Up the Gulf, down the Gulf

A quick one.

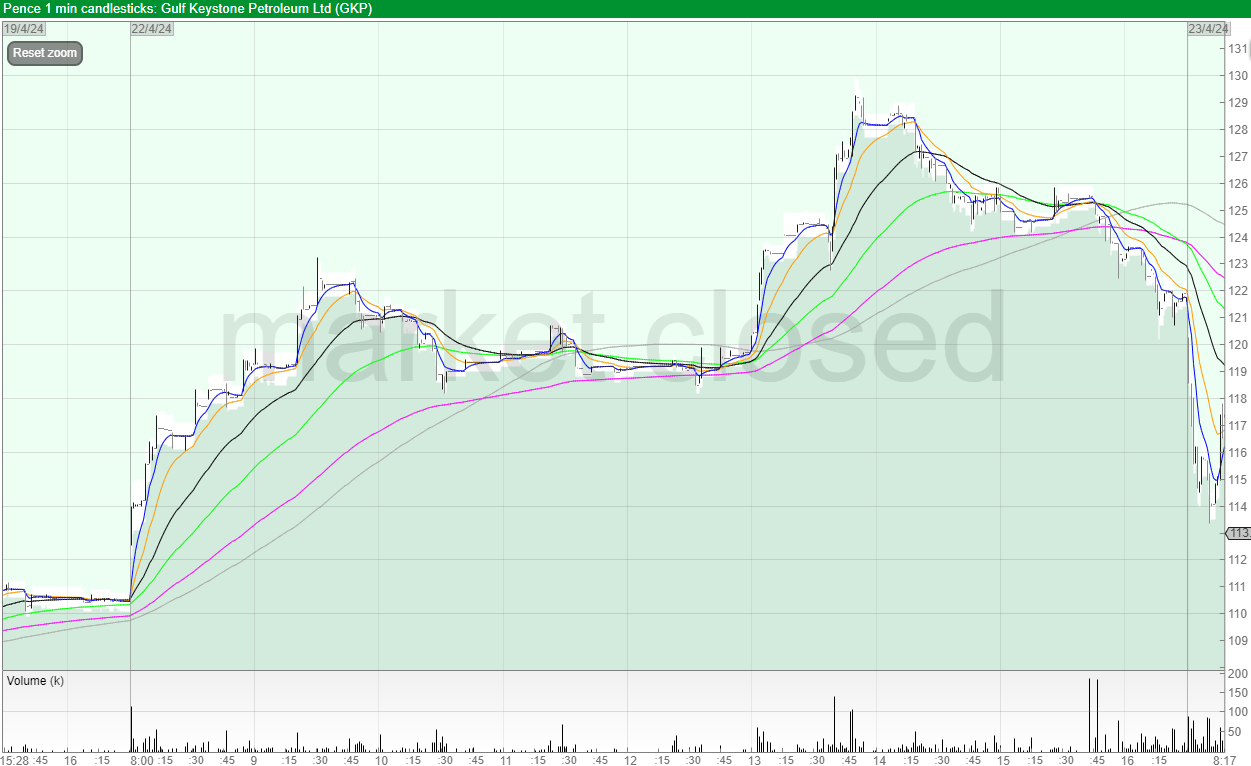

You might’ve seen Gulf Keystone Petroleum (GKP) went up and went back down.

There also wasn’t an RNS.

But price-sensitive news doesn’t always come through the RNS...

Turkey’s President Erdogan went to Iraq to talk about water and security. And as you might know, the Iraq-Turkey Pipeline (ITP) is currently shut.

It’s not terminal to GKP as it can sell oil locally, but this is at a far lower price than the profits it could be making.

As we can see, the stock rallied yesterday on speculation that this meeting would provide a resolve for the ITP.

If you knew that Erdogan was visiting Iran then you could’ve surmised this would’ve been speculated, and taken the trade.

I wasn’t aware of it so I missed it.

But when the ITP issue wasn’t resolved?

Well, what goes up, must come down…

And that’s exactly what happened.

A better trader than me once said “don’t think, just do” (and someone cooler than him said it in a movie). Trade made sense so I hit it short.

The stock uncrossed at 120p and spent the day tracking lower.

Pinewood Technologies

This was an open goal (one I missed!).

It’s the old Pendragon, which is now a software pureplay.

Regardless of what you think of the tech or the valuation the trade was there.

Yesterday’s uncrossing was 39.3p.

But today there was a share consolidation..

1 new share for every 20 held. But wait - there’s more!

A special dividend of 24.5p per existing ordinary share!

We know that the stock closed at 39.3p.

So that means ex-dividend the stock will be 14.8p, then we have to times by 20 to get the new share price of 296p.

Therefore, anything trading below 296p means the price has overshot itself and we could have expected that disconnect to reverse.

That’s exactly what happened.

Stocks that have consolidations and sometimes stocks that have big special dividends (and especially those that have both at the same time!) can cause confusion.

Confusion can cause opportunity.

Well done to those who caught it.

Anyway, if this was of any use - let me know. If I think I’ve got anything worth sharing I can always write it down here.

And if you want more of these then hit subscribe below!

There’s nothing below the subscriber break. I just don’t know how to put a subscribe button. That’s for another day.