Now we’re done with the honourable mentions we can get onto the main event.

My six stocks for 2025.

I’ve gone for a mix of larger and smaller stocks this time. Speculative stocks are great but as Peter Lynch says: “Long shots almost always miss the mark”.

This was certainly the case last year as BSF Enterprise (BSFA) fell heavily.

I did warn of the risk that if it couldn’t convert its discussions into revenue then it would run out of cash and need to raise capital at a discount.

That’s exactly what happened.

Overall, the basket of Supreme (SUP), Renold (RNO), Afentra (AET), PCI-Pal (PCIP), and BSF Enterprise (BSFA) performed well, finishing 21 percent up.

But without BSFA - that would’ve jumped to 46 percent.

And if I’d included Time Finance (TIME) which closed 86 percent up instead of BSFA (I went for speculative over steady) then that would’ve shot up further to 54 percent.

Three of the six stocks traded at least 85 percent higher from their pick price too.

But if ifs and buts were berries and nuts, then we would all have a Merry Christmas indeed.

This year, I’ve removed the more speculative stocks and focused on profitable and/or cash generative businesses.

And before we continue, a quick thank you to our sponsor Wharton and Wall Street Prep who contribute to the upkeep of this newsletter.

The Value Investing Blueprint: Learn from Wall Street’s Best

Uplevel your investing skills and learn from top value investors, world-class faculty and the trainer's Wall Street trusts the most. Reserve your spot in the self-paced Wharton Online and Wall Street Prep Applied Value Investing Certificate Program. Enroll before the final deadline on Feb. 10th

Burberry (BRBY)

Everyone has heard of Burberry.

It’s an iconic British luxury fashion house established in 1856 by Thomas Burberry, on the principle that clothes should protect people from the British weather.

A noble principle indeed.

As a history nerd, I was interested to hear that the knight logo was designed based on some armour in the Wallace Collection in Marylebone.

I was there a few weeks ago, and if you like knights, swords, and armour then it’s excellent.

And if you don’t, well, you probably won’t be much a fan.

Not only that but the famous trench coat was designed for trench warfare (I guess the clue was in the name) with the epaulettes to suspend military equipment such as gloves and whistles, and D-rings to carry grenades.

But you didn’t sign up for a history lesson.

Burberry has been smacked since the Covid days.

Weakness in consumer spending, a reliance on Asia, and the fact that it is ‘soft luxury’ has seen the company perform poorly in recent years as ultra-luxury brands have wealthier consumers who spend regardless of the economy.

But Burberry is still a well-regarded business and recent Moncler bid speculation sent the shares on a tear.

And despite Moncler denying the rumours eventually, the shares did not give much back, showing that the market believed the stock could be in play and potentially undervalued.

China has been weighing down the business, or more specifically the lack of Chinese consumer spending, and all luxury stocks were boosted by the stimulus rounds announced a few weeks ago.

Stimulus means more money in pockets, and more disposable spending. At least that is what’s hoped.

The shares are clearly off the lows now, with the bottom in sub 600p last September and the price now tagging 1,000p repeatedly.

This is bullish in my opinion - the stock isn’t giving much back.

It’s also hovering around and above the 200 EMA.

What I like about Burberry is that even though the last set of results seemed poor, the stock held up and rallied.

There’s a trading update on the 26th, where we’ll learn more.

But Google Insights may have a view..

Google Insights

What this shows is that more people are searching for Burberry than they have since January 2004. Every year, there’s a seasonal spike in Q4 which peaks in December.

And the current rank for December 2024 is 100, showing that this is the strongest search period yet.

This means this spike was the biggest for the last 20 years.

I think the risk/reward is attractive here as the business right sizes itself.

I could be wrong, of course. We’ll know more in two weeks!

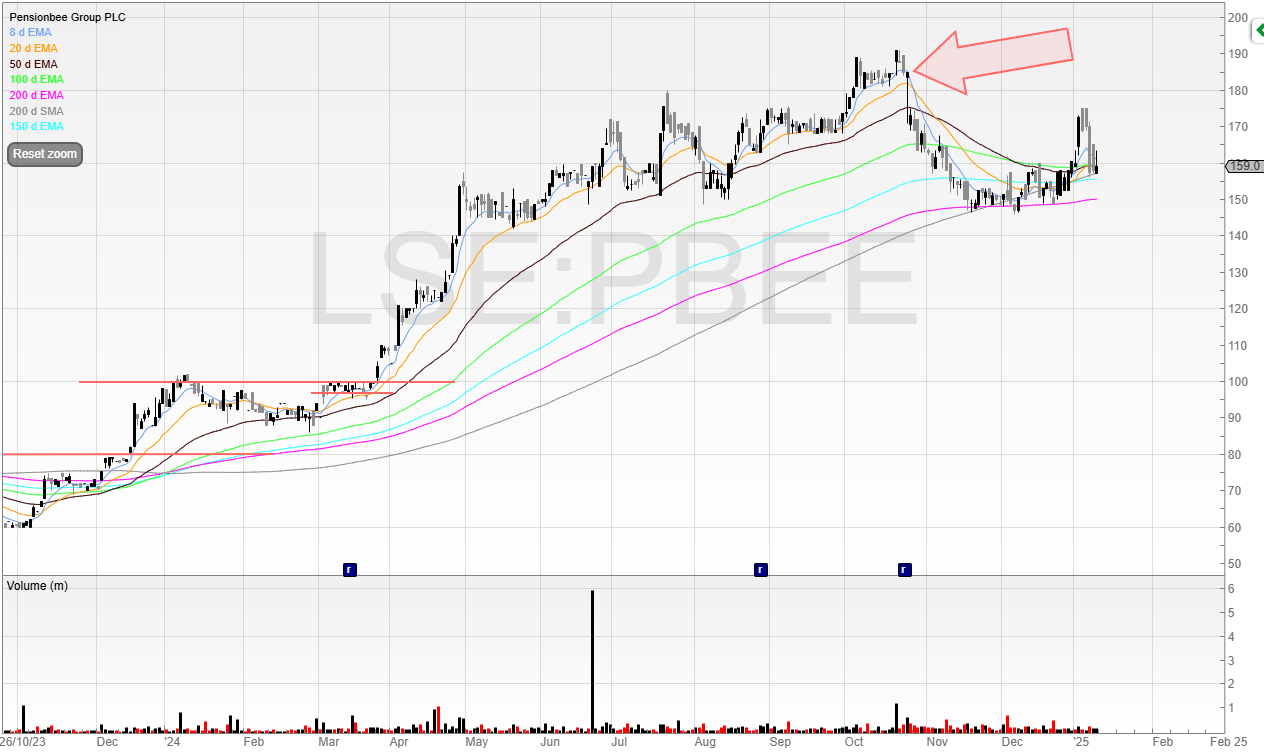

Pensionbee (PBEE)

Whilst Pensionbee is not the £3.4 billion company Burberry is, it still commands a market cap close to £400 million.

It allows customers to consolidate multiple pensions into one easy-to-manage online account. Users can then choose a plan best for them have see real-time access to their balance, as well as make contributions, and change their retirement plans.

I think that the UK market is neglecting this business as it has the potential for huge growth.

Pensions are incredibly sticky. It could turn off all of its marketing tomorrow and benefit from years of revenue and cash flow - revenue which could even grow as users add to their pensions.

Once people are happy with their pensions, they’re unlikely to change it on a whim.

Many people struggle with managing their pensions, especially if they’ve changed jobs frequently and accumulated multiple small pension pots over the years.

Pensionbee addresses this pain point by providing a streamlined, digital-first solution that makes pensions accessible and easy to understand.

This is particularly relevant as more people move to online financial services and seek transparency in their retirement planning.

Pensionbee achieved positive adjusted EBITDA is Q3 and it’s expected that it’ll be breakeven for FY24.

This means the business is significantly derisked, as it now is able to self-fund its growth rather than get the begging bowl out to keep the lights on.

Plus, the recent placing to fund its expansion into the huge pensions market in the US was done at a nil discount to the prevailing price and gobbled up.

It’s rare to see a placing done at the current share price.

I was even more surprised to see the price fall after it was announced.

Continue reading with a free 30-day trial.

More trading ideas and full access to all content. Priority for all offers and live events. A risk-free trade itself as you get value or you cancel.

Upgrade