to be a turnoff for voters.

When Labour has such a strong head start, it makes no sense to upset the apple cart and come out all guns blazing on a topic likely to lose them votes.

It could be that the market likes certainty should a majority Labour government win, but we also have to consider the other options.

Conservative majority (unlikely but possible)

Hung parliament (definitely possible)

If there is a Conservative majority, expect HBR and SQZ to move. Labour wants to increase the Windfall Tax to 78% and extend it by a year.

However, should Conservatives make dramatic gains, then perhaps these stocks will move to price this in accordingly. You’d expect so if the market was efficient. If it doesn’t - opportunity.

And in a hung parliament? Uncertainty and risk-off.

Maybe we don’t see much volatility until the actual result if Labour holds its gains or even extends them. Let’s see.

I’ve decided to make the monthly premium editions into two editions per month.

This means the content and charts will be more relevant, and hopefully more effective. A big load of charts once can quickly become outdated, whereas bi-weekly will provide a better flow of potential ideas.

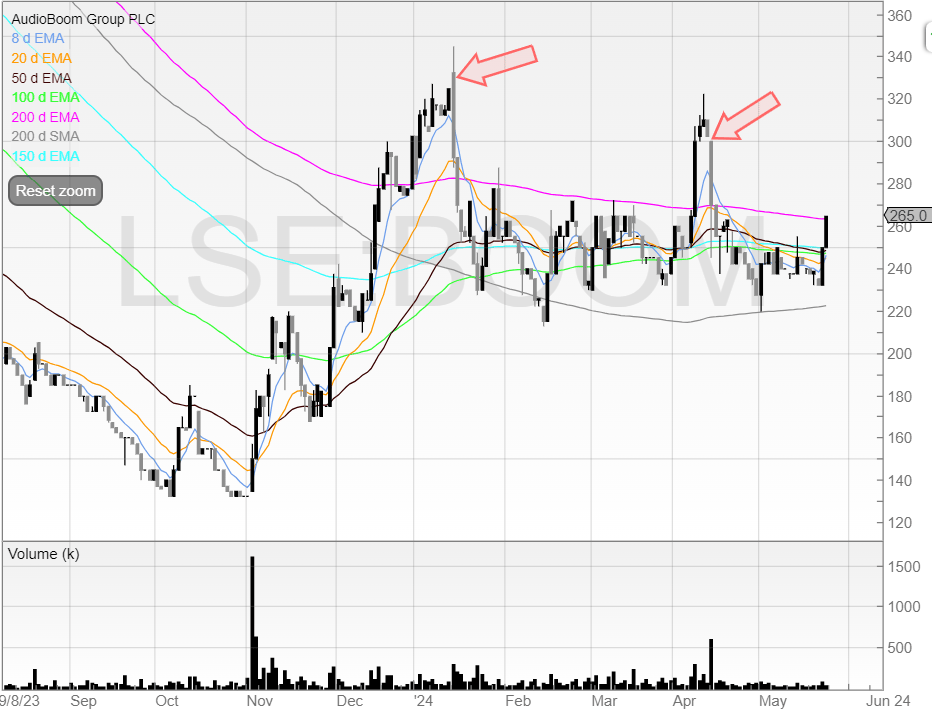

Audioboom (BOOM)

Audioboom loves to rally into news and sell off into it.

Last year there was a trading update on 23 June.

Is this the start of the move into results?

The arrows mark the previous sell on results.

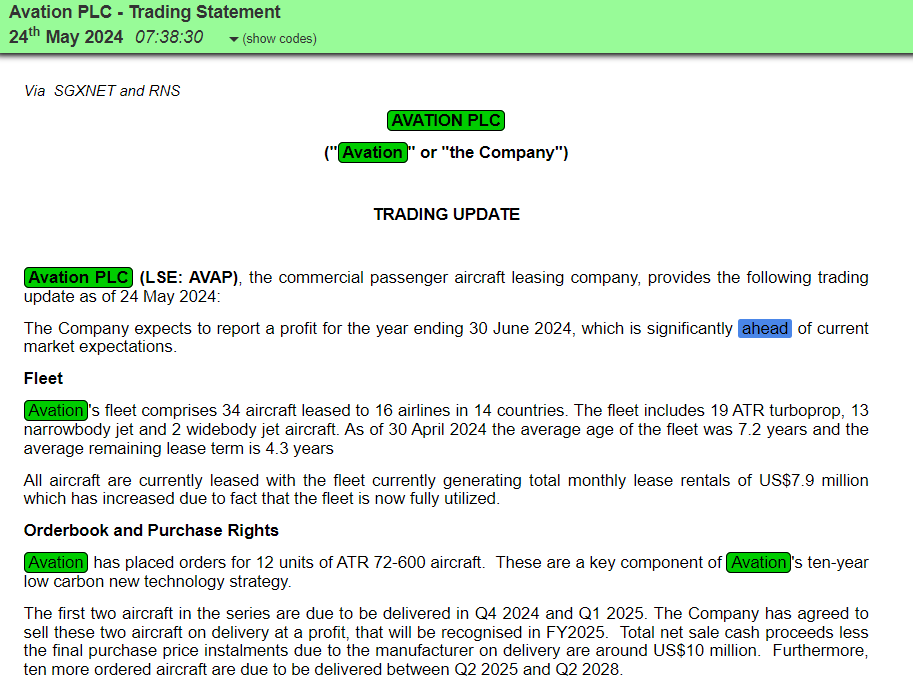

Avation (AVAP)

Avation reported that trading was significantly ahead of current market expectations.

Yet instead of rallying strongly, the stock was heavily sold into.

In fairness, the stock was up close to 50% over the last four weeks. So it could be argued that these results weren’t exactly unexpected.

The question is now: Will the price action tighten up and form a shallow base? If so, then it gives a potential trade opportunity.

Remember, we want volatility after we’ve entered, rather than before it.

Entering the trade after significant volatility means we may become liquidity for those who’ve made quick money. Sack that!

Argo Blockchain

I wrote in my piece here that I think Argo Blockchain is a potential zero.

Nothing has changed my mind with the Q1 update.

Indeed, in the Investor Meet Company presentation the company said they were prioritising cash and strengthening the balance sheet.

One obvious way to strengthen the balance sheet is to do a placing, which I think is likely unless the Bitcoin price more than doubles and more.. and soon.

Here’s the Hashprice Index. You can spot the halving event clearly.

Based on my calculations, the best case scenario is Argo delivers $5.6 million in revenue for May ($6.6 million in April and an -18% drop).

We know that Argo Blockchain has 2.7 EH/s capacity. Let's assume the company increases it by 10% even though it hasn't moved in months to 3 EH/s.

And if I use $60 per day (never printed there in May and current price is $52.7) I get $180k per day.

Now times this by 31 days in May to get $5.58m. This is not enough to sustain operations.

Real revenue could be much lower.

For the avoidance of any doubt: I am short.

Transense Technology (TRT)

I held a small position in Transense Technology back in 2021 because I thought it was undervalued.

I still think that to be the case, but the price is the same as it was three years ago.

I got stopped out, and didn’t bother looking again until recently.

After a capitulation back in the summer of 2022, since then the stock is up more than 100% off the lows.

Back in 2020, Transense made a transformative agreement with Bridgestone.