There are more than 2,000 stocks on the London Stock Exchange.

It’s a lot. And I’m often asked how I find stocks to trade.

One of the best places is through the RNS (Regulatory News Service).

This is the news feed where all company price-sensitive information is shared.

Think full-year results, half-year results, trading updates, contract wins..

Stocks will often move on these updates and every weekday from 7am the news feed starts rolling.

You can get access to this free on the London Stock Exchange’s website.

Anyone wanting to pick their own stocks needs to spend a lot of time with RNS.

The reasons are simple:

If you want to beat the market you need to do the work

The more you read, the more you learn, the better you can contextualise

For example.

Yu Group (YU.) put out great results that were better than expected in March 2022.

Anyone who bought stock on that RNS would’ve immediately been in the red as the stock plummeted.

But a smart trader would’ve either avoided the RNS or gone short.

Why?

Because the last three earnings updates which were highly positive or beat expectations saw the stock sell off.

And you would only have known that if you were an avid reader of the RNS and had followed that company.

Sure, you could’ve checked the same day. But there are lots of other companies reporting and 1 hour before the market opens isn’t a huge amount of time.

Therefore, being able to contextualise is a huge advantage against the unprepared.

And before we continue, a quick thank you to our sponsor who helps towards the upkeep of this newsletter.

Invest in AI & Tech Innovators Before They Potentially Hit the Public Market

UpMarket provides accredited investors with exclusive access to companies at the forefront of AI and tech innovation. From SpaceX and OpenAI to Neuralink and ByteDance, these private companies are pushing technological boundaries and driving innovation. With over $175M invested by our community, UpMarket is a U.S.-based platform offering vetted, private investment options.

Using filters

Another way of generating ideas is to know what you want to see and then go ahead and filter for it.

I look for stocks with big volume and stocks that are trading within 10% of their 26 or 52-week highs.

Why?

First of all, volumes speak volumes.

If a stock suddenly has a large increase in volume, that may mean that a stock has suddenly become interesting.

You can use my VOL filter on SharePad to do this. It’s in the SharePad library for everyone to use.

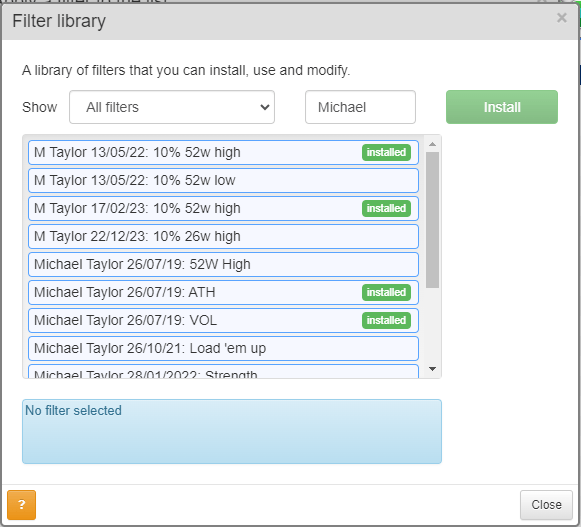

Click Filter > Library and then search “Michael” in the search bar.

This will show you all my publicly available filters.

You can see my “VOL” filter and also my “10% 26w high” filter.

However, make sure that any stock that appears on the VOL filter is genuine volume and not just an institution sending shares to someone else. You can see this by going to the Trades tab and checking if there is a single block trade or an increased frequency of trades. We’re looking for the latter.

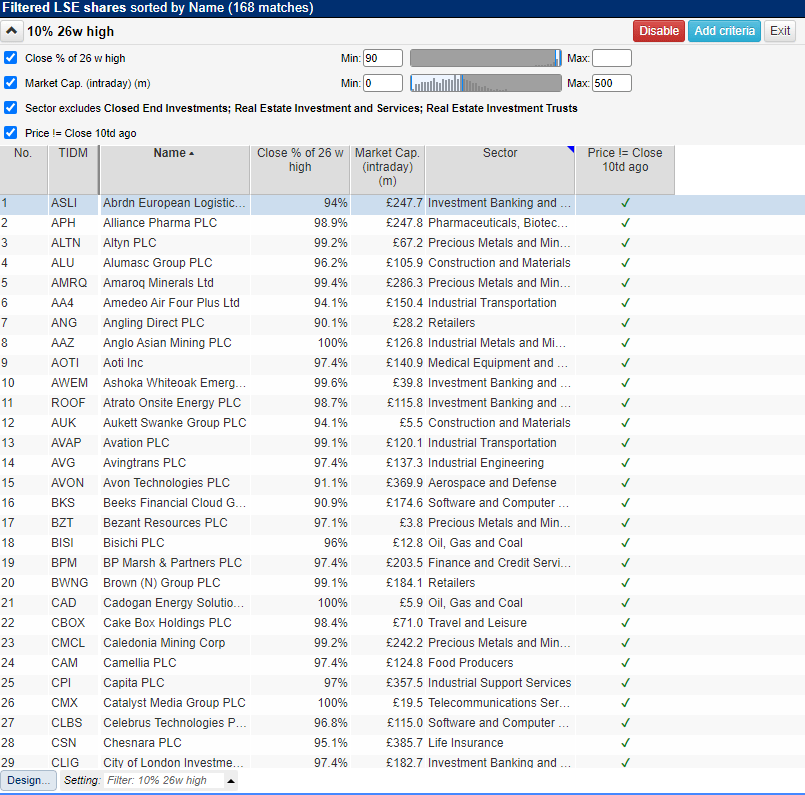

The second filter brings up all stocks that are trading within 10% of their 26-week highs.

This alerts me to stocks that might soon be breaking out, and brings them onto my radar to investigate further.

Here’s what it looks like.

This gives me a ready-made list of stocks that could be interesting, because they fit exactly what I’m looking for: stocks that could be breaking out of a base.

You can filter down further too and add more criteria. As you can see, I’ve added a market cap filter on to get rid of bigger stocks.

I’ve written a whole guide to breakouts which you should already have, but if not then hit reply, let me know, and I can send it to you.

And whenever you’re ready..

There are three ways I can help you.

If you’re wanting to profitably trade UK stocks then I’d recommend my entry level course:

Spread Bet Accelerator: The exact system I use to trade and get you to your first £10k in profits. Use the code GIVEME99 for a subscriber discount.

Want more trading ideas and a clearer view of the markets?

Buy The Bull Market Premium: Free 30-day trial covering potential trades and insights as a professional trader.

Want to work with me personally?

Alpha Trader is where I work closely with traders who want to get to a professional level.

We have our own channel, meet up, and have fun trading and learning [closed].

Speak soon!

Michael