Have you seen that movie where a tagged shark ends up in Paris?

And it has a ridiculous amount of babies because it’s “evolved”?

Then when the military try to shoot it during the Paris Olympics they hit a bomb in the Seine which sets off a chain reaction, somehow floods the whole city, and leaves thousands of sharks now roaming underwater in Paris?

No?

Good. Don’t.

Because it sucks.

But bare with me - there is a relation to trading here.

Just like in the Seine (at least in this movie) you never really know what lies beneath.

That’s the same when it comes to icebergs on the order book.

An iceberg is what’s known as a “reloader” - an order that reloads once it’s filled that keeps its time and price priority in the queue.

If you’re confused - don’t worry..

Let’s say you want to sell 100,000 shares in Dumb Movie Co.

The problem is, if word gets out you want to unwind 100,000 shares then two things can happen..

People will front run you to get ahead

People will stop buying (they know there’s a seller and so they may get the stock cheaper)

Neither of these are good if you want to get a competitive price.

But what if there was a way to disguise your order and sell it without revealing your hand?

Enter the iceberg order.

What is an iceberg order?

An iceberg order is an order that disguises its true size (like an iceberg).

They are used by people who wish to buy and sell an amount of shares that might have an impact on the market price if their full size was known.

Instead of showing your full hand to the market, an iceberg is broken down into tranches which reload onto the order book.

Imagine you chopped the top off an iceberg, it would be replaced as the iceberg would rise above the water.

That’s exactly what’s happening with iceberg orders.. hence the name!

Make sense so far? Let me know if not.

How do I place an iceberg order?

Now let’s go back to our 100,000 shares in Dumb Movie Co.

We don’t want to let anyone know we’re a seller in size.

So we split the order into 20 lots of 5,000 tranches and place this onto the order book.

You can do this on IG by opening a dealing ticket and changing the order type to “Iceberg”.

Source: IG Markets L2 Dealer

Put in your desired total size to sell in “Size”, and then “Tranche Qty” is how big you want each slice to be.

If I’m selling 50,000 shares in Vodafone (VOD) and have a 10,000 tranche each time then that means I’ll have five tranches.

So once each 10,000 tranche is filled, another 10,000 will instantly appear, until all 50,000 shares are sold or I cancel the order.

How do you spot an iceberg order?

Iceberg orders are easy to spot if you know what to look for.

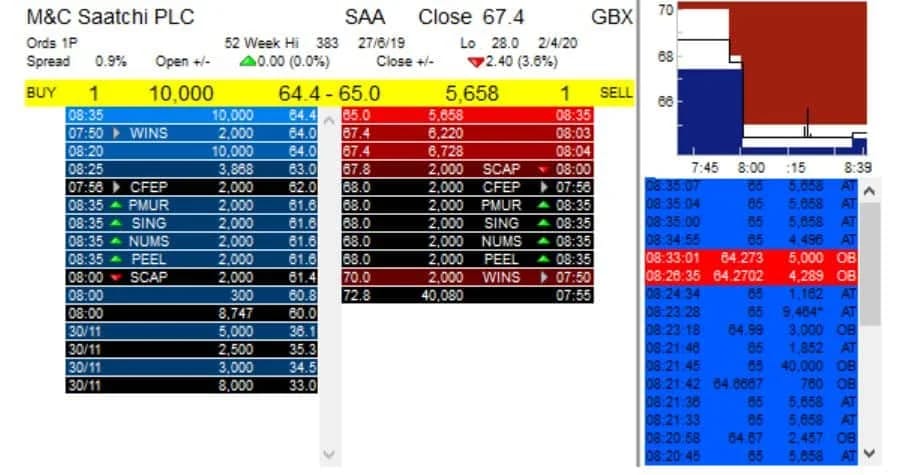

Here’s a Level 2 order book from M&C Saatchi (SAA).

In the trades column on the right you can see that there is a repeated trade of 5,658 shares showing up at 65p.

And when we look on the order book there is a 5,658 share order at 65p.

So we know that this is an iceberg, because every time that 5,658 share order at 65p order is filled in reloads.

What we don’t know is how many shares are beneath those surface shares.. and so the seller has hidden their full size with an iceberg order.

If you spot a similar order that repeats and is on the order book then it’s likely to be an iceberg.

Taking advantages of icebergs

Icebergs can offer great trading opportunities if you spot one.

This is because the price may be being held back by a large seller or buyer, and once that heavy demand or supply is exhausted the stock can see a price move.

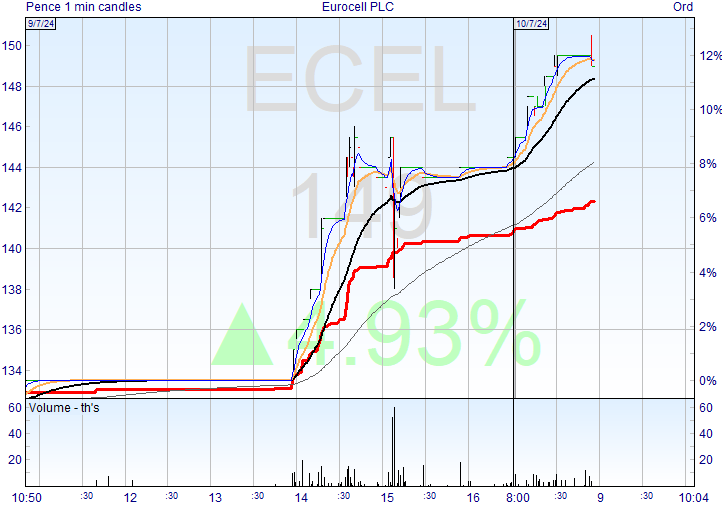

This is what happened on Eurocell (ECEL) yesterday.

I’ve been watching this for weeks because there was a consistent seller on the order book.

Here’s a tweet I posted yesterday when I saw there was no big seller on the ask.

A minute later, the price started moving.

This is why you should take note of icebergs.

When they clear, you can get big moves.

And whenever you’re ready..

There are three ways I can help you.

If you’re wanting to profitably trade UK stocks then I’d recommend my entry level course:

Spread Bet Accelerator: The exact system I use to trade and get you to your first £10k in profits. Use the code GIVEME99 for a subscriber discount.

Want more trading ideas and a clearer view of the markets?

Buy The Bull Market Premium: Free 30-day trial covering potential trades and insights as a professional trader.

Want to work with me personally?

Alpha Trader is where I work closely with traders who want to get to a professional level.

We have our own channel, meet up, and have fun trading and learning [opening soon].