It’s that time again where the tipsters have been wheeling out their share tips for the year.

The problem with tips is that bad news could come out the week after and completely change the investment thesis.

This is why following tips is completely moronic.

Blindly following anyone into a stock without a strategy is dangerous.

I say without a strategy, because if you have statistics that show you can bank P&L from a tipster or a market mover then you may be actively following but have the evidence to back you up.

If you lack this evidence then you may as well just head to the casino and enjoy the free food and drink they give you whilst relieving you of your money.

Back in 2018 I had a free money trade.

Microcaps were spiking randomly, and I couldn’t work out why.

Then I figured out the common denominator.

An account known as “welshshark” on the London South East bulletin boards.

Whichever stock he posted on, the share price would spike.

So I set up a 15-second autorefresh on his profile so that I’d never be see his posts later than 15 seconds after he’d posted.

And when he posted, I’d buy the stock he was ramping, and his followers would come in and push the price up, allowing me to dump onto them.

This is a classic pump and dump - except welshshark was doing the pumping and I was silently buying and selling in the background surfing the liquidity he was creating.

If you know prices are going to move when something happens then you’d be crazy not to trade it. Unless, of course, it’s inside information. In which case you should definitely should not trade it.

But all good things come to an end.. and one day welshshark was no more.

Some say the FCA got him. Unlikely, as they’d struggle to catch a bargain if they were locked inside an Aldi.

Some say he made his fortunes and quit whilst he was ahead.

But for a brief period, following a random account on a dodgy bulletin board was a free money glitch in the game.

And whilst it wasn’t a sophisticated strategy, it was a strategy nonetheless.

But the crowd that followed him blindly without a strategy almost certainly lost their money.

Synectics (SNX)

First up - it’s Synectics for the list of ‘honourable mentions’ in 2025.

These stocks didn’t make the cut. But were considered.

Synectics designs, integrates, and supports security solutions tailored for industries where surveillance is critical, including gaming, oil and gas, public space, transportation, and critical infrastructure.

It offers a comprehensive range of security and surveillance solutions, including:

Synergy Software Platform: A proprietary security and surveillance software platform that integrates various security systems into a unified interface, enhancing situational awareness and response capabilities.

COEX Camera Stations: Radiometric-enabled, explosion-proof cameras designed for hazardous environments, such as oil and gas facilities, providing reliable monitoring in challenging conditions.

Integrated Surveillance Systems: Custom-designed solutions that combine hardware and software to meet the specific security needs of clients across various sectors.

These offerings enable organisations to protect their assets, personnel, and operations through real-time monitoring, data analysis, and incident management.

And as you can imagine, the potential clients for this include many industries:

Casinos

Oil & gas

Transportation

Critical infrastructure

Casinos need to have huge security - and there is a casino building rebound following Covid - and so Synectics has a strong chance of winning several of these contracts.

Datacentres also need trusted protection.

The beauty of Synectics is that once it’s in it’s rather difficult to dislodge. These contracts aren’t won on price. The risk of switching is high due to the security required, and if Synectics does its job well there is no reason for move.

The chart is strong here.

It’s in a clear stage 2 uptrend, and at £60 million market cap could easily go a lot further if it keeps winning contracts in its pipeline.

I hold a small position here, and it goes into the ‘honourable mentions’ list for 2025.

Yu Group (YU.)

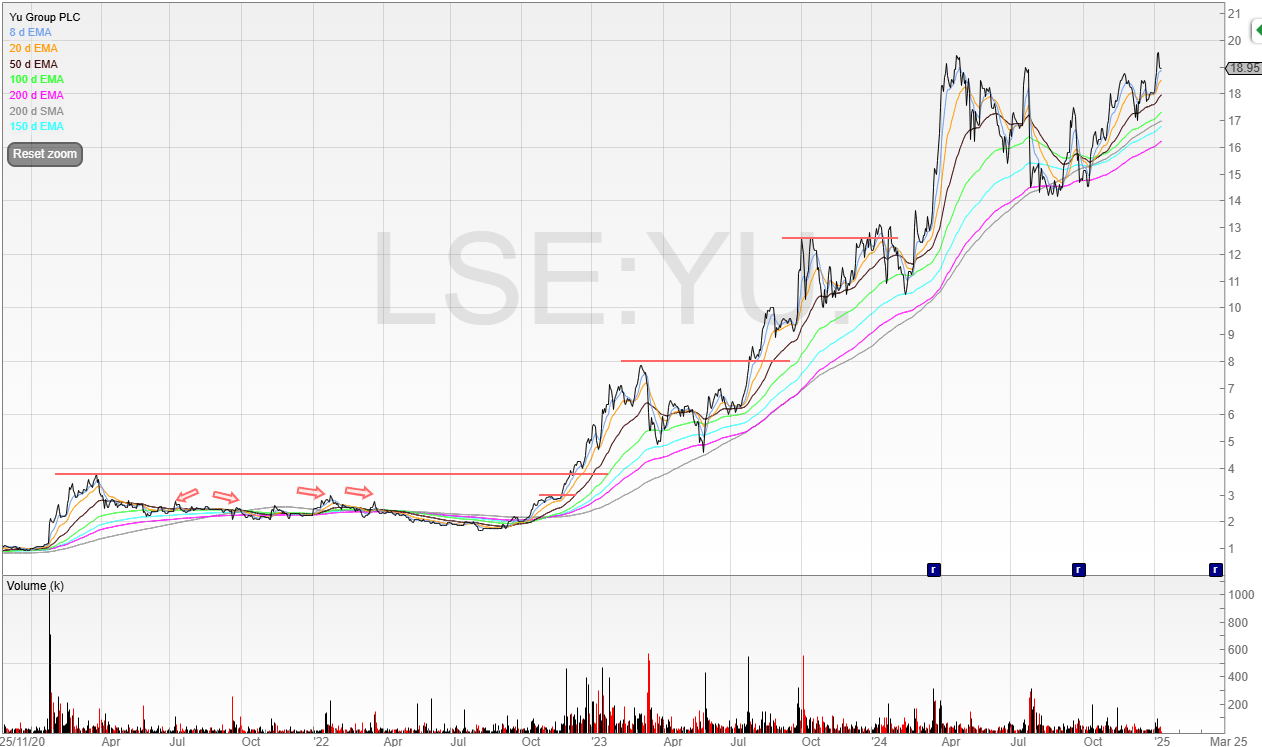

Yu Group is a ridiculously fast-growing business and this is why the share price has multibagged in recent years.

It’s an is an independent supplier of gas, electricity, and water, as well as a meter operator, serving the UK corporate sector.

I recall the chief executive telling me that it could price up contracts within seconds and also had the option to turn electricity off if clients didn’t pay.

Whilst I liked what I heard, I unfortunately didn’t pay much attention as this was in era where all stocks were rocketing.

But I’ve covered this extensively in the past, and we saw the trend was in danger of breaking last summer.

The 200 EMAs held, and the stock is powering up to new highs.

Let’s look closer.

The stock could be forming a cup and handle here, so I’m watching to go long on the breakout.

The growth here is incredible.

Revenue has shot up but this has also translated into a spike in profit, and net cash has exploded too.

All good signs.

And whilst the profit is currently forecast to moderate, the shares are on a PE of just above 10.

That seems fair to me, and so it goes on the honourable mentions list.

Gulf Keystone Petroleum (GKP)

When I first added Gulf Keystone Petroleum to my list of honourable mentions the price was 130p.

As I’m editing this the price is now close to 160p.

That said, even with the Iraq-Turkey Pipeline closed, the company is more than capable of growing its cash balance, buying back shares, and paying out dividends to shareholders.

This is by no means a company in trouble, when it looked like it could be at a point after the closure.

On the 25th of March 2023 the ITP was closed. People expected a swift resolution.

Well, two years on nearly and it appears we’re no closer.

If it does reopen, then I’d expect a re-rating for GKP.

And if it doesn’t… the company will likely continue to grow its cash balance, buy back more shares, and pay out more dividends to shareholders. I don’t hold but I am watching.

This stock is a bit of a wildcard, as it’s in a place you wouldn’t go to on holiday, and can be volatile and dependent on news.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. Priority for all offers and live events. A risk-free trade itself as you get value or you cancel.

Upgrade